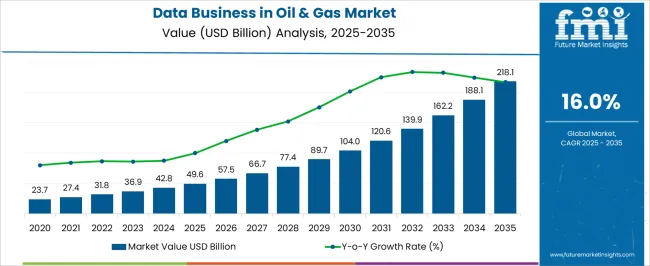

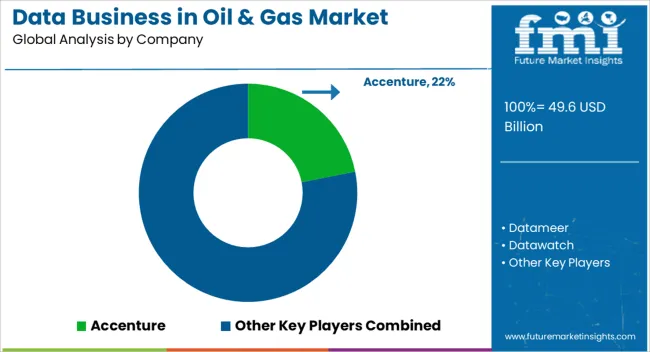

The Data Business in Oil & Gas Market is estimated to be valued at USD 49.6 billion in 2025 and is projected to reach USD 218.1 billion by 2035, registering a compound annual growth rate (CAGR) of 16.0% over the forecast period.

| Metric | Value |

|---|---|

| Data Business in Oil & Gas Market Estimated Value in (2025 E) | USD 49.6 billion |

| Data Business in Oil & Gas Market Forecast Value in (2035 F) | USD 218.1 billion |

| Forecast CAGR (2025 to 2035) | 16.0% |

The data business in oil and gas is gaining traction as companies increasingly leverage advanced analytics, cloud platforms, and AI driven tools to optimize operations and reduce costs. Rising complexities in exploration and production activities are driving demand for real time data insights that enhance decision making and minimize downtime.

Oil and gas enterprises are investing heavily in digital transformation initiatives to strengthen predictive maintenance, reservoir modeling, and supply chain efficiency. The integration of IoT devices and sensors across upstream, midstream, and downstream operations has amplified data volumes, necessitating robust solutions for storage, processing, and analysis.

Regulatory emphasis on environmental compliance and carbon footprint reduction is also encouraging adoption of data centric strategies. The outlook for the market remains strong as both international and national oil companies continue to prioritize data driven decision making for long term competitiveness.

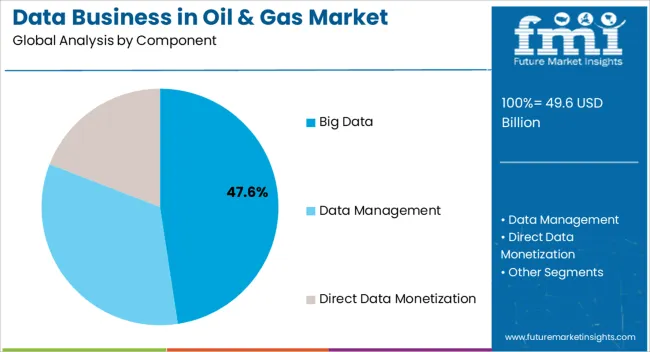

The big data segment is projected to account for 47.60% of total market revenue by 2025, making it the leading component. Its growth is being driven by the increasing need to analyze complex geological and seismic datasets, optimize drilling operations, and manage vast amounts of operational data in real time.

The ability of big data platforms to improve asset utilization, predict equipment failures, and enhance production efficiency has reinforced adoption. Oil and gas companies are also using big data to advance sustainability reporting and compliance tracking.

These benefits have established big data as the core component driving transformation in the sector.

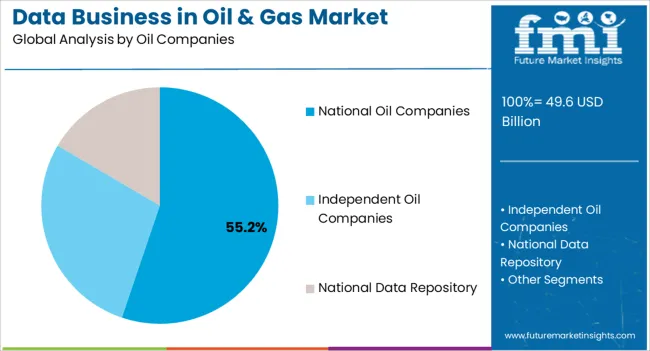

National oil companies are expected to hold 55.20% of total revenue by 2025 within the oil company category, making them the dominant players. This leadership is attributed to their large scale resource ownership, government backing, and ongoing investments in digital technologies to optimize extraction and production.

National oil companies are increasingly adopting data driven platforms to reduce reliance on imports, maximize domestic resource efficiency, and meet national energy security goals.

Their financial capacity and strategic importance to regional economies have enabled them to invest heavily in big data platforms, positioning them at the forefront of market growth.

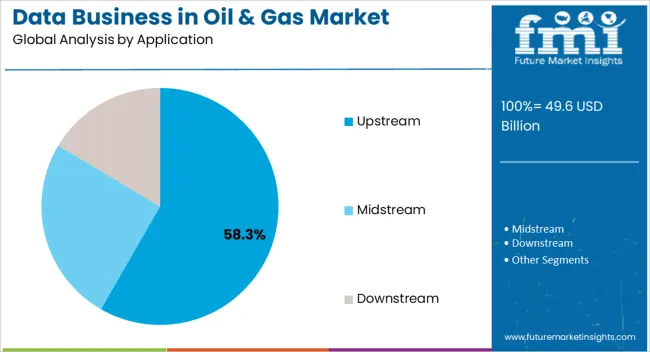

The upstream segment is anticipated to contribute 58.30% of overall revenue by 2025 within the application category, emerging as the most significant segment. This dominance is being driven by the complexity of exploration and drilling activities that require advanced analytics for reservoir characterization, seismic interpretation, and production forecasting.

Data driven technologies are reducing exploration risks, improving well productivity, and lowering costs associated with non productive time. Enhanced drilling accuracy and real time monitoring capabilities are ensuring operational efficiency and safety.

These advantages have secured upstream as the leading application in the adoption of data business strategies in oil and gas.

In the data business in oil & gas market, big data refers to a vast volume of data generated at a high rate in a variety of formats, including structured and unstructured data generated by various operations and financial activities.

The demand for data business in oil & gas market is anticipated to rise as by using diverse analytical tools and approaches, big data is used to generate useful information for better decision making.

A key factor propelling the adoption of data business in oil & gas industry includes the ability of big data to make efficient and better judgments, which can lead to enhanced operational efficiency, reduced risk, and cost savings. Oil and gas companies can move away from traditional real-time monitoring and toward faster real-time predictions with the best technology solutions.

The adoption of data business in oil & gas industry is significantly expanding. This growth can be attributed to factors such as:

The demand for data business in oil & gas market is rising due to technological advancements and innovations, and the introduction of new products in this field to improve data management efficiency.

Several new oil and gas companies are entering the global market to provide niche solutions at competitive prices, which is expected to accelerate data business in oil & gas market growth. However, certain factors are limiting the growth of the global data business in oil & gas market, which include:

A lack of understanding of the benefits of adoption of data business in oil & gas industry.

A high initial investment is required to implement a data management solution.

An increasing level of challenges arises from the growing volume and velocity of data, and the high time, costs, and risks associated with managing and moving data. To close the gap between supply and demand, oil exploration companies are looking for oilfields in remote and harsh environments.

Most oil and gas companies are following the trend of exploitation of offshore deep-water reserves and developing unconventional reserves. To optimize performance and maintain safety standards, this is anticipated to boost the demand for data business in oil & gas market, IT infrastructure, data analysis, and consultation services.

A significant drop in the oil price index has an impact on companies' return on investment (ROI), resulting in a continuous reduction in headcount and capital expenditure. As a result, the demand for effective and efficient use of large amounts of data to make technical decisions has grown. Due to this, the demand for data business in oil & gas market is increased.

Market players are likely to have new opportunities, as pervasive computing devices, advanced storage capabilities, and new analytic tools become widely adopted,

Oil and gas producers can now obtain real-time data from previously inaccessible areas at low costs to improve the performance of their oil fields and plants. For example, key players combine nearby good production with real-time down-hole drilling data to help them adapt their drilling strategy, particularly in unconventional fields. As a result of these factors, the adoption of the data business in oil & gas industry is anticipated to grow notably during the forecast period.

| Countries | Revenue Share % (2025) |

|---|---|

| The United States | 19.7% |

| Germany | 6.3% |

| Japan | 4.3% |

| Australia | 3.3% |

| Countries | CAGR % (2025 to 2035) |

|---|---|

| China | 18.6% |

| India | 18.3% |

| The United Kingdom | 16.4% |

North America region is expected to dominate the data business in oil & gas market, accounting for USD 49.6 billion with a CAGR of 16.1% during the forecast period. This growth is due to an increase in production and drilling activities in the oil and gas sector. North America held a market share of 34.2% in 2025.

Europe, followed by Asia Pacific, is expected to see increased demand over the forecast period as a result of increased focus on operational efficiency and increased usage. This region is also likely to dominate the market in the near future.

Asia Pacific is expected to see healthy growth in countries such as India and China over the forecast period, which is expected to switch to big data for making any kind of strategic decisions, as well as growth opportunities in other Asia Pacific countries.

India’s data business in oil & gas market is anticipated to expand at a CAGR of 18.3%, while China’s market is projected to expand at a CAGR of 18.6%. The above-mentioned factors are anticipated to drive the demand for market growth.

The market in Latin America, the Middle East, and Africa are set for expansion. This is due to an increase in oil production, which has been accompanied by increased drilling activity in countries such as Saudi Arabia, Iran, and Israel, which are expected to dominate the market.

| Category | By Component Type |

|---|---|

| Leading Segment | Data Management |

| Market Share (2025) | 45.4% |

| Category | By oil companies Type |

|---|---|

| Leading Segment | Independent Oil Companies |

| Market Share (2025) | 40.3% |

Based on components, the data management segment is anticipated to dominate the data business in oil & gas market as it held a market share of 45.4% in 2025. The data management segment is expected to be driven by the rising trend of cloud adoption in the coming years.

Data breaches are becoming common around the world, necessitating the modernization of existing enterprise infrastructure. As a result, global enterprise data management infrastructure modernization is expected to boost the demand for data business solutions in oil & gas in the forthcoming years.

The lack of complete data security assurance and misuse of collected data are stifling the adoption of data business in oil & gas industry in both international and domestic markets.

Based on the application, the upstream segment is anticipated to dominate the data business in oil & gas market with a CAGR of 16.8%. The demand for data business in oil & gas solutions is rising due to various services and maintenance activities requiring data analysis in various natural gas and oil-producing companies.

The key strategy used by industry players to achieve growth in the data business in oil & gas market is new product launches. This growth strategy accounted for 42.86 percent of all market players' growth strategies.

Market players are concentrating their efforts on expanding into new markets by launching technologically advanced and innovative oil and gas data management solutions and services in both established and emerging markets. The leading companies that have adopted this strategy are those developed innovative solutions for business needs.

Market Developments

The global data business in oil & gas market is estimated to be valued at USD 49.6 billion in 2025.

The market size for the data business in oil & gas market is projected to reach USD 218.1 billion by 2035.

The data business in oil & gas market is expected to grow at a 16.0% CAGR between 2025 and 2035.

The key product types in data business in oil & gas market are big data, data management and direct data monetization.

In terms of oil companies, national oil companies segment to command 55.2% share in the data business in oil & gas market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Center Refrigerant Market Size and Share Forecast Outlook 2025 to 2035

Data Center Fire Detection And Suppression Market Size and Share Forecast Outlook 2025 to 2035

Data Center Security Market Size and Share Forecast Outlook 2025 to 2035

Data Center Construction Market Size and Share Forecast Outlook 2025 to 2035

Data Center Substation Market Size and Share Forecast Outlook 2025 to 2035

Data Center GPU Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Market Size and Share Forecast Outlook 2025 to 2035

Data Center Chillers Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data Center Virtualization Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA