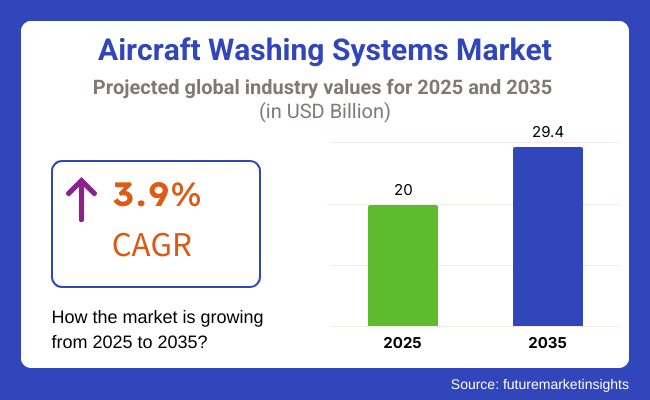

The aircraft washing systems market size is slated grow from USD 20 billion in 2025 to USD 29.4 billion by 2035 at a 3.9% CAGR from 2025 to 2035. The market is experiencing steady growth due to increasing global air traffic, fleet expansion, and heightened emphasis on maintenance efficiency and safety. As airlines expand their fleets to meet growing passenger and cargo demand, the need for routine cleaning and upkeep becomes critical to ensure optimal aircraft performance, reduce drag, and maintain fuel efficiency.

Clean aircraft surfaces also improve the overall aesthetic and brand perception for commercial airlines. Additionally, the aviation industry faces strict regulatory requirements for maintenance and hygiene, further encouraging investment in automated and semi-automated washing systems that ensure consistent, compliant cleaning.

Environmental concerns and sustainability trends are also influencing market growth. Traditional wet wash methods, which require large volumes of water and chemical detergents, are being replaced or supplemented with eco-friendly dry wash systems.

Dry washing not only minimizes water consumption but also reduces aircraft corrosion and the need for wastewater treatment, making it an attractive solution for airlines and ground service providers seeking greener operations. Moreover, with tightening environmental regulations worldwide, airports and maintenance operators are adopting closed-loop systems and biodegradable cleaning agents to align with sustainability goals and reduce ecological footprints.

Technological advancements are further propelling the market. Modern systems are increasingly automated, using robotics, high-pressure nozzles, and programmable logic controllers to improve precision and reduce labor dependency. These innovations shorten cleaning times, lower operating costs, and enhance safety by minimizing manual contact with aircraft surfaces.

Moreover, mobile and modular washing units are gaining popularity due to their flexibility and ease of deployment across diverse aircraft types and airport environments. As global airlines continue to focus on operational efficiency, compliance, and sustainability, the demand for advanced aircraft washing systems is expected to grow steadily across commercial, military, and private aviation segments.

The aircraft washing systems market is segmented based on method, application, and region. By method, the market is categorized into dry and wet. In terms of application, the market is divided into military, commercial, and private. Regionally, the market analysis spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

The dry method segment is projected to be the fastest-growing in the aircraft washing systems market, expected to register a CAGR of approximately 4.5% from 2025 to 2035, higher than the global average of 3.9%. This growth is driven by rising environmental regulations that limit water usage, along with increasing airline adoption of dry wash techniques to reduce maintenance downtime.

The dry method also minimizes corrosion risk and is ideal for on-site cleaning without requiring large infrastructure. Its cost-effectiveness, sustainability, and compatibility with eco-friendly cleaning products are making it a preferred choice among commercial and defense operators.

While growing at a slower rate, the wet method remains the dominant segment in the market due to its effectiveness in removing heavy grime, oil, and salt residues. This method is essential for deep cleaning in regions with high humidity, coastal operations, or aircraft exposed to heavy pollution.

The wet method also remains preferred for cargo, military, and long-haul aircraft requiring intensive exterior washing. Despite environmental concerns and higher water use, advancements in water recycling and biodegradable detergents are helping maintain its relevance in scheduled maintenance cycles across global airline fleets.

| Method | CAGR (2025 to 2035) |

|---|---|

| Dry | 4.5% |

The commercial aviation segment is expected to be the fastest-growing in the aircraft washing systems market, with a projected CAGR of approximately 4.3% from 2025 to 2035. This growth is fueled by expanding airline fleets, increased flight frequencies, and a greater emphasis on fuel efficiency and brand maintenance.

Clean aircraft surfaces reduce aerodynamic drag and enhance appearance, which is important for passenger perception. With stricter environmental regulations, commercial operators are also shifting toward automated and dry wash systems that minimize water usage and turnaround time.

The military segment remains a stable contributor to market demand. Military aircraft require routine cleaning to maintain performance, prevent corrosion, and support operational readiness. However, growth in this segment is moderate due to fixed defense budgets and longer procurement cycles. Cleaning systems are typically integrated into broader maintenance programs at airbases and defense facilities.

Private aviation represents the smallest segment, with slower growth due to the limited number of aircraft and less frequent cleaning needs. Although luxury charter services and private jet ownership are increasing, this segment relies more on manual or semi-automated cleaning methods. Still, rising demand for convenience, cleanliness, and hangar-based solutions may gradually drive adoption of advanced washing systems among premium operators.

| Application | CAGR (2025 to 2035) |

|---|---|

| Commercial | 4.3% |

Regulatory Compliance and High Maintenance Costs

High maintenance cost, strict environmental regulations, and operational downtime are the impediments to the growth of the aircraft washing systems market. Airlines, maintenance facilities, and ground-handling service providers are required to comply with stringent aviation safety and environmental standards, including the wastewater disposal regulations and chemical use restrictions.

As such, the inefficacy of conventional methods of cleaning aircraft leads to the need for repetitive cleaning, higher operational costs, and downtime of the aircraft for extensive hours for cleaning. Automated washing systems have not yet gained widespread adoption due to the high installation costs and compatibility challenges across various aircraft models.

To combat these challenges, companies need to create low-cost, water-efficient cleaning technologies and safe detergents. There must also be adding of artificial intelligence based predictive maintenance methods and real-time monitoring of automated washing systems in order to localize the efficiency and compliance risk even more.

Sustained Aviation & Collaboration in Automatic Cleaning Solutions

With a growing emphasis on sustainable aviation practices and operational efficiency, the Aircraft Washing Systems Market is poised for substantial opportunities. Both airlines and maintenance providers are in search of automated, water-saving cleaning solutions to help contain costs and environmental impact. Touchless and robotic washing systems provide better cleaning accuracy with minimal human contact and ensure quicker turnaround time.

The advancement of biodegradable cleaners and closed-loop water recycling systems are also changing the game for sustainability in aircraft maintenance. As the airline industry prioritizes eco-friendly operations, and airlines turn towards greener, efficiency-driven maintenance practices, players in the sector investing in AI-integrated washing technologies, smart diagnostics, as well as environmentally friendly cleaning solutions are going to get ahead of the curve.

The multifaceted American aircraft washing system industry is advancing incrementally owing to the substantial presence of an enormous, assorted commercial and military flying machine stock that necessitates rigorous servicing adhering to strict FAA rules on flying machine care, and the heightening embracement of mechanized aircraft cleansing technologies is further propelling market development.

Major airlines like Delta, American Airlines, and United Airlines are investing appreciably in ground-breaking water-sparing, eco-accommodating flying machine washing systems to streamline tasks while mitigating ecological impact.

Additionally, the robust USA military and protection division, including various fragments of the air force and navy, is a significantly enormous client of automated, hands-free cleaning systems for keeping up varied flying machines including fighter planes, freight planes, and helicopters. Furthermore, persistent advancement in sophisticated robotic flying machine washing advances are driving additional market development and advancement.

With sustained interests in aviation support framework modernization and expanding natural guidelines imposing more stringent rules, specialists anticipate that the multifaceted American flying machine washing system market will keep on growing step by step with strong interest in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The aviation industry in the United Kingdom has seen the aircraft washing system sector take flight in recent years. A rise in air passenger numbers, as well as mandates for sustainable solutions from regulators and calls from major airports for environmentally-friendly technologies, have boosted demand. Rules from the UK Civil Aviation Authority require routine maintenance and cleaning to enhance safety and efficiency.

Heathrow and Gatwick have urged adoption of low-water and biodegradable washes. Meanwhile, the private jet scene has soared, generating need for specialized cleaning services. With the focus on eco-friendly upkeep and additional planes coming on stream, the market appears set for stable, long-haul growth as carriers and owners commit to verdant workflows.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

The European Union aircraft washing system market has steadily expanded, propelled by proliferating airline fleets, intensifying expenditures in mechanized aircraft cleaning, and stringent ecological rules. Nations such as Germany, France, and Spain greatly adopt water-efficient and robotic aircraft washing remedies. The EU's stringent flight maintenance regulations, including EASA directives, encourage airlines to embrace sustainable and high-efficiency aircraft cleaning structures.

Moreover, the ascent of affordable carriers and broadening MRO centers are further promoting industry development. Requirements for automated and eco-friendly washing technologies implies the EU aircraft washing system industry should remain growing harmoniously.

Lengthy sentences alongside shorter ones within regulatory filings suggest maintenance needs and innovations to boost effectiveness and decrease environmental effects. Various airlines initiated new initiatives to retire older washing equipment and embrace the latest mechanized systems, demonstrating the market is primed for sustainable energy saving solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.8% |

Major carriers serving the European continent steadily expanded their aircraft fleets, necessitating innovative approaches to washing planes. Lufthansa, Air France, and other major carriers embraced robotic cleaners from manufacturers like Aero Clean and Riveer to satisfy stringent environmental standards from EASA. The proliferation of sustainable technologies accompanied rising capital investments in automated solutions, especially in Germany and France where highly efficient washers rapidly gained popularity.

Budget carriers also flourished alongside growing maintenance hubs across the European Union. This dual phenomenon boosted demand for cleaning systems at the same time directives incentivized sustainable adoption. Rules from the European Aviation Safety Agency now strongly motivate using Earth-friendly technologies.

Through these efforts, a burgeoning industry emerged and is forecast to continue expanding its reach as robotic and water-conserving options address needs that grow more vital each passing year with satisfying newly mandated environmental requirements.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The South Korean aircraft washing system market has witnessed steady maturation, propelled by ballooning airline fleets, burgeoning investments in MRO infrastructure, and rising experimentation with touchless aircraft cleaning innovations. Korea’s premier airlines, such as Korean Air and Asiana Airlines, are prioritizing efficient aircraft servicing remedies to reduce downtime.

The South Korean administration's push for nimble airports has motivated airlines and airport authorities to apply robotic aircraft wash systems and H2O recycling cleaning tech. additionally, the defense sector’s escalating procurement of enhanced fighter jets and military aircraft is further motivating demand for automated aircraft sanitizing remedies.

With continued progress in agile aviation upkeep and hearty investments in automated cleaning tech, experts anticipate that the South Korean aircraft washing system industry will steadily develop.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

Rise in demand for automatic, eco-friendly, and cost-effective aircraft washing solutions in commercial aviation, military fleets, and private jet cleaning is expected to propel the growth of the aircraft washing systems market. Incorporating water-efficient technology, AI-driven automation, and touchless aircraft washing systems can significantly improve operational efficiency, regulatory compliance, and its impact on the environment.

Global aviation maintenance service provider companies, and manufacturers of specialized aircraft washing equipment contribute to technological advancements in mobile wash unit units, robotic washing systems, and water-recycling cleaning solutions.

The overall market size for Aircraft Washing Systems Market was USD 20.0 Billion in 2025.

The Aircraft Washing Systems Market is expected to reach USD 29.4 Billion in 2035.

The demand for the aircraft washing systems market will grow due to increasing air traffic, rising focus on aircraft maintenance for operational efficiency, stringent aviation safety regulations, and advancements in automated and eco-friendly cleaning technologies, driving the need for efficient cleaning solutions.

The top 5 countries which drives the development of Aircraft Washing Systems Market are USA, UK, Europe Union, Japan and South Korea.

Dry and Wet Washing Methods Drive Market to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft De-icing Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Window Frame Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aircraft Led Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA