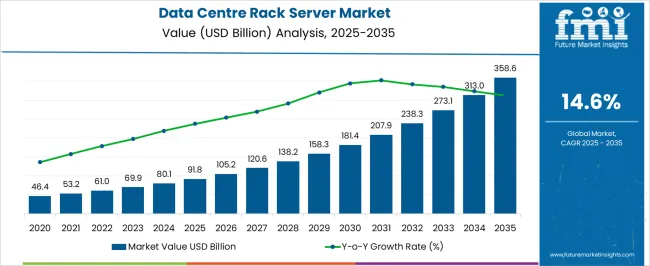

The Data Centre Rack Server Market is estimated to be valued at USD 91.8 billion in 2025 and is projected to reach USD 358.6 billion by 2035, registering a compound annual growth rate (CAGR) of 14.6% over the forecast period.

| Metric | Value |

|---|---|

| Data Centre Rack Server Market Estimated Value in (2025E) | USD 91.8 billion |

| Data Centre Rack Server Market Forecast Value in (2035F) | USD 358.6 billion |

| Forecast CAGR (2025 to 2035) | 14.6% |

The Data Centre Rack Server market is experiencing steady growth, driven by the rapid expansion of cloud computing, virtualization, and digital transformation initiatives across enterprises and service providers. Increasing demand for high-performance computing, scalable storage, and energy-efficient data center solutions is fueling adoption. Rack servers provide modularity, centralized management, and high-density deployment, which reduce operational complexity and optimize floor space utilization.

Continuous advancements in processor architectures, memory, and cooling technologies are enhancing server performance while maintaining cost efficiency. Rising adoption of AI, big data analytics, and edge computing applications further increases the need for reliable and flexible rack servers. Regulatory requirements for data security, uptime, and compliance are reinforcing the adoption of standardized and scalable rack server infrastructure.

As organizations migrate workloads to hybrid and multi-cloud environments, rack servers are expected to play a pivotal role in providing compute resources, reliability, and operational efficiency Growing investments in data centers by hyperscalers, telecom operators, and enterprises are anticipated to sustain the market expansion over the coming years.

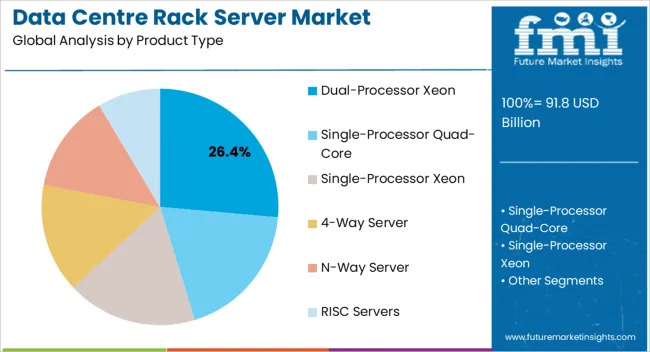

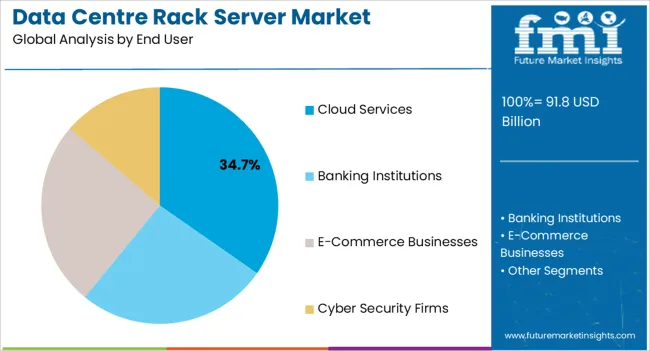

The data centre rack server market is segmented by product type, end user, and geographic regions. By product type, data centre rack server market is divided into Dual-Processor Xeon, Single-Processor Quad-Core, Single-Processor Xeon, 4-Way Server, N-Way Server, and RISC Servers. In terms of end user, data centre rack server market is classified into Cloud Services, Banking Institutions, E-Commerce Businesses, and Cyber Security Firms. Regionally, the data centre rack server industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dual-processor Xeon segment is projected to hold 26.4% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment is being driven by its superior performance, scalability, and reliability for handling compute-intensive workloads such as virtualization, AI, and big data processing.

Dual-processor Xeon servers provide enhanced memory bandwidth, multi-core processing, and virtualization support, enabling data centers to optimize resource utilization and increase operational efficiency. Compatibility with high-performance storage and networking modules further reinforces adoption.

The ability to deliver high uptime and energy efficiency while supporting mission-critical workloads makes dual-processor Xeon servers the preferred choice for cloud providers and enterprise IT infrastructure As data center operators increasingly prioritize scalability, cost efficiency, and performance reliability, the dual-processor Xeon segment is expected to maintain its leadership position, supported by continuous processor innovations and enterprise adoption trends.

The cloud services end user segment is anticipated to account for 34.7% of the market revenue in 2025, making it the leading end-use category. Growth in this segment is being driven by the rapid expansion of cloud-based applications, virtualized environments, and managed services. Cloud providers require high-density, reliable, and scalable rack servers to support multi-tenant architectures and dynamic workload demands.

Adoption is further reinforced by the need for high uptime, energy efficiency, and optimized total cost of ownership. Dual-processor Xeon-based rack servers are increasingly deployed to meet the performance requirements of AI, big data analytics, and enterprise software platforms hosted in cloud environments.

Regulatory compliance, data security, and disaster recovery considerations also encourage cloud service providers to invest in standardized and modular server infrastructure As demand for public, private, and hybrid cloud services continues to grow globally, cloud services are expected to remain the primary driver of market expansion, supporting both infrastructure scalability and operational efficiency.

This expansion is largely fueled by the increasing demand for cloud services, big data analytics, and the Internet of Things (IoT). Companies across various sectors are investing heavily in data centre infrastructure to handle the surge in data processing and storage needs.

Rack servers, known for their efficiency, scalability, and ease of management, are becoming the preferred choice in data centres. They offer high-density computing power, which is essential for modern applications that require substantial computational resources.

The adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and edge computing is further propelling the market for data centre rack servers. These technologies demand high-performance computing capabilities, which rack servers can provide.

AI and ML workloads, in particular, benefit from the parallel processing power and flexibility of rack servers, making them a crucial component in the infrastructure of tech companies and enterprises alike. Moreover, edge computing, which involves processing data closer to the source, often relies on compact and powerful rack servers to meet low-latency requirements.

Geographically, the market growth is robust across North America, Europe, and the Asia-Pacific regions. North America leads the market due to the presence of major technology companies and significant investments in data centre expansions.

Europe follows closely, with substantial growth driven by stringent data protection regulations and the rise of digital transformation initiatives. The Asia-Pacific region is witnessing the fastest growth, spurred by the increasing digitalization of economies, the proliferation of smartphones, and the growing e-commerce sector.

The market is also seeing an influx of new entrants and smaller players who are bringing innovative solutions and competitive pricing. Partnerships, mergers, and acquisitions are common strategies adopted by these companies to strengthen their market position and expand their customer base. As data continues to grow exponentially, the demand for efficient and powerful rack servers is expected to remain strong, driving further market growth and innovation.

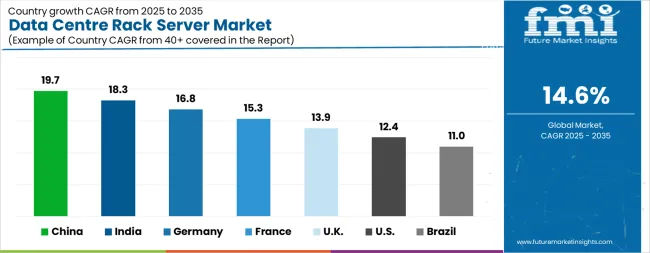

| Country | CAGR |

|---|---|

| China | 19.7% |

| India | 18.3% |

| Germany | 16.8% |

| France | 15.3% |

| UK | 13.9% |

| USA | 12.4% |

| Brazil | 11.0% |

The Data Centre Rack Server Market is expected to register a CAGR of 14.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 19.7%, followed by India at 18.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 11.0%, yet still underscores a broadly positive trajectory for the global Data Centre Rack Server Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 16.8%. The USA Data Centre Rack Server Market is estimated to be valued at USD 33.4 billion in 2025 and is anticipated to reach a valuation of USD 107.5 billion by 2035. Sales are projected to rise at a CAGR of 12.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 5.0 billion and USD 2.9 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 91.8 Billion |

| Product Type | Dual-Processor Xeon, Single-Processor Quad-Core, Single-Processor Xeon, 4-Way Server, N-Way Server, and RISC Servers |

| End User | Cloud Services, Banking Institutions, E-Commerce Businesses, and Cyber Security Firms |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

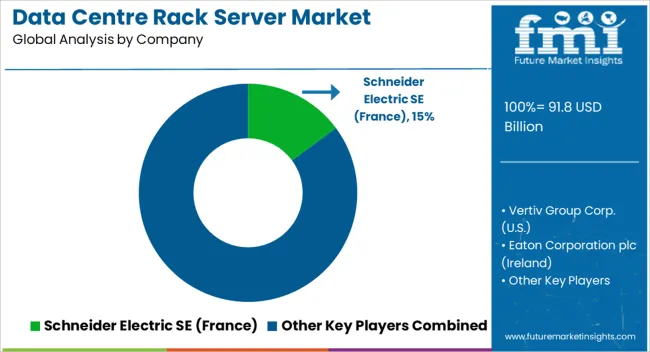

| Key Companies Profiled | Schneider Electric SE (France), Vertiv Group Corp. (USA), Eaton Corporation plc (Ireland), Cyber Power Systems, Inc. (Taiwan), Legrand S.A. (France), nVent Electric plc (UK), Hewlett Packard Enterprise Development LP (USA), Rittal GmbH & Co. KG (Germany), Dell Technologies Inc. (USA), and FUJITSU Limited (Japan) |

The global data centre rack server market is estimated to be valued at USD 91.8 billion in 2025.

The market size for the data centre rack server market is projected to reach USD 358.6 billion by 2035.

The data centre rack server market is expected to grow at a 14.6% CAGR between 2025 and 2035.

The key product types in data centre rack server market are dual-processor xeon, single-processor quad-core, single-processor xeon, 4-way server, n-way server and risc servers.

In terms of end user, cloud services segment to command 34.7% share in the data centre rack server market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Security Posture Management (DSPM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Data Pipeline Observability Solutions Market Size and Share Forecast Outlook 2025 to 2035

Data Center Market Forecast and Outlook 2025 to 2035

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Data Center Refrigerant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA