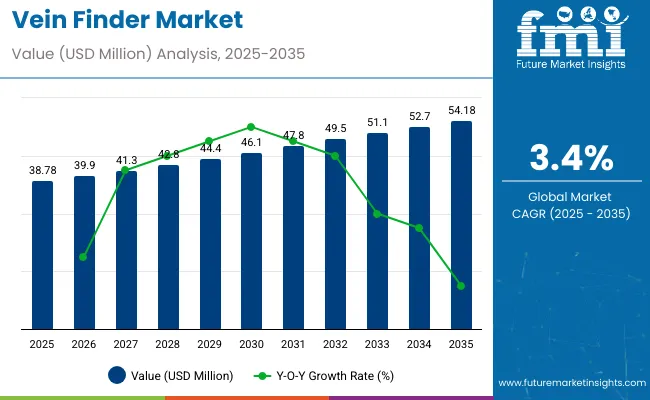

The vein finder market is valued at USD 38.78 million in 2025 and is slated to reach USD 54.18 million by 2035, which shows a CAGR of 3.4%. The increasing demand for non-invasive, accurate, and quick solutions for locating veins is driving market growth.

Vein finders are crucial in medical procedures, particularly in intravenous (IV) therapy, blood draws, and dialysis, where precision is paramount. As healthcare systems strive for improved patient care, the adoption of vein finding technology is increasing, especially in regions with a high incidence of chronic diseases and an aging population requiring frequent medical procedures.

Technological advancements in vein finder devices are a major factor propelling the market forward. The development of infrared-based devices, ultrasound, and near-infrared spectroscopy technologies has enhanced the precision and effectiveness of vein finders, making them more reliable and user-friendly.

Additionally, these devices are being integrated with artificial intelligence (AI) and machine learning to improve their ability to detect veins in patients with difficult-to-locate veins. These innovations are expected to improve the speed and accuracy of vein localization, reducing the risk of complications during procedures and enhancing overall patient satisfaction.

Government regulations and healthcare policies are further supporting market growth, as many countries are increasingly focusing on improving healthcare quality and patient safety. These regulations encourage the use of advanced medical technologies, including vein finders, to enhance care standards.

As healthcare providers continue to prioritize efficiency, accuracy, and patient comfort, the adoption of vein finder devices is expected to increase, contributing to the steady growth of the market. The growing focus on reducing medical errors and improving procedural outcomes also positions vein finding technologies as a critical tool in modern healthcare systems.

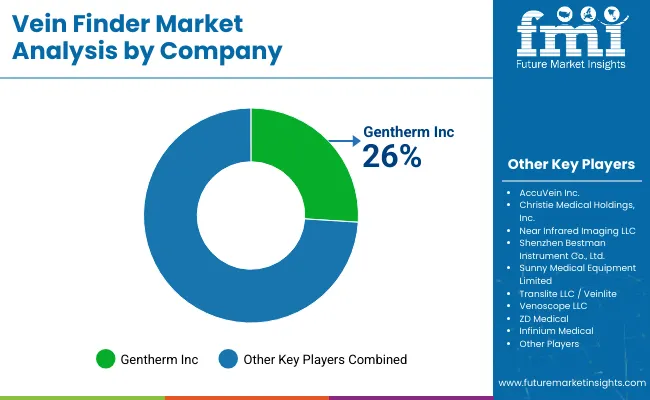

Leading companies in the vein finder market are incorporating advanced smart technologies such as artificial intelligence, infrared imaging, augmented reality, and IoT connectivity to improve vein visualization accuracy, speed up procedures, and enhance patient comfort. These innovations enable healthcare providers to perform vein access with greater precision, reducing complications and improving overall clinical outcomes.

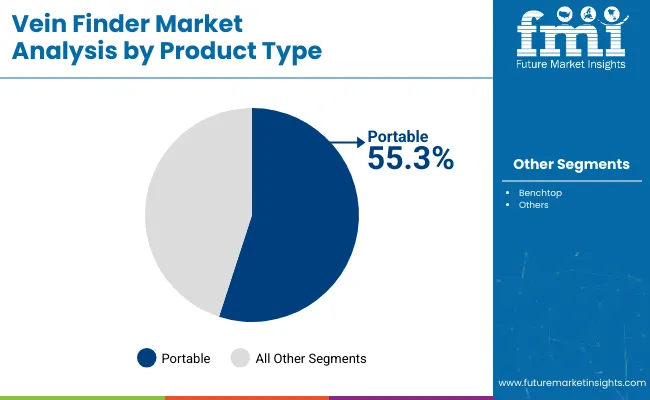

The market is segmented based on product type, technology, end user, and region. By product type, the market is divided into portable and benchtop devices. In terms of technology, the market is categorized into infrared, ultrasound, and transillumination.

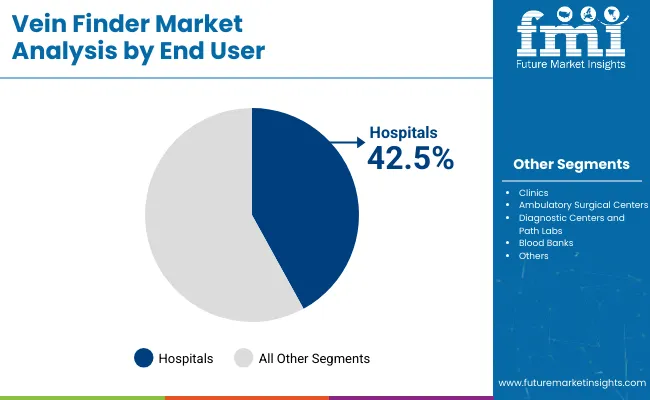

Based on end user, the market is classified into hospitals, clinics, ambulatory surgical centers, diagnostic centers and path labs, and blood banks. Regionally, the market is segmented into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa.

| Product Type Segment | Market Share (2025) |

|---|---|

| Portable | 55.3% |

The portable product type is expected to capture 55.3% of the market share in 2025. Portable devices are highly favored due to their mobility, versatility, and adaptability across various healthcare settings. Their compact nature allows them to be easily transported and used in point-of-care diagnostics, emergency medical situations, and remote healthcare environments, making them essential in modern healthcare.

With the rise in demand for home healthcare services and at-home diagnostics, the portable segment is expected to experience significant growth. These devices offer convenience for both patients and healthcare providers, allowing medical tests and monitoring to take place outside of traditional clinical settings.

The affordability and ease of use also contribute to the increasing adoption of portable devices, especially in ambulatory surgical centers, clinics, and blood banks. As the healthcare industry continues to emphasize cost-effective, flexible, and patient-centric solutions, portable devices are anticipated to remain a dominant product type in the market. The trend toward home-based healthcare services and the need for point-of-care diagnostics are expected to drive further growth in this segment throughout the forecast period.

| Technology Segment | CAGR (2025 to 2035) |

|---|---|

| Infrared | 6.7% |

Infrared technology is projected to experience a CAGR of 6.7% from 2025 to 2035, driven by its wide-ranging applications in medical diagnostics. Infrared technology is most commonly used for non-invasive temperature measurement, thermography, and blood circulation monitoring, offering healthcare providers a reliable, quick, and accurate diagnostic tool.

The increasing demand for non-invasive and patient-friendly medical technologies is supporting the adoption of infrared technology, particularly in thermometers and imaging devices. Its ability to provide fast results with minimal discomfort has made infrared technology an essential component in both clinical and home healthcare environments.

Infrared devices are used extensively in hospitals, clinics, and diagnostic centers due to their precision and ease of integration into existing healthcare workflows. The growing demand for wearable health monitors and the rise in remote patient monitoring are also contributing to the growth of infrared technology in medical diagnostics.

As healthcare providers continue to focus on improving the quality and speed of diagnosis while reducing costs, infrared technology’s non-invasive nature and rapid diagnostics will drive its significant growth in the coming years, particularly in temperature screening and monitoring applications.

| End User Segment | Market Share (2025) |

|---|---|

| Hospitals | 42.5% |

Hospitals are expected to dominate the end-user segment, capturing 42.5% of the market share in 2025. As the largest consumers of medical diagnostic equipment, hospitals rely on a wide array of diagnostic tools for patient care, emergency services, and various medical procedures.

The growing need for advanced diagnostic solutions in hospitals is driven by the rising number of patients, the increasing complexity of treatments, and the growing demand for more accurate and timely diagnoses. Technologies such as infrared, ultrasound, and transillumination are integral to many hospital departments, including emergency rooms, intensive care units, and outpatient care facilities, providing healthcare professionals with the tools to detect diseases, monitor patient conditions, and guide treatment decisions.

Additionally, hospitals are increasingly adopting portable and user-friendly diagnostic devices that improve patient access to care, especially in critical and emergency situations. With ongoing investments in healthcare infrastructure, digital health technologies, and the expansion of hospital networks, the hospital sector is expected to remain the dominant end-user segment for diagnostic equipment.

The need for accurate, reliable, and non-invasive diagnostic solutions will continue to drive the growth of hospitals as a key market segment throughout the forecast period.

Vein finders are becoming essential devices in the healthcare industry. These advanced devices are intended to improve patient care by assisting physicians in venipuncture. Growing adoption of these vein finder devices in a variety of healthcare settings is expected to boost market growth.

Vein finders are becoming critical in several tasks, including starting intravenous lines, locating veins for injections, and drawing blood. Increasing adoption of vein finders in these procedures is expected to boost growth of the vein finder market.

Growing number of surgical procedures globally necessitates accurate venous access for blood sampling, intravenous injections, and other medical procedures. This will continue to propel demand for vein finders.

Rising emphasis on improving patient safety and comfort is expected to fuel sales of vein finders during the forecast period. These vein detection devices help ensure successful first attempts at venipuncture while reducing the number of needle sticks.

Portable vein finders are witnessing higher demand globally due to their small size and easy maneuverability. They are easy for physicians to work with in various clinical settings. Portable vein finders are also ideal for delivering at-home care to the patient.

An increasing shift towards the integration of advanced technologies such as augmented reality and near-infrared spectroscopy in vein finder devices enhances their accuracy and depth of vein detection. This, in turn, is affecting the vein locator market constructively.

Top vein finder manufacturers are constantly looking to develop advanced solutions to boost their sales. This technological evolution is driven by the pursuit of more effective and user-friendly solutions for healthcare professionals.

There has also been a growing emphasis on patient-centric features in vein finder development. Manufacturers are incorporating features that enhance patient comfort during venipuncture, contributing to a positive healthcare experience.

The ongoing trends collectively reflect the market's commitment to technological innovation, adaptability to diverse healthcare settings, and a patient-centered approach to advancing vein finder technologies. As a result, a healthy CAGR has been predicted for the target industry.

Global sales of vein finders increased at a CAGR of 4.8% from 2020 to 2024. In the assessment period, the global vein finder industry is poised to grow at a CAGR of 3.4%.

Chronic diseases such as diabetes, cardiovascular disorders, and renal diseases have become increasingly prevalent on a global scale. This surge in chronic illnesses is increasing the demand for medical procedures that require accurate and efficient vein visualization. This makes vein finders an indispensable tool in contemporary healthcare settings.

Rising geriatric population globally is expected to propel vein finder demand during the forecast period. Due to aging, older people often suffer from conditions like poor venous access, creating need for vein finder devices.

According to the Journal of Frontiers in Public Health, the population of people above 50 years old in the United States is expected to rise by 61.11%, increasing from 137.25 million in 2020 to 221.13 million in 2050. Among this population group, the number of people having at least one chronic disease is estimated to increase to 142.66 million in 2050. This will positively impact vein finder sales.

Amid rising geriatric population and rising prevalence of chronic diseases, healthcare providers face an increasing need for tools that enhance the success rates of medical interventions. Modern vein finders address this need by offering healthcare professionals a reliable means to visualize veins.

Vein finders are increasingly used for intravenous nutritional support, intravenous fluid administration, and intravenous drug administration. Similarly, they find application in intravenous chemotherapy administration and parenteral nutrition, thereby driving their demand.

Due to their increasing application in IV procedures, demand for vein finders is expected to grow rapidly during the forecast period. Vein finders are also used in vascular procedures, dialysis, and cosmetic procedures, contributing to their higher sales.

Increasing usage of vein finders in procedures such as cosmetic makeovers is expected to support market growth over the forecast period. Vein finders help in locating veins before, during, and after cosmetic and vascular procedures. They also help to prevent severe bruising and vein damage during cosmetic procedures.

Vein finders have traditionally been used in healthcare settings for purposes such as IV access, blood draws, and other medical procedures. However, in recent years, there has been an increasing trend toward the use of vein finders in the cosmetic industry as well. This will likely create growth opportunities for vein finder manufacturers.

Despite the significant opportunity for vein finder industry, the high cost of vein finders acts as a restraint for the market, particularly in lower economic regions. Advanced vein finder devices, especially benchtop ones, are expensive, which negatively impacts their sales.

Lack of knowledge and experience in operating a vein finder can lead to complicated intravenous (IV) procedures that are uncomfortable for the patient. In addition, improper use of the vein finder may cause unnecessary bruising, damage to the vein, or other complications.

Patients who have had negative experiences with IV procedures, such as repeated needle sticks or multiple IV insertion attempts, may be reluctant to undergo the procedure again. Consequently, medical professionals may be less inclined to use a vein finder if they are unsure whether they can use it effectively.

If medical professionals are not properly trained in using a vein finder, they may not recognize the device's value or be aware of its benefits. This may result in low demand for vein finders, as medical professionals are more likely to use traditional, more familiar methods of locating veins, such as palpation or visualization.

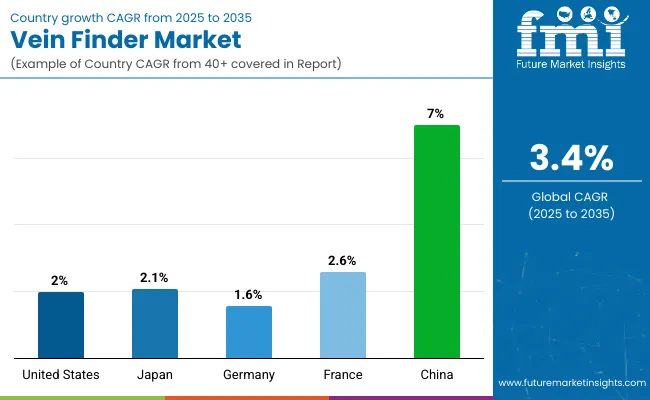

The table below shows the predicted growth rates of the top nations. China, France, and Japan are anticipated to record high CAGRs of 7.0%, 2.6%, and 2.1%, respectively from 2025 to 2035.

| Countries | Value CAGR |

|---|---|

| United States | 2% |

| Japan | 2.1% |

| Germany | 1.6% |

| France | 2.6% |

| China | 7% |

As per the latest analysis, the United States accounted for a dominant global market share of 34.2% in 2024. Over the forecast period, the United States vein finder market is expected to exhibit a CAGR of 2.0%.

The United States has a well-established healthcare infrastructure, which contributes to the growing demand for vein finders. Advanced healthcare facilities and a strong emphasis on medical innovation contribute to the widespread integration of vein finder technologies within the nation.

Growing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, in the United States is creating a substantial demand for precise vein visualization in various procedures. This will likely foster growth of the vein finder industry from 2025 to 2035.

Substantial investment has been made in state-of-the-art medical technologies, including vein finders, in the United States. The nation's regulatory environment is conducive to the approval and adoption of innovative healthcare devices, further solidifying its position as a dominating region in the vein finder industry.

Japan remains a lucrative market for vein finder manufacturers across East Asia. As per the latest report, demand for vein finders in Japan is anticipated to increase at a CAGR of 2.1% throughout the forecast period.

The geriatric population in Japan has significantly increased, which has led to the adoption of vein finders. The increasing prevalence of chronic diseases necessitates precise venipuncture, further augmenting the market.

The above factors coupled with strong regulatory framework are expected to boost Japan vein finder market during the forecast period. Similarly, a culture of early adoption of healthcare innovations will likely support market expansion.

Leading manufacturers of vein finders are constantly developing innovative products to meet the evolving end user requirements. They are focusing on enhancing vein visualization through advancements in near-infrared (NIR) and exploring novel techniques like electrical impedance or ultrasound.

For instance, players like Christie Medical Holdings, Shenzhen Bestman Instrument, and AccuVein are developing new vein finders that use improved visualization technologies. Similarly, companies are employing strategies like partnerships, mergers, acquisitions, distribution agreements, and collaborations to gain a competitive edge in the market.

The market is expected to grow from USD 38.78 million in 2025 to USD 54.18 million by 2035, at a CAGR of 3.4%.

The portable product type is projected to capture 55.3% of the market share in 2025 due to its mobility and adaptability in various healthcare settings.

Infrared technology is expected to witness a CAGR of 6.7% from 2025 to 2035, driven by its wide applications in medical diagnostics.

Hospitals are expected to dominate the end-user segment, capturing 42.5% of the market share due to their extensive use of diagnostic equipment.

China is expected to experience the highest growth, with a CAGR of 7.0% from 2025 to 2035, driven by the increasing demand for healthcare technologies.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vein Illuminator Market Size and Share Forecast Outlook 2025 to 2035

Retinal Vein Occlusion Treatment Market - Outlook 2025 to 2035

Varicose Vein Treatment Market Growth - Trends & Forecast 2025 to 2035

Cerebral Vein Thrombosis Treatment Market Analysis by Treatment, Drug Class, End Use and Region: Forecast for 2025 to 2035

IV Therapy and Vein Access Devices Market Insights – Trends & Forecast 2024-2034

Parking Finder Apps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA