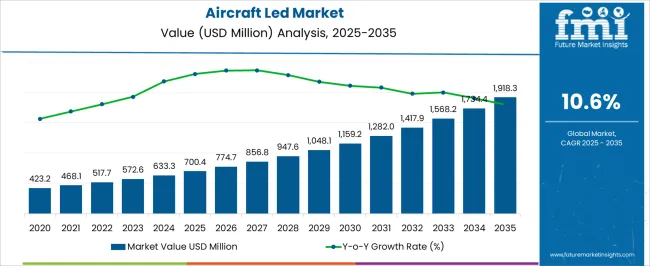

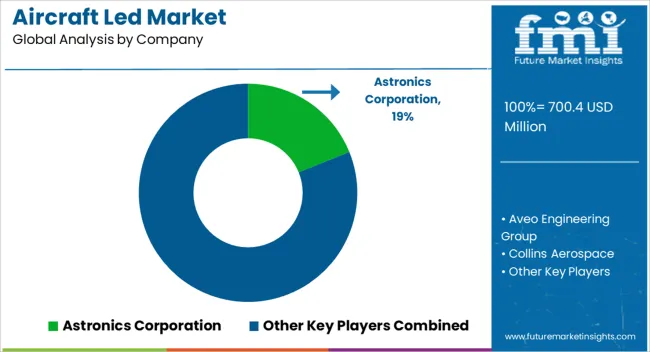

The aircraft led market is estimated to be valued at USD 700.4 million in 2025 and is projected to reach USD 1918.3 million by 2035, registering a compound annual growth rate (CAGR) of 10.6% over the forecast period.

The aircraft led market is projected to reach 700.4 USD million in 2025 and expand to 1,918.3 USD million by 2035, representing a CAGR of 10.6%. Rolling CAGR analysis indicates that annual growth will accelerate steadily, reflecting increasing adoption of energy-efficient lighting solutions in commercial, business, and military aircraft. Cabin retrofit projects, new aircraft production, and modernization programs are expected to drive incremental demand, particularly for LED systems in cockpit displays, cabin illumination, and exterior lighting applications.

Technological enhancements, including lightweight assemblies, longer lifespans, and reduced maintenance requirements, support widespread adoption. Regional differences in airline fleet modernization, regulatory requirements for energy efficiency, and passenger comfort initiatives influence adoption rates. Asia-Pacific is anticipated to witness strong growth due to expanding commercial aviation networks and rising air passenger traffic, while North America and Europe focus on retrofitting existing fleets and integrating advanced LED systems into next-generation aircraft.

Aircraft OEMs and component suppliers are increasingly collaborating to optimize design, reduce weight, and improve energy efficiency, further accelerating market penetration. Overall, the market is expected to see dynamic growth across retrofit and new-build segments, with rolling annual increases reflecting broader trends in aviation modernization, operational cost reduction, and passenger experience enhancement.

| Metric | Value |

|---|---|

| Aircraft Led Market Estimated Value in (2025 E) | USD 700.4 million |

| Aircraft Led Market Forecast Value in (2035 F) | USD 1918.3 million |

| Forecast CAGR (2025 to 2035) | 10.6% |

The aircraft led market is shaped by interconnected parent markets, each contributing significantly to overall adoption and growth. The commercial aviation market holds the largest share at 40%, as airlines and aircraft manufacturers increasingly deploy LED lighting in cabins, cockpits, and exterior systems to improve energy efficiency, passenger comfort, and operational reliability. The business and general aviation segment contributes 25%, where private jets and corporate aircraft adopt advanced LED systems for customized interior lighting, reduced maintenance, and weight reduction benefits.

The military and defense aviation market accounts for 20%, with fighter jets, transport aircraft, and surveillance planes leveraging LED technology for mission-critical lighting, low observability, and extended service life. The retrofit and maintenance services market holds a 10% share, driven by cabin refurbishment, lighting system upgrades, and compliance with evolving aviation standards. Finally, the drone and unmanned aerial vehicle (UAV) segment represents 5%, integrating lightweight LED lighting for navigation, signaling, and operational efficiency. Collectively, commercial, business, and military aviation segments account for 85% of total demand, highlighting that fleet modernization, energy efficiency, and operational enhancements remain the primary growth drivers, while retrofit services and UAV applications provide emerging adoption opportunities globally.

The aircraft LED market is experiencing steady growth driven by rising demand for energy efficient lighting solutions, enhanced passenger comfort, and evolving aircraft interior design standards. Airlines and aircraft manufacturers are increasingly adopting LED systems due to their lower power consumption, longer lifespan, and reduced maintenance requirements compared to conventional lighting.

Advancements in dimming controls, color customization, and integration with in-flight entertainment systems are further enhancing passenger experience and operational flexibility. Regulatory focus on cabin illumination quality, coupled with fleet modernization programs, is accelerating LED adoption across both new and retrofit projects.

The market outlook remains optimistic as the aviation industry prioritizes sustainability, fuel efficiency, and passenger-centric innovations, positioning LED technology as a key enabler of next-generation aircraft interiors.

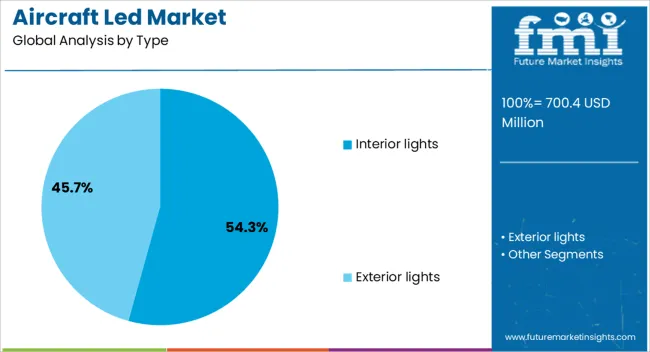

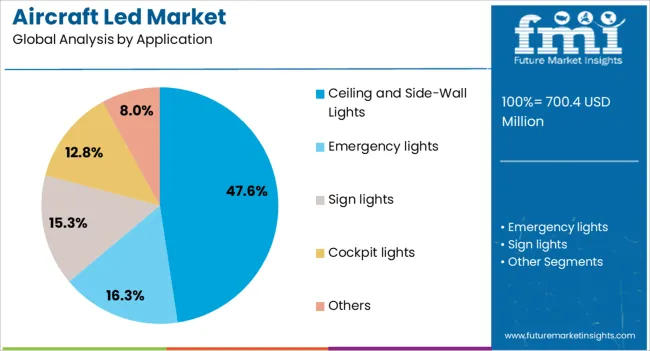

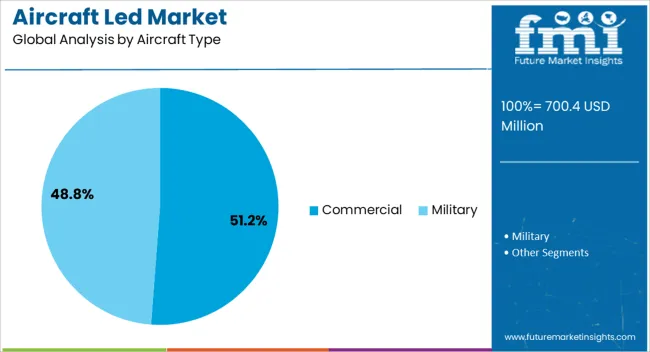

The aircraft led market is segmented by type, application, aircraft type, point of sales, and geographic regions. By type, aircraft led market is divided into interior lights and exterior lights. In terms of application, aircraft led market is classified into ceiling and sidewall lights, emergency lights, sign lights, cockpit lights, and others. Based on aircraft type, aircraft led market is segmented into commercial and military. By point of sales, aircraft led market is segmented into OEM and aftermarket. Regionally, the aircraft led industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The interior lights segment is projected to hold 54.3% of the total market revenue by 2025 within the type category, establishing it as the leading segment. This dominance is driven by the critical role of cabin lighting in influencing passenger comfort, brand differentiation, and compliance with safety standards.

LED interior lights offer improved brightness control, design flexibility, and reduced energy use, supporting airline operational efficiency. The growing trend toward mood lighting and cabin ambiance customization has further increased demand.

These advantages, coupled with reduced maintenance cycles, have solidified the position of interior lights as the most prominent type segment in the aircraft LED market.

The ceiling and side-wall lights segment is expected to contribute 47.6% of total market revenue by 2025 within the application category, making it the leading segment. This growth is attributed to their importance in achieving uniform cabin illumination, enhancing passenger perception of space, and supporting safety requirements during boarding, cruising, and emergency scenarios.

The integration of advanced LED modules with dynamic color and intensity adjustments has improved both aesthetic appeal and operational performance.

Airlines are increasingly focusing on these lighting solutions to reinforce brand identity while delivering a premium passenger experience, further driving their adoption.

The commercial aircraft segment is anticipated to account for 51.2% of total market revenue by 2025 within the aircraft type category, positioning it as the dominant segment. This is largely due to the rising number of global passenger flights, fleet expansion initiatives, and growing investments in cabin refurbishment programs.

Airlines operating in competitive markets are leveraging LED technology to create distinctive cabin environments while optimizing energy efficiency. The cost savings associated with longer lifespan and reduced maintenance of LED systems make them highly attractive for large commercial fleets.

These factors collectively ensure that the commercial aircraft segment maintains its leadership in the aircraft LED market.

Commercial, business, and military adoption drive aircraft LED growth globally. Retrofit and aftermarket services provide steady incremental demand across fleets.

The aircraft LED market is driven by increasing demand for energy-efficient and lightweight lighting solutions in commercial aircraft cabins. Airlines are investing in LED cabin lighting to enhance passenger comfort, improve ambiance, and reduce operational costs through lower energy consumption and extended product lifespans. Cabin retrofit programs and fleet modernization initiatives are creating incremental opportunities for LED suppliers.

Demand is also influenced by premium and long-haul carriers focusing on passenger experience differentiation through mood lighting, customizable illumination, and zoned lighting for reading and entertainment areas. Cabin LED adoption is further supported by compatibility with smart control systems and in-flight entertainment platforms, allowing dynamic lighting adjustments and improving overall passenger satisfaction and brand perception.

Business jets and private aircraft are increasingly integrating LED lighting systems for functional and aesthetic purposes. Lightweight and compact LED modules help reduce aircraft weight, contributing to fuel efficiency and operational cost savings. Customizable cabin illumination, adjustable color temperatures, and mood lighting are prioritized to meet client expectations for luxury, comfort, and productivity during flights.

Retrofit programs in older business jets are expanding opportunities for component suppliers, while new aircraft production continues to integrate fully LED-based cabin systems. Suppliers offering modular designs, easy installation, and low-maintenance LED solutions gain a competitive edge. Adoption in this segment is closely tied to corporate travel demand, private aviation expansion, and premium aircraft refurbishment initiatives globally.

Military and defense aviation is adopting LED lighting for cockpit displays, navigation, signaling, and exterior lighting. LEDs provide enhanced reliability, reduced maintenance, and lower power consumption in critical missions. Stealth and low-observable operations benefit from specialized lighting solutions with adjustable intensity and spectral control.

Military retrofit programs and new aircraft production programs create steady demand for LED systems designed to meet stringent operational and environmental standards. Suppliers focusing on durable, high-performance components that can withstand extreme conditions capture market share. Integration of LED lighting into both rotary-wing and fixed-wing aircraft supports operational efficiency, safety, and mission readiness, making the military segment a stable and high-value contributor to overall market growth.

The aircraft LED market is benefiting from retrofit and aftermarket services that target both commercial and private fleets. Airlines and operators are upgrading legacy lighting systems to reduce energy costs, extend component lifespan, and improve passenger experience. Suppliers offering end-to-end services, including on-site installation, replacement modules, and maintenance contracts, are increasingly capturing market share.

Market growth is further supported by the resale and refurbishment of aircraft where modern LED systems add value. Service providers that combine product quality, operational efficiency, and regulatory compliance are positioned favorably. This segment is expected to remain a consistent driver of demand, complementing new aircraft production and fleet expansion trends.

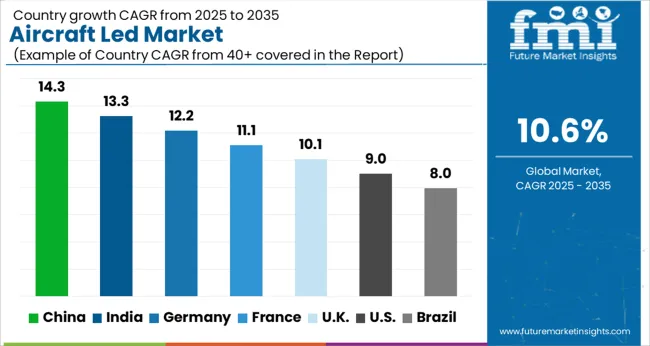

| Country | CAGR |

|---|---|

| China | 14.3% |

| India | 13.3% |

| Germany | 12.2% |

| France | 11.1% |

| UK | 10.1% |

| USA | 9.0% |

| Brazil | 8.0% |

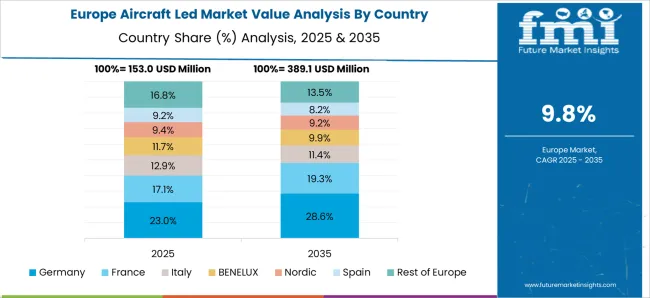

The global aircraft LED market is projected to grow at a CAGR of 10.6% from 2025 to 2035. China leads at 14.3%, followed by India at 13.3%, France at 11.1%, the UK at 10.1%, and the USA at 9.0%. Growth is driven by fleet modernization, retrofit programs, and adoption of energy-efficient cabin, cockpit, and exterior lighting solutions. Asia, particularly China and India, demonstrates rapid expansion due to increasing commercial aviation networks, aircraft production, and airline investments in passenger experience enhancements. Europe emphasizes retrofitting existing fleets and integrating LED systems in new aircraft, while North America focuses on business jets, military applications, and large-scale commercial cabin upgrades. Technological integration, including lightweight assemblies and low-maintenance designs, supports operational efficiency, reliability, and reduced energy consumption globally. The analysis includes over 40+ countries, with the leading markets detailed above.

The aircraft LED market in China is projected to grow at a CAGR of 14.3% from 2025 to 2035, driven by rapid expansion of commercial aviation, fleet modernization programs, and airline investments in passenger experience upgrades. Increasing aircraft production, including narrow-body and wide-body jets, generates substantial demand for cabin, cockpit, and exterior LED lighting systems. Retrofit programs targeting older fleets further accelerate adoption, as airlines focus on energy efficiency, reduced maintenance costs, and enhanced in-flight ambiance.

Collaboration between aircraft OEMs, LED suppliers, and airline operators ensures the integration of lightweight, durable, and high-performance lighting solutions. Government policies supporting aviation infrastructure and smart airport initiatives also contribute to market growth, while emerging regional carriers expand the addressable market across domestic and international routes.

The aircraft LED market in India is expected to expand at a CAGR of 13.3% from 2025 to 2035, supported by growth in commercial aviation, low-cost carrier expansion, and increased private jet and business aircraft operations. Retrofit and cabin upgrade programs for energy-efficient lighting, mood lighting, and cockpit displays create significant incremental demand.

Domestic and international suppliers are collaborating with airlines and OEMs to offer modular, lightweight, and low-maintenance LED solutions suitable for both new-build aircraft and fleet refurbishment projects. Airport modernization initiatives and fleet expansion for regional connectivity enhance the adoption of advanced LED systems. Adoption is also influenced by operational cost reduction efforts, passenger comfort prioritization, and compliance with international aviation standards.

The aircraft LED market in France is projected to grow at a CAGR of 11.1% from 2025 to 2035, driven by extensive retrofit programs in commercial airlines and business aviation fleets. Airlines and aircraft manufacturers are upgrading cabin interiors, cockpit displays, and exterior lighting with energy-efficient LED solutions to reduce operational costs and enhance passenger experience.

Military and defense aviation also contributes to demand for high-performance LED lighting systems capable of meeting stringent operational and environmental standards. Collaboration between local OEMs, lighting suppliers, and retrofit service providers ensures optimized integration, compliance, and performance. France’s focus on energy-efficient aviation and regulatory standards supporting material and energy savings further accelerates adoption.

The aircraft LED market in the UK is expected to grow at a CAGR of 10.1% from 2025 to 2035, fueled by commercial airline fleet modernization, private jet upgrades, and military aviation programs. Retrofit initiatives targeting older aircraft for cabin, cockpit, and exterior lighting enhance energy efficiency, reduce maintenance costs, and improve passenger experience.

Suppliers offering modular LED systems, easy installation, and low-maintenance designs are capturing market share. Collaborations between OEMs, retrofit service providers, and airlines streamline integration and operational reliability. Adoption is also supported by government regulations emphasizing environmental standards and energy efficiency. Business aviation expansion and defense modernization programs provide consistent incremental demand across multiple segments.

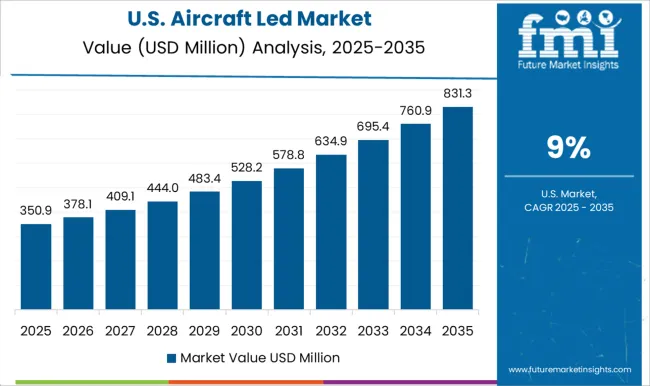

The aircraft LED market in the USA is projected to grow at a CAGR of 9.0% from 2025 to 2035, driven by commercial aviation expansion, business jet operations, and military aircraft upgrades. Airlines are increasingly adopting energy-efficient LED systems in cabins, cockpits, and exterior lighting to reduce energy consumption, enhance passenger comfort, and minimize maintenance requirements.

Retrofit programs for older fleets generate steady incremental demand, while new aircraft production integrates fully LED-based lighting solutions. Collaborations between aircraft OEMs, component suppliers, and retrofit service providers ensure optimized performance, reliability, and compliance with Federal Aviation Administration standards. Adoption is also influenced by operational cost reduction, passenger experience enhancement, and defense modernization programs across the country.

Competition in the aircraft LED market is defined by energy efficiency, reliability, and integration with cabin, cockpit, and exterior systems. Collins Aerospace and Honeywell Aerospace lead with comprehensive lighting solutions optimized for commercial, business, and military aircraft, emphasizing lightweight designs, durability, and low maintenance. Astronics Corporation and Luminator Aerospace compete with modular LED systems, retrofit kits, and cabin illumination solutions targeting airline fleets and corporate jets. Diehl Aviation, Safran, and STG Aerospace focus on cabin mood lighting, emergency lighting, and cockpit displays for enhanced passenger experience and operational efficiency.

Aveo Engineering Group, Precise Flight, Inc., and UTC Aerospace Systems differentiate through specialized components for navigation, signaling, and avionics lighting systems, ensuring compliance with aviation standards. Rockwell Collins and Cree, Inc. provide high-performance LED modules and driver systems, emphasizing longevity, reduced power consumption, and vibration resistance. Suppliers highlight retrofit programs, modular assembly, and lightweight solutions as key differentiators. OEM collaborations, integration with new aircraft production lines, and partnerships with airlines enable wide adoption. Military and defense applications benefit from high-reliability LEDs designed for extreme conditions, while commercial and business aviation focuses on passenger comfort, cabin ambiance, and operational cost reduction.

Product brochure content is technical and precise, highlighting LED type, power rating, lumens output, color temperature, and lifespan. Specifications include cabin, cockpit, and exterior lighting compatibility, modular mounting, emergency and signage lighting, and retrofit installation options. Accessories, replacement modules, and service packages are detailed to support maintenance, reliability, and compliance with aviation standards. Solutions emphasize energy savings, low maintenance, operational efficiency, and enhanced passenger experience across commercial, business, and military aircraft.

| Item | Value |

|---|---|

| Quantitative Units | USD 700.4 million |

| Type | Interior lights and Exterior lights |

| Application | Ceiling and Side-Wall Lights, Emergency lights, Sign lights, Cockpit lights, and Others |

| Aircraft Type | Commercial and Military |

| Point of Sales | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Astronics Corporation, Aveo Engineering Group, Collins Aerospace, Cree, Inc., Diehl Aviation, Honeywell Aerospace, Luminator Aerospace, Precise Flight, Inc., Rockwell Collins, Safran, STG Aerospace, and UTC Aerospace Systems |

| Additional Attributes | Dollar sales, market share, CAGR, regional adoption, commercial vs. business vs. military demand, retrofit and new-build opportunities, component type trends, supplier landscape, energy efficiency, cabin vs. cockpit vs. exterior lighting, and aftermarket growth. |

The global aircraft led market is estimated to be valued at USD 700.4 million in 2025.

The market size for the aircraft led market is projected to reach USD 1,918.3 million by 2035.

The aircraft led market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in aircraft led market are interior lights and exterior lights.

In terms of application, ceiling and side-wall lights segment to command 47.6% share in the aircraft led market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA