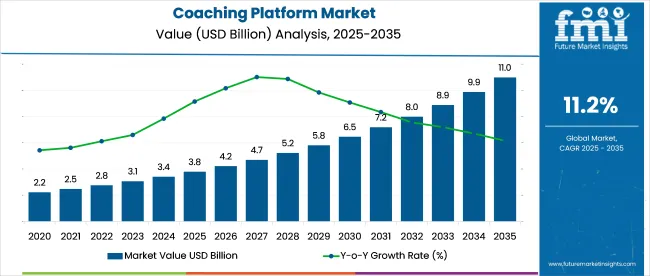

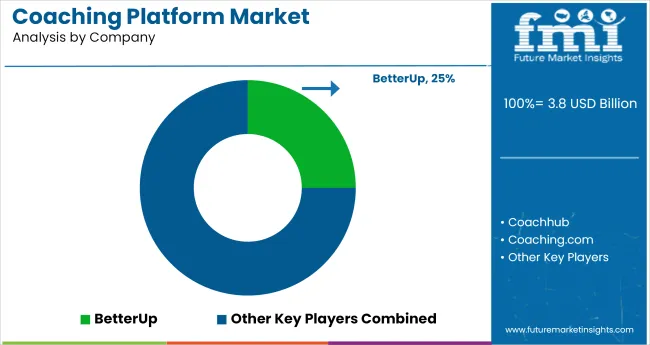

The coaching platform market is valued at USD 3.8 billion in 2025 and projected to reach USD 11.1 billion by 2035, growing at a CAGR of 11.0%. Over 61% of enterprise spend is directed toward scalable platforms integrated with HRIS systems.

| Metric | Value |

|---|---|

| Industry Size (2025) | USD 3.8 billion |

| Industry Value (2035) | USD 11.1 billion |

| CAGR (2025 to 2035) | 11.2% |

Around 44% of new contracts are structured with outcome-based pricing. Average coaching spend per manager rose to USD 690 in 2025, with 68% using bundled solutions. India, Brazil, and Indonesia show the fastest growth, aided by 40-55% lower enablement costs. Over 70% of vendors now offer hybrid delivery models with embedded analytics and multilingual capabilities.

On April 7, 2025, BTS acquired Sounding Board, a Silicon Valley-based leadership coaching platform, to expand its global coaching services. Founded in 2016, Sounding Board provides 1:1 coaching, group sessions, and mentoring through a centralized digital platform. With USD 7 million in annual revenue and over USD 45 million in funding, it now becomes a full subsidiary of BTS, joining its Coaching service line.

BTS gains access to Sounding Board’s network of 700 credentialed coaches and will fully adopt its technology to streamline program delivery. This acquisition follows BTS’s recent deals in Thailand and with Netmind, reflecting its broader strategic push in talent development.

The coaching platform market holds varying proportions across its parent industries. Within the learning management systems market, it accounts for around 4%. In the broader EdTech sector, coaching platforms contribute approximately 1%, with the focus still dominated by content delivery and virtual classrooms.

In the corporate training and development market, coaching platforms hold a larger share, at 7%, driven by demand for personalized executive and leadership development. Within the human capital management software market, its share stands near 2%, as coaching tools integrate with performance and talent modules. In the wellness and mental health tech market, personalized coaching platforms comprise around 3%, reflecting growing use in workplace resilience and well-being programs.

Per capita spending on coaching platforms is steadily rising as individuals and organizations seek accessible, flexible, and personalized development tools. These platforms support a range of goals including professional growth, leadership development, mental wellness, and performance improvement. The increasing use of mobile apps, virtual sessions, and AI-driven customization is encouraging users to allocate more resources toward digital coaching solutions.

Governments around the world are supporting coaching platforms as tools for national development in skills, employment, education, and mental wellness. This support comes in the form of funding, digital infrastructure, policy frameworks, and integration with public services.

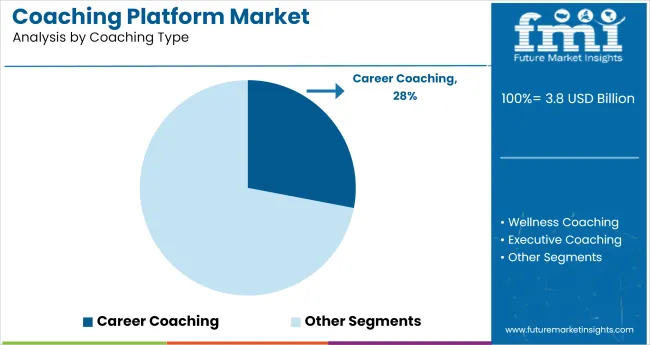

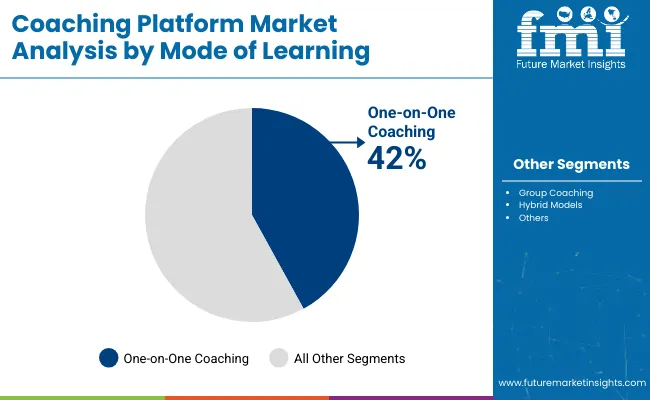

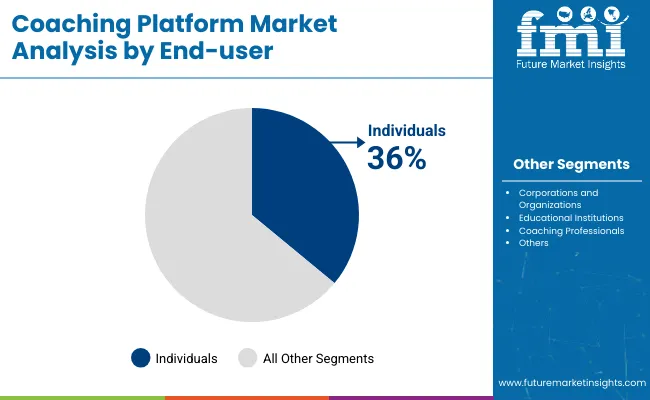

The coaching platforms industry is segmented by coaching type into career, personal development, and leadership coaching. The mode of learning includes one-on-one, group, and hybrid models. End-users are divided into individuals, organizations, and educational institutions. Technology-wise, the industry is segmented into mobile apps, web-based platforms, and AI solutions. Regional adoption spans North America, Latin America, Europe, Asia Pacific, and MEA.

The career coaching segment is expected to hold 28% of the industry share by 2025. The rising demand for career coaching is driven by individuals seeking to advance their careers, make transitions, or enhance specific skills.

Sectors such as technology, finance, and healthcare have seen a notable increase in the need for professional development. Coaching platforms are adopting AI-driven tools to provide personalized career guidance. Services such as those offered by platforms like LinkedIn Learning and Coach.me have gained popularity, as personalized career coaching helps individuals improve their skills and navigate professional challenges.

One-on-one coaching is expected to account for 42% of the industry share by 2025, as this approach allows for a highly personalized experience. It has been preferred for providing direct access to coaches and focused development. Demand has been driven by individuals seeking customized coaching in career growth, leadership, and personal development.

Coaching platforms that offer one-on-one coaching sessions have gained significant growth. Better Up and Coach Accountable are examples of platforms that offer individualized coaching solutions, helping users receive guidance tailored to their specific needs.

Mobile apps are projected to capture 58% of share by 2025. The widespread adoption of smartphones has driven demand for mobile-based coaching platforms, offering users convenient, on-the-go access to coaching services.

Mobile platforms are integrating AI and personalized learning systems, offering users tailored coaching sessions with features like real-time messaging, video calls, and progress tracking. Coach.me and MyCoach have provided accessible and personalized coaching services, making it easier for users to receive feedback and improve at their own pace.

The individual segment is forecast to hold 36% of the share by 2025. The demand for coaching has been driven by the rise in personal growth trends and self-improvement. Individuals are increasingly seeking coaching services for career development, personal growth, and leadership skills.

Coaching platforms have adapted by offering scalable, flexible coaching options such as mobile apps, allowing users to access coaching services on the go. Platforms such as Master Class and Skill share cater to this trend by offering personal development courses, helping users achieve their goals more effectively.

The industry is being influenced by a combination of technological advancements, growing demand for personalized learning experiences, and evolving workplace needs. As businesses invest in employee development, there is increasing adoption of digital platforms offering scalable and efficient coaching solutions.

Increasing Demand for Personalized Coaching Solutions

Demand for coaching platforms is rising as businesses recognize the importance of tailored development solutions for their employees. Companies are increasingly adopting AI-driven coaching tools that offer personalized learning experiences, allowing individuals to receive feedback and guidance based on their unique development needs. The demand is particularly strong in industries like technology, finance, and healthcare, where skills are rapidly evolving.

Challenges from Client Acquisition

The proliferation of coaching platforms has created a crowded industry, making it difficult for new entrants to differentiate themselves. The need to build credibility is a challenge for many platforms, as consumers seek proven effectiveness before committing to a coaching program. Attracting and retaining clients remains a significant challenge in this competitive landscape, requiring effective marketing strategies and value propositions.

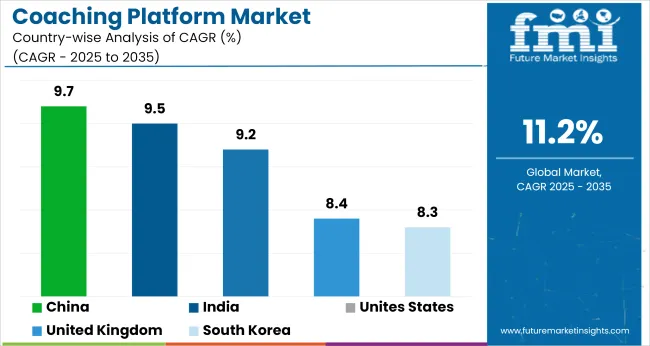

Global coaching platform demand is projected to expand at 11.2% CAGR from 2025 to 2035. China leads the tracked countries at 9.7%, driven by scaled adoption of personal and executive coaching formats through education and HR-linked platforms.

India follows at 9.5%, with high uptake across regional markets supported by mobile-first engagement models and localized language coaching modules. Both BRICS nations surpass the United States, which posts a 9.2% CAGR fueled by enterprise-level upskilling and performance-based coaching subscriptions.

The United Kingdom and South Korea register 8.4% and 8.3% respectively, reflecting steadier adoption cycles and limited expansion in non-corporate segments. In South Korea, structured learning apps remain dominant but transitions into premium coaching packages have been slower. The United Kingdom’s performance is held back by constrained institutional budgets and cautious investment in personalized coaching formats.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Unites States | 9.2% |

| United Kingdom | 8.4% |

| India | 9.5% |

| South Korea | 8.3% |

| China | 9.7% |

Demand for coaching platforms in the USA is growing at a 9.2% CAGR through 2035, outpacing global growth trends. With a highly competitive job sector and a strong focus on professional development, the demand for personalized coaching is especially pronounced. Corporate investments in leadership training and skill development continue to drive this demand.

The rise in remote work and the shift to digital platforms have further accelerated adoption, particularly in tech, healthcare, and finance sectors. As businesses emphasize skill enhancement, coaching platforms are becoming essential for improving employee productivity and leadership capabilities.

Adoption of coaching platforms in the UK is expanding at an 8.4% CAGR through 2035. Driven by the focus on employee skill enhancement and leadership development, the industry sees strong demand for personalized coaching solutions. The rising popularity of hybrid work models has contributed to the growth of online coaching platforms.

Companies are increasingly investing in coaching to enhance employee productivity and professional development, particularly in high-demand industries like finance and technology. As organizations recognize the importance of leadership coaching and skill development, digital coaching platforms continue to gain significant traction in the industry.

Demand for coaching platforms in India is projected to grow at a 9.5% CAGR through 2035. The demand for coaching services is driven by a rapidly expanding workforce and a rising focus on career development. As India continues to experience economic growth, there is an increasing need for skill enhancement, particularly in technology, healthcare, and finance sectors.

The demand for personalized coaching services is amplified by the digital transformation occurring across industries, with businesses seeking more flexible, scalable solutions. Digital coaching platforms are increasingly popular, as they offer accessible and affordable options for professionals to develop their leadership skills and career competencies.

In China, the coaching platforms market in anticipated to expand at a CAGR of 9.7% from 2025 to 2035. China’s rapid economic development and focus on workforce skill enhancement are driving the demand for coaching services. The demand is especially high in technology, manufacturing, and finance sectors, where leadership and career development are critical.

The increasing use of mobile apps and AI-driven coaching tools has also contributed to the industry growth. The Chinese government’s emphasis on workforce training has further supported the expansion of coaching platforms. As the economy continues to grow, more businesses are investing in coaching solutions for their employees.

In South Korea, the sales of coaching platform sare expected to grow at an 8.3% CAGR from 2025 to 2035. The demand for coaching platforms is fueled by the rise in awareness of personal growth, especially in leadership and career development. South Korea’s robust technology sector drives the adoption of digital coaching solutions.

There is a shift towards integrating AI and virtual tools to provide scalable and personalized coaching experiences across industries such as technology and finance. As companies and individuals focus on professional growth, coaching platforms are increasingly seen as essential tools for skill development and career progression.

The market is led by Better Up, Coachhub, and Coaching.com, who scale through enterprise-grade features, coach networks, and integration with HR systems. Torch, Bravely, and Sounding Board target mid-level leadership and DEI use cases, tailoring coaching journeys for North America and Europe.

Emerging players like EZRA, Simply. Coach, and Coach Ready use mobile-first design and API integrations to serve SMEs and global teams. As corporate wellbeing budgets grow, demand for flexible, embedded coaching models is increasing.

Competition is shaped by fragmented coach supply and low entry barriers, but scaling requires robust analytics and workflow integration. Players are now focusing on three levers embedded coaching within enterprise tools, hybrid learning formats, and content-driven behavioral outcomes.

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 3.8 billion |

| Projected Industry Size (2035) | USD 11.1 billion |

| CAGR (2025 to 2035) | 11.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million active users for volume |

| Coaching Types Analyzed (Segment 1) | Career Coaching, Wellness Coaching, Executive Coaching, Life Coaching, Academic Coaching |

| Modes of Learning Analyzed (Segment 2) | One-on-One Coaching, Group Coaching, Hybrid Models |

| Technologies Analyzed (Segment 3) | Mobile Apps, Web-Based Platforms |

| End Users Analyzed (Segment 4) | Individuals, Corporations and Organizations, Educational Institutions, Coaching Professionals |

| Regions Covered | North America, Latin America, East Asia, South Asia, Europe, Middle East & Africa, Oceania |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Better Up, Coachhub, Coaching.com, Bravely, Sounding Board Inc., EZRA, Simply. Coach, Coach Ready, Skyline G, Torch Leadership Labs, Task Human, Satori, Fingerprint for success, Nudge Coach, Profi, Landit, AceUp, Co aching Loft, Coach Accountable |

| Additional Attributes | Dollar sales, share by coaching type and end user, integration of AI-driven matching, growing enterprise wellness investments, mobile platform penetration across coaching verticals, regional user adoption differences |

The segmentation is into career coaching, wellness coaching, executive coaching, life coaching, and academic coaching.

The segmentation is into one-on-one coaching, group coaching, and hybrid models.

The segmentation is into mobile apps and web-based platforms.

The segmentation is into individuals, corporations and organizations, educational institutions, and coaching professionals.

The report covers North America, Latin America, East Asia, South Asia, Europe, the Middle East and Africa, and Oceania.

The industry is projected to reach USD 3.8 billion in 2025.

The industry is expected to grow at a CAGR of 11.2% from 2025 to 2035.

Career coaching is expected to capture approximately 28% of the industry share in 2025.

The Asia Pacific region, particularly China and India, is projected to show the highest growth through 2035.

The industry is projected to reach USD 11.1 billion by 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assessing Coaching Platform Market Share & Industry Trends

Sales Coaching Software Market Size and Share Forecast Outlook 2025 to 2035

Health Coaching Apps Market Growth – Trends & Forecast 2025 to 2035

Executive Coaching Certification Market Size and Share Forecast Outlook 2025 to 2035

Doula & Birth Coaching Services Market Trends – Growth to 2035

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Platform Architecture Market Size and Share Forecast Outlook 2025 to 2035

Platform Boots Market Trends - Growth & Industry Outlook to 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Platform Trolley Market Growth – Trends & Forecast 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

Sales Platforms Software Market Size and Share Forecast Outlook 2025 to 2035

AIOps Platform Market Forecast and Outlook 2025 to 2035

Cross-Platform & Mobile Advertising Market Report – Growth 2018-2028

RevOps Platform Market Insights – Growth & Forecast 2023-2033

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Trusted Platform Module (TPM) Market

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA