The AI Platform Market is witnessing significant growth fueled by the accelerating adoption of artificial intelligence and machine learning across industries. The market outlook remains optimistic as enterprises increasingly invest in automation, predictive analytics, and decision intelligence to enhance operational efficiency.

Rapid digital transformation initiatives, particularly in the IT, telecom, healthcare, and manufacturing sectors, are driving the deployment of AI platforms for real-time data processing and advanced analytics. The integration of AI with edge computing, cloud infrastructure, and Internet of Things technologies is expanding the functional scope of AI platforms, enabling faster and more accurate insights.

Furthermore, the surge in AI-driven enterprise applications, growing demand for model explainability, and continuous improvements in natural language processing capabilities are paving the way for broader adoption As businesses move toward intelligent automation and data-centric operations, the AI Platform Market is expected to experience sustained expansion with a strong focus on scalability, interoperability, and responsible AI deployment.

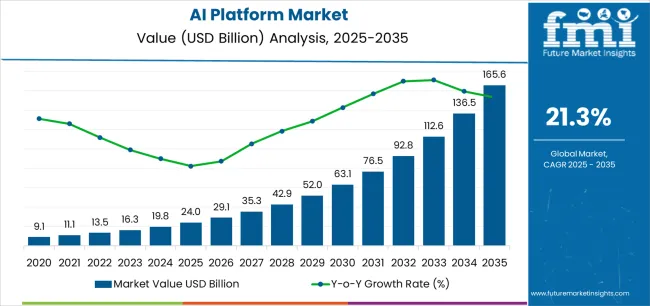

| Metric | Value |

|---|---|

| AI Platform Market Estimated Value in (2025 E) | USD 24.0 billion |

| AI Platform Market Forecast Value in (2035 F) | USD 165.6 billion |

| Forecast CAGR (2025 to 2035) | 21.3% |

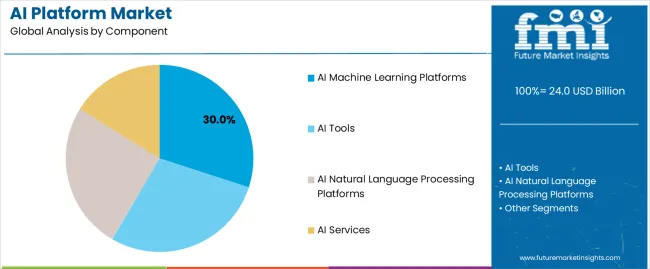

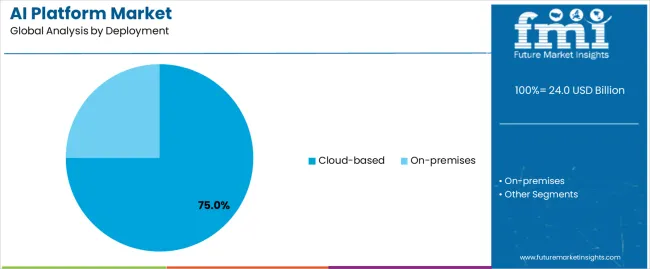

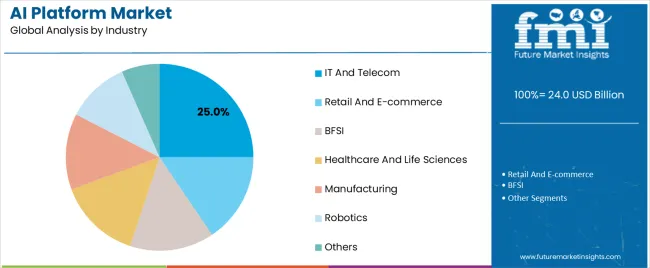

The market is segmented by Component, Deployment, and Industry and region. By Component, the market is divided into AI Machine Learning Platforms, AI Tools, AI Natural Language Processing Platforms, and AI Services. In terms of Deployment, the market is classified into Cloud-based and On-premises. Based on Industry, the market is segmented into IT And Telecom, Retail And E-commerce, BFSI, Healthcare And Life Sciences, Manufacturing, Robotics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The AI Machine Learning Platforms segment is projected to hold 30.0% of the AI Platform Market revenue share in 2025, establishing it as a leading component. This dominance is being driven by the growing integration of machine learning into enterprise applications, enabling predictive analytics, automated decision-making, and pattern recognition.

The segment has benefited from the increasing use of pre-built algorithms and open-source frameworks that simplify model development and deployment. The capability to handle large and complex data sets efficiently has also enhanced the adoption of machine learning platforms across industries.

Additionally, the focus on innovation, faster model training, and real-time analytics has strengthened the segment’s position in both commercial and industrial settings The demand for machine learning platforms continues to rise as organizations seek scalable solutions that support continuous learning and optimization, ensuring that the segment remains a critical pillar in the evolution of AI ecosystems.

The cloud-based deployment segment is expected to account for 75.0% of the AI Platform Market revenue share in 2025, making it the most prominent deployment type. This growth has been driven by the increasing shift toward digital transformation and the scalability offered by cloud environments. Cloud-based AI platforms provide flexible infrastructure, reduced upfront costs, and seamless integration with existing enterprise systems, making them highly attractive to organizations of all sizes.

The ability to deploy AI models remotely and manage resources efficiently enhances operational agility and supports faster innovation. Moreover, the growing reliance on cloud-based data storage and analytics services has accelerated the adoption of AI through cloud platforms.

Enhanced security frameworks, improved data accessibility, and the integration of advanced APIs have also reinforced the position of this segment As organizations continue to migrate workloads to the cloud to optimize performance and cost efficiency, the dominance of cloud-based deployment is expected to strengthen further.

The IT and Telecom industry segment is projected to hold 25.0% of the AI Platform Market revenue share in 2025, making it a key end-use sector. The segment’s growth is being driven by the rising adoption of AI for network optimization, predictive maintenance, customer analytics, and intelligent automation. Telecom operators are leveraging AI to enhance service delivery, optimize bandwidth utilization, and manage increasing data traffic efficiently.

In the IT sector, AI platforms are being deployed to improve software development, cybersecurity, and cloud management, fostering greater operational agility. The integration of AI in telecom networks also supports faster rollout of 5G infrastructure, enabling advanced analytics and intelligent connectivity.

The emphasis on digital transformation, real-time decision-making, and automation has further propelled the adoption of AI platforms in this sector As demand for high-speed connectivity and personalized digital experiences continues to grow, the IT and Telecom industry is expected to remain one of the largest contributors to the AI Platform Market.

The below table presents the anticipated CAGR for the global AI platform market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the AI platform industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 symbolizes first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2025 to 2035, the business is expected to grow at a CAGR of 20.8%, followed by an increased growth rate of 21.6% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2025 | 20.8% (2025 to 2035) |

| H2, 2025 | 21.6% (2025 to 2035) |

| H1, 2025 | 20.4% (2025 to 2035) |

| H2, 2025 | 21.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 20.4% in the first half and remain higher at 21.9% in the second half. In the first half (H1) the market witnessed a decrease of 40 BPS while in the second half (H2), the market witnessed an increase of 30 BPS.

Integration with Ai with Edge Computing is an Escalating Trend in AI Platform Market

Real-time data management and analysis are changing as a result of edge computing's incorporation of artificial intelligence. Instead of sending data to a centralized cloud server, edge computing involves processing data closer to its source, such as on local servers or Internet of Things devices. When combined with AI, this process provides several key advantages.

Firstly, it lessens latency. AI computations can be carried out locally, saving data from having to travel great distances to a central server before processing. This leads to faster reaction times, which is important for applications that need to make decisions in real time, driving the AI platform market growth. These applications includes autonomous vehicles, industrial automation, and smart cities.

Moreover, it improves data confidentiality and security. Keeping data processing local reduces the amount of critical information transferred over networks. This reduces the risk of data breaches and safeguarding obedience with privacy regulations. This localized approach allows for more secure handling of personal and sensitive data, creating positive outlook for AI platform market.

Additionally, incorporating AI with edge computing cuts bandwidth costs. Large-scale data transfers to the cloud can be overpriced mainly for places with poor connectivity. Companies can reduce operational costs by processing data locally. This also minimizes the quantity of data that needs to be transferred over the network.

A growing number of players are launching AI-powered edge computing platforms due to the significance of AI-based edge computing. For instance, in July 2025, IT company, NTT DATA launched an AI Edge Computing solution to speed up IT/OT convergence by bringing AI processing to the edge. This fully managed platform allows real-time decisions, improved operational efficacies, and secure AI application deployment across industries.

Growing Volume of Data is necessitating the need for Sophisticated Solutions, fueling the AI Platform Market Growth

The growing volume of data is a one of the important driver for the AI platform market. As digital transformation quickens, the amount of data generated by devices, applications, and systems expands remarkably. This spike in data includes information from social media, IoT devices, enterprise systems, and other digital sources. This creates a need to process and analyze vast datasets.

AI platforms are important in managing and leveraging this data. They provide progressive tools and technologies to handle large-scale data processing, storage, and analysis. Machine learning algorithms and data analytics capabilities by AI platforms aid companies uncover valuable insights from complex and voluminous data. This drives informed decision-making and strategic planning, supporting the expansion of AI platform market.

The challenge of managing and extracting value from big data requires the use of AI. Traditional data processing methods majorly fall short in handling the scale and complication of modern data. AI platforms address this by providing accessible solutions that can analyze massive datasets competently in real-time.

This capability is important for industries such as finance, healthcare, and retail, where timely and accurate data analysis can notably influence business outcomes.

Furthermore, advancements like personalized customer experiences, predictive maintenance, and increased operational efficiency are made possible by AI platforms' large-scale data processing and analysis capabilities. The need for AI platforms that can efficiently handle and use this data is anticipated to rise as data volume increases.

Development of Industry-wise automated Platforms is Creating Ample Opportunities for AI Platform Market

The development of industry-specific AI solutions is the creation of tailored artificial intelligence platforms and tools. These are designed to address the exclusive needs and challenges of specific sectors. This AI solutions are developed with specific capabilities and features, whereas general AI solutions cater to a wide range of applications. This caters to various requirements of specific sectors such as manufacturing, BFSI, healthcare, and retail, among others.

For instance, AI solutions in the healthcare industry may emphasis on patient diagnoses, customized treatment regimens, or medical imaging analysis. These technologies use data analytics and machine learning to improve disease detection accuracy.

These aid in enhancing operational workflows in healthcare facilities and increasing patient outcomes. In July 2025, city health department, San Mateo County Health (SMCH) has partnered with Innovaccer, a healthcare AI platform, to enhance patient care services.

Innovaccer's platform will provide SMCH with a unified patient record system, combining data from various sources. These sources contains electronic health records (EHRs) and community data. This incorporation will allow medical professionals a holistic view of patient health. This will facilitate improved decision-making and population health management.

Moreover, retail-focused AI solutions could contain tailored recommendation systems, inventory management, and customer sentiment analysis. These platforms use AI to understand consumer behavior, and augment shopping experiences, & supply chains.

The key advantage of industry-specific AI solutions is their capability to provide more precise and relevant insights. They also provide automation personalized to the specific operational and regulatory conditions of each sector.

By addressing unique industry challenges, these solutions enhance productivity, improve decision-making, and drive innovation. As industries increasingly seek to use AI for competitive benefit, the demand for customized solutions that cater to their distinct needs continues to grow, fueling the expansion of the AI platform market.

Data Privacy and Security may affect AI Platform Market Growth in the Projected Timeframe

While the incorporation of AI platform is increasing worldwide, it is also becoming exposed to cyberattacks. As AI platforms collect and process huge amounts of complex data, safeguarding strong data protection methods is important.

Growing data breaches and cyber incidents have amplified concerns about personal data misuse, driving demand for data privacy software. Lack of skilled professionals and security issues like data privacy and unreliability may hamper AI platform market growth.

Stringent data protection regulations like GDPR and CCPA have improved compliance necessities for companies handling personal data. Failure to follow to these laws can result in heavy fines. Incorporating AI and ML into data confidentiality solutions can help pinpoint risks & protect data more efficiently. However, safeguarding the responsible development and deployment of AI is critical to maintain user trust.

To lessen these challenges, AI platform providers should prioritize data privacy and security in their solution portfolios. This includes incorporating strong data governance frameworks, utilizing encryption & access controls, and allowing users with transparency & control over their data. By addressing these concerns actively, the AI platform market can continue its growth trajectory while maintaining the trust of businesses and consumers alike.

The global AI platform market registered a CAGR of 20.1% during the historic period between 2020 and 2025. The growth of AI platform industry was progressive as it reached a value of USD 24 billion in 2025 from USD 9.1 billion in 2020.

The AI platform market grew from 2020 to 2025. Companies started to recognize how AI could enhance their data analysis, customer service, and operational effectiveness. Because of this, the year witnessed a big jump in growth. To gain an edge over their rivals early adopters in sectors like banking and retail began to put AI technologies into action.

The COVID-19 pandemic in 2025 played a big role in growing the market. Companies worldwide stepped up their efforts to go digital. AI technologies improved supply chain management, customer service automation, and remote work solutions. The outbreak showed the need for flexible and easy-to-access tech, which LED to more demand for AI solutions.

Progress in machine learning and natural language processing, along with the growth of cloud-based AI services also drove market demand. More and more businesses in different fields, like manufacturing and healthcare, are using AI to boost productivity, streamline workflows, and make smarter choices.

After the pandemic, AI technology progress more money for AI research, and wider use in different fields helped the increase. Making better AI for specific industries and adding AI to other digital changes played a big part in this strong growth.

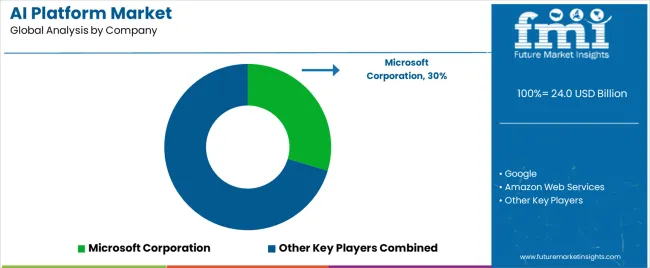

The top tier includes leading companies like Microsoft Corporation, Google, Amazon Web Services (AWS), IBM Corporation, Salesforce, Oracle Corporation, and SAP SE. These firms stand out in AI innovation providing full platforms that combine cutting-edge AI and machine learning features with their wide-ranging cloud and business solutions.

Microsoft, Google, and AWS stand out for their wide AI offerings, including machine learning tools and AI services built into their cloud systems. IBM is known for its AI products such as IBM Watson, which finds use across many fields. Salesforce uses its Einstein AI to boost customer relationship management, while Oracle and SAP build AI functions into their business software to make business processes work better.

Tier 2 includes businesses such as Infosys Limited, Avenga, and Infogain Corporation. These firms excel at AI and data analytics, and they specialize in building tailored AI tools and offering guidance to boost business operations. Infosys Limited has developed the Infosys Nia platform, which uses AI to provide insights and automate processes for many different industries.

Avenga and Infogain Corporation also offer specialized AI services and solutions meeting the specific needs of their clients and the requirements of various industries.

Tier 3 includes up-and-coming players like Vital AI, LLC, Receptiviti Inc., Kasisto, Premonition, and Rainbird Decision Intelligence. These companies stand out for their specific AI uses and fresh ideas. Vital AI develops cutting-edge AI tools for healthcare and life sciences, while Receptiviti Inc. offers AI-based insights on how people behave and communicate.

Kasisto creates AI answers for online banking, and Premonition specializes in AI-powered legal data analysis. Rainbird Decision Intelligence provides AI solutions to help with decision-making and automation catering to specific markets with custom-made technology.

The section below covers the industry analysis for the AI platform market for different countries. Market demand analysis on key countries in several regions of the globe, including the USA, Germany, China, India, Brazil, and UK is provided. The United States is anticipated to remain at the forefront in North America, with a value share of 76.32% through 2035. In East Asia, South Korea is projected to witness a CAGR of 10.8% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 19.1% |

| Germany | 18.5% |

| China | 22.1% |

| India | 21.6% |

| UK | 17.4% |

North America, spearheaded by the USA which currently holds around 80.2% share of the North America AI platform industry in 2025. USA AI platform market is anticipated to grow at a CAGR of 19.1% throughout the forecast period.

In the USA retail sector, AI has an influence on improving customer experience. Majority of retailers use AI to give customers personalized shopping and automated service. This trend leads to fast AI adoption. As per FMI, almost 80% of USA retailers will use AI-driven plans by 2025 to keep up with rivals and give customers what they want.

China’s AI platform market is poised to exhibit a CAGR of 22.1% between 2025 and 2035. Currently, it holds the significant market share in the East Asia market, and the dominance is expected to continue through the forecast period.

In China, AI platforms are becoming a big part of industrial manufacturing to boost productivity. FMI predict that using AI in factories will bump up production by 10-15% come 2035. Companies are bringing in AI to fine-tune their operations, cut down on machine downtime, and get more done overall. This makes AI a key player in China's drive towards high-tech manufacturing.

India’s AI platform market is expected to witness a CAGR of 21.6% in the forecast period and hold considerable market share in South Asia & Pacific region through 2035.

In India's banking and finance sector, companies are using AI and ML notably to fight fraud. This change is shown by the expected big growth in the AI platform market. AI and ML tools help spot fraud better by looking at huge amounts of data right away finding odd things, and guessing possible risks. This trend has an influence on the need to make security and rule-following better as more people use digital money.

The section contains information about the leading segments in the industry. By component, AI natural language processing platforms segment is estimated to grow at a CAGR of 21.9% throughout 2035. Additionally, the by industry, healthcare and life sciences segment is projected to expand at 22.0% till 2035.

| Component | AI Tools |

|---|---|

| Value Share (2025) | 33.2% |

AI Tools segment is expected to acquire share of 33.2% in the market in terms of component in 2025. Large enterprises mostly prefers on-premises solutions owing to enhanced data security. With on-premises solutions, organizations have complete control over their data, as it resides within their own infrastructure.

Since the company doesn’t need to share the data to third party vendors, there is less changes of data leakage in on-premises solutions. However, emergence of cost-effective and flexible cloud-based solutions may restrict the market growth in forecast period.

| Industry | IT and Telecom |

|---|---|

| Value Share (2025) | 29.6% |

The IT and telecom segment is expected to capture share of 29.6% in 2025. This sector's top spot comes from its quick adoption of AI tech to boost operations, improve customer service, and handle big data loads. The industry's push for new ideas, along with its need for cutting-edge AI tools to stay ahead, has cemented its top position in the market.

Key players operating in the AI platform market are investing in advanced technologies and also entering into partnerships. Key AI platform providers have also been acquiring smaller players to grow their presence to further penetrate the market across multiple regions.

Recent Industry Developments in AI Platform Market

In terms of component, the industry is divided into AI tools, AI machine learning platforms, AI natural language processing platforms, and AI services.

In terms of deployment, the industry is divided into cloud-based and on-premises.

The industry is classified by industry as retail and e-commerce, IT and telecom, BFSI, healthcare and life sciences, manufacturing, robotics, and others.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa (MEA) have been covered in the report.

The global AI platform market is estimated to be valued at USD 24.0 billion in 2025.

The market size for the AI platform market is projected to reach USD 165.6 billion by 2035.

The AI platform market is expected to grow at a 21.3% CAGR between 2025 and 2035.

The key product types in AI platform market are AI machine learning platforms, AI tools, AI natural language processing platforms and AI services.

In terms of deployment, cloud-based segment to command 75.0% share in the AI platform market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AI Platform Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

AIOps Platform Market Forecast and Outlook 2025 to 2035

AI Trading Platform Market Forecast Outlook 2025 to 2035

AI Security Platforms Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered CRM Platform Market Forecast Outlook 2025 to 2035

No-code AI Platform Market Size and Share Forecast Outlook 2025 to 2035

Online Airline Booking Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Embryo Selection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

AI Code Assistant Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

AI Powered Software Testing Tool Market Size and Share Forecast Outlook 2025 to 2035

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

AI in Fintech Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA