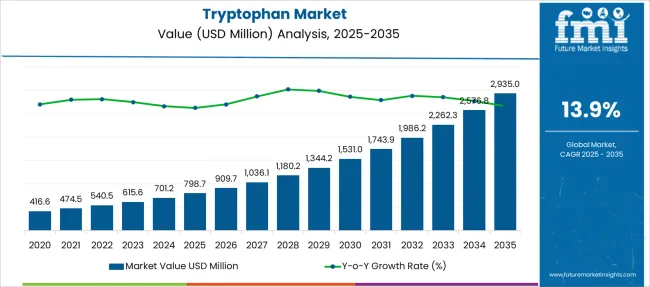

The Tryptophan Market is estimated to be valued at USD 798.7 million in 2025 and is projected to reach USD 2935.0 million by 2035, registering a compound annual growth rate (CAGR) of 13.9% over the forecast period.

| Metric | Value |

|---|---|

| Tryptophan Market Estimated Value in (2025 E) | USD 798.7 million |

| Tryptophan Market Forecast Value in (2035 F) | USD 2935.0 million |

| Forecast CAGR (2025 to 2035) | 13.9% |

The tryptophan market is witnessing steady growth driven by the increasing demand for amino acid fortification across food, beverage, and nutraceutical sectors. Rising health consciousness, a shift toward functional foods, and growing emphasis on protein-rich diets are contributing to widespread adoption of tryptophan in both human and animal nutrition.

The compound’s role in supporting mood regulation, sleep health, and metabolic balance has positioned it as a key ingredient in wellness-focused formulations. Manufacturers are investing in biosynthetic production methods and fermentation technologies to enhance output quality and scalability.

Regulatory support for clean-label, bioavailable amino acid sources further strengthens the market outlook. As consumer preference continues to align with holistic wellness and dietary supplements, the tryptophan market is poised for consistent expansion across global health, nutrition, and food sectors.

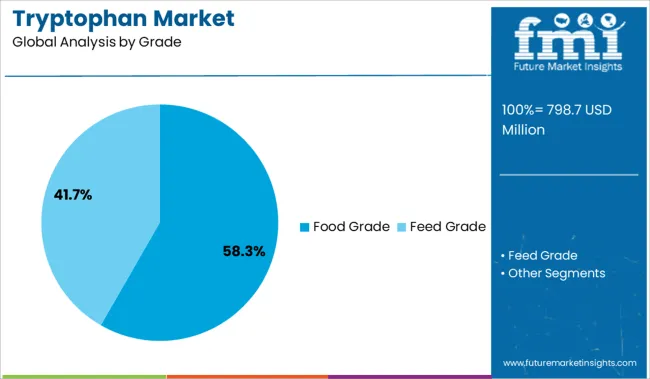

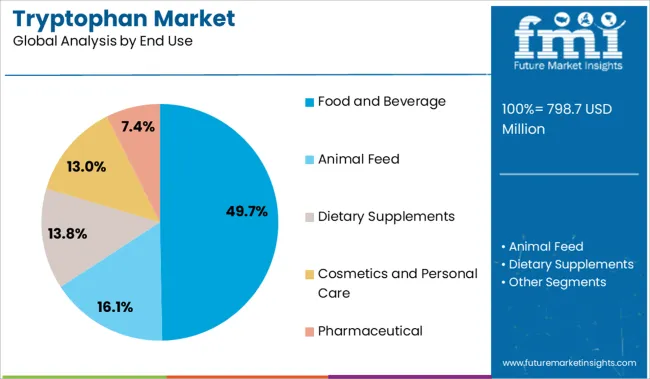

The market is segmented by Grade and End Use and region. By Grade, the market is divided into Food Grade and Feed Grade. In terms of End Use, the market is classified into Food and Beverage, Animal Feed, Dietary Supplements, Cosmetics and Personal Care, and Pharmaceutical. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food grade segment is projected to account for 58.30% of total market revenue by 2025 under the grade category, making it the most dominant classification. This strong market share is attributed to increasing use of tryptophan in functional foods, dietary supplements, and fortified beverages.

Demand for clean-label and natural ingredients has supported the integration of food grade amino acids into various health-oriented product formulations. Food grade tryptophan is widely used for its regulatory recognition, purity, and compatibility with nutritional applications.

As consumers seek alternatives that promote mental well-being and sleep quality through diet, food manufacturers have scaled adoption of tryptophan-enriched solutions, consolidating the segment’s leadership.

The food and beverage segment is estimated to hold 49.70% of market revenue by 2025 within the end use category, positioning it as the largest application sector. Growth in this segment is driven by the demand for functional beverages, protein-enriched snacks, and wellness-enhancing foods.

The incorporation of tryptophan into consumables is supported by its proven benefits in serotonin synthesis and neurological health, making it highly attractive for product developers targeting stress, sleep, and mood support. Moreover, increased innovation in ready-to-drink, plant-based, and clean-label product lines has expanded the application of tryptophan in diverse formats.

As health-focused formulations continue to gain consumer preference, the food and beverage sector remains a key driver of tryptophan market demand.

The global tryptophan market is primarily driven by a significant increase in the consumption of feed ingredients. When tryptophan is supplemented with the feed of the livestock, it improves the feed intake of the animals, especially piglets. Also, since serotonin production is increased, it impacts the appetite of the livestock.

Gaining popularity in the cosmetic industry, an increase in consumption of animal feed, and a growing health-conscious population are some of the key factors fuelling the tryptophan market growth. Furthermore, more and more advancements in technology and modernization in the market, coupled with increasing demand from developing economies - all these factors are said to create novel opportunities for tryptophan manufacturers during the forecast period of 2025 to 2035.

The tryptophan market is also driven by the rising expenditure on health products and increased consumption of dietary supplements. Tryptophan supplements enhance mood and decrease depression, assist in insomnia treatment, and betters poor cognition and other neurological conditions.

The demand for tryptophan in the global market is rising owing to the efficient results studied with the supplementing feed with it. Moreover, most commonly, tryptophan is consumed by bodybuilders to assist with weight gain of the body. Tryptophan is said to elevate growth hormone levels and reduces body fatigue. Consumption of tryptophan has several health benefits, and this factor will increase the demand and sales of tryptophan in the global market.

Besides the driving factors, some of the factors which restrain the global market are side effects linked with the consumption of tryptophan and an increase in strict government actions. These factors will further possess as a market challenge during the forecast period.

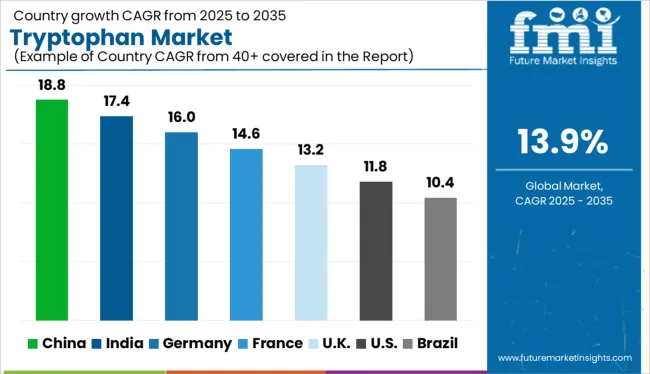

Region-wise, North America has the majority market share in the global market owing to the rising number of health-conscious consumers and the increase in animal feed ingredients consumption in this region. North America is followed by Europe, dominating the global market. Strong animal nutrition and animal feed industry in these regions is accountable for the higher consumption of tryptophan in these regions.

In the North American region, a country like the USA has more consumers who are dedicated to their health, and this has resulted in healthy eating and an active lifestyle. This has catered to the demand for tryptophan, and several functional food manufacturers have integrated the use of tryptophan.

In terms of consumption, the Asia Pacific tryptophan market is anticipated to witness a huge growth rate during the forecast period. This higher demand is backed by development in the food and beverage industry, animal nutrition, and niche application in other industries like pharmaceutical, cosmetics, etc.

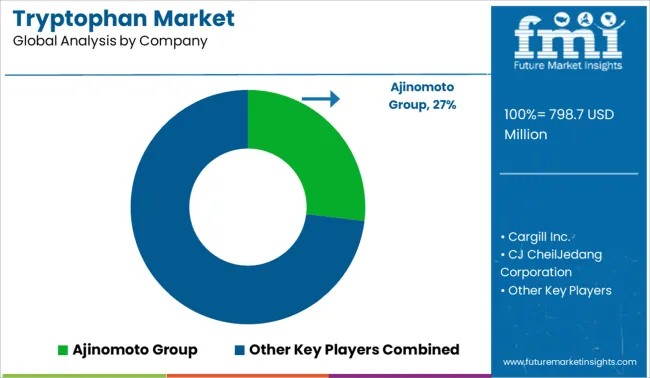

A few of the key players in the tryptophan market include Ajinomoto Group, Cargill Inc., CJ CheilJedang Corporation, Kyowa Hakko Bio Co., Ltd., Penta Manufacturing Company, Daesang Corporation, ADM Company, Evonik, Novus International, and Glanbia Plc.

In June 2024, Evonik proves the ecological benefits of its feeding solutions for poultry and swine. Evonik’s comparative life cycle assessment (LCA) showcased the ecological benefits of using its feed amino acids and feeding concepts in comparison with generic animal nutrition practices.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 13.9% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Grade, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Ajinomoto Group; Cargill Inc.; CJ CheilJedang Corporation; Kyowa Hakko Bio Co., Ltd; Penta Manufacturing Company; Daesang Corporation; ADM Company; Evonik; Novus International; Glanbia Plc |

| Customization | Available Upon Request |

The global tryptophan market is estimated to be valued at USD 798.7 million in 2025.

The market size for the tryptophan market is projected to reach USD 2,935.0 million by 2035.

The tryptophan market is expected to grow at a 13.9% CAGR between 2025 and 2035.

The key product types in tryptophan market are food grade and feed grade.

In terms of end use, food and beverage segment to command 49.7% share in the tryptophan market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA