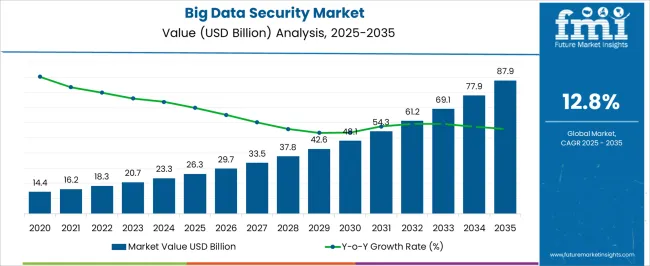

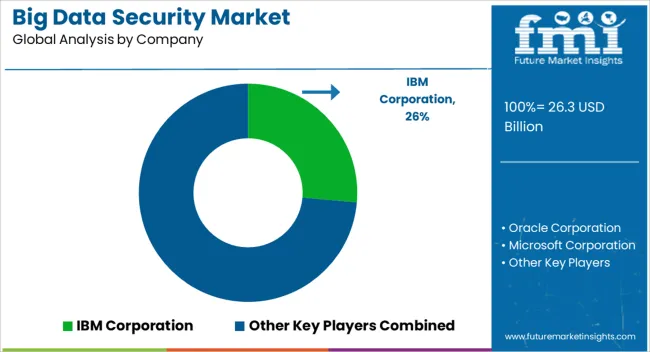

The Big Data Security Market is estimated to be valued at USD 26.3 billion in 2025 and is projected to reach USD 87.9 billion by 2035, registering a compound annual growth rate (CAGR) of 12.8% over the forecast period.

| Metric | Value |

|---|---|

| Big Data Security Market Estimated Value in (2025 E) | USD 26.3 billion |

| Big Data Security Market Forecast Value in (2035 F) | USD 87.9 billion |

| Forecast CAGR (2025 to 2035) | 12.8% |

The Big Data Security market is witnessing significant expansion as organizations increasingly prioritize data protection in the era of digital transformation. With growing reliance on data-driven decision-making, enterprises are investing heavily in safeguarding sensitive information against evolving cyber threats. The current market landscape reflects a strong shift towards scalable and flexible solutions that can adapt to dynamic security requirements.

Emerging technologies such as cloud computing, artificial intelligence, and advanced encryption techniques have been integrated into security frameworks, offering more robust protection mechanisms. As regulatory frameworks tighten and data privacy concerns intensify, enterprises are being compelled to deploy advanced security measures. The market outlook is expected to be further strengthened by increased adoption across sectors such as financial services, healthcare, and government, where data integrity and compliance are critical.

Future opportunities are projected in areas where data proliferation and cross-platform integration demand continuous monitoring and threat intelligence The market is set to benefit from proactive risk management, automated security responses, and cloud-native solutions that allow seamless scaling without compromising performance or regulatory adherence.

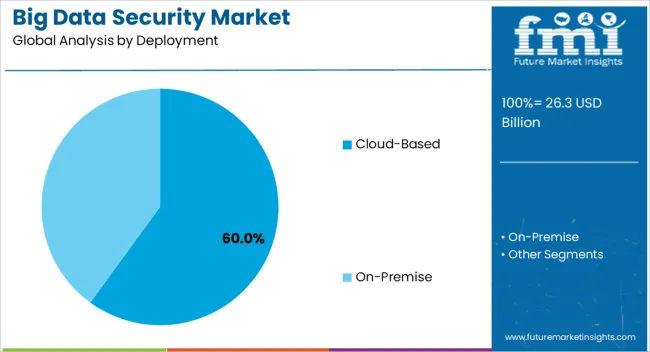

The Cloud-Based deployment segment is expected to hold 60.00% of the Big Data Security market revenue share in 2025, making it the largest deployment model in the industry. This prominence is being driven by the flexibility and scalability offered by cloud environments, which allow organizations to manage vast amounts of data while maintaining robust security controls. The ability to deploy security solutions on-demand and integrate them with existing cloud architectures has accelerated adoption across enterprises seeking cost-effective protection strategies.

Cloud-based deployment models provide advantages such as simplified management, automatic updates, and real-time threat detection, reducing the need for extensive on-premise infrastructure. The growing trend of remote workforces and distributed data environments has further encouraged enterprises to adopt cloud-first security strategies.

Cloud environments also offer rapid provisioning and seamless integration with identity management, compliance tools, and encryption protocols, making them ideal for organizations facing complex security requirements As data volumes continue to expand, cloud-based security solutions are expected to remain central to enterprise protection strategies.

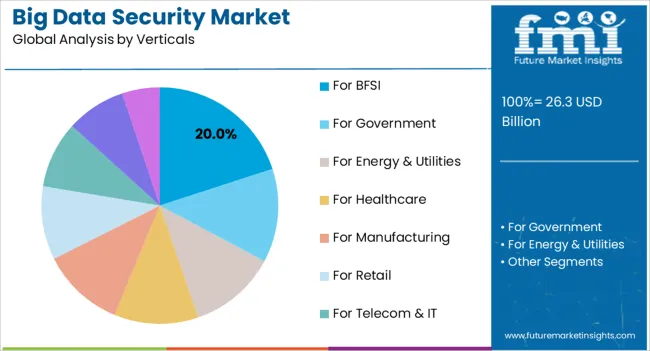

The For BFSI verticals segment is projected to account for 20.00% of the Big Data Security market revenue share in 2025, emerging as one of the key industry sectors driving growth. This dominance is being attributed to the high sensitivity of financial data, stringent regulatory requirements, and the increasing threat landscape targeting banking and financial institutions. Financial organizations are increasingly deploying advanced security frameworks to protect customer information, transactional data, and intellectual property from sophisticated cyber attacks.

Data integrity, fraud prevention, and compliance with regulations such as data protection and financial reporting have made security a top priority within this sector. The adoption of encryption techniques, behavioral analytics, and threat intelligence platforms has been facilitated by the need for real-time monitoring and rapid incident response.

Additionally, with the rising trend of digital banking services and mobile financial transactions, securing cloud environments and network endpoints has become essential As trust and reputation are critical for customer retention in this sector, investments in advanced big data security frameworks are expected to sustain strong growth in the BFSI verticals.

The global demand for big data security is projected to increase at a CAGR of 13.5% during the forecast period between 2025 to 2035, reaching a total of USD 72,652.6 million in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2025, sales witnessed significant growth, registering a CAGR of 11.4%.

Significant growth in the information technology (IT) sector is driving the global market. Along with this, the rise in cyberattacks and data thefts worldwide has prompted many businesses to invest heavily in deploying effective security systems, which is boosting market growth.

Continuous technological advancements are creating a positive market outlook. The widespread integration of machine learning (ML) and artificial intelligence (AI) technologies with big data security solutions, for example, is positively impacting market growth. Other factors, such as an increase in data generation and extensive research and development research and development activities by key players, are expected to drive market growth even further.

Rising Cyber Attacks Globally to Promote Market Growth

The use of targeted attacks to penetrate targets' network infrastructure while remaining anonymous has recently increased. Endpoints, networks, on-premises devices, cloud-based apps, data, and other IT infrastructures are typically targeted by attackers who know exactly who they're going after. The primary goal of targeted attacks is to gain access to the network of the targeted businesses or organizations and steal sensitive data.

Business disruption, intellectual property loss, financial loss, and the loss of sensitive customer information are all negative consequences of these targeted attacks on enterprises' most critical operations. Cyberattacks on specific companies have an impact on their local and international clients. Attackers steal PII, which includes names, phone numbers, addresses, license numbers, and social security numbers.

As a result, security breaches and identity theft occur. Therefore, such cyber attacks increase the demand for scalable big data security solutions, boosting the market's overall growth.

Advancements in Technological Breakthroughs to Drive the Market Growth

Targeted cyberattacks have an impact on the targeted companies as well as their local and international clients. Attackers steal Personally Identifiable Information (PII), which includes names, phone numbers, addresses, license numbers, and social security numbers. This results in security breaches and identity theft. As a result, such cyber-attacks raise the demand for scalable big data security solutions, boosting the market's overall growth.

With the advancement of technology, a significant amount of research and development is being conducted in this field, which is anticipated to drive market growth. Furthermore, cloud solutions for big data security are cost-effective and accessible globally. They can be accessed from anywhere, anytime, due to the minimal hardware required. Because of these factors, cloud technologies greatly simplify the process of securing and managing data, propelling the growth of the big data security market.

Identifying and Analyzing Sensitive Information as well as Costly Installation to Impede Market Growth

In contrast to structured data, which is housed within well-protected IT perimeters, sensitive content appears in unstructured formats, such as office documents, files, or photographs, and is disseminated and published through file sharing, social media, and email.

Organizations are no longer just concerned with sensitive data accumulated primarily on-premises, thanks to the rapid adoption of cloud computing and the rise in remote workers. At the moment, sensitive data can reside in various locations and travel through various channels.

Finding and analyzing sensitive data among the structured and unstructured data collected from various sources has become a key concern, which is expected to stymie market growth. Moreover, young start-ups' cybersecurity budgets need to be increased to implement Next-Generation Firewalls (NGFWs) and Advanced Threat Protection (ATP) technologies. Small businesses in emerging economies are expected to need more support in their adoption of big data security solutions due to several key concerns, including a dearth of capital and limited investment.

Of a dearth of adequate IT security infrastructure due to limited financial resources, these businesses gradually implement new technologies and enterprise security solutions. Small businesses face challenges in managing planned budget funds for various operational challenges and business continuity planning.

Cloud Deployment Remain Highly Sought-After in the Big Data Security Market, Witnessing a Value Share of 58.3% in 2025

By deploying them on-premises, organizations may gain more control over all big data security solutions, including next-generation firewalls and intrusion prevention systems. On the other hand, cloud deployment models for big data security solutions benefit enterprises by providing speed, scalability, and improved IT security. As more applications are delivered via the cloud, there is a growing demand for cloud-based big data security solutions among SMEs and large corporations.

Factors such as improved security measures and increased cybersecurity awareness may accelerate overall market growth during the forecast period. Furthermore, the increasing volume of business data generated from multiple sources is expected to drive the big data security market growth rate.

The BSFI is a Key Vertical, Acquiring 30.5% of the Global Market

On the basis of vertical, the big data security market is segmented into BFSI, Government, energy & utilities, healthcare, manufacturing, retail, Telecom & IT, transportation & logistics, and others. During the forecast period from 2025 to 2035, the BFSI segment holds a leading market share.

The elements that contribute to its cost-effectiveness and ease of use, several FinTech firms frequently use big data solutions for operations, supply chain optimization, and risk management. Moreover, the retail segment is likely to accelerate during the forecast period. The increasing adoption of cloud-based solutions in the retail industry to optimize in-store operations and employee performance is expected to drive segment growth.

High Penetration of Security Solutions for Creating Opportunities for Big Data Security manufacturers

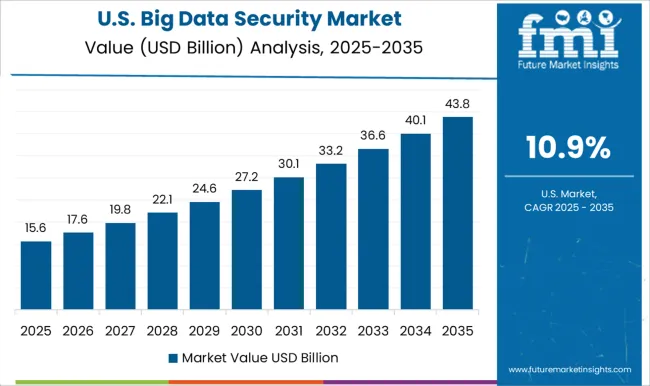

North America is likely to command the big data security market from 2025 to 2035 due to the region's early adoption of technologies and high penetration of security solutions. Furthermore, increased enhanced security measures are expected to accelerate the expansion over the forecast period. The region's businesses are increasingly adopting IoT devices.

Organizations, particularly in the United States, have begun to use big data solutions to generate data insights for strategic business decisions and market competitiveness, and ongoing projects may expand the market in the North American sphere. Thus, for the aforementioned reasons, North America is expected to possess a 32.2% market share in 2025, registering a CAGR of 13% for the big data security market from 2025 to 2035.

Increasing Amount of Data favoring the market growth

The amount of data on the planet is growing by leaps and bounds, and it has become a critical concern for effectively analyzing this big data. According to reports, data analysis has gained importance in each domain and has played a significant role in production activities, along with capital investment and labor.

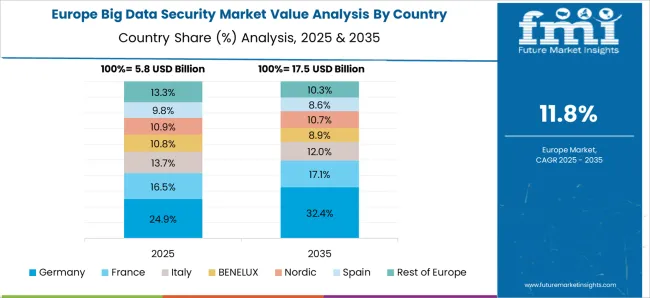

Every year, big data adds value to every sector in both developed and developing countries. For example, big data results in value creation for the public sector and the manufacturing sector in Europe. Aside from that, big data provides enormous benefits to both consumers and businesses. As a result, it has become necessary to provide assurance to big data, which drives market trends in Europe. Thus, Europe is expected to hold 24.8% of the market share for the big data security market in 2025, recording a CAGR of 12.7% in the forecast period 2025 to 2035.

High Digital Connectivity Fueling Rapid Adoption

Due to factors such as high digital connectivity, cybersecurity awareness, and increased data transfer across borders within the region, Asia Pacific is expected to grow significantly between 2025 and 2035.

The production of digital data has increased dramatically over the last few decades, and this trend is expected to continue, providing lucrative opportunities to the market. One of the primary causes of this increase in digital data generation is the increasing daily use of digital devices such as smartphones and laptop computers.

The growing popularity of the Internet of Things (IoT) and the data produced by various IoT devices have also contributed to this data boom. It can be difficult for data analysts to evaluate and make sense of massive amounts of digital data output. Big data technologies must be deployed in order to handle these massive amounts of data, discover data trends, and communicate these massive amounts of data. Thus, Asia Pacific is expected to procure a 19% market share for the big data security market in 2025, recording a CAGR of 12.5% in the assessment period 2025 to 2035

Oracle Corporation, Microsoft Corporation, Symantec Corporation, IBM Corporation, Amazon Web Services, Hewlett Packard Enterprise, Mcafee, LLC, Check Point Software Technologies Ltd., Imperva, Inc., and Dell Technologies are the leading vendors in the global big data security market. To gain a competitive advantage, key market vendors invest heavily in Research and Development and continuous technological innovations to detect malicious attacks.

Recent Developments in the Big Data Security Market

In August 2025, Anaconda and Oracle announced a strategic cloud partnership to enable seamless, secure open-source innovation in the cloud.

In August 2025, Barclays used Microsoft Teams as its preferred collaboration platform around the world to improve connectivity for its employees.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 12.8% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered |

Deployment, Vertical, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa; Oceania |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Oracle Corporation; Microsoft Corporation; Symantec Corporation; IBM Corporation; Amazon Web Services; Hewlett Packard Enterprise; MacAfee LLC; Check Point Software Technologies Ltd.; Imperva Inc.; Dell Technologies |

| Customization & Pricing | Available upon Request |

The global big data security market is estimated to be valued at USD 26.3 billion in 2025.

The market size for the big data security market is projected to reach USD 87.9 billion by 2035.

The big data security market is expected to grow at a 12.8% CAGR between 2025 and 2035.

The key product types in big data security market are cloud-based and on-premise.

In terms of verticals, for bfsi segment to command 20.0% share in the big data security market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Big Data in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Big Data Analytics in Construction Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA