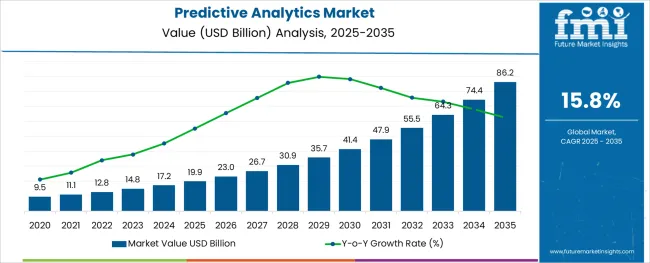

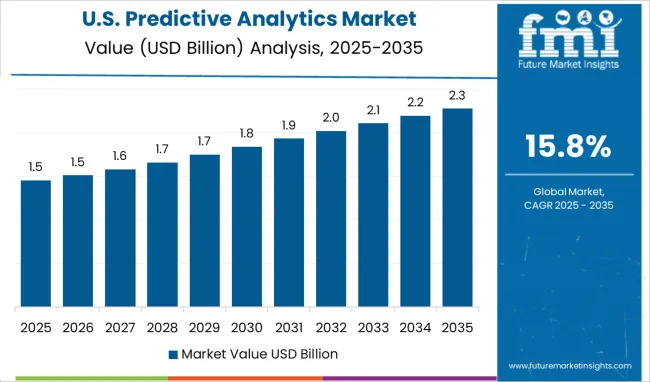

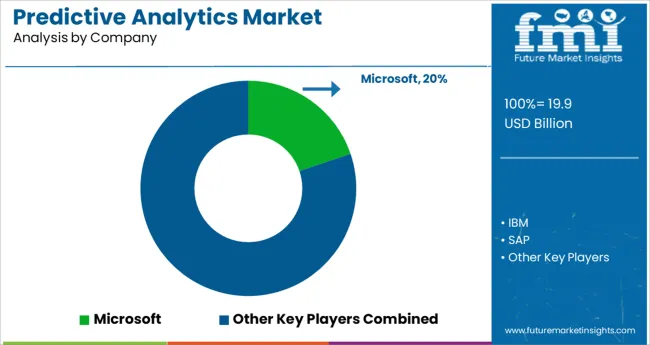

The Predictive Analytics Market is estimated to be valued at USD 19.9 billion in 2025 and is projected to reach USD 86.2 billion by 2035, registering a compound annual growth rate (CAGR) of 15.8% over the forecast period.

The predictive analytics market is expanding rapidly due to increasing reliance on data-driven decision-making across industries. Organizations are adopting advanced analytics solutions to anticipate future trends, optimize operations, and improve customer experiences. The growing availability of big data and improvements in machine learning algorithms have enhanced the accuracy and usability of predictive models.

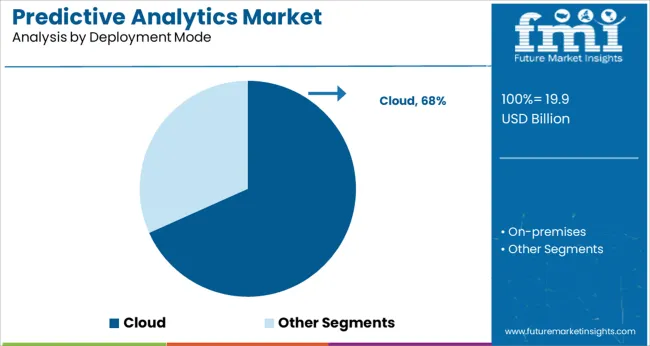

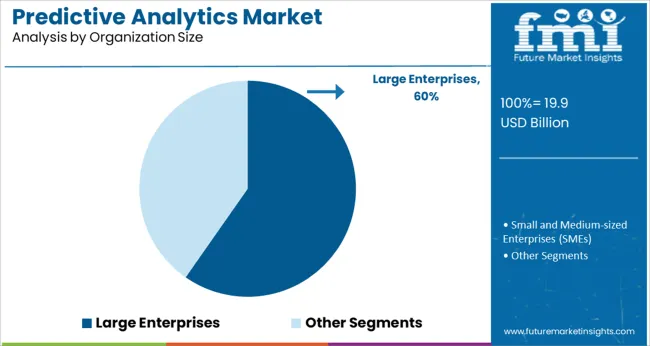

Cloud deployment has become prominent as it offers scalability, flexibility, and cost efficiency for managing complex analytics workloads. Large enterprises are leading the adoption because of their extensive data infrastructure and need for sophisticated insights to maintain competitive advantage.

Furthermore, increasing digital transformation initiatives and regulatory requirements to leverage data effectively are accelerating market growth. Future opportunities lie in industry-specific tailored solutions and integration with emerging technologies such as artificial intelligence and Internet of Things (IoT). The market is expected to continue growing with the Solutions component, Cloud deployment mode, and Large Enterprises segment driving the majority of demand.

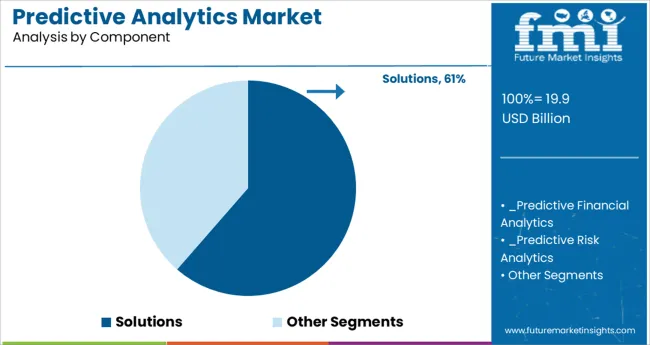

The market is segmented by Component, Deployment Mode, Organization Size, and Vertical and region. By Component, the market is divided into Solutions and Services. In terms of Deployment Mode, the market is classified into Cloud and On-premises. Based on Organization Size, the market is segmented into Large Enterprises and Small and Medium-sized Enterprises (SMEs).

By Vertical, the market is divided into BFSI Predictive Analytics, Manufacturing Predictive Analytics, Retail and eCommerce Predictive Analytics, Government and Defense Predictive Analytics, Healthcare and Life Sciences Predictive Analytics, Energy and Utilities Predictive Analytics, Telecommunications and IT Predictive Analytics, Transportation and Logistics Predictive Analytics, Media and Entertainment Predictive Analytics, Travel and Hospitality Predictive Analytics, and Other Predictive Analytics.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Solutions segment is projected to capture 61.4% of the predictive analytics market revenue in 2025, maintaining its dominance in market components. This growth is due to the comprehensive value offered by end-to-end analytics solutions, which include data processing, modeling, visualization, and reporting tools.

Solutions enable organizations to derive actionable insights quickly without the need for extensive in-house expertise. Continuous innovations have enhanced the capabilities of predictive models, improving their accuracy and interpretability.

Moreover, these solutions support integration with existing enterprise systems and cloud platforms, making them versatile across industries. Organizations prioritize solutions that deliver measurable business outcomes such as cost savings, risk mitigation, and revenue growth, sustaining the demand in this segment.

The Cloud deployment segment is expected to hold 68.3% of the market revenue in 2025, positioning it as the leading deployment mode. Cloud platforms offer scalable infrastructure and rapid deployment, reducing the need for heavy upfront investments in hardware and software.

The flexibility of cloud-based predictive analytics allows businesses to adjust resource usage based on demand, facilitating cost management. Enhanced security protocols and compliance certifications have increased enterprise confidence in cloud solutions.

Additionally, cloud deployment supports remote collaboration and integration with diverse data sources, which are crucial for distributed teams. The growing adoption of hybrid cloud architectures and edge computing is also expanding the scope of cloud-based predictive analytics. This segment’s leadership is set to continue as cloud services become more sophisticated and widely accessible.

Large Enterprises are projected to account for 59.7% of the predictive analytics market revenue in 2025, reflecting their significant role as early adopters and heavy users of predictive technologies. These organizations typically have vast data volumes and complex operational environments that benefit substantially from predictive insights.

Large enterprises invest heavily in digital transformation and analytics capabilities to optimize supply chains, enhance customer experiences, and drive innovation. Their ability to allocate resources towards deploying comprehensive solutions and managing data governance frameworks has supported sustained market growth.

Furthermore, these organizations often set industry standards and influence broader market adoption through their strategic technology implementations. The dominance of large enterprises is expected to persist as the demand for predictive analytics continues to rise across sectors.

As per the Predictive Analytics Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, market value of the Predictive Analytics Market increased at around 27.9% CAGR.

The market is expanding due to an increase in awareness among companies about the huge volume of data created to anticipate future events utilizing predictive analytic solutions. Furthermore, the increased use of the internet, along with the availability of several ways to access the internet, has resulted in a rise in data creation.

As a result, exploiting this data to generate precise business plans and decisions improves revenue, creating demand for predictive analytics solutions.

The e-commerce sector has enhanced customers' usual purchase experiences. The most important aspects for increasing business sales are dedicated social media marketing and consumer perception analysis. Since linked gadgets are becoming more popular, businesses are focusing on real-time analysis of consumer purchasing behavior. Real-time analytics information may also be utilized to build personalized offers to boost client retention.

As big data becomes more prevalent, predictive analysis is projected to be applied in Finance and Human Resources. Factors such as a scarcity of experienced IT personnel and hefty implementation costs may constrict industry expansion.

Furthermore, data integrity provides a greater barrier in the application of predictive analytics technology in many end-user verticals, which is expected to increase slowly throughout the projected period. High time consumption, the demand for constant trial, and testing of the sophisticated algorithm are possible limitations impeding worldwide market expansion.

The increased use of smartphones has directly led to a tremendous rise in the volume of data generated. This figure is expected to rise further as high-speed internet services become more available and inexpensive in both urban and rural locations. Globalization, economic progress, and the availability of low-cost, easy-to-use smartphones are all factors promoting increased data output in countries.

The generation of data by corporate enterprises is likely to witness an exponential increase, owing to the ease of data capture. Companies these days have in-house teams of scientists and analysts that record and analyze both internal and external data obtained through surveys and other data gathering methods.

Venture finance businesses have also been extremely supportive of big data projects throughout the world. Another element driving the rise of business data is the digitization of transactions.

The increasing efficiency of data processing technology and solutions is a fundamental driver of predictive business analytics growth. Because of the rapid development of artificial intelligence and deep-learning algorithms, activities that formerly required extensive knowledge and expertise may now be accomplished with ease.

Analytical software is already widely available, ranging from simple statistical tools in spreadsheets to statistical software suites. As data volumes and analytical complexity grow at an exponential rate, in-database analytics solutions are becoming increasingly prevalent.

The rising need to store, process, and analyze massive amounts of structured and unstructured data has pushed many businesses and individuals to adopt advanced and big data analytics, which is projected to drive market growth.

Many firms, like Alphabet and Meta, leverage big data to generate advertisement income by serving customized adverts to social media and web users. Furthermore, as a consequence of the vast amount of data created in numerous company verticals, big data investment will increase, supporting the growth of the predictive analytics market.

Because of the growth of the Internet of Things (IoT) trend, multimedia, which has produced a massive flow of data, the amount of data obtained by organizations is constantly increasing.

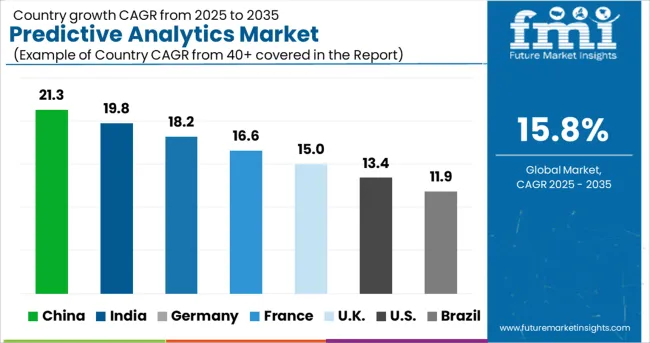

North America is the most lucrative region with a double-digit projected growth and predictive analytics market share of approximately 47%. Because of the region's strong investment in big data analytics and early deployment of current technologies such as IoT and AI in predictive analytics.

The need to study client behavior and purchase patterns, estimate budget requirements, and develop efficient marketing campaigns by examining historical trends are the primary driving drivers in the North American predictive analytics industry. Increased digitization will boost the adoption of Predictive Analytics software and services in North America over the projected period.

The market in the USD is expected to account for the largest revenue of USD 86.2 Billion by 2035. This is due to the growing technology improvements as well as the strong foothold of key firms such as Microsoft and Oracle across the United States.

For instance, the Orlando Magic of the NBA uses SAS predictive analytics to increase revenue and establish starting line-ups. The Orlando Magic organization's business users get fast access to information. The Magic can now visually examine the most recent statistics, down to the game and seat level. Furthermore, increased awareness of the value of predictive analytics solutions in corporate operations is likely to boost market expansion in this area.

Revenue through BFSI segment is forecasted to grow at the highest CAGR of over 15.7% during 2025 to 2035. The variables that may be associated with higher adoption of advanced financial analytics solutions by large BFSI organizations because of enhanced regulatory compliance processes.

As the global regulatory environment has become more complex, demand for predictive analytics solutions in the BFSI business has increased. As a result of regulatory requirements, credit risk management, capital planning, and insurance risk management, among other things, are becoming increasingly important.

Using predictive analytics solutions allows BFSI organizations to embark on a digital transformation journey. It improves the customer experience and helps businesses deal with changing customer behavior.

From the perspective of a financial institution, when a loan is made, there is always a high level of risk involved. As a result, a bank's ability to accurately predict the risk of default is critical. Predictive analytics models are being used by banks to enhance loan approval and collection procedures. This enables companies to assess applicants' repayment ability, analyze patterns in earlier loans, and do other things.

With digital payment systems, wallets, cryptocurrencies, mobile banking, and other possibilities, the frequency of financial scams and counterfeit transactions has increased along with customer delight and ease of banking. To be more specific, between 2024 and 2024, India recorded 229 financial frauds (worth up to USD 18 Billion). The more concerning fact is that less than 1% of the total has only been retrieved.

The Solutions segment is forecasted to grow at the highest CAGR of over 15.4% during 2025 to 2035. The factors that can be linked to the widespread usage of numerous risk analytics systems for forecasting future dangers and devising risk mitigation strategies.

Since they focus on risk management and what-if scenarios, predictive analytics solutions are a reliable form of forecasting. Furthermore, it allows businesses to adapt to industry trends and grow on the run.

In business, predictive analytics solutions assess previous and current data to better understand items, customers, and partners, as well as identify potential opportunities and risks. As a result, purchasing patterns are analyzed and relevant insights are supplied, supporting businesses in adding more value to their offerings and assuring a better buying experience for customers.

Among the leading players in the global Predictive Analytics market are Microsoft, IBM, SAP, Oracle, SAS Institute. To gain a competitive advantage in the industry, these market players are investing in product launches, partnerships, mergers and acquisitions, and expansions.

Due to the growing demand for the product around the world, many new companies are expected to enter the market. This is expected to increase competition on a worldwide scale. Additionally, global predictive analytics market growth is expected to be fuelled by collaborations among current players to improve quality throughout the research period.

Over the projection period, established market players are expected to diversify their portfolios and offer one-stop solutions to combat fierce competition.

Similarly, recent developments related to companies in Predictive Analytics services have been tracked by the team at Future Market Insights, which are available in the full report.

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, UK, Spain, Italy, China, South Korea, Japan, Saudi Arabia, South Africa |

| Key Market Segments Covered | Component, Deployment Mode, Organization Size, Vertical, Region |

| Key Companies Profiled | Microsoft Corporation; Oracle Corporation; SAP SE; SAS Institute Inc.; Alteryx, Inc.; Fair Isaac Corporation; Information Builders; Google; International Business Machines (IBM) ; Corporation; TIBCO Software Inc. |

| Pricing | Available upon Request |

The global predictive analytics market is estimated to be valued at USD 19.9 billion in 2025.

It is projected to reach USD 86.2 billion by 2035.

The market is expected to grow at a 15.8% CAGR between 2025 and 2035.

The key product types are solutions, predictive financial analytics, predictive risk analytics, predictive marketing analytics, predictive sales analytics, predictive customer analytics, predictive web and social media analytics, predictive supply chain analytics, predictive network analytics, other predictive analytics solutions, services, professional services and managed services.

cloud segment is expected to dominate with a 68.3% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Predictive Disease Analytics Market Size and Share Forecast Outlook 2025 to 2035

Transportation Predictive Analytics Market Report – Growth & Forecast 2017-2027

Predictive Quality Assurance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Predictive Touch Market Size and Share Forecast Outlook 2025 to 2035

Predictive Maintenance Market Analysis – Growth & Industry Trends through 2034

Predictive Automobile Technology Market

AI-driven Predictive Maintenance Market Forecast and Outlook 2025 to 2035

Analytics Of Things Market Size and Share Forecast Outlook 2025 to 2035

Analytics as a Service (AaaS) Market - Growth & Forecast 2025 to 2035

Analytics Sandbox Market

Ad Analytics Market Growth - Trends & Forecast 2025 to 2035

HR Analytics Market

AI-Powered Analytics – Transforming Business Intelligence

NFT Analytics Tools Market Size and Share Forecast Outlook 2025 to 2035

App Analytics Market Trends – Growth & Industry Forecast 2023-2033

Dark Analytics Market Size and Share Forecast Outlook 2025 to 2035

Text Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Drone Analytics Market Size and Share Forecast Outlook 2025 to 2035

Video Analytics Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA