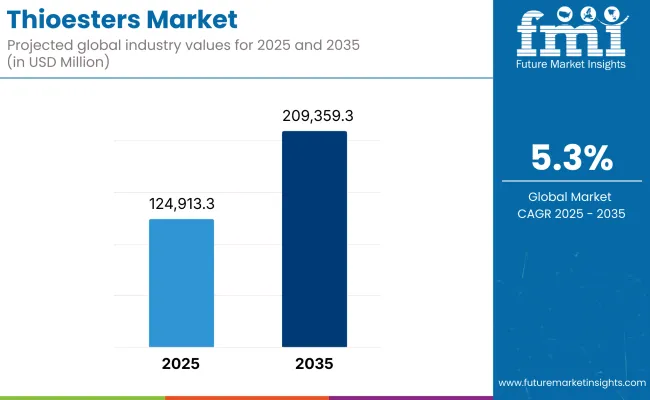

The worldwide thioesters market will grow a lot in the next ten years. These compounds help make tough rubbers and plastics. The market will rise from USD 124,913.3 Million in 2025 to USD 209,359.3 Million by 2035, growing 5.3% each year. Better use in factories, caring for the environment, and wanting greener choices in chemicals drive this growth.

Thioesters have sulfur in them and are mainly used to keep things stable, make plastics soft, and prevent oxidation. They are key to many sectors, like cars, medicine, food and drinks, and chemicals.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 124,913.3 Million |

| Market Value (2035F) | USD 209,359.3 Million |

| CAGR (2025 to 2035) | 5.3% |

Asia-Pacific is the fastest growing thioesters market. With these upsurge, the rapidly growing industrialization, urbanization and the already established manufacturing base of nations like China, India, Japan, South Korea are contributing to this growth. Automotive and electronics production has led to a rise in demand for thioesters as they bring high thermal stability and resistance to oxidation.

As governments call for greener manufacturing processes, thioesters that meet sustainability criteria are becoming increasingly prominent. Meanwhile, China and India are playing a crucial role in establishing themselves as prominent thioester production centers, taking advantage of expanding chemical export ventures.

In North America, thioesters are gaining popularity. Various industries like car-making, packing, and medicines use them. The car sector, for instance, uses thioesters because they help make parts last longer and stay strong. They are used in rubber, plastic, and coatings.

Earth-friendly packing and cleaner products are making the use of thioesters grow in the food and drink industry. Strict rules from groups like the Environmental Protection Agency (EPA) push for safer chemicals. There is also more money going into green ways of making stuff and using bio-based chemicals, helping the market grow even more.

Europe is a key market for thioesters, driven by strict rules and a need for green materials. Germany, France, and the UK use thioesters to meet rules set by the European Chemicals Agency (ECHA). Thioesters are found in car interiors, furniture, and electrical goods for their heat stability and fire resistance.

Europe’s move towards a circular economy and cutting carbon fits with the use of safe, biodegradable chemicals like thioesters. Also, the rising need for green packaging in the area should boost the thioester market, offering a safer choice over regular plasticizers and stabilizers.

Challenges

Compatibility with Other Materials

One of the major challenges the thioesters market faces is its compatibility with other materials which is important as such compounds can be used in complex chemical formulations. Certain thioester compounds, meanwhile, can introduce mechanical properties impacts or alter the performative characteristics of other chemicals, limiting their use among some high-performance sectors.

Moreover, compared to traditional stabilizers and plasticizers, the high cost of thioester production is another challenge, particularly affecting its uptake in price-sensitive industries. There are many challenges that must be overcome for thioesters to see broader adoption, and these challenges are not static.

Opportunities

Rising Demand for Sustainable Alternatives

The shift towards going green and using eco-friendly stuff is good news for thioesters. As more companies need safe and natural chemicals, thioesters especially those from green sources are becoming popular. Car and packaging industries want stable and safe additives, so they are now picking thioesters to work well and be eco-friendly.

Also, using thioesters in green packaging and as food stabilizers offers a big chance to grow the market. The focus on eco-friendly ways and green chemistry in many places shows a bright future for thioesters. They are becoming a key part of the move towards safer, planet-friendly choices in many fields.

The thioesters market is set to grow a lot from 2025 to 2035. This rise is due to more factory demand, new tech, and a bigger focus on green ways. By 2025, the market will grow strong as people look for safer and greener choices.

One big reason for this rise is the change in how things are made, like using AI and robots. These new ideas not only make things faster but also let us make thioesters fit special needs in many fields like cars, packaging, drugs, personal care, and farm chemicals. At the same time, using green ways to make things, like renewable sources and eco-friendly chemicals, will make thioesters a top pick in many areas.

Market Shifts: 2025 to 2035

| Key Dimensions | 2025 to 2030 |

|---|---|

| Technological Innovation | AI-driven production, enhanced automation, and green chemistry adoption |

| Geographic Expansion | Growth in North America, Europe, and Asia-Pacific |

| Sustainability Focus | Increased focus on biodegradable thioesters, sustainable production methods |

| Regulatory Impact | Stricter regulations driving demand for eco-friendly chemicals |

| End-Use Industry Adoption | Significant adoption in automotive, packaging, and food industries |

| Process Efficiency | Improved yield and reduced waste with AI-enhanced processes |

| Supply Chain & Logistics | Optimized logistics using AI and IoT technologies |

| By-Product Valorization | Limited adoption of by-product recycling |

| R&D and Innovation | Increased investment in sustainable production research |

| Key Dimensions | 2030 to 2035 |

|---|---|

| Technological Innovation | Expansion of AI in supply chain management and advanced predictive analytics |

| Geographic Expansion | Increased market penetration in Africa, Latin America, and South Asia |

| Sustainability Focus | Circular economy practices, use of renewable feedstock, and zero-emission processes |

| Regulatory Impact | Global standardization of environmental and safety regulations |

| End-Use Industry Adoption | Expansion into new sectors such as pharmaceuticals, personal care, and agrochemicals |

| Process Efficiency | Highly energy-efficient and low-waste production processes |

| Supply Chain & Logistics | Advanced automation of global supply chains with improved traceability |

| By-Product Valorization | Widespread adoption of circular economy principles in manufacturing |

| R&D and Innovation | Focus on multi-feedstock production systems and integrated process solutions |

The USA market for thioesters is set to grow. Industries like chemicals, medicine, farming, and food processing are driving demand. Groups like the FDA and EPA oversee product safety, labels, and environmental effects. The biotech and specialty chemicals fields are also growing and helping the market.

Key trends include more thioester use in factories, higher demand in farming for growth aids and fungus-killers, and new, greener ways to make products to meet environmental rules.

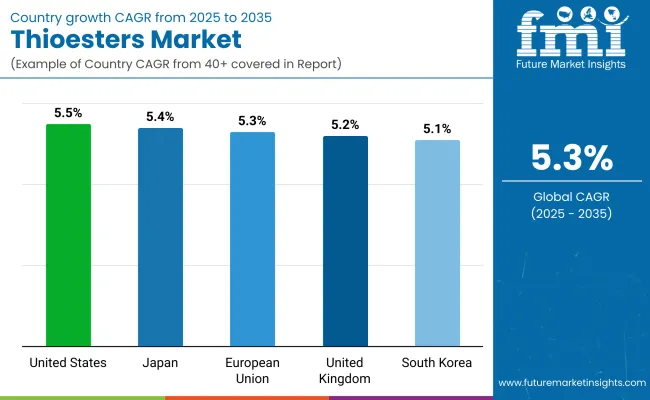

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

The thioesters market in the United Kingdom is formulating steadily about expanding applications in pharmaceuticals, agrochemicals, and polymers. The UK government has been trying to encourage these types of innovations in the chemical arena via investment and research funding. The Chemical Industries Association (CIA) and the Health and Safety Executive (HSE) must ensure chemicals to be manufactured and used safely.

Trends fueling market expansion include higher use of thioesters in agricultural chemicals and the rising demand for high-performance additives for use in polymers and plastics. Moreover, with the evolution of sustainable chemistry production methods, there are new market dynamics at play.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

Thioesters have diverse applications, fuelling the growth of the EU Thioesters Market as they are used in high-performance chemicals across industries including food and feed additives, automotive, pharmaceuticals, agriculture, and others. Indeed, regulatory agencies such as the European Chemicals Agency (ECHA) and the European Food Safety Authority (EFSA) are currently striving for safety standards concerning chemical products.

The top markets are Germany, France, and Italy; several national agricultural and chemical industries encourage the use of thioesters as an additive or growth regulator. The market is driven by sustainable chemistry initiatives, such as the demand for greener chemicals and processes.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.3% |

Japan is the fastest-growing thioesters market. Use for these in medicines, farming, and plastic-making is increasing. ENSURING THIOESTER SAFETY Various organizations including the Ministry of Health, Labor and Welfare (MHLW), and the Japan Chemical Industry Association (JCIA) regulate the safety to use and produce thioesters.

Top matters in Japan are increased demand for environmental friendly materials on plastics, increased use of thioesters since they protect crops, and development of risk-free methods for making chemicals. Additionally, Japan’s emphasis on new tech in chemical production aids the market expand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

In South Korea, the chemical and drug industries are quite dynamic, resulting in a growing thioesters market. The Ministry of Environment (MOE) and the Korea Chemical Industry Association (KCIA) monitor chemical manufacturing and sales, ensuring they are harmless and won't harm the environment.

More thioesters are found in high-performance chemicals for farming and medicines in South Korea. There is also a shift toward greener methods for producing these commodities, reducing environmental harm.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

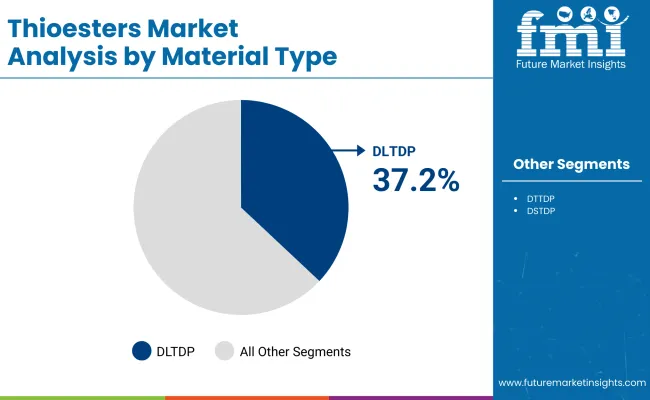

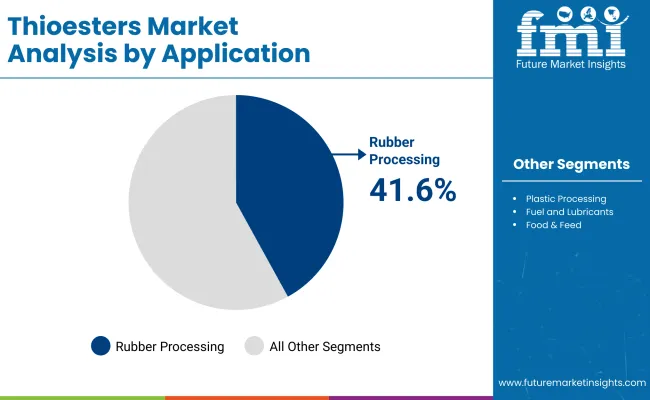

DLTDP and DTTDP Lead as the Top Choices for Rubber and Plastic Processing; Fuel and Lubricants Segments Drive Growth in Industrial Applications

The thioesters market is driven by an increase in demand for thioester-based chemicals for use in rubber and plastic processing, fuel and lubricants, and food & feed industries. The market segmentation includes material types such as DLTDP (DilaurylThiodipropionate) and DTTDP (DitridecylThiopropionate) is the most widely used material type in the industry, and applications such as rubber processing accounts for the major share of the rubber processing market and which is the largest application, segment. Industry demands evolve, prompting the market toward improvements in material efficiency and performance.

| Material Type | Market Share (2025) |

|---|---|

| DLTDP ( Dilauryl Thiodipropionate ) | 37.2% |

| DTTDP ( Ditridecyl Thiopropionate ) | 33.8% |

DLTDP and DTTDP; The Preferred Thioesters for Industrial ApplicationsDLTDP and DTTDP dominate the segment of material, as they provide greater performance in the processing of rubber and plastic by acting as stabilizers and antioxidants in these materials. HenceDLTDP is considered as useful agents to improve the durability andolder rubber products of long time use.

In contrast, DTTDP is often employed in lubrication and fuel formulations, that is because it is a polar compound, and it helps overcome both power and thermal limitations associated with these fluids at high temperatures. Collectively, these thioesters play a pivotal role in the development of high-quality industrial and automotive materials, catalyzing the growth of the respective markets.

| Application | Market Share (2025) |

|---|---|

| Rubber Processing | 41.6% |

Rubber Processing; The Dominant Driver of Thioester DemandThe rubber processing was found to be the largest application segment and accounted for the largest share of the thioesters market. Thioesters like DLTDP and DTTDP help make rubber better. They make it last longer.

In cars and factories, these chemicals are used to make strong tires, seals, gaskets, and other rubber items. Increasing need for high-performance and durable rubber-based materials in automotive manufacturing, construction, and other industries is likely to continue driving market growth in rubber processing application.

Thioesters market is growing on a global level. Thioesters are commonly utilized as stabilizers, antioxidants, and flavoring agents as they can enhance a product's integrity, quality, and performance. Thioesters market is anticipated to grow substantially due to increasing industrial applications, especially in Asia-Pacific and North America.

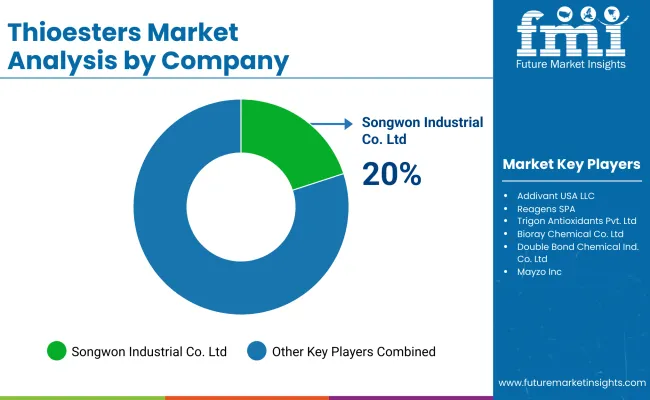

The major market players dominating the competitive landscape are Songwon Industrial Co. Ltd, Addivant USA LLC, Reagens SPA among others. These companies specialize in providing advanced thioester products with superior performance andaturecraracracy.

Songwon Industrial Co. Ltd. is the forerunner with a wide portfolio of thioester antioxidants and stabilization solutions. Addivant USA LLC produces high-performance stabilizers for a wide range of industries, including the plastics and automotive sector. Reagens SPA develops custom thioester solutions under customer-specific conditions for a wide range of applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Songwon Industrial Co. Ltd. | 20-25% |

| Addivant USA LLC | 18-22% |

| Reagens SPA | 10-15% |

| Trigon Antioxidants Pvt. Ltd. | 8-12% |

| Bioray Chemical Co. Ltd. | 6-9% |

| Double Bond Chemical Ind. Co. Ltd. | 5-8% |

| Mayzo Inc. | 4-6% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Songwon Industrial Co. Ltd. | In 2024, offered new thioester antioxidants for plastic use. In 2025, produced more to meet higher demand in North America. |

| Addivant USA LLC | In 2024, made a great stabilizer for cars. In 2025, added more green products due to new rules. |

| Reagens SPA | In 2024, launched special thioester for food and drinks. In 2025, studied eco-safe formulas for cosmetics. |

| Trigon Antioxidants Pvt. Ltd. | n 2024, released cheap thioester stabilizers for polymers. In 2025, grew in new markets, mostly in Asia. |

| Bioray Chemical Co. Ltd. | In 2024, created new thioester for medicine. In 2025, filled up its green product list to meet the call for safe chemicals. |

| Double Bond Chemical Ind. Co. Ltd. | In 2024, made high-end thioester for coatings. In 2025, increased offers for cars and electronics. |

| Mayzo Inc. | In 2024, offered thioester products for saving energy. In 2025, teamed up with top plastic makers to upgrade their goods. |

Key Company Insights

Songwon Industrial Co. Ltd. (20-25%)

Songwon Industrial Co. Ltd. leads the thioesters market, offering many antioxidants and stabilization solutions. They grow their product range and production to meet the rising need for eco-friendly solutions, mainly in plastics and car industries.

Addivant USA LLC (18-22%)

Addivant USA LLC makes high-quality stabilizers and thioester-based items for different industries. They aim to produce in a greener manner and follow rules to satisfy the increasing desire for green chemicals in car, building, and plastics sectors.

Reagens SPA (10-15%)

Reagens SPA makes special thioester products for food, drink, and beauty businesses. They keep looking into new ways to make green products to match what buyers want.

Trigon Antioxidants Pvt. Ltd. (8-12%)

Trigon Antioxidants Pvt. Ltd. offers affordable, top-notch thioester stabilizers. They are growing into new areas, with a focus on plastic and rubber businesses and also answering the demand for eco-friendly chemicals.

Bioray Chemical Co. Ltd. (6-9%)

Bioray Chemical Co. Ltd. is growing in the thioesters market, focusing on top-grade thioester products for drugs. They are increasing their eco-friendly items and innovating in green production to match industry trends.

Double Bond Chemical Ind. Co. Ltd. (5-8%)

Double Bond Chemical Ind. Co. Ltd. offers high-quality thioesters for coatings, cars, and electronics. They are expanding their product range to meet the needs for energy-saving and eco-friendly solutions.

Mayzo Inc. (4-6%)

Mayzo Inc. develops thioester items for energy-saving uses, mainly in plastics and rubber areas. They aim to improve their products through partnerships with top makers and using their wide distribution network.

Other Key Players (Combined)

Several other companies contribute to the dynamic landscape of the thioesters market:

The overall market size for the thioesters market was USD 124,913.3 Million in 2022.

The thioesters market is expected to reach USD 209,359.3 Million in 2032.

Increasing demand for thioesters in the rubber and plastics processing industry, food and feed industry, and fuel and lubricants sector will drive market growth.

China, India, the USA, Japan, and Germany are key contributors.

The antioxidant segment is expected to lead due to its widespread use in preventing oxidative degradation of polymers.

Table 01: Global Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Material, 2013–2028

Table 02: Global Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Application, 2013–2028

Table 03: Global Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Region, 2013–2028

Table 04: North America Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Country, 2013–2028

Table 05: North America Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Material, 2013–2028

Table 06: North America Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Application, 2013–2028

Table 07: Latin America Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Country, 2013–2028

Table 08: Latin America Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Material, 2013–2028

Table 09: Latin America Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Application, 2013–2028

Table 10: Western Europe Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Country, 2013–2028

Table 11: Western Europe Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Material, 2013–2028

Table 12: Western Europe Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Application, 2013–2028

Table 13: Eastern Europe Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Country, 2013–2028

Table 14: Eastern Europe Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Material, 2013–2028

Table 15: Eastern Europe Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Application, 2013–2028

Table 16: SEA & Other APAC Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Country, 2013–2028

Table 17: SEA & Other APAC Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Material, 2013–2028

Table 18: SEA & Other APAC Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Application, 2013–2028

Table 19: China Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Material, 2013–2028

Table 20: China Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Application, 2013–2028

Table 21: Japan Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Material, 2013–2028

Table 22: Japan Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Application, 2013–2028

Table 23: India Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Material, 2013–2028

Table 24: India Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Application, 2013–2028

Table 25: MEA Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Country, 2013–2028

Table 26: MEA Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Material, 2013–2028

Table 27: MEA Thioester Market Value (US$ Mn) and Volume (MT) Forecast, by Application, 2013–202

Figure 01: Global Historical Market Size (US$ Mn) and Volume (Tons) Analysis, 2013-2021

Figure 01: Global Thioester Market Value Share by Material, 2022 & 2028

Figure 02: Global Current and Future Market Size (US$ Mn ) and Volume (Tons) Analysis, 2018 – 2028

Figure 02: Global Thioester Market Volume Share by Material, 2022 & 2028

Figure 03: Global Thioester Market, BPS Analysis, by Material, 2013, 2022 & 2028

Figure 04: Global Thioester Market, Y-o-Y Growth Comparison, by Material, 2021–2028

Figure 05: Chemicals Sales in 10 Prominent Countries - 2016

Figure 05: Global Thioester Market Attractiveness Index, by Material, 2022–2028

Figure 06: Global Chemical Sales Share By Region - 2016

Figure 06: Global Thioester Market Absolute $ Opportunity by DLTPL Segment, 2022–2028

Figure 07: Global Thioester Market Absolute $ Opportunity by DTTDP Segment, 2022–2028

Figure 08: Global Thioester Market Absolute $ Opportunity by DSTDP Segment, 2022–2028

Figure 09: Global Thioester Market Value Share by Application, 2022 & 2028

Figure 10: Global Thioester Market Volume Share by Application, 2022 & 2028

Figure 11: Global Thioester Market, BPS Analysis, by Application, 2013, 2022 & 2028

Figure 12: Global Thioester Market, Y-o-Y Growth Comparison, by Application, 2021–2028

Figure 13: Global Thioester Market Attractiveness Index, by Application, 2022–2028

Figure 14: Global Thioester Market Absolute $ Opportunity by Rubber Processing Segment, 2022–2028

Figure 15: Global Thioester Market Absolute $ Opportunity by Plastic Processing Segment, 2022–2028

Figure 16: Global Thioester Market Absolute $ Opportunity by Food & Feed Segment, 2022–2028

Figure 17: Global Thioester Market Absolute $ Opportunity by fuel & lubricants Segment, 2022–2028

Figure 18: Global Thioester Market Absolute $ Opportunity by Others Segment, 2022–2028

Figure 19: Global Thioester Market, BPS Analysis, by Region, 2013, 2022 & 2028

Figure 20: Global Thioester Market, Y-o-Y Growth Comparison, by Region, 2021–2028

Figure 21: Global Thioester Market Attractiveness Index, by Region, 2022–2028

Figure 22: North America Thioester Market Absolute $ Opportunity, 2022–2028

Figure 23: Latin America Thioester Market Absolute $ Opportunity, 2022–2028

Figure 24: Western Europe Thioester Market Absolute $ Opportunity, 2022–2028

Figure 25: Eastern Europe Thioester Market Absolute $ Opportunity, 2022–2028

Figure 26: South East Asia & Pacific Thioester Market Absolute $ Opportunity, 2022–2028

Figure 27: Middle East & Africa Thioester Market Absolute $ Opportunity, 2022–2028

Figure 28: China Thioester Market Absolute $ Opportunity, 2022–2028

Figure 29: Japan Thioester Market Absolute $ Opportunity, 2022–2028

Figure 30: India Thioester Market Absolute $ Opportunity, 2022–2028

Figure 31: North America Thioester Market Split (Value) by Material, 2022E

Figure 32: North America Thioester Market Split (Value) by Application, 2022E

Figure 33: North America Thioester Market Split (Value) by Country, 2022E

Figure 34: North America Thioester Market, BPS Analysis, by Country, 2013, 2022 & 2028

Figure 35: North America Thioester Market, Y-o-Y Growth Comparison, by Country, 2021–2028

Figure 36: North America Thioester Market Attractiveness Index, by Country, 2022–2028

Figure 37: U.S. Thioester Market Absolute $ Opportunity, 2022–2028

Figure 38: Canada Thioester Market Absolute $ Opportunity, 2022–2028

Figure 39: North America Thioester Market, BPS Analysis, by Material, 2013, 2022 & 2028

Figure 40: North America Thioester Market, Y-o-Y Growth Comparison, by Material, 2021–2028

Figure 41: North America Thioester Market Attractiveness Index, by Country, 2022–2028

Figure 42: North America Thioester Market, BPS Analysis, by Application, 2013, 2022 & 2028

Figure 43: North America Thioester Market, Y-o-Y Growth Comparison, by Application, 2021–2028

Figure 44: North America Thioester Market Attractiveness Index, by Application, 2022–2028

Figure 45: Latin America Thioester Market Split (Value) by Material, 2022E

Figure 46: Latin America Thioester Market Split (Value) by Application, 2022E

Figure 47: Latin America Thioester Market Split (Value) by Country, 2022E

Figure 48: Latin America Thioester Market, BPS Analysis, by Country, 2013, 2022 & 2028

Figure 49: Latin America Thioester Market, Y-o-Y Growth Comparison, by Country, 2021–2028

Figure 50: Latin America Thioester Market Attractiveness Index, by Country, 2022–2028

Figure 51: Brazil Thioester Market Absolute $ Opportunity, 2022–2028

Figure 52: Mexico Thioester Market Absolute $ Opportunity, 2022–2028

Figure 53: Rest of LA Thioester Market Absolute $ Opportunity, 2022–2028

Figure 54: Latin America Thioester Market, BPS Analysis, by Material, 2013, 2022 & 2028

Figure 55: Latin America Thioester Market, Y-o-Y Growth Comparison, by Material, 2021–2028

Figure 56: Latin America Thioester Market Attractiveness Index, by Product Type , 2022–2028

Figure 57: Latin America Thioester Market, BPS Analysis, by Application, 2013, 2022 & 2028

Figure 58: Latin America Thioester Market, Y-o-Y Growth Comparison, by Application, 2021–2028

Figure 59: Latin America Thioester Market Attractiveness Index, by Application, 2022–2028

Figure 60: Western Europe Thioester Market Split (Value) by Material, 2022E

Figure 61: Western Europe Thioester Market Split (Value) by Application, 2022E

Figure 62: Western Europe Thioester Market Split (Value) by Country, 2022E

Figure 63: Western Europe Thioester Market, BPS Analysis, by Country, 2013, 2022 & 2028

Figure 64: Western Europe Thioester Market, Y-o-Y Growth Comparison, by Country, 2021–2028

Figure 65: Western Europe Thioester Market Attractiveness Index, by Country, 2022–2028

Figure 66: Germany Thioester Market Absolute $ Opportunity, 2022–2028

Figure 67: Italy Thioester Market Absolute $ Opportunity, 2022–2028

Figure 68: France Thioester Market Absolute $ Opportunity, 2022–2028

Figure 69: UK Thioester Market Absolute $ Opportunity, 2022–2028

Figure 70: Spain Thioester Market Absolute $ Opportunity, 2022–2028

Figure 71: BENELUX Thioester Market Absolute $ Opportunity, 2022–2028

Figure 72: Rest of WE Thioester Market Absolute $ Opportunity, 2022–2028

Figure 73: Western Europe Thioester Market, BPS Analysis, by Material, 2013, 2022 & 2028

Figure 74: Western Europe Thioester Market, Y-o-Y Growth Comparison, by Material, 2021–2028

Figure 75: Western Europe Thioester Market Attractiveness Index, by Material, 2022–2028

Figure 76: Western Europe Thioester Market, BPS Analysis, by Application, 2013, 2022 & 2028

Figure 77: Western Europe Thioester Market, Y-o-Y Growth Comparison, by Application, 2021–2028

Figure 78: Western Europe Thioester Market Attractiveness Index, by Application, 2022–2028

Figure 79: Eastern Europe Thioester Market Split (Value) by Material, 2022E

Figure 80: Eastern Europe Thioester Market Split (Value) by Application, 2022E

Figure 81: Eastern Europe Thioester Market Split (Value) by Country, 2022E

Figure 82: Eastern Europe Thioester Market, BPS Analysis, by Country, 2013, 2022 & 2028

Figure 83: Eastern Europe Thioester Market, Y-o-Y Growth Comparison, by Country, 2021–2028

Figure 84: Eastern Europe Thioester Market Attractiveness Index, by Country, 2022–2028

Figure 85: Russia Thioester Market Absolute $ Opportunity, 2022–2028

Figure 86: Poland Thioester Market Absolute $ Opportunity, 2022–2028

Figure 87: Rest of Eastern Europe Thioester Market Absolute $ Opportunity, 2022–2028

Figure 88: Eastern Europe Thioester Market, BPS Analysis, by Material, 2013, 2022 & 2028

Figure 89: Eastern Europe Thioester Market, Y-o-Y Growth Comparison, by Material, 2021–2028

Figure 90: Eastern Europe Thioester Market Attractiveness Index, by Country, 2022–2028

Figure 91: Eastern Europe Thioester Market, BPS Analysis, by Application, 2013, 2022 & 2028

Figure 92: Eastern Europe Thioester Market, Y-o-Y Growth Comparison, by Application, 2021–2028

Figure 93: Latin America Thioester Market Attractiveness Index, by Application, 2022–2028

Figure 94: SEA & Other APAC Thioester Market Split (Value) by Material, 2022E

Figure 95: SEA & Other APAC Thioester Market Split (Value) by Application, 2022E

Figure 96: SEA & Other APAC Thioester Market Split (Value) by Country, 2022E

Figure 97: SEA & Other APAC Thioester Market, BPS Analysis, by Country, 2013, 2022 & 2028

Figure 98: SEA & Other APAC Thioester Market, Y-o-Y Growth Comparison, by Country, 2021–2028

Figure 99: SEA Thioester Market Attractiveness Index, by Country, 2022–2028

Figure 100: South Korea Thioester Market Absolute $ Opportunity, 2022–2028

Figure 101: Taiwan Thioester Market Absolute $ Opportunity, 2022–2028

Figure 102: ASEAN Thioester Market Absolute $ Opportunity, 2022–2028

Figure 103: Taiwan Thioester Market Absolute $ Opportunity, 2022–2028

Figure 104: SEA & Other APAC Thioester Market, BPS Analysis, by Material, 2013, 2022 & 2028

Figure 105: SEA & Other APAC Thioester Market, Y-o-Y Growth Comparison, by Material, 2021–2028

Figure 106: SEA & Other APAC Thioester Market Attractiveness, by Material, 2014–2028

Figure 107: SEA & Other APAC Thioester Market, BPS Analysis, by Application, 2013, 2022 & 2028

Figure 108: SEA & Other APAC Thioester Market, Y-o-Y Growth Comparison, by Application, 2021–2028

Figure 109: SEA Thioester Market Attractiveness Index, by Application, 2022–2028

Figure 110: China Thioester Market Split (Value) by Material, 2022E

Figure 111: China Thioester Market Split (Value) by Application, 2022E

Figure 112: China Thioester Market Absolute $ Opportunity, 2022–2028

Figure 113: China Thioester Market, BPS Analysis, by Material, 2013, 2022 & 2028

Figure 114: China Thioester Market, Y-o-Y Growth Comparison, by Material, 2021–2028

Figure 115: China Thioester Market Attractiveness Index, by Material, 2022–2028

Figure 116: China Thioester Market, BPS Analysis, by Application, 2013, 2022 & 2028

Figure 117: China Thioester Market, Y-o-Y Growth Comparison, by Application, 2021–2028

Figure 118: China Thioester Market Attractiveness Index, by Application, 2022–2028

Figure 119: Japan Thioester Market Split (Value) by Material, 2022E

Figure 120: Japan Thioester Market Split (Value) by Application, 2022E

Figure 121: Japan Thioester Market, BPS Analysis, by Material, 2013, 2022 & 2028

Figure 122: Japan Thioester Market, Y-o-Y Growth Comparison, by Material, 2021–2028

Figure 123: Japan Thioester Market Attractiveness Index, by Material, 2022–2028

Figure 124: Japan Thioester Market, BPS Analysis, by Application, 2013, 2022 & 2028

Figure 125: Japan Thioester Market, Y-o-Y Growth Comparison, by Application, 2021–2028

Figure 126: Japan Thioester Market Attractiveness Index, by Application, 2022–2028

Figure 127: India Thioester Market Split (Value) by Material, 2022E

Figure 128: India Thioester Market Split (Value) by Application, 2022E

Figure 129: India Thioester Market Absolute $ Opportunity, 2022–2028

Figure 130: India Thioester Market, BPS Analysis, by Material, 2013, 2022 & 2028

Figure 131: India Thioester Market, Y-o-Y Growth Comparison, by Material, 2021–2028

Figure 132: India Thioester Market Attractiveness Index, by Material type, 2022–2028

Figure 133: India Thioester Market, BPS Analysis, by Application, 2013, 2022 & 2028

Figure 134: India Thioester Market, Y-o-Y Growth Comparison, by Application, 2021–2028

Figure 135: India Thioester Market Attractiveness Index, by Application, 2022–2028

Figure 136: MEA Thioester Market Split (Value) by Material, 2022E

Figure 137: MEA Thioester Market Split (Value) by Application, 2022E

Figure 138: MEA Thioester Market Split (Value) by Country, 2022E

Figure 139: MEA Thioester Market, BPS Analysis, by Country, 2013, 2022 & 2028

Figure 140: MEA Thioester Market, Y-o-Y Growth Comparison, by Country, 2021–2028

Figure 141: MEA Thioester Market Attractiveness Index, by Country, 2022–2028

Figure 142: Turkey Thioester Market Absolute $ Opportunity, 2022–2028

Figure 143: GCC Thioester Market Absolute $ Opportunity, 2022–2028

Figure 144: South Africa Thioester Market Absolute $ Opportunity, 2022–2028

Figure 145: GCC Thioester Market Absolute $ Opportunity, 2022–2028

Figure 146: MEA Thioester Market, BPS Analysis, by Material, 2013, 2022 & 2028

Figure 147: MEA Thioester Market, Y-o-Y Growth Comparison, by Material, 2021–2028

Figure 148: MEA Thioester Market Attractiveness Index, by Material, 2022–2028

Figure 149: MEA Thioester Market, BPS Analysis, by Application, 2013, 2022 & 2028

Figure 150: MEA Thioester Market, Y-o-Y Growth Comparison, by Application, 2021–2028

Figure 151: MEA Thioester Market Attractiveness Index, by Application, 2022–2028

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA