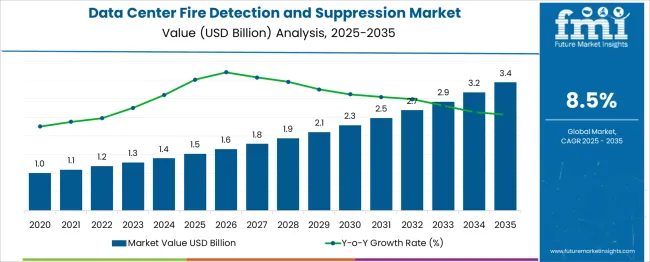

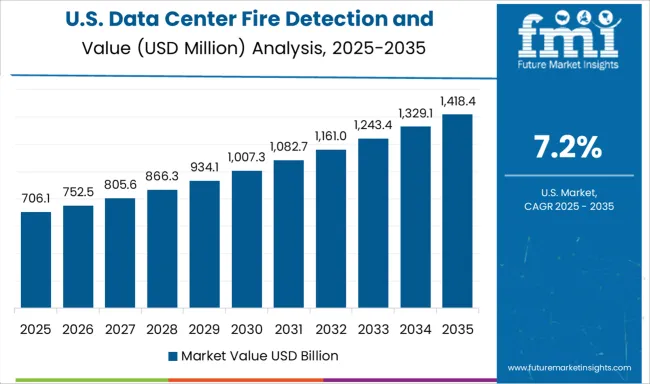

The data center fire detection and suppression market is projected to grow from USD 1.5 billion in 2025 to USD 3.4 billion by 2035, registering a CAGR of 8.5% during the forecast period. Between 2025 and 2030, the market is expected to rise from USD 1.5 billion to USD 2.3 billion, driven by the increasing need for enhanced safety and risk management in data centers, as the demand for cloud services and data storage continues to grow.

Year-on-year analysis shows steady growth, with values reaching USD 1.6 billion in 2026 and USD 1.8 billion in 2027, supported by the adoption of advanced fire suppression systems, such as inert gas and clean agent technologies. By 2028, the market is forecasted to reach USD 1.9 billion, advancing to USD 2.1 billion in 2029 and USD 2.3 billion by 2030. Growth is expected to be further fueled by increasing regulatory requirements for data center safety, the rise in high-density server installations, and innovations in fire detection systems with enhanced accuracy and speed. These dynamics position the fire detection and suppression market as a critical component for ensuring the safety and continuity of operations in the rapidly expanding data center industry.

| Metric | Value |

|---|---|

| Data Center Fire Detection And Suppression Market Estimated Value in (2025 E) | USD 1.5 billion |

| Data Center Fire Detection And Suppression Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The data center fire detection and suppression market is advancing steadily as the critical need for operational continuity and regulatory compliance reshapes fire safety strategies in digital infrastructure. Rising power densities, increasing deployment of high-value IT equipment, and the growing prevalence of edge and hyperscale facilities are compelling operators to invest in advanced fire safety systems.

Enhanced focus on minimizing downtime, protecting mission-critical assets, and aligning with stringent safety codes is driving demand. The adoption of clean agent technologies and intelligent detection systems is improving response times and reducing collateral damage, while innovations in modular and scalable suppression systems are supporting diverse deployment scenarios.

Future growth is anticipated to be fueled by the expansion of hyperscale and colocation facilities, rising insurance expectations, and integration of fire safety with building management and monitoring platforms, paving the way for enhanced protection and operational resilience.

The data center fire detection and suppression market is segmented by system, deployment, data center, and geographic regions. The system of the data center fire detection and suppression market is divided into Fire suppression and fire detection. In terms of deployment of the data center fire detection and suppression market is classified into Room levelBuilding level.

Based on the data center, the data center fire detection and suppression market is segmented into Hyperscale, Colocation, Enterprise, Edge, Government & military. Regionally, the data center fire detection and suppression industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

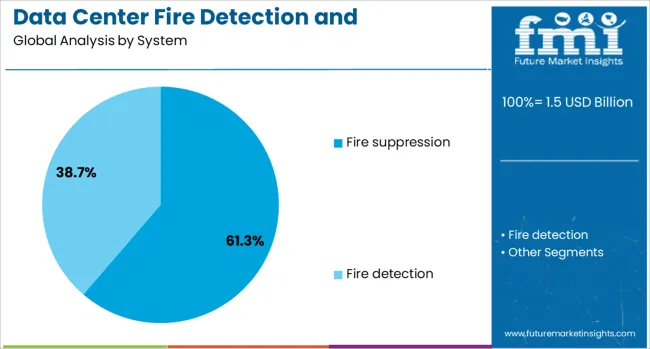

When segmented by system, fire suppression is projected to account for 61.3% of the total market revenue in 2025, making it the dominant system segment. This leadership has been shaped by the necessity to not only detect but also actively mitigate fire risks in environments housing sensitive and expensive IT infrastructure.

The ability of suppression systems to minimize both asset loss and service interruption has positioned them as indispensable in high-density data centers. Technological advances such as clean agent suppression and water mist systems have enabled effective protection without damaging electronic equipment.

Furthermore, the integration of suppression with intelligent monitoring has improved precision and reduced false activations, increasing operator confidence and adoption rates. Operational priorities focused on reducing downtime and adhering to global safety standards have further reinforced the preference for comprehensive suppression solutions.

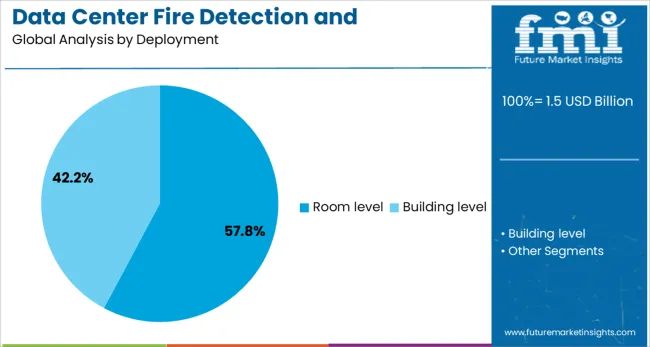

Segmented by deployment, room level solutions are expected to command 57.8% of the market revenue in 2025, establishing their position as the leading deployment type. This dominance has been driven by the practicality and cost-effectiveness of protecting entire server rooms rather than individual racks or cabinets.

Room level deployment allows for a uniform and scalable approach to safeguarding large areas, which aligns with the design of most enterprise and colocation data centers. The simplicity of installation and maintenance, combined with compliance with widely adopted safety standards, has encouraged widespread implementation.

Advances in room-wide detection technologies and suppression distribution have enhanced response times and reduced the risk of localized failures. The preference for comprehensive room coverage to ensure uninterrupted operation and safeguard personnel and assets has firmly positioned this segment at the forefront of deployment strategies.

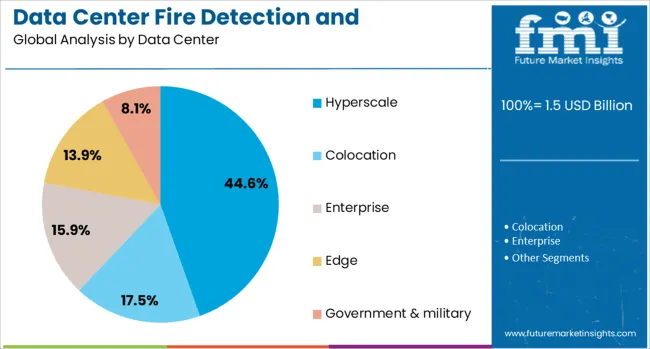

When segmented by data center type, hyperscale facilities are projected to hold 44.6% of the market revenue in 2025, asserting their leadership within this market. This leading share has been influenced by the massive scale, high equipment density, and critical nature of operations in hyperscale environments.

Operators of these facilities prioritize advanced fire safety solutions to protect investments, meet contractual service-level agreements, and minimize risk of catastrophic loss. The ability to deploy sophisticated detection and suppression systems that cover vast spaces while accommodating rapid expansion has aligned well with hyperscale design principles.

Additionally, the growing number of hyperscale builds globally and the concentration of mission-critical cloud and digital services in these facilities have amplified the demand for robust fire protection. Strategic focus on resilience, regulatory alignment, and operational reliability has cemented hyperscale data centers as the primary driver of this segment’s growth.

The data center fire detection and suppression market is growing due to the increasing reliance on data storage and processing. Growth drivers in 2024 and 2025 include rising data center infrastructure investments and the increasing need for robust safety systems. Opportunities are emerging in cloud computing and edge data centers. Emerging trends include the integration of AI for predictive maintenance. However, high installation costs and regulatory compliance challenges are significant market restraints.

The major growth driver in the data center fire detection and suppression market is the significant rise in data center infrastructure investments. In 2024, as companies expanded their data storage and processing capabilities, the need for advanced fire detection and suppression systems became more critical. With the growing demand for data centers, businesses are increasingly focusing on ensuring operational safety and preventing potential disruptions caused by fires, contributing to market growth.

Opportunities in the data center fire detection and suppression market are found in the expansion of cloud computing and edge data centers. In 2025, as businesses transition to cloud-based solutions and deploy edge data centers, the need for specialized fire protection solutions is growing. These data centers, often located in remote or distributed areas, require fire detection and suppression systems that ensure uninterrupted service and prevent costly damage, creating a substantial market opportunity.

Emerging trends in the data center fire detection and suppression market include the integration of AI and IoT for predictive fire maintenance. In 2024, AI-enabled systems began to be used for monitoring fire risks in real-time, anticipating potential fire hazards before they escalate. These technologies help reduce false alarms and optimize suppression efforts, leading to enhanced efficiency and cost savings. As the demand for smarter solutions increases, this trend is expected to shape the market in the coming years.

The major market restraints in the data center fire detection and suppression market include high installation costs and challenges related to regulatory compliance. In 2024 and 2025, the cost of installing fire detection and suppression systems for large-scale data centers remained high, particularly for advanced systems. Additionally, the complexity of meeting diverse regulatory requirements across regions and industries increased operational challenges.

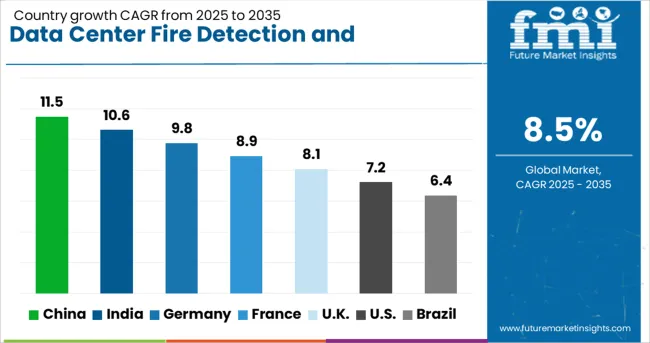

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

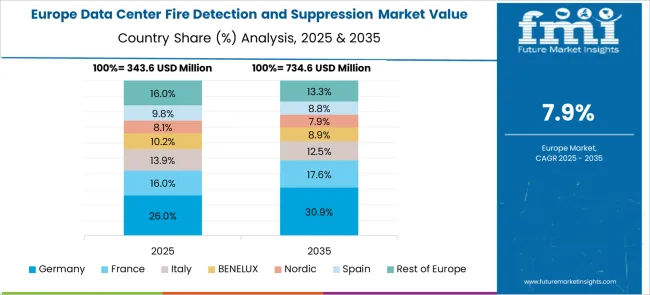

The global Data Center Fire Detection and Suppression market is projected to grow at a robust 8.5% CAGR from 2025 to 2035. China leads with an impressive 11.5% CAGR, followed by India at 10.6% and Germany at 9.8%. The United Kingdom records a growth rate of 8.1%, while the United States shows the slowest growth at 7.2%. These growth variations are largely driven by the expansion of data centers and the increasing demand for advanced fire safety systems. Emerging markets like China and India are seeing rapid data center expansion, necessitating enhanced fire detection and suppression systems, while mature markets such as the USA and the UK exhibit slower growth due to the existing infrastructure.

The data center fire detection and suppression market in China is expected to grow at an impressive CAGR of 11.5%. The country’s rapid development in the digital economy and booming data center industry are key factors driving the market. As China continues to invest in technological infrastructure, the demand for advanced fire detection and suppression systems in data centers is on the rise. With increasing concerns over fire safety in high-density server environments, data centers are prioritizing the adoption of more effective and efficient fire suppression solutions. Government initiatives to improve data security and infrastructure also further accelerate market demand.

The data center fire detection and suppression market in India is forecasted to grow at a CAGR of 10.6%. With a surge in digitalization and the growth of cloud computing, the demand for data centers in India is increasing rapidly. As the number of data centers expands, the need for reliable fire safety systems is becoming more critical. India’s growing IT and telecommunications sectors are further contributing to this demand. Additionally, the government’s focus on boosting infrastructure and data security is pushing data centers to prioritize fire detection and suppression systems, ensuring compliance with safety regulations and minimizing operational risks.

The data center fire detection and suppression market in Germany is projected to grow at a CAGR of 9.8%. As one of Europe’s largest data center hubs, Germany is witnessing an increase in the construction of data centers to support the digital economy. The country’s strict safety and regulatory standards necessitate advanced fire detection and suppression technologies. With growing concerns around fire risks in high-density server rooms and data centers, businesses are investing in state-of-the-art systems to mitigate these risks. Additionally, the ongoing shift toward cloud storage and data centers in Germany is further pushing the demand for effective fire safety solutions.

The data center fire detection and suppression market in the United Kingdom is projected to grow at a CAGR of 8.1%. The UK’s well-established data center industry is evolving to meet the growing demand for cloud storage, big data, and digital transformation. As the market matures, companies are increasingly focused on enhancing fire safety measures within their facilities. Strict regulatory frameworks and the need for business continuity are further accelerating the adoption of fire detection and suppression systems in UK data centers. Additionally, the increasing number of high-risk, high-density data centers in the region is pushing for more advanced fire suppression technologies.

The data center fire detection and suppression market in the United States is expected to grow at a CAGR of 7.2%. While the market is mature, there is still a consistent demand for advanced fire detection and suppression technologies due to the growing number of data centers across the country. The USA government’s initiatives to promote digital infrastructure, along with increasing concerns over fire risks in data centers, are driving the market. The increasing importance of business continuity and operational safety, combined with technological advancements in fire suppression, ensures that USA data centers will continue to adopt new systems.

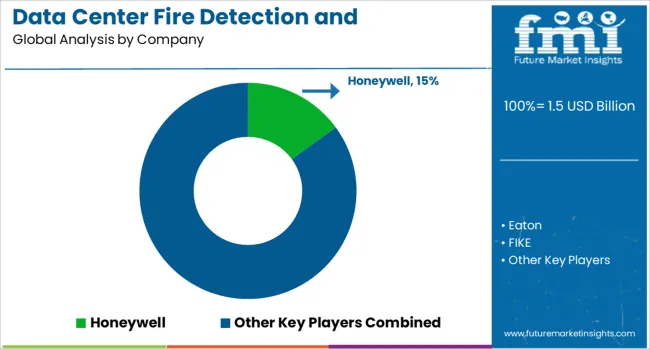

The data center fire detection and suppression market is dominated by Honeywell, which leads through its advanced fire safety solutions tailored for mission-critical environments such as data centers. Honeywell’s dominance is supported by its innovative technologies in smoke detection, fire suppression systems, and real-time monitoring, ensuring the safety and reliability of critical IT infrastructure. Key players such as Eaton, Johnson Controls, FIKE, and Siemens maintain significant market shares by providing comprehensive fire detection, alarm, and suppression solutions that meet stringent safety standards and reduce downtime in data centers. These companies focus on enhancing system integration, scalability, and operational efficiency, offering both active and passive fire protection measures.

Emerging players like Minimax, ORR, Robert Bosch, and SEM-SAFE are expanding their market presence by offering specialized fire suppression systems and detection technologies designed for specific data center needs, including clean agent suppression and advanced smoke detection. Their strategies include improving system responsiveness, increasing energy efficiency, and providing tailored solutions to meet the diverse needs of modern data centers. Market growth is driven by the increasing demand for data storage, the rise of cloud computing, and the growing need for robust fire safety solutions in high-value, highly sensitive environments. Innovations in non-toxic suppression agents, integrated detection systems, and AI-based fire risk analytics are expected to shape competitive dynamics and drive the global data center fire detection and suppression market forward.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| System | Fire suppression and Fire detection |

| Deployment | Room level and Building level |

| Data Center | Hyperscale, Colocation, Enterprise, Edge, and Government & military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell, Eaton, FIKE, Johnson Controls, Minimax, ORR, Robert Bosch, SEM-SAFE, and Siemens |

| Additional Attributes | Dollar sales by detection and suppression system type and application, demand dynamics across hyperscale, enterprise, and colocation data centers, regional trends in fire detection and suppression adoption, innovation in early detection technologies and automated suppression systems, impact of regulatory standards on safety and environmental concerns, and emerging use cases in edge computing and IoT-enabled monitoring. |

The global data center fire detection and suppression market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the data center fire detection and suppression market is projected to reach USD 3.4 billion by 2035.

The data center fire detection and suppression market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in data center fire detection and suppression market are fire suppression, _smoke, _heat, _flame, _gas, fire detection, _clean agent, _water-based, _gas- based and _foam- based.

In terms of deployment, room level segment to command 57.8% share in the data center fire detection and suppression market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA