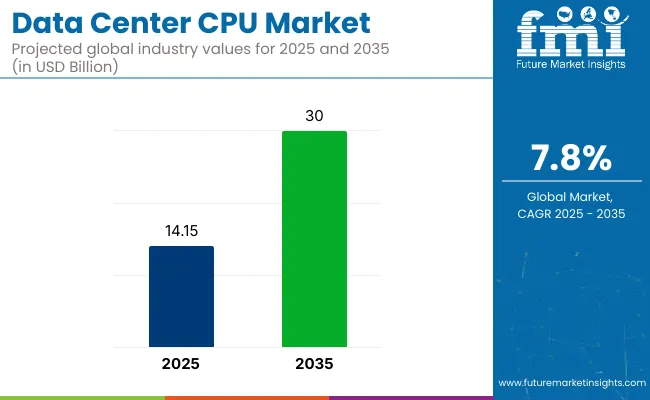

The global data center CPU market is valued at USD 14.15 billion in 2025 and is poised to reach USD 30 billion by 2035, which shows a CAGR of 7.8% over the forecast period. This substantial growth is being driven by the rapid acceleration of digital transformation, rising cloud adoption, and exponential growth in data generation across industries.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 14.15 billion |

| Industry Value (2035F) | USD 30 billion |

| CAGR (2025 to 2035) | 7.8% |

Central processing units (CPUs) are at the core of data center infrastructure, powering workloads across artificial intelligence, machine learning, big data analytics, and enterprise IT operations. As demand for high-performance computing increases, hyperscale cloud providers and colocation facilities are scaling their data center capacities and upgrading to next-generation CPUs.

Advancements in processor architecture, chip density, and thermal management are shaping the next wave of data center innovation. Leading manufacturers are introducing multi-core CPUs with improved power efficiency, parallel processing capabilities, and integrated AI acceleration to support data-intensive tasks.

The transition toward ARM-based processors and custom silicon designed for specific workloads is also gaining momentum. Open-source architectures like RISC-V, chiplet designs, and hybrid CPU-GPU platforms are further expanding the options available to data center operators.

These technologies enable better workload optimization, reduced total cost of ownership, and increased energy efficiency key priorities in a highly competitive environment. New and enhanced capabilities of products are being launched by companies to outshine their position.

Government incentives for digital infrastructure, increased enterprise investment in private cloud setups, and growing demand for edge computing are reinforcing market growth globally. Data sovereignty regulations and rising cybersecurity needs are also prompting regional data center expansions, further boosting demand for high-performance CPUs.

In emerging markets, increasing internet penetration, 5G rollout, and e-commerce expansion are creating strong tailwinds for data center development. As organizations prioritize computing agility, scalability, and sustainability, the global data center CPU market is expected to grow rapidly, fueled by innovation, cloud proliferation, and the rising complexity of digital workloads.

The below table presents the expected CAGR for the global data center CPU market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the memory interconnect industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half H1 of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 6.6%, followed by a slightly higher growth rate of 6.9% in the second half H2 of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.6% |

| H2 (2024 to 2034) | 6.9% |

| H1 (2025 to 2035) | 7.8% |

| H2 (2025 to 2035) | 8.1% |

Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to increase slightly to 5.4% in the first half and remain higher at 6.3% in the second half. In the first half H1 the market witnessed an increase of 30 BPS and in the second half H2, the market witnessed an increase of 40 BPS.

The market is segmented based on component, number of CPU cores, server form factor, and region. By component, the market includes x86 processor, ARM processors, and power processors. In terms of number of CPU cores, it is categorized into 1-core, 2-core, 3-core, 4-core, 8-core, 16-core, 32-core, 64-core, 128-core, and others (256-core, 512-core).

Based on server form factor, the market is divided into 1-socket, 2-socket, and 4-socket systems. Regionally, the market is classified into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

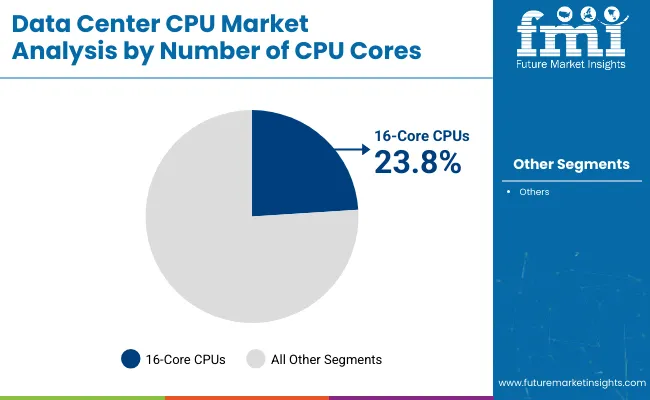

16-core CPUs are projected to lead the data center CPU market by number of cores, capturing a commanding 28.3% market share in 2025. These processors are widely adopted due to their optimal balance between computational performance, power efficiency, and affordability.

| Number of CPU Cores Segment | Market Share (2025) |

|---|---|

| 16-Core CPUs | 28.3% |

Enterprises increasingly rely on 16-core CPUs for virtualization, AI training, large-scale data processing, and cloud workloads, where simultaneous multi-threading and high core density significantly improve operational throughput. Data centers prioritize 16-core CPUs as they provide a scalable solution capable of handling modern, resource-intensive applications like deep learning inference, genome modeling, and high-frequency trading.

These processors efficiently manage parallel tasks and reduce latency in critical workloads, making them a top choice among public cloud providers and hyperscalers.

Leading manufacturers such as AMD (EPYC series) and Intel (Xeon Scalable processors) are expanding their 16-core portfolios with innovations like 7nm and 10nm lithography, integrated accelerators, and improved power-per-watt ratios.

In 2024, the USA Department of Energy committed USD 1.2 billion toward next-gen computing infrastructure, further fueling demand for mid-to-high core CPUs in national research labs and government data centers. As the push for high-performance, energy-efficient computing grows, 16-core CPUs will maintain their stronghold in the data center landscape.

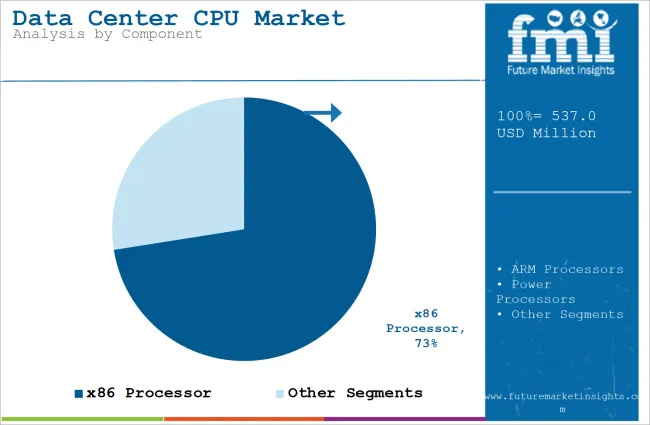

x86 processors are projected to dominate the data center CPU market by component, capturing a commanding 72.5% market share in 2025. These processors have built a robust legacy in enterprise computing due to their compatibility with an extensive software ecosystem and strong support for complex, multi-threaded workloads.

| Component Segment | Market Share (2025) |

|---|---|

| x86 Processor | 72.5% |

Companies such as Intel and AMD have led innovations in x86 chip design, offering CPUs with higher core counts, faster clock speeds, and improved instruction-per-cycle performance, optimized for artificial intelligence, big data, and cloud-native applications.

The x86 architecture remains the industry standard for hyperscale cloud platforms, with top providers like Amazon Web Services and Microsoft Azure integrating high-performance x86 CPUs in their core infrastructure. The widespread availability of development tools, mature compilers, and operating system compatibility makes x86 processors the backbone of most business-critical operations across the globe.

As data centers scale to meet growing demand for real-time analytics, machine learning, and edge computing, x86 CPUs continue to offer a balance between cost, performance, and ecosystem stability. In addition, advancements in energy efficiency and integrated security features further reinforce the dominance of x86 architecture in global data centers, especially in private, hybrid, and multi-cloud environments.

The 2-socket server form factor is projected to grow at the fastest CAGR of 6.7% from 2025 to 2035, becoming the preferred configuration across modern data centers. These systems offer a powerful balance of processing capability and scalability, allowing organizations to optimize workloads without the higher cost or energy burden of 4-socket or larger configurations.

They are increasingly favored in enterprise IT environments, cloud computing platforms, and academic research institutions that demand high computational density and parallel processing.

2-socket servers provide greater flexibility for deploying CPUs with high core counts, advanced memory interleaving, and GPU integration, making them ideal for data-heavy applications like deep learning, virtualization, and large-scale simulations. Vendors such as HPE, Dell Technologies, Lenovo, and Supermicro are rolling out energy-efficient and modular 2-socket solutions tailored to hyperscale and edge deployments.

In 2023, the National Science Foundation’s USD 800 million grant for advanced computing significantly boosted interest in scalable server technologies, including dual-socket configurations. Enhanced manageability, cost-efficiency, and compatibility with advanced workload orchestration tools continue to support their demand. As data center operators look for sustainable performance upgrades, 2-socket systems remain central to next-gen infrastructure expansion strategies.

| Server Form Factor Segment | AGR (2025 to 2035) |

|---|---|

| 2-Socket Servers | 6.7% |

Rising demand for cloud services drives the adoption of x86 processors for their compatibility and performance

The x86 processors type is well-known for high compatibility and performance are integral to infrastructure of modern cloud computing platforms. According to USA. government initiative by Federal Data Center Optimization Initiative (FDCCI) has propel the need for advanced x86 processors. This will help in improving efficiency and reduce operational costs across federal data centers propelling the demand for processors that will offer both high performance and cost-effectiveness. In 2024, Intel's launched Xeon Scalable processors and it is designed for cloud and data center applications to help in enhancing cloud capabilities with cutting-edge x86 technology.

The rise of edge computing fuels the popularity of ARM processors for lightweight, decentralized data processing

ARM processors - renowned for energy efficiency and compact design - are particularly appropriate for edge computing environments in which processing power is distributed closer to data sources. In 2024, the USA Department of Energy granted USD 50 million to the project based around research of cutting-edge edge-computing technologies. ARM Holdings also collaborated with AWS to integrate ARM-based processors in edge services that quickly accelerate the adoption. It's a notable growing influence, with ARM now on 20% of the edge computing CPU market.

Growing demand for scalable and flexible computing solutions opens new opportunities for Power processors in enterprise data centers

Power processors recognized for robust performance and efficient management of complex workloads due to rising demand for extensive data processing and scalability. According to USA Department of Defense allocated USD 1.2 billion for invest in advanced computing infrastructure for their initiative Defense Modernization Program. This initiative highlights the growing need for computing solutions. In 2025, IBM released Power10 processors and it showcase the advanced capabilities and focused on improving cloud and enterprise data center performance. Power processors accounts approximately 15% in high-performance computing market.

Integration challenges with existing infrastructure hinder the adoption of new CPU technologies

The data centers are increasingly adopting new CPU technologies to enhance performance and scalability they encounter many difficulties for integrating advanced processors with their legacy systems. This challenge will arise due to new CPU technologies requires specific hardware, software or configuration changes that are not compatible with older infrastructure. The advanced processors with higher core counts or different architectures necessitate upgrades to other system components include memory or storage solutions for achieving optimal performance. This will lead to increased costs and operational complexities as data centers navigate the compatibility issues and potential disruptions with integrating new technologies.

Tier 1 vendors dominating the market, Vendors such as Intel Corporation, NVIDIA and AMD are global leaders with extensive manufacturing capabilities, significant R&D investment, and broad market penetration. Tier 1 vendor CPUs are widely adopted across data centers due to established reputations and strong customer relationships.

Tier 2 vendors include Marvel Technology Group, IBM and Ampere Computing. These vendors are typically regional or niche players with competitive offerings but lack the extensive global reach of Tier 1 vendors. Tier 2 vendors mainly focus on specific markets or segments providing specialized or cost-effective solutions.

Tier 3 Vendors are small vendors cater to specific, localized markets and offer highly specialized products. Their influence is limited and it includes Broadcom, Inspur and others typically operate in highly competitive or emerging markets where they leverage unique capabilities or lower costs to gain a foothold.

The section highlights the CAGRs of countries experiencing growth in the Data Center CPU market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and Germany are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 7.4% |

| China | 8.9% |

| Germany | 4.1% |

| South Korea | 7.0% |

| United States | 6.5% |

The Chinese government goal is to become a world leader in AI by 2030 through various strategic initiatives and plans. The China government allocated USD 30 billion for AI research and development. China is also focused on construction AI data centers across the country. The demand for data center CPUs is estimated to grow 25% annually over the next five years. This is fuel by the need to support complex AI algorithms and machine learning models require powerful processing capabilities. The expansion of AI applications in various sectors such as finance, healthcare and autonomous vehicles will accelerate the demand for cutting-edge CPU technologies in China’s data centers. China is anticipated to see substantial growth at a CAGR 8.9% from 2025-2035 in the Data Center CPU market.

The strong focus on investment and digital infrastructure the Indian government initiative such as Digital India initiative goal is to create a digitally empowered society and knowledge economy. In 2022, the government of India allocated USD 6 billion helps to enhance digital infrastructure development. The growing demand for web hosting services in India with an estimated growth of 20% in the number of websites hosted. This growth is anticipated to propel by 30% annually due to increase in demand for data center CPUs over the next five years.

Major tech cities such as Bengaluru, Hyderabad and Mumbai are experiencing a surge in data center construction supported by government incentives and streamlined regulations. India's Data Center CPU market is anticipated to expand from USD 543.0 Million in 2024 to USD 1,217.3 Million by 2035 poised at a CAGR 7.4% during this period.

The USA government recognized the strategic importance of data centers and initiated various programs to boost this sector. According to National Science Foundation allocated USD 1 billion for advancing computing infrastructure includes significant funding for data center technologies. This federal support is expected to ensure USA vendors remain leading giants in cloud computing and big data analytics. The leading cloud providers spend more than USD 20 billion on expanding and optimizing their data centers with a significant portion toward acquiring cutting-edge CPUs that can handle the increasing demand for processing power. These investments are very crucial as the USA continues to dominate the global cloud market which is anticipated to grow 15% annually over the next five years. USA is anticipated to see substantial growth in the Data Center CPU market significantly holds dominant share of 68.6% in 2025.

The data center CPU market is witnessing competition as the players in this market are focused on innovation and expansion of product offerings to meet the demand of AI, cloud computing and high-performance computing. Vendors are focused on launching processors with some special features to enhance performance and energy efficiency which will cater to diverse workloads.

In terms of type, the segment is divided into da x86 Processor, ARM Processors and Power Processors.

In terms of no of CPU core, the segment is segregated into 1-Core, 2-Core, 3-Core, 4-Core, 8-Core, 16-Core, 32-Core, 64-Core, 128-Core and Others (256-Core, 512-Core).

In terms of server form factor, the segment is segregated into 1-socket, 2-socket and 4-socket.

In terms of application, the segment is segregated into Web Hosting, Cloud Computing, High Performance Computing, Artificial Intelligence, Machine Learning and Big Data Analytics.

A regional analysis has been carried out in key countries of North America, Latin America, Asia Pacific, Middle East and Africa (MEA) and Europe.

The global data center CPU market is valued at USD 14.15 billion in 2025 and is projected to reach USD 30 billion by 2035, growing at a CAGR of 7.8%.

The 16-core CPU segment is expected to dominate by number of cores, accounting for 28.3% of the market share in 2025 due to its optimal performance-to-efficiency ratio across cloud and enterprise workloads.

x86 processors hold the leading position with a 72.5% market share in 2025, driven by their compatibility, high-performance capabilities, and widespread adoption in hyperscale data centers.

2-socket servers are projected to register the fastest CAGR of 6.7% from 2025 to 2035, favored for their scalability, cost-efficiency, and adaptability in AI, HPC, and virtualization environments.

Rising demand for cloud computing, AI and big data processing, edge infrastructure, and government investments in digital infrastructure are fueling rapid adoption of high-performance CPUs globally.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Leaders & Share in the Data Center CPU Industry

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA