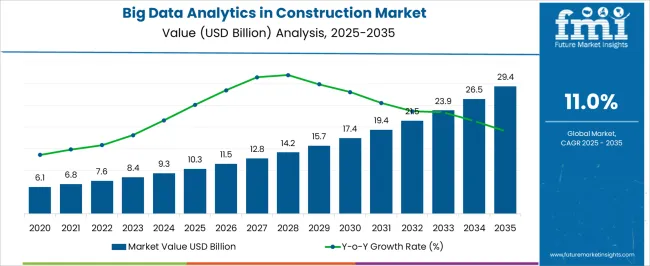

The big data analytics in construction market is estimated to be valued at USD 10.3 billion in 2025 and is projected to reach USD 29.4 billion by 2035, registering a compound annual growth rate (CAGR) of 11.0% over the forecast period. A Growth Rate Volatility Index (GRVI) analysis indicates relatively moderate fluctuations in the growth trajectory of this market, reflecting the combination of accelerating adoption and some periods of market maturity. Between 2025 and 2030, the market grows from USD 10.3 billion to USD 17.4 billion, contributing USD 7.1 billion in growth, with a CAGR of 13.0%.

This early-phase acceleration reflects the rising demand for data-driven solutions in the construction industry, where big data analytics is increasingly used for project planning, risk management, and efficiency improvement. The adoption of technologies like IoT (Internet of Things) and AI to manage construction data plays a crucial role in this early expansion. From 2030 to 2035, the market continues to grow, moving from USD 17.4 billion to USD 29.4 billion, contributing USD 12 billion in growth, with a slightly lower CAGR of 9.9%. The deceleration indicates the market reaching a more mature phase, where growth becomes more incremental. Despite this, the demand for big data analytics remains strong due to continuous technological advancements and growing emphasis on smart construction practices. The GRVI highlights early acceleration, followed by more stable growth as the market matures.

| Metric | Value |

|---|---|

| Big Data Analytics in Construction Market Estimated Value in (2025 E) | USD 10.3 billion |

| Big Data Analytics in Construction Market Forecast Value in (2035 F) | USD 29.4 billion |

| Forecast CAGR (2025 to 2035) | 11.0% |

Growing complexities in project management, regulatory requirements, and the need for real-time insights across all phases of construction are driving this shift.

According to recent investor communications and industry-led technology briefings, companies are integrating analytics platforms to reduce cost overruns, improve safety compliance, and forecast project timelines with greater accuracy. Advancements in connected devices, sensors, and IoT infrastructure are generating high volumes of structured and unstructured data, which is further fueling the adoption of advanced analytics platforms.

The market outlook remains strong due to rising investments in smart infrastructure, increasing pressure for sustainability compliance, and the growing role of digital twin technologies in large-scale projects. These developments are encouraging more construction firms to implement scalable, cloud-ready, and AI-powered analytics solutions to remain competitive and future-ready.

The big data analytics in construction market is segmented by component, deployment model, technology, application, end-user, and geographic regions. By component, the big data analytics in construction market is divided into Solution and Services. In terms of deployment model, the big data analytics in construction market is classified into Cloud and On-premises. Based on technolog, the big data analytics in construction market is segmented into Machine learning and AI, Predictive analytics, Data visualization, IoT integration, and Others. By application, the big data analytics in construction market is segmented into Project management, Design and planning, Construction management, Operations and maintenance, and Others.

By end-user, the big data analytics in construction market is segmented into General contractors, Subcontractors, Project owners, Architects and engineers, and Government agencies. Regionally, the big data analytics in construction industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

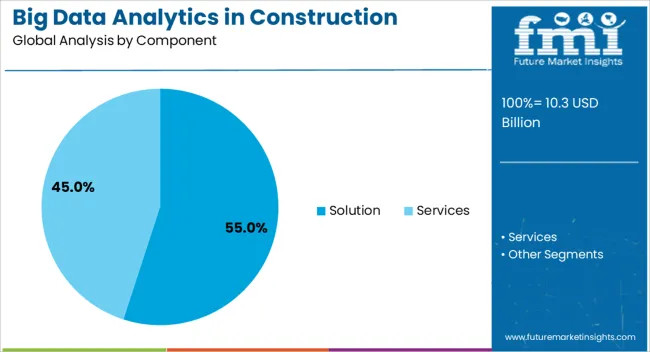

The solution component segment is projected to hold 55.0% of the big data analytics in construction market revenue share in 2025, positioning it as the leading segment under this classification. This dominance has been supported by the increasing demand for comprehensive platforms that offer data integration, visualization, and predictive modeling tailored to the construction environment.

Enterprise IT strategies have been observed to prioritize solutions over services due to their long-term cost benefits and the ability to scale across multi-site operations. According to technology-focused publications and infrastructure modernization updates, these platforms are being widely adopted for their ability to centralize data from multiple sources and offer actionable insights for project managers and site engineers.

The capability to integrate with ERP, BIM, and project scheduling tools has further contributed to their widespread adoption. The preference for solutions over standalone services has been reinforced by the need for continuous system improvements, automated reporting, and risk forecasting, which are essential for controlling project complexity and budget constraints.

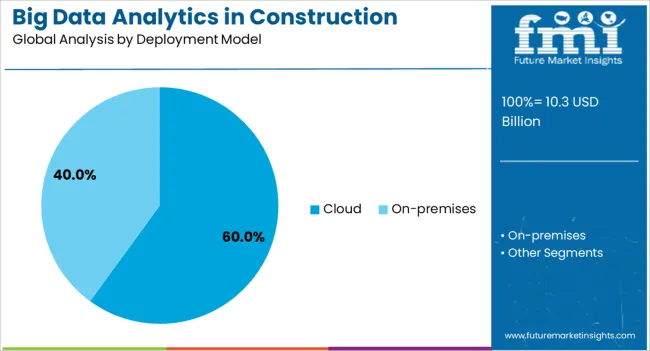

The cloud deployment model segment is forecasted to account for 60.0% of the big data analytics in construction market revenue share in 2025, making it the most dominant deployment model. This growth has been supported by a significant shift toward flexible, scalable, and remotely accessible infrastructure solutions in the construction sector.

As reported in CIO interviews and industry forums, the cloud model is enabling real-time collaboration across geographically dispersed teams, a critical factor for large-scale construction projects. Enhanced data security frameworks, supported by industry certifications and government policies, have improved trust in cloud adoption for critical infrastructure applications.

Construction firms are also leveraging cloud environments to reduce IT overhead costs, improve data recovery, and access AI and analytics tools without extensive on-premise hardware investment These operational and economic benefits have solidified cloud deployment as the preferred choice, particularly among mid to large-scale construction enterprises seeking agility, integration, and cost control.

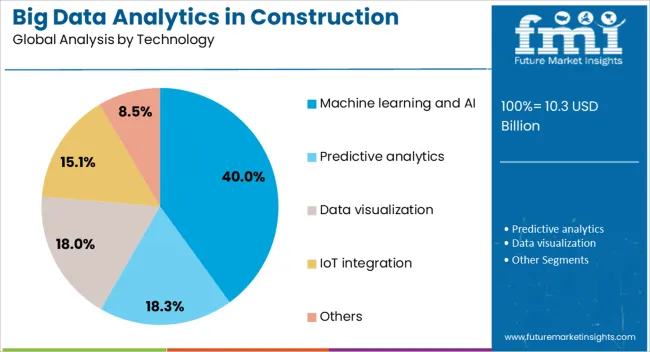

The machine learning and AI technology segment is expected to represent 40.0% of the big data analytics in construction market revenue share in 2025, placing it as the leading technology category. This growth has been influenced by the increasing demand for intelligent systems capable of identifying patterns, forecasting project risks, and automating data interpretation.

As highlighted in innovation press releases and construction tech symposiums, AI is being applied to predict equipment failure, optimize scheduling, and enhance worker safety protocols. Machine learning algorithms have been integrated into project planning platforms to recommend optimal resource allocation and budget adjustments in real time.

Furthermore, the ability to process vast volumes of historical and real-time data has enabled firms to reduce delays and rework, two of the most costly aspects in construction This segment's advancement has also been reinforced by strategic collaborations between construction companies and tech vendors aiming to embed AI-driven capabilities within legacy systems, leading to measurable improvements in project outcomes.

The adoption of big data analytics in the construction market is growing as companies look for ways to improve efficiency, reduce costs, and enhance project outcomes. Big data enables construction firms to gather and analyze vast amounts of data, from project timelines and resource allocation to safety compliance and cost management. The growing trend of smart construction and the digital transformation of the industry are fueling the demand for data-driven solutions. Despite challenges such as data security and integration, big data analytics continues to drive innovation and improve decision-making processes in construction.

The primary driver of growth in the big data analytics in construction market is the increasing need for improved project efficiency and outcomes. Construction projects often involve multiple stakeholders, complex logistics, and stringent deadlines. Big data analytics allows construction companies to make data-driven decisions, improving resource allocation, project timelines, and risk management. By analyzing historical data and real-time project metrics, companies can identify potential bottlenecks, predict delays, and optimize costs. Additionally, the rise of smart construction technologies, such as Building Information Modeling (BIM) and Internet of Things (IoT) devices, is contributing to the growing demand for data analytics solutions, as these technologies generate vast amounts of data that can be analyzed for continuous improvement.

A key challenge in the big data analytics in the construction market is data security and integration issues. As construction projects generate massive amounts of data, ensuring the confidentiality, integrity, and availability of this data becomes a priority. Construction companies need to protect sensitive project data from cyber threats and ensure compliance with industry standards. Additionally, integrating big data analytics into existing workflows and systems can be complex and time-consuming. Many construction firms still rely on traditional methods of project management, and integrating data analytics tools into these systems requires significant changes in infrastructure, employee training, and operational processes. These challenges can slow down the adoption of big data analytics in the construction industry.

The big data analytics in construction market presents several opportunities driven by technological advancements and the increasing adoption of smart construction solutions. Innovations in machine learning, artificial intelligence, and cloud computing are enabling construction companies to harness the power of big data more efficiently. These technologies help automate data collection, improve predictive analysis, and generate actionable insights that can drive cost savings and enhance productivity. Additionally, the growing trend of smart cities and infrastructure development in emerging markets provides significant growth opportunities. As construction projects become more complex and interconnected, the demand for data-driven decision-making tools is expected to rise, creating opportunities for software providers and technology developers to expand their market reach.

The integration of Internet of Things (IoT) devices and sensors is becoming more common, allowing for real-time data collection on construction sites. This data is used to monitor everything from equipment performance to environmental conditions, providing actionable insights for project management teams. Machine learning and artificial intelligence (AI) are increasingly being applied to process and analyze large datasets, helping construction companies predict potential issues before they arise, such as equipment failure or project delays. Additionally, cloud-based platforms are making it easier for stakeholders to access and share data in real time, facilitating better collaboration between teams. The use of drones for surveying and data collection is also gaining traction, providing more accurate site assessments and progress tracking. As these technologies advance, big data analytics will continue to play a pivotal role in optimizing the construction process, improving safety, and reducing costs.

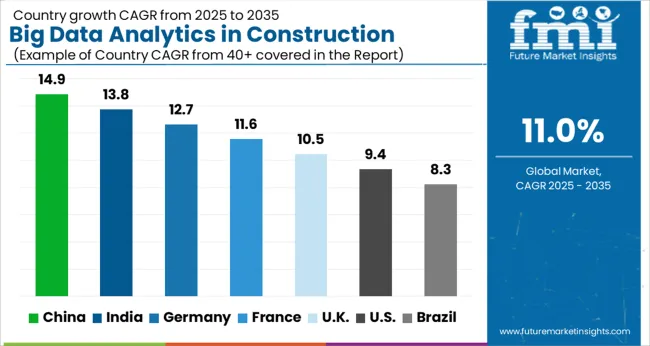

The big data analytics in construction market is projected to grow at a global CAGR of 11.0% from 2025 to 2035. China leads the market with a growth rate of 14.9%, followed by India at 13.8%. France records a growth rate of 11.6%, while the UK shows 10.5% and the USA follows at 9.4%. The market is primarily driven by the increasing adoption of data-driven technologies to enhance construction efficiency, reduce costs, and improve decision-making. China and India are at the forefront of growth, fueled by rapid urbanization and extensive infrastructure development. In developed economies like the USA, the UK, and France, the focus is on leveraging big data to optimize construction operations and improve overall performance and safety standards. The analysis spans over 40+ countries, with the leading markets shown below.

The big data analytics in construction market in China is projected to grow at 14.9%, supported by the country’s massive construction and infrastructure projects. As China urbanizes rapidly, the demand for efficient and optimized construction processes is driving the adoption of big data analytics. The use of data-driven insights helps in minimizing costs, improving resource management, and enhancing the overall quality of construction projects. China’s government is also pushing for smart city initiatives, which are accelerating the integration of big data technologies into the construction sector. As a result, the market for big data analytics is seeing significant growth.

The big data analytics in construction market in India is expected to grow at 13.8%, driven by the country’s expanding infrastructure projects and digital transformation in the construction sector. As India focuses on modernizing its infrastructure and expanding urban areas, the adoption of big data analytics is helping improve construction project management, reducing delays, and enhancing resource efficiency. The Indian government’s push toward building smart cities and improving urban infrastructure is further boosting market growth. With increasing awareness of the benefits of data analytics in construction, both large and small-scale construction projects are adopting these technologies for better decision-making.

The big data analytics in construction market in France is projected to grow at 11.6%, supported by the country’s commitment to modernizing its construction industry. The use of big data in construction is helping French companies optimize project timelines, improve budget management, and increase sustainability. With an increasing focus on reducing environmental impact and enhancing energy efficiency in construction, big data analytics plays a crucial role in designing smarter and more efficient buildings. France’s regulatory environment, which encourages the adoption of innovative technologies, also contributes to the growth of the big data analytics market in the construction sector.

The UK’s big data analytics in construction market is expected to grow at 10.5%, driven by increasing demand for smart construction solutions. As the construction industry in the UK faces challenges related to cost overruns and project delays, big data analytics is becoming a key tool for improving project delivery, resource optimization, and decision-making. The UK government’s emphasis on infrastructure improvements and smart cities is encouraging the integration of data-driven technologies in construction. Big data analytics is also helping construction firms monitor site safety and improve the quality of building materials, contributing to enhanced project outcomes.

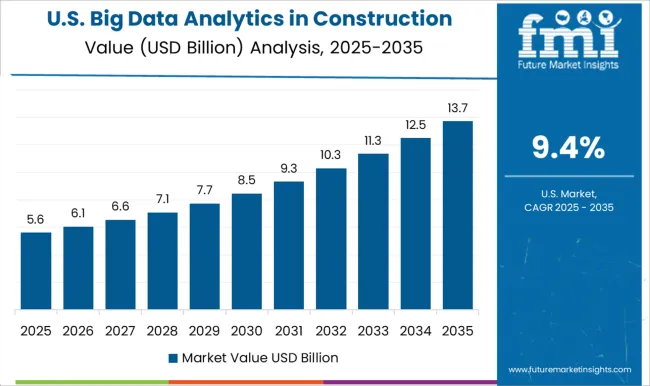

The USA big data analytics in construction market is projected to grow at 9.4%, driven by the increasing adoption of data technologies in the construction sector. As the USA construction industry focuses on improving efficiency and reducing waste, big data analytics is becoming integral to project management. From cost control to improving worker safety and predicting equipment maintenance needs, big data is being used to optimize construction processes. The growing trend of smart cities, along with the USA government’s investment in infrastructure, is also driving the need for advanced data analytics solutions in construction, helping improve decision-making and overall productivity.

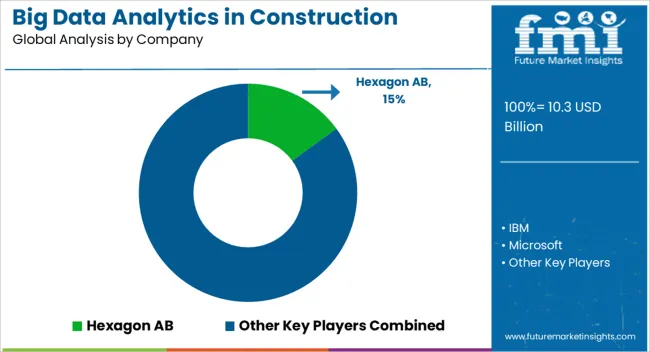

The big data analytics in construction market is driven by leading players that provide advanced solutions for improving efficiency, project management, cost reduction, and decision-making processes in the construction industry. Hexagon AB is a market leader, offering a broad range of big data solutions tailored to the construction sector, focusing on design, engineering, and operational management, helping companies optimize their workflows and make data-driven decisions. IBM provides advanced AI-powered analytics and cloud-based solutions that help construction firms gather, process, and analyze data from various sources, ensuring real-time insights and predictive capabilities for project management.

Microsoft and Oracle play significant roles by offering cloud-based analytics platforms that allow construction companies to leverage big data for improving project efficiency, reducing costs, and enhancing collaboration. Microsoft Azure and Oracle Cloud enable businesses to store, process, and analyze construction data, helping organizations achieve better planning, risk management, and performance monitoring. Procore is a key player focused on providing construction project management software with big data capabilities, offering real-time project insights, streamlining operations, and improving team collaboration. Sage offers cloud-based software that incorporates big data analytics, providing tools for budgeting, project tracking, and financial forecasting, helping contractors optimize resources and reduce waste. SAP SE provides integrated big data analytics solutions that help construction companies manage data across various project stages, from planning and execution to maintenance, improving operational efficiency and profitability. Trimble offers geospatial and construction software solutions that incorporate big data analytics, enhancing project visibility, resource management, and overall decision-making capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.3 Billion |

| Component | Solution and Services |

| Deployment Model | Cloud and On-premises |

| Technology | Machine learning and AI, Predictive analytics, Data visualization, IoT integration, and Others |

| Application | Project management, Design and planning, Construction management, Operations and maintenance, and Others |

| End-user | General contractors, Subcontractors, Project owners, Architects and engineers, and Government agencies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hexagon AB, IBM, Microsoft, Oracle, Procore, Sage, SAP SE, and Trimble |

| Additional Attributes | Dollar sales by product type (cloud-based analytics, AI-powered analytics, predictive analytics, real-time project tracking) and end-use segments (residential, commercial, infrastructure, industrial construction). Demand dynamics are influenced by the growing need for efficiency in construction projects, the rise of smart construction technologies, and increasing adoption of data-driven decision-making tools to reduce costs and improve project timelines. Regional trends show strong growth in North America and Europe, driven by investments in smart infrastructure and digital construction solutions, while Asia-Pacific is expanding due to rapid urbanization and industrialization. |

The global big data analytics in construction market is estimated to be valued at USD 10.3 billion in 2025.

The market size for the big data analytics in construction market is projected to reach USD 29.4 billion by 2035.

The big data analytics in construction market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in big data analytics in construction market are solution and services.

In terms of deployment model, cloud segment to command 60.0% share in the big data analytics in construction market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Big Data Security Market Size and Share Forecast Outlook 2025 to 2035

Big Data in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Center Refrigerant Market Size and Share Forecast Outlook 2025 to 2035

Data Center Fire Detection And Suppression Market Size and Share Forecast Outlook 2025 to 2035

Data Center Security Market Size and Share Forecast Outlook 2025 to 2035

Data Center Substation Market Size and Share Forecast Outlook 2025 to 2035

Data Center GPU Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Market Size and Share Forecast Outlook 2025 to 2035

Data Center Chillers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA