The Aircraft Maintenance, Repair and Overhaul Market is estimated to be valued at USD 48.4 billion in 2025 and is projected to reach USD 66.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

| Metric | Value |

|---|---|

| Aircraft Maintenance, Repair and Overhaul Market Estimated Value in (2025 E) | USD 48.4 billion |

| Aircraft Maintenance, Repair and Overhaul Market Forecast Value in (2035 F) | USD 66.3 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The Aircraft Maintenance, Repair and Overhaul market is experiencing robust growth, driven by the increasing global air traffic, fleet expansion, and rising demand for operational efficiency in the aviation sector. Growth is being supported by the need to maintain safety standards, extend aircraft service life, and comply with stringent regulatory requirements. Technological advancements in predictive maintenance, digital inspection, and automated repair processes are enhancing service efficiency while reducing turnaround times.

Airlines and MRO providers are increasingly investing in engineering capabilities, advanced diagnostics, and component tracking systems to ensure reliability and minimize operational disruptions. Rising adoption of narrow body and wide body aircraft across commercial and regional aviation segments has further propelled demand for specialized maintenance services.

Fleet modernization initiatives, coupled with the need for fuel efficiency and reduced downtime, are shaping market dynamics As aviation operators prioritize cost-effective and technologically advanced maintenance solutions, the Aircraft MRO market is expected to maintain sustained growth, with engineering services and specialized aircraft divisions remaining key drivers.

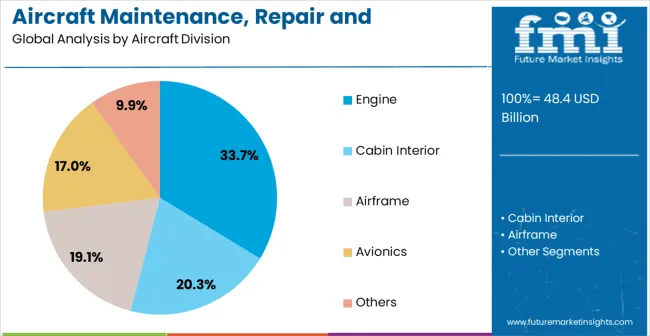

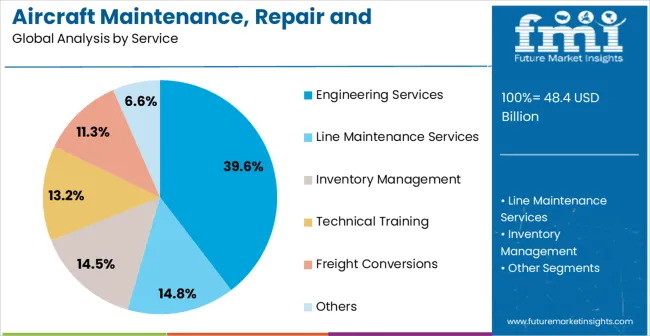

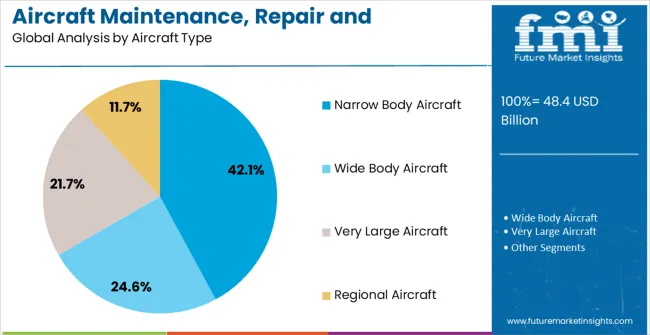

The aircraft maintenance, repair and overhaul market is segmented by aircraft division, service, aircraft type, and geographic regions. By aircraft division, aircraft maintenance, repair and overhaul market is divided into Engine, Cabin Interior, Airframe, Avionics, and Others. In terms of service, aircraft maintenance, repair and overhaul market is classified into Engineering Services, Line Maintenance Services, Inventory Management, Technical Training, Freight Conversions, and Others. Based on aircraft type, aircraft maintenance, repair and overhaul market is segmented into Narrow Body Aircraft, Wide Body Aircraft, Very Large Aircraft, and Regional Aircraft. Regionally, the aircraft maintenance, repair and overhaul industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The engine division segment is projected to hold 33.7% of the market revenue in 2025, establishing it as the leading aircraft division. Growth in this segment is being driven by the critical role of engines in aircraft safety, performance, and fuel efficiency. Advanced engine designs and higher thrust capabilities require specialized maintenance, repair, and overhaul procedures.

Predictive maintenance, digital monitoring, and diagnostic technologies have enhanced operational reliability while minimizing unscheduled downtime. Airlines and MRO providers are increasingly focusing on extending engine service life through regular inspections, component replacements, and performance optimization. The ability to integrate engine maintenance with digital record-keeping and real-time performance tracking has improved operational efficiency and reduced lifecycle costs.

Regulatory compliance and certification requirements further reinforce the importance of dedicated engine MRO services As air traffic and fleet sizes grow globally, the engine division segment is expected to remain a dominant contributor to market revenue, supported by technological innovation and demand for high-performance aircraft engines.

The engineering services segment is expected to account for 39.6% of the market revenue in 2025, making it the leading service category. Its growth is being driven by the increasing need for specialized technical expertise in inspection, component repair, modification, and performance optimization. Advanced engineering services provide airlines and MRO providers with solutions for predictive maintenance, troubleshooting, and compliance with aviation safety standards.

Integration of digital technologies such as augmented reality, 3D scanning, and AI-driven analytics has enhanced precision, reduced downtime, and improved operational efficiency. The ability to provide end-to-end engineering support for diverse aircraft systems, including engines, avionics, and airframes, further strengthens adoption.

As airlines focus on minimizing operational disruptions and maximizing asset utilization, demand for engineering services continues to rise Regulatory requirements, technological advancements, and the growing complexity of aircraft systems ensure that engineering services will remain a key revenue contributor within the Aircraft MRO market.

The narrow body aircraft type segment is projected to hold 42.1% of the market revenue in 2025, establishing it as the leading aircraft type. Its dominance is being driven by the increasing deployment of narrow body aircraft in regional and short-haul commercial operations due to cost efficiency, fuel economy, and operational flexibility. The rising global demand for air travel, especially in densely populated regions and low-cost carrier networks, has fueled fleet expansion of narrow body aircraft.

Maintenance, repair, and overhaul services are critical to ensuring safety, operational reliability, and compliance with aviation regulations for these aircraft. Advanced diagnostic tools, predictive maintenance, and component optimization technologies have enhanced service efficiency and reduced turnaround times.

Integration of MRO solutions with digital record management and real-time performance monitoring has further strengthened adoption As airlines continue to expand narrow body fleets and optimize operational costs, the segment is expected to remain the largest contributor to market revenue, supported by ongoing technological advancements and fleet modernization initiatives.

Aircraft maintenance, repair and overhaul or MRO is a service that deals with rectifying issues related to various parts, navigational devices and engine components that make up an aircraft. The services provided comprise visual inspection, fixing, alteration or modification as well as supply of accessories, spare parts, coatings, sealants and other consumables.

Aircraft maintenance, repair and overhaul is a critical service adopted by various airline carriers to keep their fleet young, improve lifespan and fuel efficiency and take the air worthiness of the fleet to a higher level. The aircraft maintenance, repair and overhaul market is a highly organized market in which players are regulated by various international and local governing bodies.

These bodies ensure that highest quality of MRO service is being provided to airline carriers. The global standards for the market are set by the International Civil Aviation Organization (ICAO).

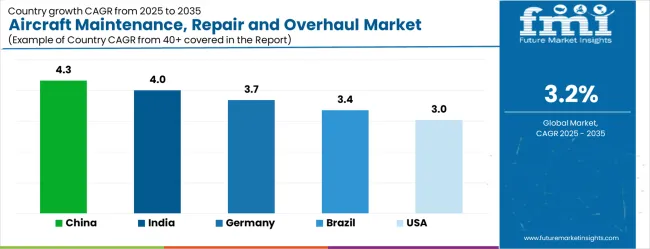

| Country | CAGR |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| Brazil | 3.4% |

| USA | 3.0% |

| U.K. | 2.7% |

| Japan | 2.4% |

The Aircraft Maintenance, Repair and Overhaul Market is expected to register a CAGR of 3.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 4.3%, followed by India at 4.0%. Developed markets such as Germany, France, and the U.K. continue to expand steadily, while the U.S. is likely to grow at consistent rates. Japan posts the lowest CAGR at 2.4%, yet still underscores a broadly positive trajectory for the global Aircraft Maintenance, Repair and Overhaul Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 3.7%. The U.S. Aircraft Maintenance, Repair and Overhaul Market is estimated to be valued at USD 16.8 billion in 2025 and is anticipated to reach a valuation of USD 16.8 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.5 billion and USD 1.3 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 48.4 Billion |

| Aircraft Division | Engine, Cabin Interior, Airframe, Avionics, and Others |

| Service | Engineering Services, Line Maintenance Services, Inventory Management, Technical Training, Freight Conversions, and Others |

| Aircraft Type | Narrow Body Aircraft, Wide Body Aircraft, Very Large Aircraft, and Regional Aircraft |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

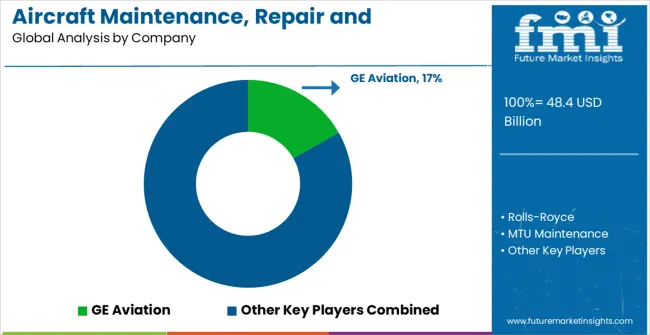

| Key Companies Profiled | GE Aviation, Rolls-Royce, MTU Maintenance, Lufthansa Technik, Pratt & Whitney, Air France Industries KLM E&M, Safran S.A. (Snecma), Delta TechOps, Standard Aero, BBA Aviation, and Chromalloy |

The global aircraft maintenance, repair and overhaul market is estimated to be valued at USD 48.4 billion in 2025.

The market size for the aircraft maintenance, repair and overhaul market is projected to reach USD 66.3 billion by 2035.

The aircraft maintenance, repair and overhaul market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in aircraft maintenance, repair and overhaul market are engine, cabin interior, airframe, avionics and others.

In terms of service, engineering services segment to command 39.6% share in the aircraft maintenance, repair and overhaul market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft De-icing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA