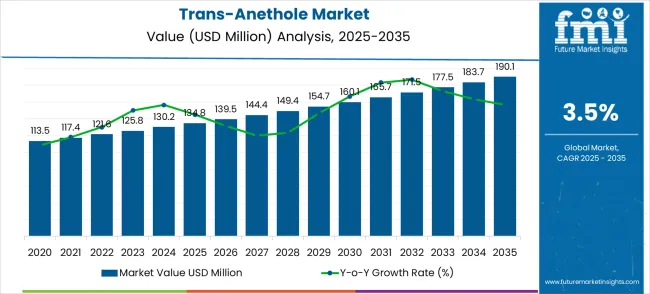

The trans-anethole market is projected to grow from USD 134.8 million in 2025 to USD 190.1 million by 2035, reflecting a steady CAGR of 3.5%. This growth is primarily driven by its increasing use as a flavoring agent in the food and beverage industry, particularly in products like confectionery, alcoholic beverages, and baked goods. The rising demand for natural and plant-based ingredients, particularly in the food sector, further enhances the market’s expansion.

Over the years, despite a moderate growth rate, consistent demand for trans-anethole has been observed across various sectors, including food and cosmetics. The steady rise is attributed to its wide applications in fragrances and essential oils, where it plays a critical role in enhancing aromatic profiles. The market sees a slow but consistent rise as trans-anethole continues to be favored for its natural origin and unique flavor-enhancing properties.

Growth in this market is also supported by the increasing consumer preference for natural additives over synthetic alternatives. As health-conscious consumers seek more plant-based ingredients in their food and personal care products, the demand for trans-anethole, which is derived from star anise and fennel, has grown significantly. The market's trajectory shows slight acceleration during certain periods, especially when consumer trends shift towards more organic, chemical-free solutions.

However, the growth rate remains stable as trans-anethole is integrated into various industrial applications beyond food and beverages, such as pharmaceuticals and cosmetics, where it serves as a key ingredient due to its antioxidant properties. The projected CAGR of 3.5% indicates a steady yet secure growth outlook for the market, driven by consistent demand across various industries.

| Trans-Anethole Market | Value |

|---|---|

| Market Value (2025) | USD 134.8 million |

| Market Forecast Value (2035) | USD 190.1 million |

| Market Forecast CAGR | 3.5% |

The trans-anethole market commands a prominent position within the essential oils market, contributing about 10% of the total share due to its extensive use in aromatherapy and fragrances. In the flavor and fragrance ingredients market, it holds around 8%, reflecting its application in the creation of sweet, anise-like scents. Within the natural aromatic chemicals market, the share is estimated at 7%, as trans-anethole is valued for its role in natural extract formulations.

The food additives market accounts for about 6%, driven by its use in flavoring food and beverages. In the pharmaceutical ingredients market, trans-anethole accounts for approximately 5%, with applications in various therapeutic formulations. These combined figures highlight its broad usage across the flavoring, fragrance, and chemical sectors, demonstrating its value in a range of consumer and industrial products.

Market expansion is being supported by the rapid increase in specialty food production worldwide and the corresponding need for distinctive aromatic compounds that provide superior flavor characteristics and natural authenticity for premium food formulations. Modern food industries rely on consistent flavor quality and aromatic profile reliability to ensure optimal consumer appeal including food processing facilities, beverage manufacturers, and specialty ingredient suppliers. Even minor flavor variations can require comprehensive formulation adjustments to maintain optimal taste standards and product consistency.

The growing complexity of food flavor composition requirements and increasing demand for natural aromatic ingredients are driving demand for trans-anethole from certified suppliers with appropriate purity capabilities and production expertise. Food manufacturers are increasingly requiring documented flavor specifications and supply reliability to maintain product quality and taste consistency. Industry specifications and quality standards are establishing standardized flavor compound procedures that require specialized production technologies and trained processing personnel.

The Trans-Anethole market is entering a new phase of growth, driven by demand for natural flavors, specialty food expansion, and evolving quality and sustainability standards. By 2035, these pathways together can unlock USD 25-35 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Ultra-High Purity Leadership (99% Purity Grade) The 99% purity segment already holds the largest share due to its superior quality and flavor characteristics. Expanding purity optimization, quality certification, and premium positioning can consolidate leadership. Opportunity pool: USD 8-12 million.

Pathway B -- Premium Flavor Applications (Food & Beverage Enhancement) Flavors and spices applications account for the majority of demand. Growing premium food markets, especially in emerging economies, will drive higher adoption of trans-anethole for distinctive flavor profiles. Opportunity pool: USD 6-9 million.

Pathway C -- Pharmaceutical & Nutraceutical Growth Medical and health applications are expanding with increasing focus on natural compounds. Products tailored for pharmaceutical uses (high purity, certified quality, regulatory compliance) can capture significant growth. Opportunity pool: USD 3-5 million.

Pathway D -- Emerging Market Expansion Asia-Pacific and Latin America present a growing demand due to rising food processing industries. Targeting distribution networks and quality-assured supply chains will accelerate adoption. Opportunity pool: USD 2-4 million.

Pathway E -- Sustainable & Natural Sourcing With increasing sustainability requirements, there is an opportunity to promote naturally-sourced and environmentally-friendly trans-anethole innovations. Opportunity pool: USD 2-3 million.

Pathway F -- Specialized Processing Features Products with custom purification, enhanced flavor intensity, and specialized packaging offer premium positioning for high-end food manufacturers and pharmaceutical applications. Opportunity pool: USD 1-2 million.

Pathway G -- Technical Services & Application Support. Recurring value from formulation consulting, flavor testing, and technical support services creates long-term customer relationships. Opportunity pool: USD 1-2 million.

Pathway H -- Quality Assurance & Traceability Systems Digital quality tracking, batch certification, and supply chain transparency can elevate trans-anethole into premium specialty chemical categories while strengthening customer confidence. Opportunity pool: USD 1-2 million.

The market is segmented by purity level, application, and region. By purity level, the market is divided into 98% purity, 99% purity, and other grades. Based on application, the market is categorized into flavors and spices, food, and pharmaceuticals. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

In 2025, the 99% purity trans-anethole segment is projected to capture around 56% of the total market share, making it the leading purity category. This dominance is largely driven by the widespread adoption of ultra-high-purity aromatic compounds that provide superior flavor intensity and formulation reliability, catering to a wide variety of premium applications. The 99% purity grade is particularly favored for its ability to deliver consistent olfactory and taste performance in both traditional and innovative flavor formulations, ensuring aromatic excellence. Food processing companies, pharmaceutical manufacturers, beverage producers, and specialty ingredient facilities increasingly prefer this purity level, as it meets stringent quality requirements without imposing excessive processing complexity or sourcing difficulties. The availability of well-established supply chains, along with comprehensive quality assurance options and regulatory compliance from leading suppliers, further reinforces the segment's market position. Additionally, this purity category benefits from consistent demand across regions, as it is considered a reliable and effective solution for applications requiring high flavor intensity and chemical consistency. The combination of quality, performance, and versatility makes 99% purity trans-anethole a dependable choice, ensuring its continued popularity in the specialty chemical and flavor ingredient markets.

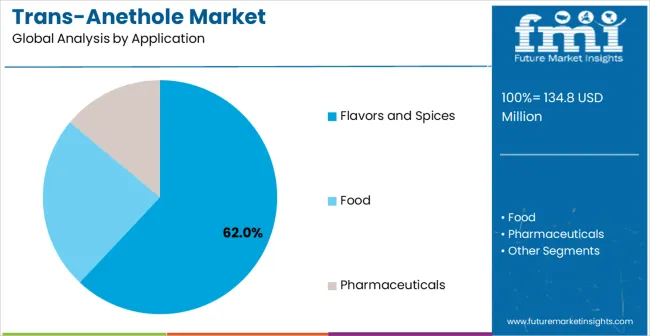

The flavors and spices segment is expected to represent 62% of trans-anethole demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the essential aromatic properties of trans-anethole in flavor enhancement applications, where distinctive taste profiles and natural authenticity are critical to product differentiation and consumer acceptance. Flavors and spices applications often feature complex formulation requirements that demand specialized aromatic compounds throughout extensive product development periods, requiring reliable and consistent ingredient sources. Trans-anethole is particularly well-suited to these applications due to its ability to provide unique anise-like flavor characteristics and natural complexity, even in sophisticated flavor compositions. As food and beverage industries expand globally and emphasize premium natural ingredients, the demand for trans-anethole continues to rise. The segment also benefits from heightened consumer preference trends within the food industry, where manufacturers are increasingly prioritizing natural ingredients and authentic flavor experiences as essential product features. With food companies investing in natural ingredient sourcing and premium formulation standards, trans-anethole provides an essential component to maintain high-quality flavor profiles. The growth of artisanal food products, coupled with increased focus on natural flavor standards, ensures that flavors and spices applications will remain the largest and most stable demand driver for trans-anethole in the forecast period.

The Trans-Anethole market is advancing moderately due to increasing specialty food industry development and growing recognition of natural aromatic compound advantages over synthetic alternatives in premium consumer applications. However, the market faces challenges including seasonal raw material availability affecting supply consistency, regulatory variations for food additives across different regions, and competition from synthetic anise compounds in cost-sensitive applications. Quality standardization efforts and sustainable sourcing programs continue to influence product development and market adoption patterns.

The growing development of advanced purification and distillation systems is enabling higher purity levels with improved yield efficiency and enhanced aromatic compound preservation. Advanced purification technologies and optimized crystallization processes provide superior quality control while maintaining natural compound integrity requirements. These technologies are particularly valuable for specialty chemical operators who require reliable product quality that can support extensive formulation operations with consistent aromatic results.

Modern trans-anethole producers are incorporating advanced sustainable production practices and environmental management systems that enhance production efficiency and product quality. Integration of green chemistry principles and optimized reaction processes enables superior environmental performance and comprehensive sustainability capabilities. Advanced production features support operation in diverse manufacturing environments while meeting various environmental requirements and quality specifications.

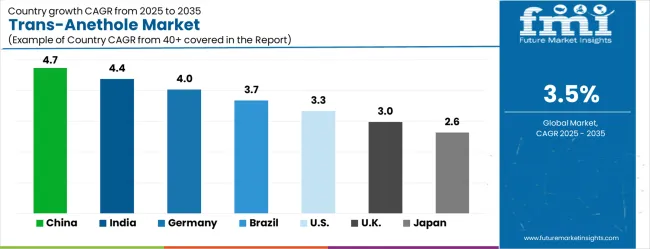

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| Brazil | 3.7% |

| United States | 3.3% |

| United Kingdom | 3.0% |

| Japan | 2.6% |

The trans-anethole market is growing steadily, with China leading at a 4.7% CAGR through 2035, driven by expanding food processing industry development and increasing adoption of specialty aromatic compounds. India follows at 4.4%, supported by rising food manufacturing infrastructure development and growing awareness of natural flavor ingredients. Germany grows consistently at 4.0%, integrating natural aromatic compounds into its established food and pharmaceutical industries. Brazil records 3.7%, emphasizing food industry modernization and natural ingredient sourcing initiatives. The United States shows solid growth at 3.3%, focusing on premium food applications and quality enhancement. The United Kingdom demonstrates steady progress at 3.0%, maintaining established food processing and pharmaceutical applications. Japan records 2.6% growth, concentrating on quality optimization and specialized flavor applications.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The trans-anethole market in China is projected to exhibit the highest growth rate with a CAGR of 4.7% through 2035, driven by rapid expansion of food processing infrastructure and increasing demand for specialty aromatic compounds. The country's growing food manufacturing sector and expanding flavor ingredient production are creating significant demand for natural aromatic compounds. Major food manufacturers are establishing comprehensive sourcing networks to support the increasing requirements of food companies and flavor ingredient facilities across manufacturing regions.

Government food industry development initiatives are supporting establishment of modern food processing facilities and specialty ingredient complexes, driving demand for premium aromatic compounds throughout major industrial zones. Food sector modernization programs are facilitating adoption of natural flavor ingredients that enhance product appeal and consumer satisfaction standards across food product networks.

The trans-anethole market in India is expanding at a CAGR of 4.4%, supported by increasing food manufacturing sector development and growing awareness of natural aromatic compound benefits. The country's expanding food processing industry infrastructure and rising product quality standards are driving demand for specialty flavor ingredients. Food manufacturers and processing companies are gradually implementing premium aromatic compounds to maintain product standards and market competitiveness.

Food industry growth and processing infrastructure development are creating opportunities for suppliers that can support diverse formulation requirements and quality specifications. Professional training and technical programs are building expertise among food technologists, enabling effective utilization of trans-anethole technology that meets food quality standards and consumer preference requirements.

The trans-anethole market in Germany is projected to grow at a CAGR of 4.0%, supported by the country's emphasis on food industry quality standards and specialty chemical technology adoption. German food processing facilities are implementing sophisticated aromatic compound sourcing that meets stringent quality requirements and regulatory specifications. The market is characterized by focus on ingredient reliability, formulation excellence, and compliance with comprehensive industry standards.

Food industry investments are prioritizing premium aromatic technology that demonstrates superior performance and consistency while meeting German quality and regulatory standards. Professional certification programs are ensuring comprehensive technical expertise among food processing personnel, enabling specialized flavor capabilities that support diverse food applications and product requirements.

The trans-anethole market in Brazil is growing at a CAGR of 3.7%, driven by increasing food industry development and growing recognition of natural aromatic compound advantages. The country's expanding food processing sector is gradually integrating premium aromatic ingredients to enhance product quality and market appeal. Food processing facilities and manufacturing companies are investing in natural compound sourcing to address evolving consumer preferences and quality standards.

Food industry modernization is facilitating adoption of natural aromatic technologies that support comprehensive formulation capabilities across food processing regions. Professional development programs are enhancing technical capabilities among food processing personnel, enabling effective trans-anethole utilization that meets evolving industry standards and product requirements.

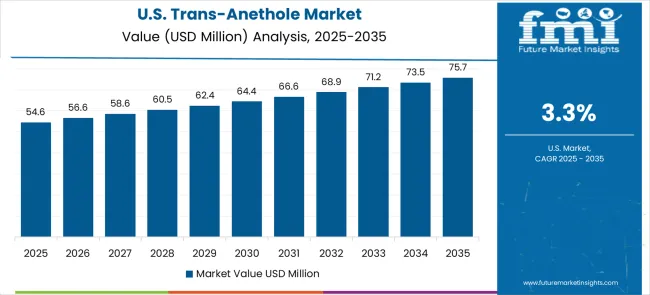

The trans-anethole market in the USA is expanding at a CAGR of 3.3%, driven by established food industries and growing emphasis on premium product enhancement. Large food companies and specialty ingredient providers are implementing comprehensive aromatic compound capabilities to serve diverse formulation requirements. The market benefits from established supply distribution networks and professional development programs that support various food and pharmaceutical applications.

Food industry leadership is enabling standardized ingredient utilization across multiple product types, providing consistent quality standards and comprehensive flavor coverage throughout regional markets. Professional development and certification programs are building specialized technical expertise among formulation specialists, enabling effective trans-anethole utilization that supports evolving food facility requirements.

The trans-anethole market in the UK is projected to grow at a CAGR of 3%, supported by established food processing sectors and growing emphasis on natural flavor capabilities. British food processing facilities and manufacturing service providers are implementing aromatic compound sourcing that meets industry quality standards and regulatory requirements. The market benefits from established food processing infrastructure and comprehensive training programs for food technology professionals.

Food processing facility investments are prioritizing natural aromatic compounds that support diverse formulation applications while maintaining established quality and regulatory standards. Professional development programs are building technical expertise among food processing personnel, enabling specialized trans-anethole operation capabilities that meet evolving facility requirements and quality standards.

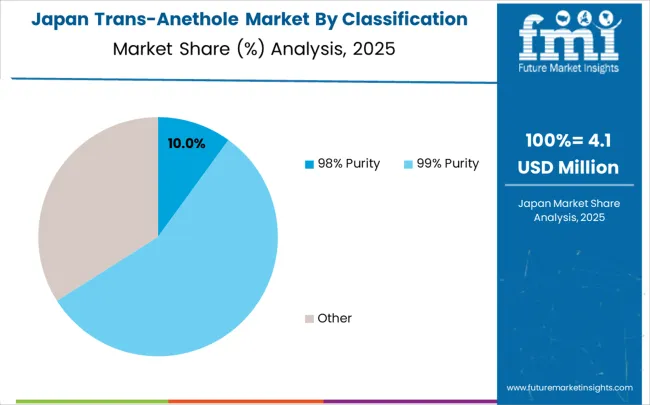

The trans-anethole market in Japan is growing at a CAGR of 2.6%, driven by the country's focus on food technology innovation and quality enhancement applications. Japanese food processing facilities are implementing advanced aromatic compound sourcing that demonstrates superior quality reliability and formulation consistency. The market is characterized by emphasis on ingredient excellence, quality assurance, and integration with established food processing workflows.

Food technology investments are prioritizing innovative aromatic solutions that combine natural compound sourcing with precision quality control while maintaining Japanese reliability and consistency standards. Professional development programs are ensuring comprehensive technical expertise among food processing personnel, enabling specialized formulation capabilities that support diverse food applications and product requirements.

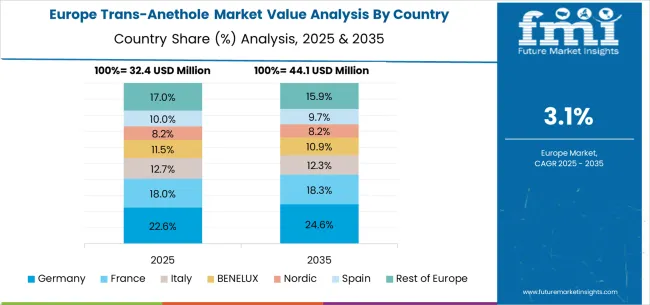

The trans-anethole market in Europe is forecast to expand from USD 35.2 million in 2025 to USD 49.7 million by 2035, registering a CAGR of 3.5%. Germany will remain the largest market, holding 28.4% share in 2025, easing to 27.9% by 2035, supported by strong food processing infrastructure and advanced flavor ingredient standards. The United Kingdom follows, rising from 21.3% in 2025 to 21.8% by 2035, driven by premium food demand and specialty flavor applications. France is expected to maintain stability from 17.8% to 17.5%, reflecting consistent food industry investments and natural ingredient preferences. Italy holds around 13.6% throughout the forecast period, supported by traditional food manufacturing and flavor ingredient facility upgrades. Spain grows from 10.2% to 10.8% with expanding food processing infrastructure and increased focus on natural aromatic ingredients. BENELUX markets maintain 5.4% to 5.2%, while the remainder of Europe hovers near 3.3%--3.4%, balancing emerging Eastern European food processing development against mature Nordic markets with established specialty ingredient adoption patterns.

The trans-anethole market is defined by competition among specialized aromatic compound suppliers, flavor ingredient companies, and specialty chemical solution providers. Companies are investing in advanced production technology development, quality assurance optimization, sustainable sourcing improvements, and comprehensive technical service capabilities to deliver reliable, consistent, and cost-effective aromatic solutions. Strategic partnerships, quality innovation, and market expansion are central to strengthening product portfolios and market presence.

Penta Manufacturing provides specialized chemical products with focus on quality reliability and processing efficiency. Berjé delivers advanced specialty aromatic solutions with emphasis on purity and application-friendly operation. A.G Organica specializes in aromatic compounds with advanced production technology integration.

Nanjing Cosmos Chemical offers professional-grade chemical ingredients with comprehensive quality support capabilities. Hunan Shineway Enterprise delivers established specialty chemical solutions with advanced aromatic compound technologies. Chuanhui Perfumery provides specialized aromatic equipment with focus on quality optimization. These companies offer specialized manufacturing expertise, product reliability, and comprehensive development capabilities across global and regional market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 134.8 million |

| Purity Level | 98% Purity, 99% Purity, Other |

| Application | Flavors and Spices, Food, Pharmaceuticals |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Atul, Penta Manufacturing, Berjé, A.G Organica, Nanjing Cosmos Chemical, Hunan Shineway Enterprise, Chuanhui Perfumery |

| Additional Attributes | Dollar sales by purity level and application segment, regional demand trends across major markets, competitive landscape with established aromatic compound suppliers and emerging specialty providers, customer preferences for different purity options and production methods, integration with food industry systems and formulation protocols, innovations in production efficiency and quality assurance technologies, and adoption of sustainable production design features with enhanced purity capabilities for improved formulation workflows. |

The global trans-anethole market is estimated to be valued at USD 134.8 million in 2025.

The market size for the trans-anethole market is projected to reach USD 190.1 million by 2035.

The trans-anethole market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in trans-anethole market are 98% purity, 99% purity and other.

In terms of application, flavors and spices segment to command 62.0% share in the trans-anethole market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA