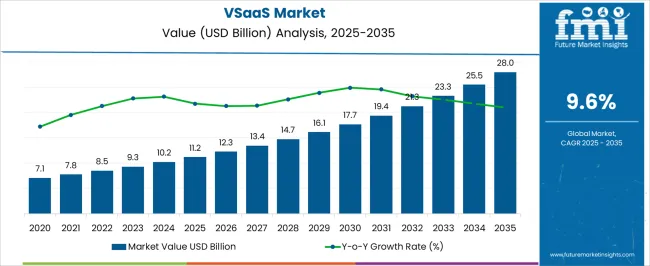

The VSaaS Market is estimated to be valued at USD 11.2 billion in 2025 and is projected to reach USD 28.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.6% over the forecast period.

| Metric | Value |

|---|---|

| VSaaS Market Estimated Value in (2025 E) | USD 11.2 billion |

| VSaaS Market Forecast Value in (2035 F) | USD 28.0 billion |

| Forecast CAGR (2025 to 2035) | 9.6% |

The VSaaS market is witnessing a structural transformation as enterprises and public entities shift from traditional on-premise systems to cloud-based surveillance models. This migration is driven by the need for scalable, remotely accessible, and cost-effective video surveillance systems. Increasing concerns around data security, combined with demand for centralized monitoring across multi-location facilities, have positioned video surveillance as a service as a preferred deployment method.

Advancements in network bandwidth, real-time video analytics, and cloud storage capabilities are strengthening the value proposition for VSaaS offerings. Enterprises are increasingly leveraging video intelligence for business insights, operational safety, and regulatory compliance, which is expanding the application scope of these platforms.

Continuous innovation in AI-enabled video management, cybersecurity integration, and mobile platform compatibility is expected to further accelerate adoption across commercial, public, and industrial domains. As connectivity infrastructure improves globally, and cloud service reliability rises, the market is poised for sustainable long-term growth with broad adoption across organizational sizes and industries.

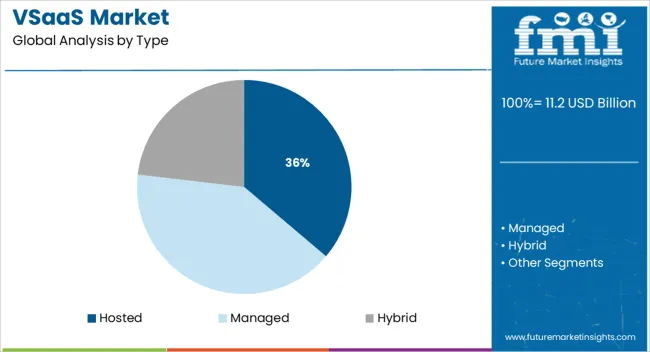

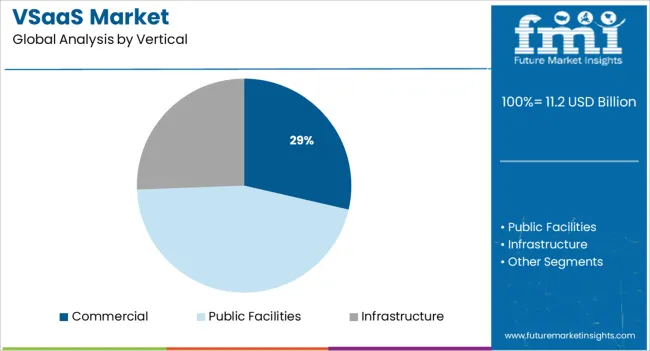

The market is segmented by Type and Vertical and region. By Type, the market is divided into Hosted, Managed, and Hybrid. In terms of Vertical, the market is classified into Commercial, Public Facilities, Infrastructure, Residential, Military and Defense, and Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hosted subsegment is projected to contribute 36.2% of revenue within the type category in 2025, making it the leading service type in the VSaaS market. This leadership is supported by strong demand from businesses seeking lower upfront capital expenditure and reduced IT maintenance burdens.

Hosted services eliminate the need for complex hardware and local storage, offering a subscription-based model that simplifies scalability and supports real-time access through secure cloud environments. The ability to deploy surveillance solutions rapidly across multiple locations has made hosted VSaaS particularly attractive to SMEs and decentralized enterprises.

Enhanced features such as remote health checks, automatic updates, and integrated threat alerts are driving customer retention and platform stickiness. As hosted solutions evolve with improved cybersecurity protocols and compatibility with edge devices, their leadership in the market is expected to remain intact through 2025 and beyond.

The commercial vertical is expected to hold a 28.6% revenue share in 2025, emerging as the top industry sector in the VSaaS market. Growth in this segment is being driven by heightened demand from retail chains, corporate offices, hospitality venues, and service providers for centralized video surveillance that can be managed across dispersed facilities.

Commercial users have increasingly prioritized video analytics for use cases such as occupancy monitoring, theft prevention, visitor management, and employee safety. The flexibility of cloud-based video surveillance allows businesses to scale their infrastructure in response to growth without significant IT overhead.

Integration with access control systems, alarms, and IoT sensors is providing additional value, enabling proactive threat detection and improved incident response. As customer experience, brand protection, and operational efficiency become strategic goals, commercial organizations are continuing to invest in advanced VSaaS platforms, ensuring this segment's continued dominance in the market landscape.

As per the VSaaS Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the VSaaS Market increased at around 10.6% CAGR.

The expanding prevalence of do-it-yourself surveillance footage for home safety, along with the increasing usage of smart devices, is offering significant potential for VSaaS service providers in the market. Smartphone prevalence has increased in recent years in China, the USA, the United Kingdom, India, and Japan, owing to lower prices, technological breakthroughs, and enhanced usefulness. The growing utilization of smart devices has opened up new prospects for VSaaS providers. By providing VSaaS compatible with various devices, service providers are expected to expand their market share. The introduction of innovative Internet protocol digital technologies to identify and prevent undesired behavior such as stealing, robberies, vandalism, and terror acts is predicted to boost the expansion of the video surveillance market.

Axis Communications confirmed the delivery of a standard open-source platform as part of a video authentication initiative, which would bring accessible authentication & video validation capabilities to the video surveillance sector. Axis uses signed video to achieve this approach in its cameras. The open-sourced reference design may be utilized by security camera makers and video software solution suppliers as a simple way to verify the validity of video footage without having accessibility to the camera and operating even when the camera is turned off.

One of the primary drivers of VSaaS market growth is the growing need for actual monitoring data throughout commercial and infrastructural sectors. Users with different company locations also require real-time network connectivity to surveillance data in order to maintain an eye on the location from afar. Smart cities also use systems of sensing devices to collect data and arrange system reactions to issues as they happen, as well as to optimize operations like traffic flow. The growing desire for remote monitoring for monitoring data at any time is allowing the VSaaS industry to expand globally since it provides real-time access to video footage on any device located anywhere.

Neurala, a provider of visual AI software, formed a partnership alongside FLIR Systems Inc. to develop an AI-based industrial image solution that includes both software and hardware. Neurala and FLIR have teamed together to provide businesses wishing to apply deep learning to the production process with a speedier, and more cost-effective entry point. This happened at a time when businesses are looking to AI and automation to help them deal with production restrictions, supply chain interruptions, and sporadic worker availability. Customers may use Neurala's Brain Builder on the VIA network to quickly develop deep neural networks without any data and any AI experience. By using the free FLIR Spinnaker SDK, the models may be instantly attached to a FLIR Firefly DL camera.

The latest Autodome IP starlight 5100i IR motion camera from Bosch does have new 1/1.8-inch sensors with 4-megapixel quality and 30x optical zoom. It has HDR X, starlight technologies, and dual illumination using IR and white lighting to capture photographs that may identify people or things for identification or evidence. When not in use, the camera's built-in artificial intelligence assists operators with object recognition in areas of interest, enhancing safety in city monitoring and perimeter security applications. It is designed for outdoor use and incorporates an automated rain-sensing wiper to keep pictures clear in rainy circumstances. It is weatherproof (IP66) and vandal-resistant (IK10).

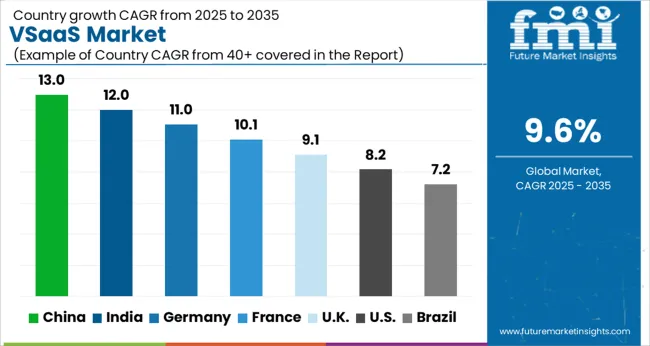

During the projected timeframe, the VSaaS market in Asia Pacific is expected to develop at the fastest rate. The growth of smart cities in the region will promote the regional adoption of VSaaS solutions. To improve efficiency, advanced video surveillance systems have been integrated with city management. Yinchuan, China, is an innovative smart city where everything is connected to a uniform system, from buses to trash cans. In China, over 10.2 Million theft offenses were reported in 2024. In China, cameras are typically installed in public settings and are subsidized by the government in order to provide comprehensive video surveillance coverage.

The USA is expected to account for the highest market of USD 28 Billion by the end of 2035. The existence of a wide number of camera manufacturers, as well as the relatively inexpensive video surveillance systems, give chances for the VSaaS industry to grow. Government measures to improve safety and infrastructural development in the region are also driving demand for VSaaS.

Eagle Eye LPR is a real cloud-based system that uses artificial intelligence for high accuracy in a variety of challenging circumstances. Eagle Eye LPR is based on common security cameras, making it both inexpensive and useful for today's company owners. Many manufacturers' LPR equipment, including cameras, are supported by Eagle Eye Networks. Eagle Eye Networks uses an open approach that allows clients to make their own decisions. Cameras and other LPR technology will continue to be supported by the Eagle Eye Cloud VMS.

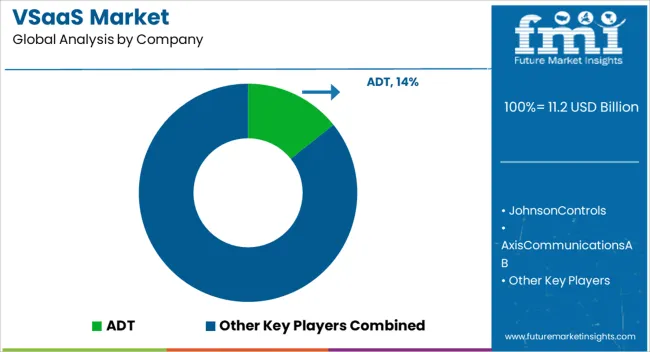

Among the leading players in the global VSaaS market are ADT Inc, ALARM.COM, Arcules, Arlo Technologies, Avigilon, a Motorola Solutions Company, Axis Communications AB, Bosch Security Systems, LLC, Brivo, Inc., Cisco Systems, Inc., Comcast Corporation, Duranc Inc, Eagle Eye Networks, Inc, and Genetec Inc.

Similarly, recent developments related to companies in VSaaS services have been tracked by the team at Future Market Insights, which are available in the full report.

The global VSaaSmarket is estimated to be valued at USD 11.2 billion in 2025.

The market size for the VSaaSmarket is projected to reach USD 28.0 billion by 2035.

The VSaaSmarket is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in VSaaSmarket are hosted, managed and hybrid.

In terms of vertical, commercial segment to command 28.6% share in the VSaaSmarket in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA