The data center market is experiencing robust growth driven by accelerated digital transformation, rapid adoption of cloud computing, and the increasing volume of data generated across industries. Market expansion is being reinforced by rising enterprise investments in IT infrastructure modernization and the integration of energy-efficient technologies to enhance operational sustainability. Demand for hyperscale and edge data centers is rising as organizations focus on reducing latency and improving processing efficiency.

The current scenario reflects heightened activity in infrastructure development, with global providers expanding capacity to meet evolving digital requirements. Future growth is expected to be influenced by continued advancements in artificial intelligence, Internet of Things (IoT) connectivity, and network virtualization.

Market participants are prioritizing modular and scalable architecture to optimize cost efficiency and resource utilization This growth rationale is underpinned by the critical need for reliable data storage, processing, and distribution infrastructure, ensuring the market remains a fundamental enabler of global digital ecosystems.

| Metric | Value |

|---|---|

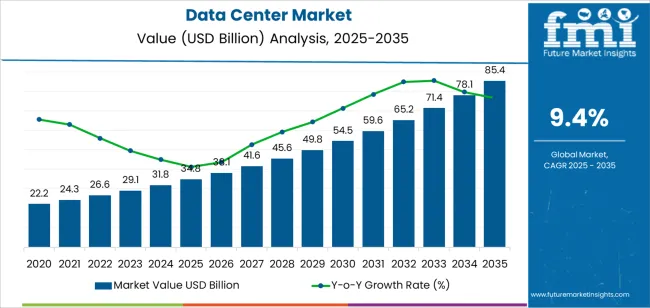

| Data Center Market Estimated Value in (2025 E) | USD 34.8 billion |

| Data Center Market Forecast Value in (2035 F) | USD 85.4 billion |

| Forecast CAGR (2025 to 2035) | 9.4% |

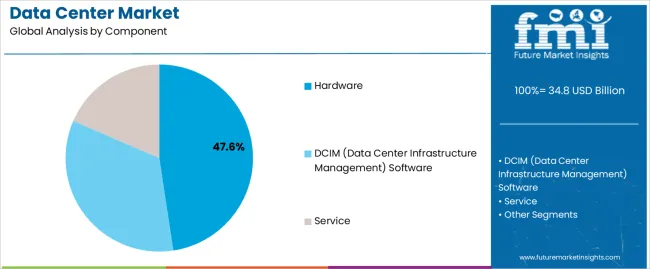

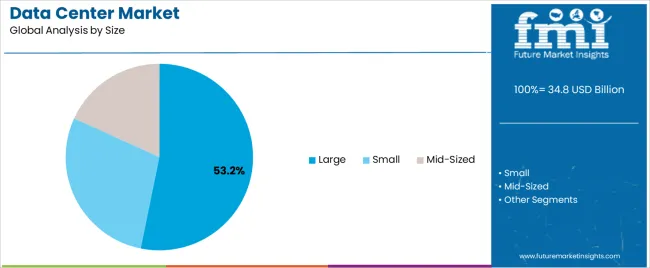

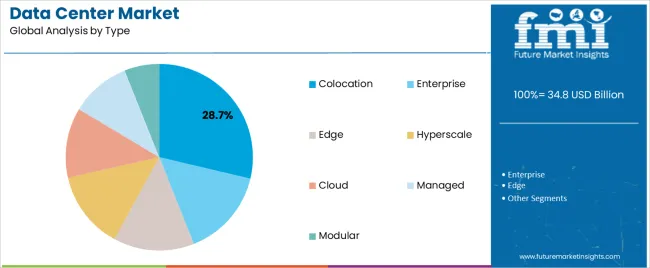

The market is segmented by Component, Size, Type, and Industry and region. By Component, the market is divided into Hardware, DCIM (Data Center Infrastructure Management) Software, and Service. In terms of Size, the market is classified into Large, Small, and Mid-Sized. Based on Type, the market is segmented into Colocation, Enterprise, Edge, Hyperscale, Cloud, Managed, and Modular. By Industry, the market is divided into IT & Telecom, BFSI, Manufacturing, Healthcare, Government, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment, accounting for 47.60% of the component category, has maintained its leadership due to its indispensable role in supporting data processing, storage, and networking functions. Market share has been strengthened by the ongoing demand for high-performance servers, storage systems, and network switches required to manage large-scale workloads.

Continuous innovation in processing power, energy management, and equipment cooling has improved hardware efficiency, driving adoption across hyperscale and enterprise data centers. The proliferation of AI-driven applications and data-intensive analytics has further elevated the need for advanced computing infrastructure.

Supply chain stability, supported by diversified vendor networks and strategic partnerships, has contributed to consistent growth Ongoing investments in hardware standardization and sustainability are expected to reinforce the segment’s dominance and ensure its continued relevance in evolving data infrastructure landscapes.

The large data center segment, representing 53.20% of the size category, has emerged as the leading segment due to its capability to support massive computing loads and extensive enterprise requirements. Market dominance has been sustained by global expansion of hyperscale facilities catering to cloud service providers, telecommunications, and financial institutions.

High operational efficiency, advanced cooling systems, and scalable energy management solutions have made large data centers the preferred choice for organizations prioritizing performance and reliability. Increasing integration of renewable energy sources and automation technologies is further optimizing cost and energy efficiency.

Expansion initiatives in strategic locations are addressing data sovereignty and latency requirements, enhancing global connectivity The segment’s continued leadership is being reinforced by steady enterprise digitization, ongoing infrastructure upgrades, and rising demand for centralized data processing capacity.

The colocation segment, holding 28.70% of the type category, has gained prominence as enterprises increasingly seek cost-effective and secure infrastructure alternatives to in-house data facilities. Growth is being driven by demand for flexible, scalable environments that reduce capital expenditure while ensuring high availability and compliance.

Colocation providers are enhancing value propositions through improved connectivity, advanced cybersecurity, and hybrid cloud integration. Rising adoption among small and medium enterprises and the shift toward distributed IT architecture are fueling expansion.

Strong emphasis on sustainability and green energy sourcing is strengthening customer trust and regulatory alignment Continuous investment in infrastructure expansion, coupled with customized service models, is expected to sustain the segment’s share and support long-term growth across regional and global data center markets.

From 2020 to 2025, the data center market showed strong growth, boasting a 12.70% CAGR. During this period growth accelerated because of the COVID-19 pandemic. This has pushed organizations towards digital transformation.

Around every organization shifted to remote working. This mandated the demand for speedy mobilization of cloud computing to handle the substantial amount of data. This has positively impacted the market outlook.

| Attributes | Quantitative Outlook |

|---|---|

| Data Center Market Size (2025) | USD 26.83 billion |

| Historical CAGR (2020 to 2025) | 12.70% |

Short-term Data Center Market Analysis

The introduction of 5G networks speeds up data transmission and enables new applications. This, in turn, is creating a need for more data center infrastructure to handle the increased data flow. This wireless technology requires quicker downloads, faster access, and seamless streaming, leading to increased demand for high-speed data centers.

Long-term Data Center Market Analysis

Cloud services rely on strong data centers to support applications and computing resources. Cloud providers are prioritizing edge computing, which requires smaller data center infrastructures closer to users.

Consequently, this is leading to a rise in demand for micro data centers. The growing use of cloud services by small, medium, and large businesses is likely to contribute to the market expansion through 2035.

The emergence of micro data centers is likely to create significant opportunities for market players. The rising interest in small, convenient, and modular data centers is expected to create a large foundation for micro data centers.

Micro data centers can be set up or expanded easily as needed, helping companies react swiftly to customer needs without extra costs. This increasing demand for micro data centers is likely to bring about future prospects for the market.

The North America data center market stands out as a moderately performing regional market. The adoption of cloud facilities and the trend toward digital transformation in every field is driving the demand for hyperscale data center edifice in this region. Europe is witnessing continuous and steady growth in demand for data centers.

| Countries | Data Center Industry Forecasted CAGR (2025 to 2035) |

|---|---|

| United States | 11.30% |

| Germany | 9.90% |

| China | 15.00% |

Demand for data centers in the United States is set to rise with an anticipated CAGR of 11.30% through 2035. Key factors influencing the data center market include:

The Germany data center market is expected to surge at a CAGR of 9.90% through 2035. The topmost dynamic forces supporting the data center adoption in the country include:

The market in China is likely to exhibit a CAGR of 15.00% through 2035. Reasons supporting the growth of the data center market in the country include:

As far as the component of data center is concerned, the hardware segment is likely to acquire 51.80% data center market share. Similarly, the tier 3 data center segment is expected to generate considerable profit in terms of data center tier, possessing a 38.10% revenue share of Data Center industry in 2025.

| Segment | Estimated Market Share in 2025 |

|---|---|

| Hardware | 51.80% |

| Tier 3 Data Center | 38.10% |

The hardware segment is anticipated to perform better than others in the market. Here are a few key factors that contribute to its acceptance in the market:

The tier 3 data center segment is set to take a little less than 1/3rd of the market share, a trend validated by factors such as:

Data center market players implement diverse strategies to gain an edge in this fiercely competitive market. Many companies focus on differentiation through innovative technologies and services.

Some prioritize cost leadership by offering competitive pricing and efficient operations. Others emphasize customer service and support,. Additionally, partnerships and strategic alliances are common strategies to expand market reach and enhance service offerings.

Recent Developments

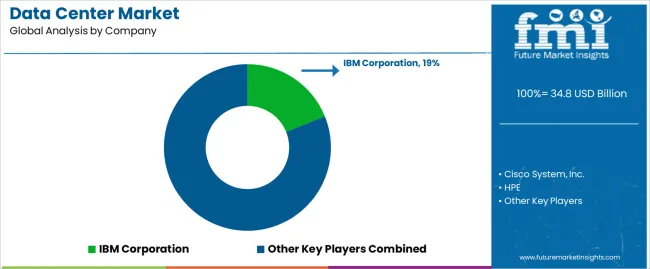

The global data center market is estimated to be valued at USD 34.8 billion in 2025.

The market size for the data center market is projected to reach USD 85.4 billion by 2035.

The data center market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in data center market are hardware, _power systems, _cooling systems, _racks, _servers, _networking devices, _others, dcim (data center infrastructure management) software, _cloud-based, _on-premises, service, _professional services and _managed services.

In terms of size, large segment to command 53.2% share in the data center market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Grid Interface Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Data Center Refrigerant Market Size and Share Forecast Outlook 2025 to 2035

Data Center Fire Detection And Suppression Market Size and Share Forecast Outlook 2025 to 2035

Data Center Security Market Size and Share Forecast Outlook 2025 to 2035

Data Center Construction Market Size and Share Forecast Outlook 2025 to 2035

Data Center Substation Market Size and Share Forecast Outlook 2025 to 2035

Data Center Immersion Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Center GPU Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Market Size and Share Forecast Outlook 2025 to 2035

Data Center Chillers Market Size and Share Forecast Outlook 2025 to 2035

Data Center Industry Analysis in Egypt Size and Share Forecast Outlook 2025 to 2035

Data Center Virtualization Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA