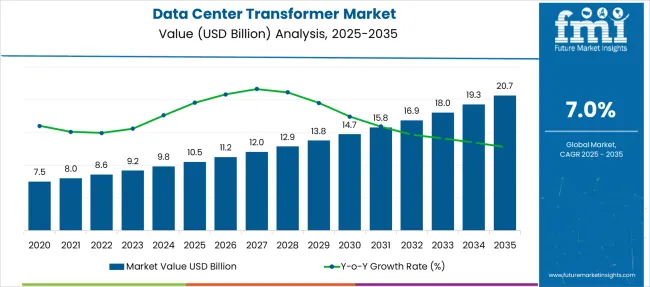

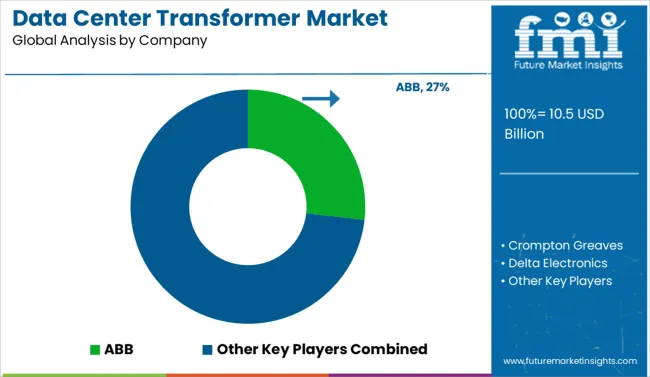

The Data Center Transformer Market is estimated to be valued at USD 10.5 billion in 2025 and is projected to reach USD 20.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Data Center Transformer Market Estimated Value in (2025 E) | USD 10.5 billion |

| Data Center Transformer Market Forecast Value in (2035 F) | USD 20.7 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The data center transformer market is expanding steadily due to the surging demand for digital infrastructure, growing investments in hyperscale data centers, and increased focus on energy efficiency and grid stability. The transition toward renewable energy integration and high density server environments is intensifying the need for reliable power distribution systems with minimal energy losses.

Data centers require constant, high quality power to avoid downtime and ensure seamless operations, driving the demand for technologically advanced transformers with optimized thermal management and overload protection. Additionally, global growth in cloud computing, artificial intelligence, and edge computing is supporting the development of new data facilities, particularly across North America, Europe, and Asia Pacific.

With rising environmental and energy efficiency regulations, the market outlook remains positive as stakeholders prioritize sustainable, compact, and high performance transformer solutions for mission critical infrastructure.

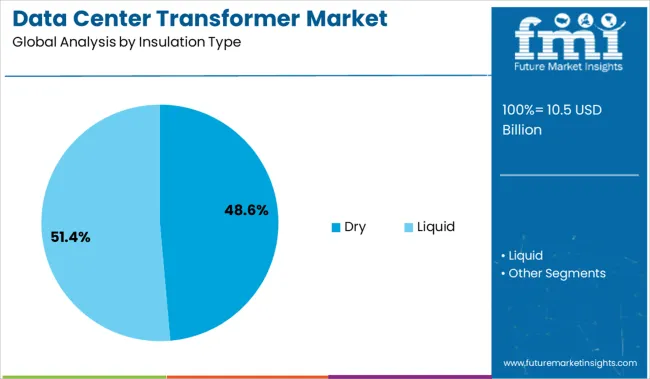

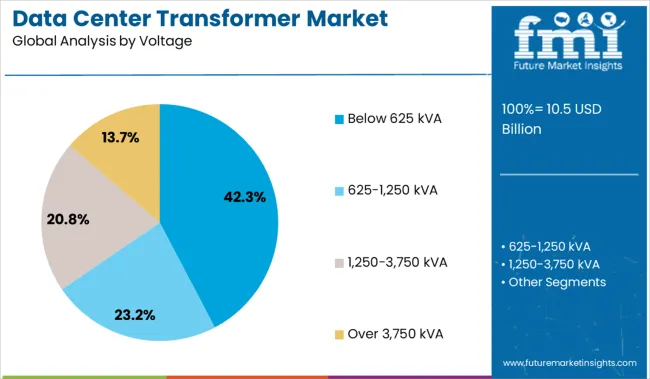

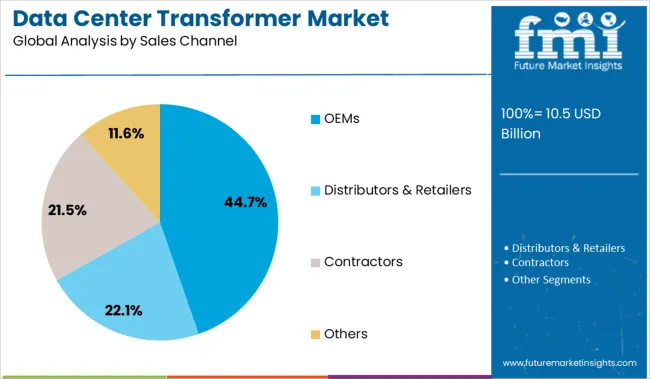

The data center transformer market is segmented by insulation type, voltage, sales channel, and application and geographic regions. Based on insulation type, the data center transformer market is divided into Dry and Liquid. In terms of voltage, the data center transformer market is classified into below 625 kVA, 625-1,250 kVA, 1,250-3,750 kVA, and over 3,750 kVA. Based on the sales channel, the data center transformer market is segmented into OEMs, Distributors & Retailers, Contractors, and Others. Based on the data center transformer market, it is segmented into Main and UPS. Regionally, the data center transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dry insulation segment is anticipated to account for 48.60 percent of market revenue by 2025, establishing it as the leading insulation type in the data center transformer landscape. This dominance is driven by the operational safety, lower maintenance requirements, and environmental advantages offered by dry type transformers.

Unlike oil filled alternatives, these transformers reduce the risk of fire hazards and eliminate the need for liquid containment, making them well suited for indoor installations and confined spaces within data centers. Their compatibility with high load fluctuations and energy efficient performance has contributed to growing preference in both hyperscale and edge data center environments.

The dry insulation type has proven effective in supporting sustainability goals and safety compliance, leading to its strong adoption across the industry.

The below 625 kVA voltage segment is projected to contribute 42.30 percent of total market revenue by 2025, making it the most significant segment under voltage classification. This is largely due to its suitability for small to mid sized data centers and distributed edge facilities where space optimization and modular scalability are key considerations.

These voltage levels are adequate for supporting decentralized computing operations and meet the growing power demands without overengineering the system. Additionally, transformers in this range offer easier integration, faster deployment timelines, and cost effective operation, aligning with the evolving infrastructure strategies of colocation providers and enterprise data centers.

As the market shifts toward modular and edge computing solutions, the below 625 kVA segment continues to gain traction.

Original equipment manufacturers are expected to hold 44.70 percent of market revenue by 2025 under the sales channel category, making them the leading distribution route. This is primarily driven by their direct integration capabilities, bundled solutions, and customization offerings tailored to the technical specifications of modern data centers.

OEMs play a key role in delivering turnkey infrastructure systems that include transformers as part of a broader package of power and cooling solutions. Their ability to offer certified components, lifecycle support, and streamlined procurement processes has increased buyer confidence and adoption rates.

As data center operators seek end to end power solutions with built in compliance and efficiency features, OEMs continue to lead the market with scalable and future ready transformer technologies.

Demand for data center transformers is intensifying as hyperscale and edge facilities scale up power density. Sales of dry-type and liquid-immersed transformers are rising due to grid-resilience needs, renewable integration, and redundancy-focused power infrastructure investments.

Demand for data center transformers rated above 2.5 MVA grew 21% in 2025, led by hyperscale projects in the USA, Ireland, and Singapore. Operators are deploying oil-immersed transformers with dual secondary windings to meet Tier IV uptime standards. Modular liquid-cooled designs are enabling higher rack densities without thermal compromise. Data center developers in the Middle East adopted 66kV–132kV primary transformers for direct-to-grid access, bypassing substation bottlenecks and reducing latency. Load balancing via smart tap changers has reduced peak power penalties by 14%. Redundant transformer arrays are now embedded into prefabricated power skids, accelerating deployment timelines by 29% in colocation buildouts.

Sales of dry-type data center transformers jumped 26% in 2025, driven by edge computing growth and indoor deployment constraints. Air-insulated cast resin units below 2 MVA gained traction in urban micro data centers and telecom switching hubs. Operators prefer low-fire-risk, low-maintenance units for colocated environments, especially in high-rise retrofits across Asia-Pacific. Smart monitoring on dry-type transformers enabled real-time core temperature tracking, cutting reactive maintenance costs by 17%. OEMs are now bundling dry transformers with UPS bypass switches and voltage regulation modules, creating plug-and-play packages for 5G data edge rollouts. This segment is seeing fast conversion from diesel genset-reliant backup systems.

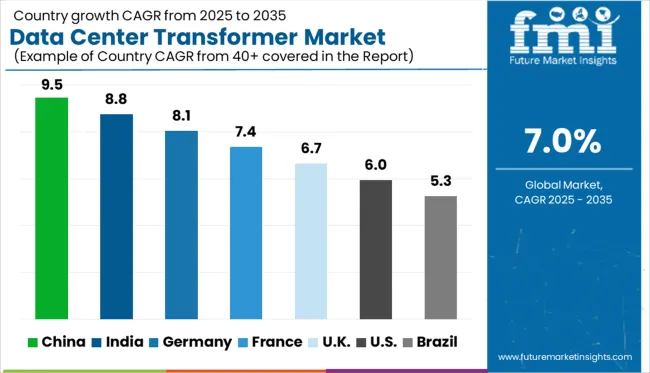

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global data center transformer market is forecasted to expand at a CAGR of 7.0% from 2025 to 2035. China (BRICS) leads with a CAGR of 9.5%, outpacing the global average by 2.5 percentage points, driven by major investments in hyperscale data centers and growing deployment of edge computing across industrial zones. India (BRICS) follows closely at 8.8% (+1.8 pp), fueled by expanding cloud infrastructure, AI workloads, and state-level data localization mandates. Germany (OECD) records 8.1% (+1.1 pp), supported by the country's aggressive transition to green data centers and increased transformer retrofits for energy efficiency. The UK lags slightly at 6.7% (–0.3 pp), with modest upgrades in existing facilities and slow scaling of hyperscale projects. The United States trails further behind at 6.0% (–1.0 pp), where aging infrastructure and regulatory bottlenecks constrain transformer modernization efforts. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a CAGR of 9.5% from 2025 to 2035, fueled by hyperscale data center expansion and national digital infrastructure goals. Between 2020 and 2024, transformer demand was largely driven by cloud service providers and telecom operators. Looking ahead, rising AI workloads and power-dense racks are pushing investments in high-efficiency transformers.

India’s market is anticipated to expand at a CAGR of 8.8% from 2025 to 2035, supported by a growing base of colocation and cloud facilities. From 2020 to 2024, growth was driven by Tier I city deployments and global tech investment. The upcoming decade will see rising demand from edge data centers and tier-2 city expansion.

Germany is forecast to register a CAGR of 8.1% between 2025 and 2035, underpinned by green data center growth and energy security policies. From 2020 to 2024, demand was driven by colocation projects in Frankfurt and Berlin. Going forward, adoption of smart transformer systems and grid-resilient infrastructure will shape the market.

The UK market is poised to grow at a CAGR of 6.7% through 2035, driven by cloud adoption and increasing computational demand in AI and financial sectors. Between 2020 and 2024, London remained the core transformer market, supported by data compliance requirements. Future growth will stem from distributed centers and sustainability-focused retrofits.

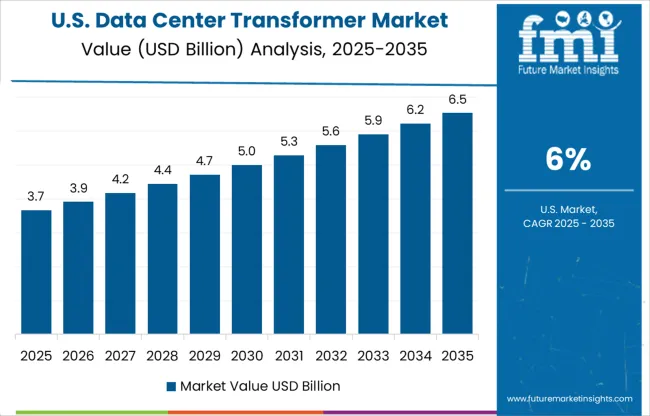

The USA is expected to witness a CAGR of 6.0% from 2025 to 2035, led by data sovereignty laws and continuous cloud expansion. Between 2020 and 2024, large hyperscale providers like AWS and Azure drove transformer deployment. The next phase of growth will prioritize transformer efficiency, redundancy, and thermal reliability.

Sales of data center transformers are surging in 2025, driven by hyperscale expansions and rising grid stability concerns. ABB dominates the market with a significant share, capitalizing on its energy-efficient, low-loss transformer portfolio tailored for mission-critical IT loads. Schneider Electric, Siemens, and Eaton are strengthening their presence across Tier III and IV data center deployments with modular transformer units. General Electric and Hitachi are investing in hybrid dry-type and liquid-filled systems for edge data centers. Delta Electronics and Fuji Electric are witnessing strong traction across Asia, benefiting from 5G rollouts and localized manufacturing. Companies like Hyosung, Toshiba, and SPX Transformer Solutions are competing on advanced insulation and IoT-enabled monitoring features. Market competition remains high as operator’s demand higher reliability and lower lifecycle costs.

In June 2025, Eaton and Siemens Energy formed a collaboration to deliver modular power plants, including SGT‑800 gas turbines and battery storage, for new data centers. The standardized systems accelerate capacity deployment and integrate renewables on-site.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.5 Billion |

| Insulation Type | Dry and Liquid |

| Voltage | Below 625 kVA, 625-1,250 kVA, 1,250-3,750 kVA, and Over 3,750 kVA |

| Sales Channel | OEMs, Distributors & Retailers, Contractors, and Others |

| Application | Main and UPS |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Crompton Greaves, Delta Electronics, Delta Star, Eaton, Emerson, Fuji Electric Co., Ltd., General Electric, Hitachi, Hyosung Heavy Industries, Legrand, Schneider Electric, Siemens, SPX Transformer Solutions, Inc., and Toshiba Corporation |

| Additional Attributes | Dollar sales by transformer type (dry‑type vs oil‑immersed) and data center tier classification, demand dynamics across hyperscale vs edge sites, regional build-out trends, innovation in modular and liquid‑cooled units, environmental impact of efficiency and waste transformers, and emerging use cases in AI/ML‑driven computing environments. |

The global data center transformer market is estimated to be valued at USD 10.5 billion in 2025.

The market size for the data center transformer market is projected to reach USD 20.7 billion by 2035.

The data center transformer market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in data center transformer market are dry, _paper, _pressboard, _resin, _others and liquid.

In terms of voltage, below 625 kva segment to command 42.3% share in the data center transformer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA