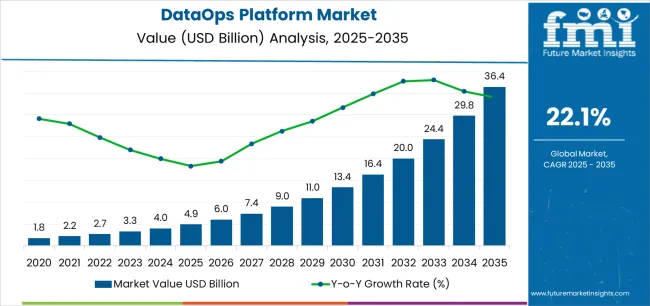

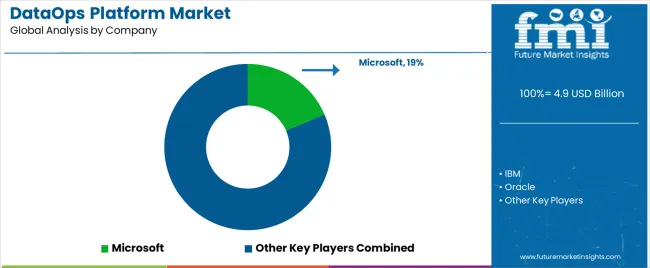

The DataOps Platform Market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 36.4 billion by 2035, registering a compound annual growth rate (CAGR) of 22.1% over the forecast period.

The DataOps platform market is witnessing accelerated growth, fueled by the need for agile data management and real-time analytics in modern enterprises. As data volumes expand across hybrid and multi-cloud environments, organizations are investing in platforms that streamline collaboration between data engineers, analysts, and IT teams. The market is being shaped by the increasing emphasis on automation, continuous integration, and deployment within data pipelines.

Enhanced governance, compliance, and data quality control are further strengthening adoption. Cloud-native technologies and open-source frameworks have improved platform scalability and flexibility.

Businesses in finance, retail, and healthcare are leveraging DataOps for faster insights and improved decision-making. With ongoing digital transformation initiatives and AI-driven data utilization, the DataOps platform market is positioned for sustained expansion in the coming years.

| Metric | Value |

|---|---|

| DataOps Platform Market Estimated Value in (2025 E) | USD 4.9 billion |

| DataOps Platform Market Forecast Value in (2035 F) | USD 36.4 billion |

| Forecast CAGR (2025 to 2035) | 22.1% |

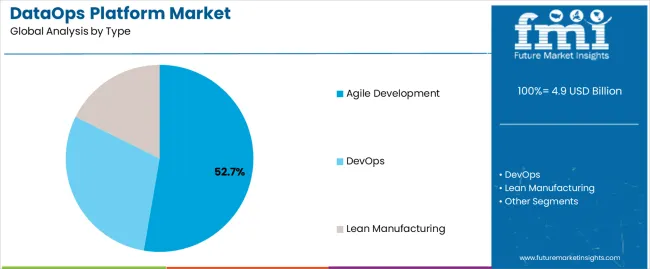

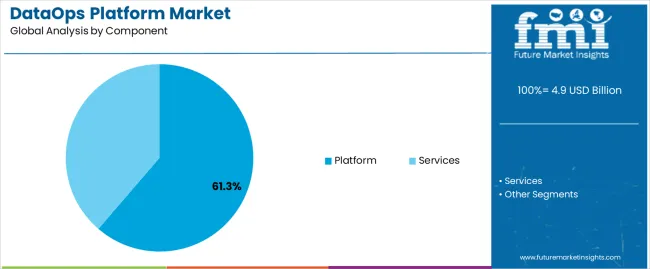

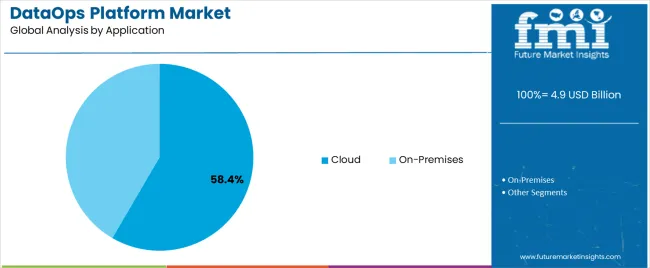

The market is segmented by Type, Component, and Application and region. By Type, the market is divided into Agile Development, DevOps, and Lean Manufacturing. In terms of Component, the market is classified into Platform and Services. Based on Application, the market is segmented into Cloud and On-Premises. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The agile development segment leads the type category with approximately 52.7% share, driven by the increasing demand for iterative, flexible, and collaborative data management approaches. Enterprises are adopting agile methodologies to accelerate deployment cycles and reduce time-to-insight.

The segment benefits from integration with DevOps practices, enabling seamless workflow automation and continuous data delivery. Adoption has been further enhanced by the need for real-time decision-making and adaptive data architecture.

As organizations prioritize operational agility and responsiveness, the agile development segment is expected to remain dominant in the DataOps ecosystem.

The platform segment dominates the component category, representing approximately 61.3% share. This leadership reflects the growing need for unified, end-to-end solutions that manage data ingestion, processing, monitoring, and delivery.

Platform-based models enable data teams to standardize operations, improve collaboration, and ensure data quality across pipelines. Cloud integration and AI-driven automation enhance scalability and performance.

As organizations continue to invest in comprehensive DataOps solutions rather than isolated tools, the platform segment is anticipated to sustain its leading position.

The cloud segment holds approximately 58.4% share of the application category, reflecting the ongoing migration of enterprise data operations to cloud environments. Cloud-based DataOps enables scalability, real-time analytics, and remote accessibility while reducing infrastructure costs.

It supports seamless integration with multi-cloud ecosystems and modern analytics frameworks. The segment benefits from the growing adoption of SaaS-based models and hybrid cloud strategies among large enterprises.

With continued emphasis on digital transformation and agile data processing, the cloud segment is expected to maintain its leadership through the forecast period.

The global DataOps platform market exhibited a CAGR of about 27.8% in the historical period. It is estimated to showcase a 23.3% CAGR in the forecast period. The market attained a valuation of USD 4.9 billion in 2025.

| Historical CAGR (2020 to 2025) | 27.8% |

|---|---|

| Historical Valuation (2025) | USD 4.9 billion |

Companies often relied on conventional data management solutions in the past. These mainly revolved around siloed approaches to data analysis, processing, and storage. These solutions lacked scalability, were time-consuming, and were manual.

The need for a more collaborative and superior software solution deployment & development process emerged in the early 2000s. This gave rise to the DevOps movement for the continuous integration of data and automation.

Data quality management in DataOps began to gain momentum in the mid-2010s when companies started following the principles of DevOps. The new platform helped with the application of automated, collaborative, and agile practices to data storage & management processes. This further enabled companies to prevent issues such as low-quality data, slow time-to-insights, and data silos.

The table provides information about significant variations in growth rates and dynamic trends in the DataOps platform market. Readers can gain insights into changing consumer tastes and evolving market dynamics throughout an array of different periods. The table offers an explanation of growth potential, scrutinizing the role that actual numbers and predictions have in determining the future path of the market.

| Details | CAGR |

|---|---|

| H1 (2025 to 2035) | 22.8% |

| H2 (2025 to 2035) | 23.1% |

| H1 (2025 to 2035) | 23.7% |

| H2 (2025 to 2035) | 23.2% |

The section below highlights the CAGRs of the leading countries in the DataOps platform market. The three main countries pushing DataOps platform demand include Japan, the United Kingdom, and China.

According to the analysis, Japan is set to lead the DataOps platform market by showcasing a CAGR of 24.4% in the forecast period. The country is anticipated to be followed by the United Kingdom and China, with CAGRs of 24.2% and 23.9%, respectively.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 23.5% |

| United Kingdom | 24.2% |

| China | 23.9% |

| Japan | 24.4% |

| South Korea | 23.8% |

Japan’s DataOps platform market is expected to rise at a CAGR of 24.4% from 2025 to 2035. The country is projected to reach a valuation of around USD 36.4 billion by 2035. Factors pushing growth in Japan are:

The United Kingdom is anticipated to attain a value of about USD 1.3 billion by 2035. The country is likely to expand at a CAGR of 24.2% in the assessment period. Key factors driving the growth of the DataOps platform market in the country are:

China’s DataOps platform market is expected to showcase a CAGR of 23.9% through 2035. A value of USD 5.1 billion is anticipated for China by 2035. Demand for DataOps platforms in the country is projected to be augmented by:

The below section shows the global trends in the DataOps platform industry in terms of type and components. The agile development segment is expected to lead the DataOps platform market based on type.

It is set to showcase a CAGR of around 23.1% from 2025 to 2035. Based on the component, the platform segment is anticipated to exhibit a dominant CAGR of 22.8% through 2035.

| Segment | Value CAGR (2025 to 2035) |

|---|---|

| Platform (Component) | 22.8% |

| Agile Development (Type) | 23.1% |

In terms of components, the platform segment is projected to showcase a CAGR of around 22.8% from 2025 to 2035. The segment is expected to generate a significant DataOps platform market share due to the following factors:

Based on type, the agile development category is anticipated to rise at a CAGR of 23.1% in the forecast period in the DataOps platform industry. This growth is attributed to the following factors:

Leading companies in the DataOps platform market are focusing on the constant innovation of their in-house platforms to provide new features, including high data volume management, automated workflows, real-time monitoring, machine learning capabilities, and AI tools.

They are also engaging in collaborations with consulting firms and technology providers to provide customized solutions & help clients use complementary technologies. At the same time, they are focusing on offering smooth troubleshooting, customization, and onboarding processes to clients by investing in customer support.

For instance

The global dataops platform market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the dataops platform market is projected to reach USD 36.4 billion by 2035.

The dataops platform market is expected to grow at a 22.1% CAGR between 2025 and 2035.

The key product types in dataops platform market are agile development, devops and lean manufacturing.

In terms of component, platform segment to command 61.3% share in the dataops platform market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Platform Architecture Market Size and Share Forecast Outlook 2025 to 2035

Platform Boots Market Trends - Growth & Industry Outlook to 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Platform Trolley Market Growth – Trends & Forecast 2025 to 2035

AI Platform Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Trends – Growth & Forecast through 2034

AIOps Platform Market Forecast and Outlook 2025 to 2035

Sales Platforms Software Market - Growth & Forecast 2034

Cross-Platform & Mobile Advertising Market Report – Growth 2018-2028

RevOps Platform Market Insights – Growth & Forecast 2023-2033

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Trusted Platform Module (TPM) Market

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Coaching Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agritech Platform Market Size and Share Forecast Outlook 2025 to 2035

Assessing Coaching Platform Market Share & Industry Trends

Vertical Platform Lift Market

AI Trading Platform Market Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA