Thioglycolate Market Size and Share Forecast Outlook 2025 to 2035

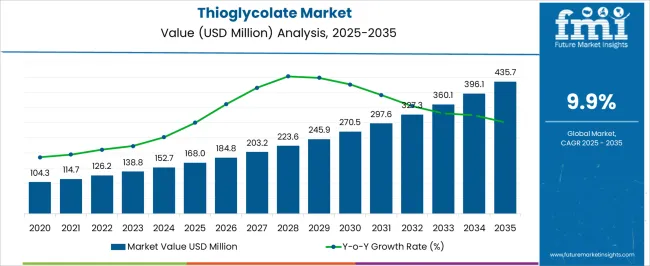

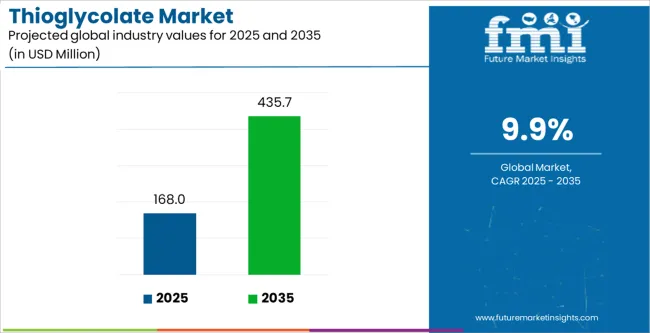

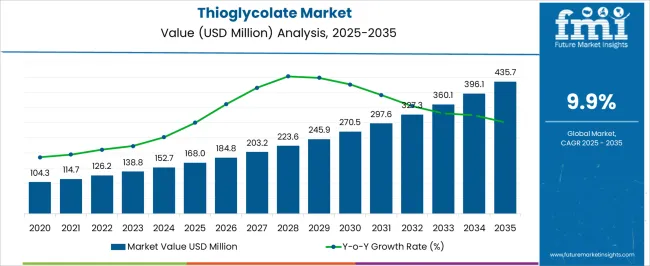

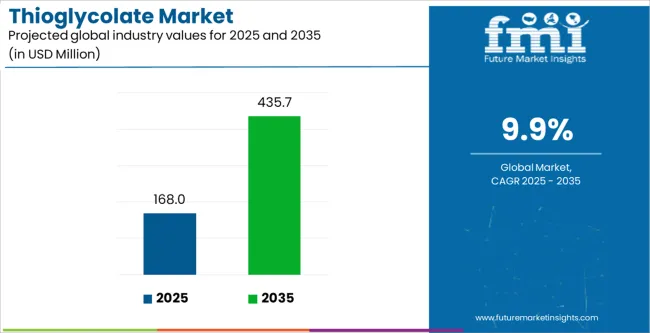

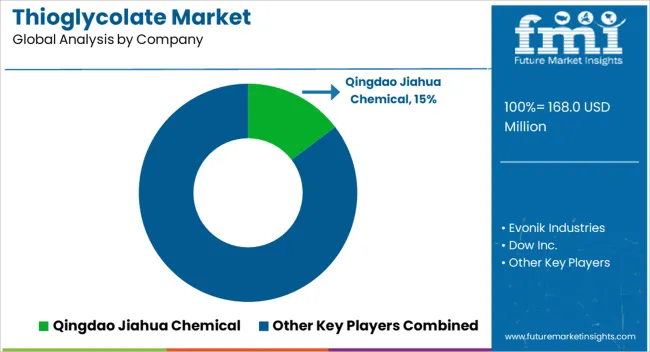

The Thioglycolate Market is estimated to be valued at USD 168.0 million in 2025 and is projected to reach USD 435.7 million by 2035, registering a compound annual growth rate (CAGR) of 9.9% over the forecast period.

Quick Stats for Thioglycolate Market

- Thioglycolate Market Industry Value (2025): USD 168.0 million

- Thioglycolate Market Forecast Value (2035): USD 435.7 million

- Thioglycolate Market Forecast CAGR: 9.9%

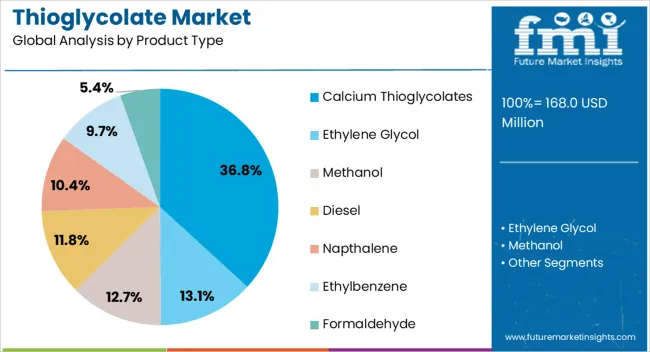

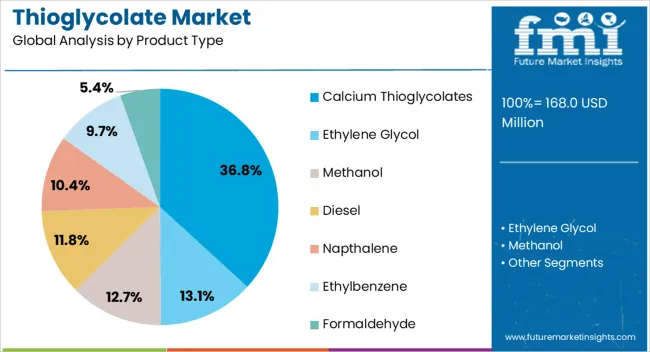

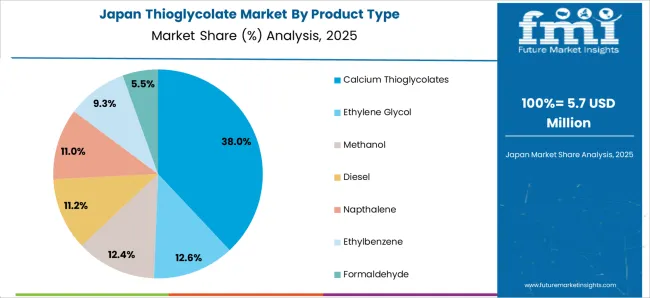

- Leading Segment in Thioglycolate Market in 2025: Calcium Thioglycolates (36.8%)

- Key Growth Region in Thioglycolate Market: North America, Asia-Pacific, Europe

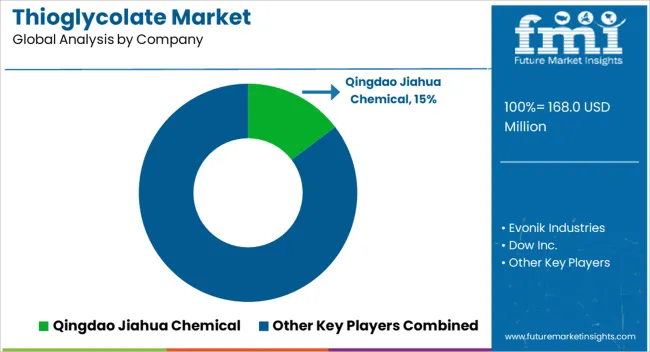

- Top Key Players in Thioglycolate Market: Qingdao Jiahua Chemical, Evonik Industries, Dow Inc., Merck KGaA, Bruno Bock Chemische Fabrik GmbH & Co. KG, Nippon Shokubai Co., Ltd., Jiaxing Weifang Chemical

| Metric |

Value |

| Thioglycolate Market Estimated Value in (2025 E) |

USD 168.0 million |

| Thioglycolate Market Forecast Value in (2035 F) |

USD 435.7 million |

| Forecast CAGR (2025 to 2035) |

9.9% |

Rationale for Segmental Growth in the Thioglycolate Market

The thioglycolate market is witnessing steady expansion, underpinned by its growing utilization in personal care, cosmetics, and specialty chemical applications. Rising consumer expenditure on grooming products and advanced cosmetic formulations has amplified the demand for thioglycolates as functional ingredients, particularly in depilatory creams and hair treatment solutions.

The market is further influenced by advancements in chemical synthesis and increased demand for specialized compounds in pharmaceuticals and industrial applications. Currently, the competitive environment is shaped by the balance between regulatory frameworks on chemical safety and the necessity for effective formulations in end-use sectors.

The future outlook is reinforced by continuous R&D aimed at developing safer, more efficient derivatives that comply with stringent cosmetic and healthcare standards. With the dual influence of consumer-driven trends and industrial demand, thioglycolates are expected to maintain their strategic importance across multiple industries.

Segmental Analysis

Insights into the Calcium Thioglycolates Segment

The calcium thioglycolates segment leads the product type category with approximately 36.8% share, supported by its widespread adoption in cosmetic and personal care formulations. The compound’s high solubility and efficacy in hair removal and treatment products have positioned it as the preferred variant among manufacturers.

Cost-effectiveness and favorable performance characteristics further contribute to its prominence in large-scale production. Demand is additionally reinforced by its compatibility with established formulation techniques, ensuring consistent results across diverse product lines.

As consumer preference for effective and accessible grooming solutions grows, the calcium thioglycolates segment is projected to sustain its dominant role in the market.

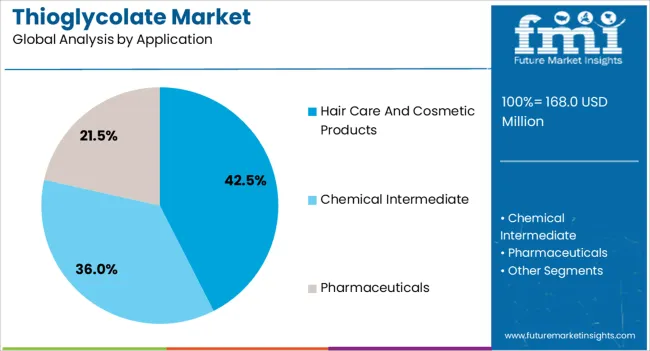

Insights into the Hair Care and Cosmetic Products Segment

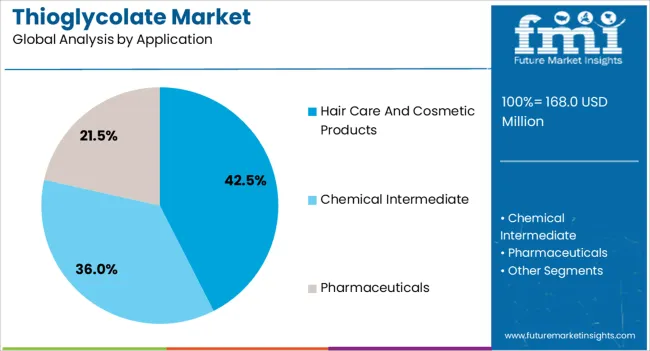

The hair care and cosmetic products segment accounts for approximately 42.5% share of the application category in the thioglycolate market. This leadership is linked to the rising global consumption of depilatory creams, hair perming agents, and specialized treatments.

Thioglycolates are valued for their keratin-disrupting properties, which enable effective restructuring or removal of hair fibers. Expanding demand across both mass-market and premium cosmetic brands has further boosted utilization.

Increased grooming awareness in emerging economies and the popularity of home-use products have reinforced this segment’s position. With continued growth in beauty and personal care expenditure, the hair care and cosmetic products segment is expected to sustain its strong share over the forecast period.

Historical Performance and Future Growth of the Thioglycolate Market

The market has grown at a CAGR of 3.5% from 2020 to 2025 mainly due to the consistent demands from the cosmetics and textile sectors. The market showed moderate growth during the historical period due to established market conditions.

| CAGR from 2020 to 2025 |

3.5% |

| CAGR from 2025 to 2035 |

10% |

- An increase in innovations in the formulations and applications played a major role in the market’s growth. The CAGR remained constant even after the cosmetic companies tried to find new uses for thioglycolates.

- The market dynamics were affected by the fluctuations in the economy and the unpredictability of the global market. This had a strong impact on thioglycolates as they were part of several industries.

- The market hasn’t seen a noteworthy growth in the cosmetics sector after its initial rise in demand was passed. This led to a slight decrease in the CAGR as the market approached maturity in certain applications.

Future Outlook for the Thioglycolate Industry

It is expected that there will newer variety in applications of thioglycolates during the period of 2025 to 2035. Industries such as pharmaceuticals and biotechnology are likely to start using thioglycolates.

- The forecast period is projected to see breakthroughs in technology, enhancing the efficiency and effectiveness of thioglycolate applications. This is expected to lead to a surge in demand as companies capitalize on the improved capabilities of thioglycolates.

- The increased focus on sustainable and eco-friendly practices is likely to play in favor of thioglycolates.

- The demand for specialized thioglycolate formulations is expected to grow as the pharmaceutical and biotechnology sectors are projected to grow. Companies offering products for these particular sectors are likely to witness accelerated growth.

Key Trends Influencing the Thioglycolate Market

Personalized Beauty Solutions

The rising trend of personalized beauty solutions is increasing the demand for thioglycolates. Thioglycolate manufacturers are trying new formulations which offer customized based on customer preference offering specialized products for specific hairs and skin types. Companies are exploring the use of technology, such as AI and machine learning, to analyze consumer data and recommend personalized thioglycolate-based products. This combination of technology and beauty is well-suited to satisfy the growing demand for personalized experiences.

Cross-Industry Hybrid Products

Companies are trying to create new hybrid products that combine the properties of thioglycolates with other new ingredients. For example, formulations that not only offer hair care benefits but also incorporate antioxidant properties for overall skin health. Thioglycolates are being integrated into products with multi-functional benefits, such as combining hair care with anti-aging properties. This trend caters to the consumers who are looking for an all-in-one solution.

Enhanced Delivery Systems with Nanoencapsulation Technology

Nanoencapsulation involves encapsulating thioglycolates at the nanoscale. This technology offers improved stability, controlled release, and enhanced penetration, contributing to more efficient and targeted applications in cosmetics and pharmaceuticals. Nanoencapsulation can enhance the bioavailability of thioglycolates, making them more effective in various formulations. This trend is anticipated to influence the development of advanced and high-performance products.

Category-wise Insights

The section offers category-wise insights into the thioglycolates industry. When segmented based on product type, the analysis shows that calcium thioglycolates are leading the segment of that market with a share of 23% in 2025. By application type most dominant one is the personal care and cosmetics segment with a market share of 21% in 2025.

Calcium Thioglycolates Lead the Thioglycolates Industry with a Share of 23% in 2025

| Attributes |

Detail |

| Top Product Type |

Calcium Thioglycolates |

| Market Share in 2025 |

23% |

Calcium thioglycolates dominate the thioglycolate market by product, with a share of 23% in 2025.

- Calcium thioglycolates possess multiple applications, from hair removal to leather tanning, making them a valuable and adaptable ingredient.

- As compared to other thioglycolates calcium thioglycolates offer a cost-effective solution to the manufacturers which strengthens their market position.

- Due to its widespread usage, calcium thioglycolates have a rather safe position in the market while other thioglycolates are surrounded by safety concerns.

Use of Thioglycolates in Personal Care Products and Cosmetics

| Attributes |

Detail |

| Top Application |

Personal Care and Cosmetics |

| Market Share in 2025 |

21% |

The personal care and cosmetics segment is estimated to lead the industry with a share of 21% in 2025.

- Growing consumer demand for hair removal solutions, particularly in emerging markets, fuels the need for effective and affordable ingredients like calcium thioglycolates.

- As consumers’ preference towards natural and organic ingredients in personal care increases the demand for calcium thioglycolate also increases as it is seen as a milder and less harsh hair removal chemical.

- Innovations in the hair removal formulations adding calcium thioglycolates have improved the efficiency and also reduced the irritation making its market position stronger in the personal care market.

- Major personal care brands incorporating calcium thioglycolates in their products have contributed to increased awareness and adoption of this ingredient among consumers.

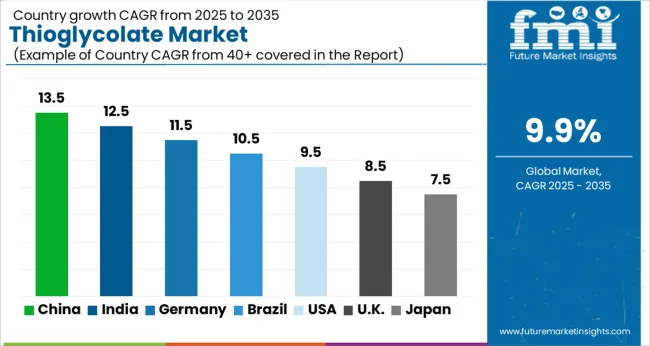

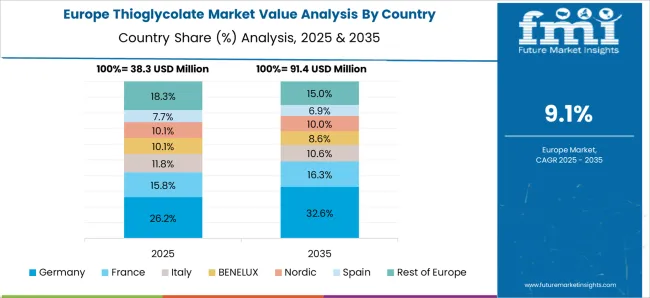

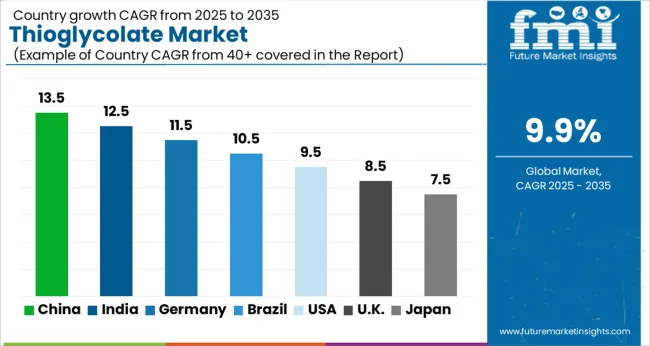

Country-wise Insights

This section delves into the growth trajectories of the thioglycolates industry across key geographic markets. This section provides an analysis of each country offering a deeper understanding of the growth path, key drivers, and opportunities of each country.

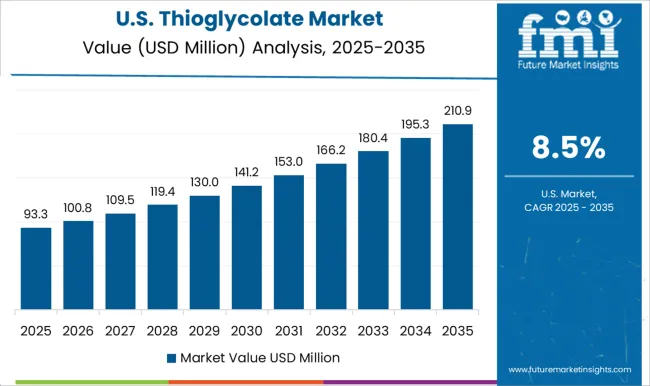

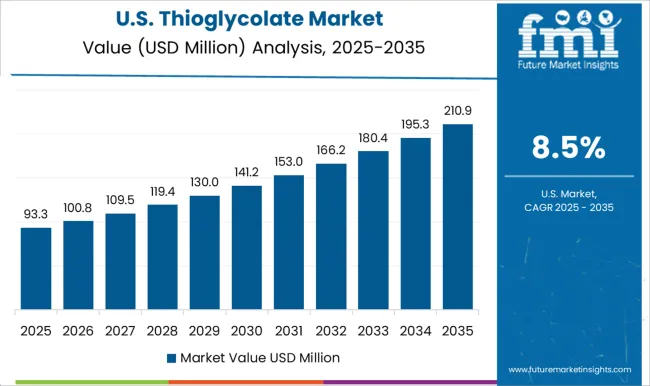

Thioglycolate Market in the United States

The United States thioglycolates industry is estimated to witness a stable CAGR of 5.4% through 2035.

- The established presence of thioglycolates in personal care and cosmetics, particularly hair removal products, provides a strong base for continued market expansion.

- Manufacturers of thioglycolates in the United States are open to the idea of using new technologies and advancements in the thioglycolate-based formulations improving product effectiveness and consumer satisfaction.

- Thioglycolate is seeing growth in opportunities in sectors like leather tanning and industrial use.

- Due to the rising awareness of natural and organic ingredients, the demand for some thioglycolates is also increasing as they are seen as mild and less harsh compared to other alternatives which is driving their adoption.

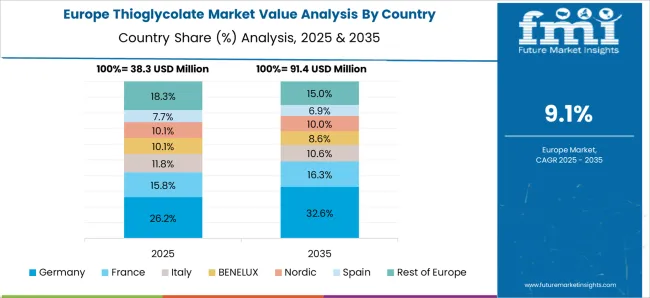

Thioglycolate Market in Germany

Germany's thioglycolate market is projected to rise at a CAGR of 6.0% through 2035.

- Demand from the automotive and medical sectors, where performance and reliability are of high value, acts as a major factor in the growth of the global thioglycolates market.

- German manufacturers follow strict quality control measures increasing the safety and efficiency of the thioglycolate products which increases customer confidence and market acceptance.

- The personal care and cosmetics segment remains a significant contributor to Germany’s thioglycolate market, offering the potential for continued expansion.

- Finding out ways to use thioglycolates in new areas like agriculture and environmental protection could open up numerous opportunities for future growth.

- The trend of increasing focus on eco-friendly practices in Germany may lead to the development of more sustainable and environment-friendly thioglycolate products that satisfies the consumer demands.

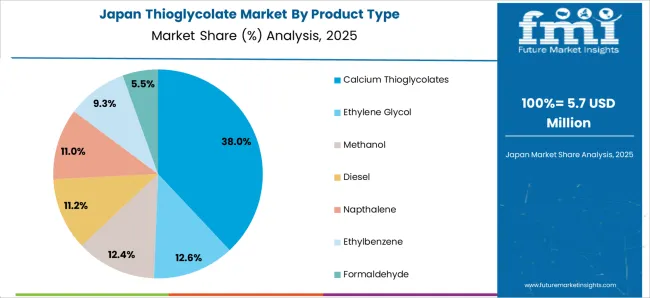

Thioglycolate Market in Japan

With a projected CAGR of 8.0% through 2035, Japan's thriving thioglycolates industry is fueled by the following:

- A deeply ingrained culture of hair removal, particularly among female consumers, creates a consistent and robust demand for effective and readily available depilatory solutions, driving the use of thioglycolates.

- Japan’s strict rules and attention to quality control have led to high-performing and reliable thioglycolate products which increases consumer trust and market growth.

- Japan's thioglycolates manufacturers are exploring opportunities in other sectors like medical and industrial uses.

- As Japan's population ages, the demand for hair removal solutions for older individuals is expected to rise, creating another potential growth driver for the thioglycolates industry.

Thioglycolate Market in Australia

The Australia thioglycolate market is projected to grow at a CAGR of 4.5% through 2035. This potential stems from several key factors:

- One of the key drivers of thioglycolate is the consistent demand for hair removal solutions particularly among women.

- While personal care is dominant, opportunities for thioglycolate applications in other areas like industrial uses and water treatment are yet to be fully explored.

- Australian manufacturers are open to adopting new technologies and adapting their offerings to meet changing consumer preferences, which can help them stay ahead of the competition.

Thioglycolate Market in China

China’s thioglycolate market is expected to have a CAGR of 7.5% through 2035.

- There is a rising demand for personal care and beauty products including the ones that contain thioglycolates, this is because of the rapid increase in China’s middle class and their rising disposable income.

- As awareness of hair removal and personal care products increases, especially in rural areas, the adoption of thioglycolates is expected to see substantial growth.

- China's strong manufacturing capabilities can lead to increased domestic production of thioglycolates, potentially reducing dependence on imports and boosting market expansion.

- Chinese manufacturers are actively adapting existing technologies and developing new applications for thioglycolates.

Competitive Landscape

The thioglycolate industry faces intense competition and shifting market trends. The established players are having a hard time dealing with new entrants, changing regulations, and the introduction of new alternative technologies to maintain their market position.

One of the trends of diversification is speeding up the market as players extend their product offerings beyond traditional applications in hair care to serve different industries. This reduces the risk and opens up new revenue streams.

Challenges Faced by Thioglycolates Manufacturers

- The strict regulations of cosmetics and pharmaceuticals create challenges of continuous use of formulas and compliance with changing standards.

- The rise in keratin treatments and other hair-straightening methods presents a competitive threat, necessitating market players to focus on continuous innovation and product differentiation.

Investment Opportunities for New Entrants

- Creating new and unique formulations for specific requirements such as sensitive scalps, curly hairs, or other specific industrial applications can provide a rewarding opportunity in this niche segment.

- Combining sustainable production technologies with eco-friendly thioglycolate offerings could not only align very well with the increasing consumer demand for responsible environmental products but would also open up new market opportunities.

- New entrants can directly reach the consumer through online platforms, therefore avoiding traditional channels of distribution, which can be an inexpensive and effective market entry strategy.

Recent Developments in the Thioglycolate Industry

- Evonik Industries launched a new INFINAM® TPA elastomer powder material for SLS 3D printing, introducing carbon fiber-reinforced PEEK filament for long-term 3D printed medical implants and strengthening its portfolio of nanoparticle technologies and services for parenteral drug delivery.

- L’Oréal Group acquired Lactobio, a leading probiotic and microbiome research company based in Copenhagen, partnering with Cosmo International Fragrances to bring a Green Sciences-based extraction process to revolutionize the art of fine fragrance creation and sponsoring Orient Express Racing Team, the French Challenger for the 37th America’s Cup sailing competition.

Key Companies in the Market

- Qingdao Jiahua Chemical

- Evonik Industries

- Dow Inc.

- Merck KGaA

- Bruno Bock Chemische Fabrik GmbH & Co. KG

- Nippon Shokubai Co., Ltd.

- Jiaxing Weifang Chemical

Key Segments

By Product Type:

- Calcium Thioglycolates

- Ethylene Glycol

- Methanol

- Diesel

- Napthalene

- Ethylbenzene

- Formaldehyde

By Application:

- Hair care and Cosmetic Products

- Chemical Intermediate

- Pharmaceuticals

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia

- Middle East and Africa

Frequently Asked Questions

How big is the thioglycolate market in 2025?

The global thioglycolate market is estimated to be valued at USD 168.0 million in 2025.

What will be the size of thioglycolate market in 2035?

The market size for the thioglycolate market is projected to reach USD 435.7 million by 2035.

How much will be the thioglycolate market growth between 2025 and 2035?

The thioglycolate market is expected to grow at a 9.9% CAGR between 2025 and 2035.

What are the key product types in the thioglycolate market?

The key product types in thioglycolate market are calcium thioglycolates, ethylene glycol, methanol, diesel, napthalene, ethylbenzene and formaldehyde.

Which application segment to contribute significant share in the thioglycolate market in 2025?

In terms of application, hair care and cosmetic products segment to command 42.5% share in the thioglycolate market in 2025.