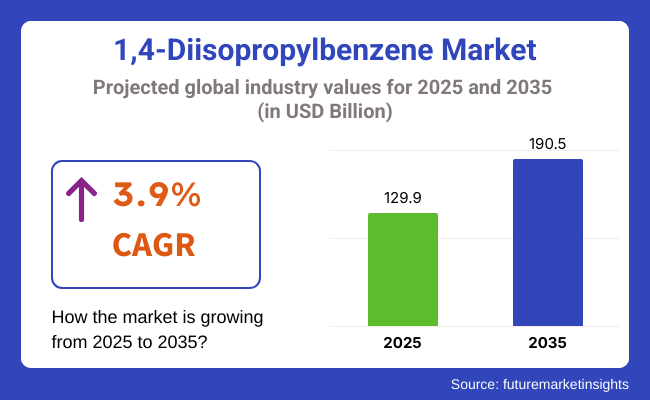

The global 1,4-Diisopropylbenzene market is estimated at USD 129.9 billion in 2025, and is projected to reach USD 190.5 billion by 2035, progressing at a CAGR of 3.9%. The growth is being supported by its expanding role in the production of high-performance polymers, antioxidants, and specialty chemicals. Increased demand for polyphenylene oxide (PPO) resins, where 1,4-Diisopropylbenzene acts as a precursor, has sustained market interest.

A significant portion of demand has originated from the electrical and electronics sector, where thermal-resistant resins are prioritized. According to the 2025 strategic materials roadmap from SABIC’s Performance Chemicals Division, 1,4-Diisopropylbenzene remains essential in synthesizing polyphenylene oxide (PPO) resins, notably for high-density circuit insulators. Its ability to function in oxidative and high-heat environments has expanded its use in automotive ignition systems and aerospace-grade plastics.

In its 2025 investor report, Kumho Petrochemical disclosed a 6,000 metric ton capacity addition for isopropylbenzene derivatives at its Yeosu complex. The company’s CEO stated that “consistent demand growth in polyolefin antioxidants has made capacity expansion for para-substituted isomers a strategic priority.” These advancements have improved downstream supply reliability, especially in East Asia.

In solvent applications, 1,4-Diisopropylbenzene has emerged as a key precursor for phenolic antioxidants used in pesticide formulations. In a 2024 technical bulletin published by Sumitomo Chemical, replacement of older benzene intermediates with 1,4-Diisopropylbenzene led to a 12% increase in yield efficiency and lower solvent waste.

The compound’s chemical inertness and storage stability have also aligned with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) standards under the European Union’s chemical safety framework.

Pharmaceutical synthesis pathways have increasingly relied on 1,4-Diisopropylbenzene for intermediate molecules. The Shanghai Institute of Organic Chemistry, in a 2025 research paper, outlined catalytic conversion routes that yielded 28% higher reactivity and cleaner end products than standard benzene-based approaches. These findings are now informing preclinical production workflows for APIs.

On the manufacturing front, innovation has enabled greater selectivity. A 2025 patent filed by LG Chem describes a continuous flow reactor design that enhances para-isomer selectivity while reducing purification overhead by 18%. This development has made high-purity applications more commercially viable.

Raw material sourcing, particularly for isopropyl feedstock, has posed volatility risks due to propylene market fluctuations. In response, Mitsui Chemicals signed a long-term propylene procurement deal in Q1 2025 with suppliers in the Middle East, targeting feedstock cost stability and reducing exposure to price shocks.

Industries are always on the lookout for reliable chemical intermediates, solvents, and performance-enhancing additives, which is why the high purity and the standard segments lead the 1,4-diisopropylbenzene market. As the need for high-performance materials continues to grow, manufacturers are ramping up production for paints, coatings and electronics, among other products.

High Purity 1,4-Diisopropylbenzene Emerging as the Preferred Choice in Precision Applications

1,4-Diisopropylbenzene is a high purity solvent (99% or more) is used by industries in applications that need consistent performance, low impurities, and chemical stability. This grade is commonly used in insulation, polymer synthesis, and more demanding coatings where the purity can affect performance.

Electronics manufacturers depend on high-purity 1,4-diisopropylbenzene in semiconductor processing, dielectric fluids, and precision cleaning applications. It is an excellent choice for capacitor fluids, semiconductor production, and advanced polymer developments as it is thermally stable and low volatile. With the growing demand for miniaturized electronic components and high-frequency devices, the continued growth of high-purity variants is anticipated in the market.

Nevertheless, tight quality control measures, elaborate purification processes, and high manufacturing costs are hampering the market expansion. Manufacturers are overcoming these challenges by investing in highly sophisticated distillation processes, AI-based quality monitoring, and solvent-free purification processes to ensure efficiency and cost-effectiveness.

The standard grade is a cost- effective grade for solvent based applications, polymer formulations and coatings. Its functions as prominent materials in paints, varnishes, and industrial coatings, ensures sustained market demand.

Manufacturers of paints and coatings use standard 1,4-diisopropylbenzene as a performance-enhancing solvent to improve the adhesion, durability, and chemical resistance of architectural and industrial coatings. The segment is being driven by ongoing infrastructure projects, rising demand for automotive refinishing, and investment on protective coatings for machinery and equipment.

Although the technology is widely adopted, things like environmental regulations that restrict volatile organic compounds (VOCs) and fluctuating raw material prices can act as constraints. To accommodate, manufacturers are bringing low-VOC formulas, hybrids of solvent blends, and eco-friendly coatings compliant with sustainability references to market without compromising performance.

By application, paints & coatings and electrical & electronics segments are forecasted to maintain the leading positions, mainly owing to the demand for high-performance materials, thermal stability, and increased durability.

Paints & Coatings Segment Advantage of Durability and Chemical Resistance

In paints & coatings industry, 1,4-diisopropylbenzene finds its applications in protective coatings, anti-corrosion paints and high-durability industrial finishes. It is widely used in automotive, aerospace, and construction applications due to its ability to improve solvent stability, increase the dispersion of pigments, and enhance adhesion properties.

1,4-Diisopropylbenzene is used by architectural coatings manufacturers to prolong the longevity of coatings, increase weather resistance, and provide better gloss retention. Industrial coatings producers also blend it with metal protection finishes/pipeline coatings/machinery protection paint to improve durability.

Market demand for solvent-based and specialty coatings is driven by the growing automotive sector, renovation activities, and increasing investment in infrastructure development. Due to regulations regarding VOC, the push to transition to waterborne coatings, and the growing usage of alternative green solvents, it is very difficult to attain. In response to these hurdles, companies are investing in bio-based solvent formulations, hybrid solvent systems, and AI-driven coatings development as a means of aligning with regulatory trends as well as their sustainability goals.

In the electrical & electronics industry, 1, 4-diisopropylbenzene is often used as an important component in dielectric fluids, manufacturing circuit boards, and polymer insulator processes. Owing to the relatively low electrical conductivity, high thermal stability, and chemical inertness of PET, it is extensively used as capacitor insulation, power transmission systems, and semiconductor applications.

Emerging miniaturized electronic components, increasing incorporation of high-frequency circuits & surge investments in 5G & IoT-enabled devices are expected to fuel demand for advanced insulation materials, ensuring efficiency enhancement along with reliability. Moreover, the market is benefitting from the rising requirement for lightweight, durable and thermally-stable electronic materials.

Although they will need to deal with supply chain interruptions, changes in prices of raw materials, besides adherence to emerging standards of quality as well as safety, organizations will increasingly resort to device automations for production integration, material synthesis optimization, coupled with AI driven predictive maintenance for IT-OT convergence toward quality control to counter the complex challenges of this domain.

With expanding usage of high-performance chemicals in the industries of United States and Canada, North America is the leading region of global 1,4-Diisopropylbenzene market.

The polymer and plastics industry has sought 1,4-Diisopropylbenzene as a key component in antioxidant-based additions, which are increasingly used to improve the longevity of materials used in the automotive, aerospace, and industrial industries.

Moreover, a long-established chemical manufacturing base in the region stimulates ongoing product development and particular for mature technologies, such as polymers economy of scale. With strict Environmental Protection Agency (EPA) rules, manufacturers are following greener synthesis routes and better sustainability despite no loss of efficiency.

Leads in chemical engineering and material sciences, Europe will retain a significant market share. The specific application of 1,4-Diisopropylbenzene in industrial lubricants, high-performance resins, and electronic components can spark its requirement in a range of specialty applications throughout the region.

The REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations implemented by the European Union compel the manufacturers to work in the direction of eco-friendly production process. Companies are investing in catalytic synthesis methods that reduce emissions and waste as part of regional sustainability initiatives. European manufacturers are innovating production processes to improve product quality and market standing.

The Asia-Pacific will show the most rapid growth, thanks to expanding chemical, automotive, and electronics firms in China, India, and Japan. 1,4-Diisopropylbenzene is manufactured primarily in China as it has large-scale chemical production facilities and low-cost manufacturing processes.

Demand for specialty chemicals is increasing in India, its rapid industrialization leads manufacturers to enhance production capacity. In contrast, Japan and South Korea are making strides in high-performance material development with the introduction of 1,4-Diisopropylbenzene in capacitor electrolyte, lubricants, and polymer additives.

Market dynamics are also being changed by government initiatives aimed at increasing domestic chemical production and decreasing import dependency. Rising investments in AI-enabled manufacturing, precision chemical synthesis, and automation have made the region a global hub for specialty chemical production.

During the period of 2020 - 2024, the 1,4-Diisopropylbenzene market flourished as companies utilized this compound in specialty chemicals, polymer manufacturing, and chemical intermediates. As key precursors to hydro peroxides, antioxidants, and cross-linking agents required in polymer production, chemical companies had found new ways to use it during this time in order to maintain stability.

They were driven by rising demand for high-performance plastics, adhesives and coatings in the automotive, construction and electronics sectors.

Manufacturers improved production processes to improve purity, yield and actively cut production costs. They advanced catalytic alkylation techniques to improve the efficiency and reduce by-product formation. But variability in raw material prices, regulatory pressures on hydrocarbon-based intermediates, and supply chain disruptions posed challenges for steady growth.

With the growth in sustainability, researchers have been working more and more to create bio-sourced replacement to petrochemical formulations. Regulatory pressures have tightened environmental goals, driving manufacturers to transition to green chemistry and lower emissions. Under these pressures, larger producers focused on process innovation and capacity expansion, and overall market growth was steady.

The 1,4-Diisopropylbenzene market would be impacted by sustainable practices, new technologies and development and advanced materials applications. Manufacturers will transition to bio-based feedstocks and circular economy models, which will drive research into renewable sources of hydrocarbons and sustainable production routes.

Employing renewable raw materials and innovating synthesis processes will allow manufacturers to reduce their carbon footprint while maintaining effective performance attributes.

This momentum is anticipated to persist, driven by a rising demand for high-performance polymers, specialty coatings, and adhesives across key sectors such as automotive, aerospace, and consumer electronics.

Through the integration of 1,4-Diisopropylbenzene derivatives for use in printed circuit boards (PCBs), semiconductors, and OLED displays, manufacturers are expected to broaden the chemical's scope of applications. Developing advanced formulations that enhance the properties of metals, polymers, and composites while or reducing energy consumption and waste will be critical for durability, efficiency, and sustainability across industries.

Tech innovation will play a crucial role in achieving production efficiency and sustainability. Relying on the newest developments in nanotechnology, companies will create improved catalysts that help reaction selectivity and reduce by-product formation - and therefore be able to use fewer resources.

AI powered intelligent process automation will enhance chemical synthesis through real-time adjustments of variables (pressure, temperature), predictive maintenance, and quality control machine learning algorithms will help manufacturers optimize reaction conditions for the best yield at the least energy cost, facilitating cheap and green manufacturing.

The chemical industry will further revolutionize its operations from digital transformation. In a bid to enhance transparency, regulatory compliance and risk management, manufacturers will implement block chain-based supply chain tracking systems. Therefore, companies will increasingly choose real-time monitoring solutions, enabling them to monitor inefficiencies in advance and take corrective action to ensure the quality of their products remains consistent.

Manufacturers will transition to green solvents and water-based reaction systems, keeping production strategies aligned with global sustainability goals in the context of increasing environmental regulations. As the industry moves to low-emission and resource-efficient processes, firms will develop next-generation chemical formulations that meet performance and environmental requirements.

While meeting the changing demand from mega trends in many high-tech industries, a significant share of market consolidation will be implemented by key players in research, innovation, sustainable manufacturing, and long-term growth.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strict environmental policies on petrochemical emissions |

| Technological Advancements | Improvements in catalytic alkylation and process efficiency |

| Industry Adoption | Dominant use in specialty chemicals, polymer additives, and coatings |

| Supply Chain Efficiency | Supply chain disruptions and dependence on petroleum-based feedstock’s |

| Market Competition | Presence of established chemical producers focusing on cost optimization |

| Market Growth Drivers | Demand for polymer additives, hydro peroxides, and adhesives |

| Sustainability and Energy Efficiency | Early adoption of emission-reduction techniques and process optimization |

| Raw Material Sourcing | Dependence on petroleum-based hydrocarbons |

| Automation & Digitalization | Limited AI integration in production workflows |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Widespread adoption of bio-based synthesis and carbon-neutral production |

| Technological Advancements | AI-optimized chemical synthesis, nanotechnology-driven catalysts, and automated quality control |

| Industry Adoption | Expansion into electronics, nanomaterials, and advanced composites |

| Supply Chain Efficiency | Decentralized manufacturing hubs, block chain-based logistics, and sustainable raw material sourcing |

| Market Competition | Emergence of start-up specializing in green chemistry and sustainable alternatives |

| Market Growth Drivers | Expansion in electronics, smart materials, and high-performance coatings |

| Sustainability and Energy Efficiency | Full-scale integration of bio-based solvents, energy-efficient processes, and circular economy models |

| Raw Material Sourcing | Shift toward renewable feedstock’s, bio-based hydrocarbons, and waste-to-chemical innovations |

| Automation & Digitalization | AI-powered process automation, real-time quality analytics, and machine learning-driven efficiency improvements |

Global Demand for high-performance chemical intermediates boosting USA 1,4-Diisopropylbenzene market, as the specialty chemicals & polymer industries continue to expand to improve efficiency and meet strict regulatory requirements for low-emission processes, manufacturers are investing heavily in sustainable chemical manufacturing, exploring advanced production techniques.

Through more environmentally friendly synthesis routes and a better catalyst, companies can lower their environmental footprint without sacrificing product quality.

Besides, the growing usage of 1,4-Diisopropylbenzene in antioxidants and lubricants is driving market growth in diverse applications, such as automotive, aerospace, and industrial. With industries increasingly interested in durable, high-performance materials, manufacturers are creating alternative formulations that boost stability, oxidation resistance, and course longevity.

Also, its plethora research institutions and chemical innovation hubs drives advances in its synthetic methods and applications development.

Regulatory bodies like The Environmental Protection Agency (EPA) are placing stricter environmental standards, and companies continue to modify their production processes to meet new guidelines.

Implementing process automation, AI-driven monitoring, and block chain-based supply chain tracking enhances operational efficiency, aligning with sustainability objectives. Overall, this makes the USA the leading contributor to the global 1,4-Diisopropylbenzene market, pushing the industry forward and setting the standards for sustainable chemical production.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.6% |

The Lloyd's List report also found that in the United Kingdom, 1,4-Diisopropylbenzene market is thriving as industries it utilized in Performance Materials and Industrial Lubricants. This chemical increasingly finds its way into sophisticated formulas that improve durability, stability, and efficiency in customers within automotive, aerospace and heavy equipment industries.

Pursuing its Aid to high Performance and Anti-oxidant materials, 1,4-Diisopropylbenzene is becoming increasingly successful in these niches among Industries.

Rapid market growth specifically in the polymer industry is anticipated to fuel growth of the high-performance resins, adhesives, and coatings market. One of the most significant applications for 1,4-Diisopropylbenzene comes in the form of polymer stabilization and antioxidant formulations, allowing manufacturers to consistently toughen their plastics with carefully designed formulations using 1,4-Diisopropylbenzene to achieve desirable strength and working properties.

UK research institutions and chemical companies collaborate on innovation, such as using bio-based alternatives to create production models based on the circular economy.

Investments in process optimization, sustainability-driven manufacture, and advanced material applications continue to preserve the UK’s position as a principal player in the European 1,4-Diisopropylbenzene market. Manufacturers tapping into technological advances and regulatory support to enable long-term growth and supercharge the emergent industrial trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.5% |

Asia Pacific is expected to emerge as a fast-growing region in the 1,4-Diisopropylbenzene market driven by increased applications in the chemical, automotive, and plastics industries. This chemical is indispensable to manufacturers throughout the region for its critical role in producing high-performance polymers, antioxidants, and industrial lubricants.

In specialty applications, the usage of 1,4-Diisopropylbenzene is growing as industries look for reliable and effective materials, bolstering market demand.

The chemical sector in Europe at the forefront, has been experiencing significant advances such as the development of innovative syntheses that add value to final products while also increasing energy and environmental efficiencies.

As it aggregates laboratory resources, research institutions and industrial leaders work together to improve catalyst performance, optimize reaction conditions, and investigate possibilities for bio-based alternatives, strengthening the European chemical sector’s competitive edge.

AI-driven process optimization and real-time monitoring are just two examples of the kind of digital technologies that help manufacturers improve operational efficiency, reduce waste, and decrease energy consumption.

The European Union holds a significant market share of the global 1,4-Diisopropylbenzene market and continues to advance such breakthroughs through recent developments within the field of chemical engineering, material sciences, and sustainability initiatives.

Manufacturers are paving the way for long-term growth in the market by focusing on innovation and compliance with regulation to better meet the evolving needs of high-performance industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.7% |

Japan has been able to lay the groundwork for its ever-increasing industries by utilizing the above-mentioned automotive chemistry in high-performance polymers and specialty chemicals. They also manufacture specialized production methods to ensure high-purity formulation with superior performance in advanced material applications in automotive, electronics, and aerospace sectors.

Companies are focused on optimizing production processes, eliminating undesired products even while working with high-quality, durable materials, as demand for the same is driven upwards.

The top chemical manufacturers in Japan are also at the forefront of innovating, adopting advanced catalytic technologies and precision-engineered production processes to enhance product consistency and scalability.

Next-generation applications for 1,4-Diisopropylbenzene are being discovered and developed as a result of collaboration between research institutions and industry leaders, solidifying Japan's position in global specialty chemicals markets.

Government incentives drive the market growth, the policies focuses on chemical research and industrial innovation and sustainable manufacturing. The importance given by regulatory bodies encouraging companies to switch to greener synthesis techniques and advanced automation solutions is made through funding for R&D initiatives and tax benefits for environmentally friendly production.

The growth of high-tech sectors in Japan, coupled with the increasing emphasis on sustainability and technological advancement, ensures the steady growth of the 1,4-Diisopropyebenzene market in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

The 1,4-Diisopropylbenzene market in South Korea is growing due to investment by companies in chemical processing and specialty applications. Here, manufacturers increased their production capacity by employing the desired technique for the synthesis process to become more advanced, product purity increase and yield efficiency.

The increasing demand for high-performance lubricants and polymer additives also contribute to the growth of the market, especially in automotive, electronics, and industrial manufacturing industries.

In South Korea, companies are increasingly incorporating 1,4-Diisopropylbenzene with advanced formulations within their strong industrial base, enhancing the durability, stability, and oxidation resistance properties of materials. Major chemical manufacturers work with research institutions to create novel applications, further strengthening the country’s hold on the specialty chemicals market internationally.

Government support is critical to industry growth, advancing chemical innovation, and enabling sustainable manufacturing and industrial competitiveness. Industry adoption of green production techniques and scaling up manufacturing capabilities is incentivized with R&D funding, tax incentives, infrastructure investments, etc.

However, with the focus of South Korea on advanced materials and the high-tech industry, the country will continue to see growth in the 1,4-Diisopropylbenzene market, as industrial output will remain strong and technology will progress.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

Key Factors Influencing the 1,4-Diisopropylbenzene Market: The continually growing demand for pure aromatic hydrocarbons from all sectors such as in chemical synthesis, rubber and polymerization, and as intermediate agents in the pharmaceutical industry has been pouring growth opportunities on the 1,4-Diisopropylbenzene market over the time.

A market characterizing definition of solutions (Plant) Scale-up production ability, Sustainable chemistry resolves is that lots of companies are focusing on it, Staples such as catalysis advances, high-performing substrates, and green production stoke competition among multinationals and specialty chemical manufacturers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Eastman Chemical Company | 16-20% |

| SAGECHEM | 12-16% |

| Goodyear Chemicals | 10-14% |

| Syntechem Co. Ltd. | 8-12% |

| Tokyo Chemical Industry Co. Ltd. | 7-11% |

| Biosynth Carbosynth | 6-10% |

| Angene International | 5-9% |

| Kanto Chemicals | 4-8% |

| ABCR GmbH | 4-8% |

| BLD Pharmatech | 3-7% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Eastman Chemical Company | Manufactures high-purity 1,4-Diisopropylbenzene for polymer synthesis and industrial applications, integrating eco-friendly production methods. |

| SAGECHEM | Supplies bulk and specialty-grade 1,4-Diisopropylbenzene for pharmaceutical and chemical industries, ensuring regulatory compliance. |

| Goodyear Chemicals | Produces high-performance aromatic hydrocarbons, supporting advanced material applications and polymer enhancements. |

| Syntechem Co. Ltd. | Specializes in fine chemical synthesis, delivering customized 1,4-Diisopropylbenzene formulations for R&D and commercial production. |

| Tokyo Chemical Industry Co. Ltd. | Offers laboratory-grade and commercial-scale 1,4-Diisopropylbenzene for research and industrial applications. |

| Biosynth Carbosynth | Develops high-purity chemical intermediates, focusing on biochemical research and pharmaceutical formulations. |

| Angene International | Supplies custom synthesis and bulk 1,4-Diisopropylbenzene, catering to fine chemical and polymer industries. |

| Kanto Chemicals | Manufactures specialty chemicals, emphasizing quality assurance and advanced material synthesis. |

| ABCR GmbH | Provides tailored chemical solutions, ensuring high-grade aromatic hydrocarbons for industrial and research applications. |

| BLD Pharmatech | Produces high-purity 1,4-Diisopropylbenzene for pharmaceutical and material science research, integrating scalable synthesis. |

Key Company Insights

Eastman Chemical Company (16-20%)

Eastman Chemical leads the 1,4-Diisopropylbenzene market, manufacturing high-purity aromatic hydrocarbons for polymer synthesis and industrial applications. The company integrates sustainable production methods and large-scale refining processes.

SAGECHEM (12-16%)

SAGECHEM supplies bulk and specialty-grade 1,4-Diisopropylbenzene for pharmaceutical and chemical industries, ensuring regulatory compliance and advanced purification techniques.

Goodyear Chemicals (10-14%)

Goodyear Chemicals develops high-performance aromatic hydrocarbons, supporting polymer enhancements, coatings, and specialty material applications.

Syntechem Co. Ltd. (8-12%)

Syntechem specializes in fine chemical synthesis, providing customized 1,4-Diisopropylbenzene formulations for R&D and commercial production.

Tokyo Chemical Industry Co. Ltd. (7-11%)

Tokyo Chemical Industry supplies laboratory-grade and commercial-scale 1,4-Diisopropylbenzene, catering to research and industrial manufacturing.

Biosynth Carbosynth (6-10%)

Biosynth Carbosynth focuses on high-purity chemical intermediates, supporting biochemical research and pharmaceutical formulations.

Angene International (5-9%)

Angene International supplies custom synthesis and bulk 1,4-Diisopropylbenzene, catering to fine chemical and polymer industries.

Kanto Chemicals (4-8%)

Kanto Chemicals develops specialty chemicals, ensuring high-quality and advanced material synthesis for industrial and research purposes.

ABCR GmbH (4-8%)

ABCR GmbH provides tailored chemical solutions, ensuring high-grade aromatic hydrocarbons for industrial and research applications.

BLD Pharmatech (3-7%)

BLD Pharmatech manufactures high-purity 1,4-Diisopropylbenzene, catering to pharmaceutical and material science applications, ensuring scalable synthesis.

Several specialty chemical companies and manufacturers contribute to the innovation and supply of high-performance aromatic hydrocarbons. Key contributors include:

The overall market size for 1, 4-Diisopropylbenzene market was USD 129.9 billion in 2025.

The 1, 4-Diisopropylbenzene market expected to reach USD 190.5 billion in 2035.

The demand for the 1, 4-Diisopropylbenzene market will be driven by its increasing use in specialty chemicals, growing demand in the polymer and resin industries, expanding applications in lubricants and coatings, rising industrial manufacturing activities, and advancements in chemical synthesis technologies.

The top 5 countries which drives the development of 1, 4-Diisopropylbenzene market are USA, UK, Europe Union, Japan and South Korea.

High purity and standard grades growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA