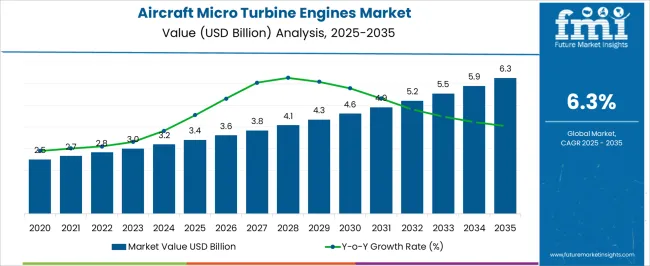

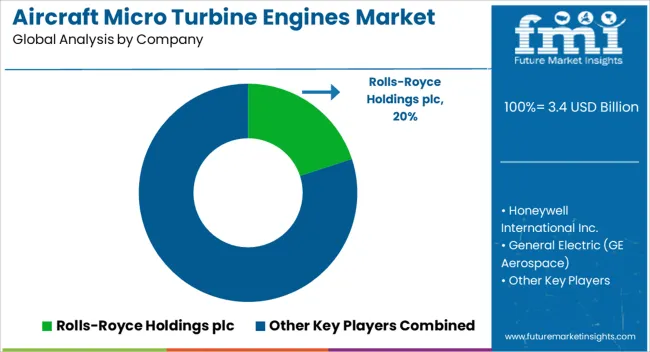

The aircraft micro turbine engines market is anticipated to advance from USD 3.4 billion in 2025 to USD 6.3 billion by 2035, registering a CAGR of 6.3%. An assessment of saturation points reveals that growth is strong in the early and mid-phases but gradually tapers as the market matures toward the forecast horizon. Between 2021 and 2025, the market expands from USD 2.5 billion to USD 3.4 billion. This early stage reflects rapid adoption, largely driven by increasing use of micro turbines in UAVs, auxiliary power units, and small aircraft applications.

Demand in this phase highlights the first growth surge before saturation pressures emerge. From 2026 to 2030, the market rises from USD 3.6 billion to USD 4.6 billion. Here, the curve maintains momentum but begins to show early signs of leveling, as penetration in defense and commercial UAV sectors reaches higher thresholds. Incremental advances in efficiency and hybrid integration help sustain demand, yet the adoption rate slows compared to the initial burst. Between 2031 and 2035, the market increases from USD 4.9 billion to USD 6.3 billion. This period marks the approach to a saturation point, where incremental growth moderates as replacement demand, technological refinement, and niche applications dominate. The earlier surge in adoption is replaced by a steadier pace, with expansion concentrated in specific areas such as hybrid-electric aviation and advanced UAV fleets.

| Metric | Value |

|---|---|

| Aircraft Micro Turbine Engines Market Estimated Value in (2025 E) | USD 3.4 billion |

| Aircraft Micro Turbine Engines Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The aircraft micro turbine engines market sits as a specialized subsegment across multiple aviation and propulsion domains, with shares reflecting its niche but growing adoption. Within the aerospace propulsion market, micro turbines contribute about 2 to 3%, a relatively small portion compared to turbofans and turboprops, but one that is valued for compact design and high power-to-weight ratios.

In the unmanned aerial vehicle (UAV) propulsion market, their role is more significant, accounting for nearly 12 to 14%, since drones and target UAVs increasingly use micro turbines for endurance, reliability, and greater payload capacity. The general aviation market shows moderate uptake, where micro turbines hold close to 4 to 5%, primarily in experimental aircraft and lightweight aviation platforms emphasizing efficiency. Within the auxiliary power unit (APU) market, micro turbines contribute nearly 6 to 7%, providing compact energy solutions for onboard electrical and pneumatic needs in smaller or specialized aircraft. The defense and military aviation market reflects another important arena, where micro turbines capture about 8 to 9%, used in reconnaissance drones, target drones, and tactical equipment needing portable and resilient energy sources.

The Aircraft Micro Turbine Engines market is experiencing strong momentum, driven by increasing demand for lightweight, fuel-efficient propulsion systems across multiple aviation categories. Growth is being supported by advancements in turbine efficiency, materials technology, and manufacturing processes, enabling higher performance with lower operational costs. The ability of micro turbine engines to operate with diverse fuel types and provide high power-to-weight ratios is expanding their adoption in general aviation, unmanned aerial vehicles, and specialized defense applications.

The aftermarket service ecosystem is expanding in parallel, as operators prioritize maintenance, overhauls, and upgrades to extend service life and ensure operational readiness. Technological innovation is also enhancing engine reliability and reducing downtime, which supports sustained fleet utilization.

With regulatory pressures emphasizing emissions reduction and efficiency, market participants are increasingly integrating advanced digital control systems and predictive maintenance capabilities The future outlook remains positive, underpinned by growing investments in next-generation platforms, expanding usage in urban air mobility, and strong demand from both commercial and defense aviation sectors.

The aircraft micro turbine engines market is segmented by installation, platform, engine type, horsepower, fuel type, end use, and geographic regions. By installation, aircraft micro turbine engines market is divided into Aftermarket and Original equipment manufacturers. In terms of platform, aircraft micro turbine engines market is classified into General aviation, Commercial aviation, and Advanced air mobility. Based on engine type, aircraft micro turbine engines market is segmented into Turboshaft micro turbine engines market, Turbojet micro turbine engines market, and Turboprop micro turbine engines market. By horsepower, aircraft micro turbine engines market is segmented into 50 to 100 HP, Below 50 HP, 100 to 200 HP, and Greater than 200 HP. By fuel type, aircraft micro turbine engines market is segmented into Jet fuel and Multi fuel. By end use, aircraft micro turbine engines market is segmented into Propulsion and Auxiliary power. Regionally, the aircraft micro turbine engines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

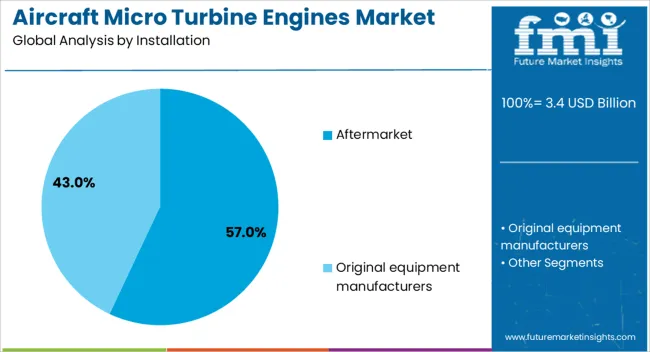

The aftermarket segment in the installation category is projected to hold 57% of the Aircraft Micro Turbine Engines market revenue share in 2025, making it the dominant segment. This leadership has been supported by the growing need for maintenance, repair, and overhaul services to extend engine service life and ensure optimal performance. Operators are prioritizing aftermarket solutions to maximize return on investment and minimize downtime.

Increased adoption of advanced diagnostic and predictive maintenance technologies in the aftermarket is helping to reduce operational risks and maintenance costs. The presence of well-established service networks, along with the flexibility to incorporate software and hardware upgrades, has reinforced the demand for aftermarket services.

In addition, regulatory compliance requirements have driven consistent maintenance cycles, further contributing to this segment’s dominance The strong focus on lifecycle cost optimization, combined with the availability of service packages tailored to operator needs, has ensured the aftermarket segment’s sustained leadership in the installation category.

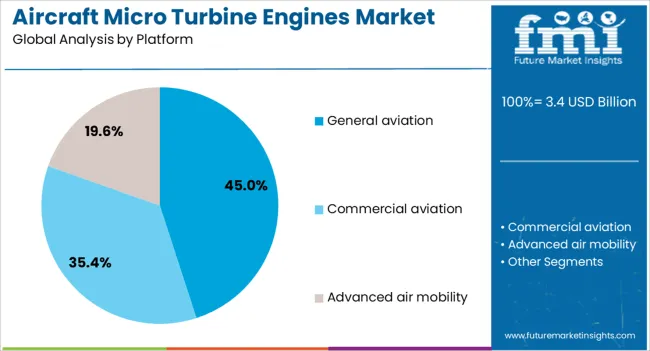

The general aviation segment within the platform category is expected to command 45% of the Aircraft Micro Turbine Engines market revenue share in 2025, positioning it as the leading platform type. Growth in this segment has been supported by the rising demand for efficient, lightweight propulsion systems for small aircraft, business jets, and personal aviation. The performance advantages of micro turbine engines, including high power-to-weight ratios and fuel flexibility, have enhanced their adoption in general aviation.

The ability to operate efficiently in diverse climatic conditions and at varying altitudes has made these engines well-suited for a wide range of missions. Additionally, the integration of digital control systems has improved reliability and reduced pilot workload, strengthening their appeal.

With the expansion of recreational and business flying activities, coupled with growing interest in personal air mobility solutions, the general aviation segment continues to hold a strong position Sustained investment in modernizing aircraft fleets has further reinforced this category’s leadership in the market.

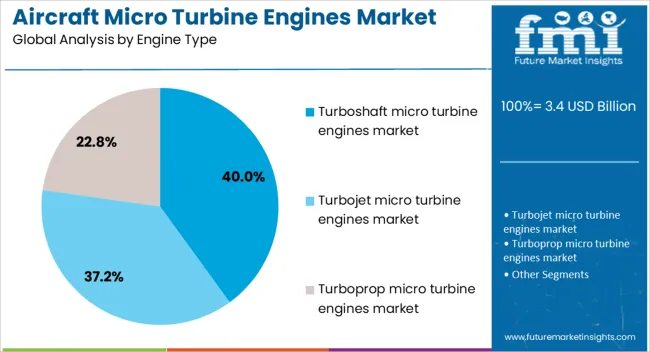

The turboshaft engine type is projected to account for 40% of the Aircraft Micro Turbine Engines market revenue share in 2025, making it the leading engine category. This dominance has been driven by the engine’s suitability for applications requiring sustained high power output, particularly in rotary-wing and specialized fixed-wing platforms. Turboshaft micro turbine engines are valued for their durability, high efficiency, and operational versatility across varied conditions.

Their compact size and lightweight design make them ideal for aircraft where weight savings directly translate into improved range and payload capacity. The ability to operate on multiple fuel types has enhanced their adaptability for both civil and defense missions.

Technological enhancements, including improved thermal efficiency and reduced noise levels, have further expanded their adoption As demand for reliable and efficient powerplants for helicopters, unmanned aerial vehicles, and light aircraft continues to rise, the turboshaft segment is expected to maintain its strong market position.

Micro turbine engines are gaining ground in UAVs, experimental programs, and compact power units as operators seek high power density, simple packaging, rapid starts, and steady electrical output. Adoption is restrained by small scale efficiency limits, thermal and acoustic management, precision manufacturing costs, and rigorous certification needs. Opportunity exists in hybrid turbogenerators, long endurance unmanned operations, and compact APUs that support cabin loads. Material upgrades, additive methods, bearings, and data driven maintenance are shaping product direction. Suppliers that pair engines with generators, controllers, and integration support are poised to win.

Adoption is being accelerated as micro turbine engines expand roles across UAVs, light sport programs, and auxiliary power units in new airframes. High power density, compact packaging, low vibration, and tolerance of varied fuels make them attractive where payload and space are constrained. Rapid start capability and altitude resilience support missions that require frequent cycling and dependable electrical output. Defense and civil operators value predictable power for sensors, datalinks, and flight control systems on endurance sorties. For experimental aircraft, simple architecture and fewer moving parts reduce maintenance burden versus complex piston installations. Developers of hybrid electric platforms are specifying micro turbines as range extenders that stabilize battery state under demanding profiles. Training fleets, target services, and research institutions are piloting micro turbine packages since installation is compact and integration with generators is straightforward. These drivers have positioned micro turbines as choices for aircraft where reliability and packaging efficiency are decisive.

Constraints are evident in efficiency, cost, and certification pathways. Specific fuel consumption at small scales remains higher than comparable piston alternatives, so endurance and fuel mass planning can be demanding. Thermal management and acoustic control are complex because exhaust temperatures are high and casings must protect nearby structures. Manufacture requires precision for small rotating components, tight clearances, and heat resistant materials, which raises yields risk and price. High speed bearings, lubrication systems, and filtration demand disciplined maintenance to prevent early wear in dusty or maritime environments. Noise and emissions rules add compliance workload, while proving durability across temperature, vibration, and ingestion events lengthens test campaigns. Certification under accepted engine and environmental standards requires documentation, software evidence, and change control. Export controls, insurance requirements, and limited test infrastructure add friction for entrants. These barriers keep adoption cautious where budgets are tight or endurance per kilogram of fuel is the dominant requirement.

Opportunities are expanding in hybrid electric propulsion, auxiliary power, and long endurance unmanned operations. Micro turbines paired with high speed generators and power electronics are being deployed as turbogenerators that maintain battery state and reduce depth of discharge on demanding missions. This architecture enables extended range for eVTOL, cargo drones, and short takeoff concepts without large battery swaps. Unmanned aircraft benefit from reliable electrical supply for sensors, navigation, and communications in beyond visual line operations, where quick refuel and minimal downtime are prized. Business aviation and special mission platforms assess compact micro turbine APUs to support cabin loads and avionics during ground turns. Fuel flexibility across kerosene grades and synthetic fuels offers planning latitude in remote regions. Aftermarket kits, modular cartridges, and field replaceable units create service revenue for engine makers and partners. Vendors that package engines with matched generators, controllers, and installation guides are gaining traction in fleet commitments.

Roadmaps indicate progress in thermal materials, additive methods, and data rich monitoring. Ceramic matrix components, advanced coatings, and improved alloys are being introduced to raise turbine inlet tolerance and extend time on wing. Additive manufacturing supports intricate cooling passages, integrated blisks, and lightweight housings that reduce part count and simplify spares. Foil and magnetic bearing concepts are gaining attention to cut oil system complexity and enable cleaner packaging. High speed generators paired with silicon carbide power electronics are improving conversion efficiency and shrinking turbogenerator footprints. Embedded sensors, edge logging, and secure connectivity are enabling condition based maintenance with clearer remaining life estimates. Standardized electrical interfaces for high voltage direct current buses are being proposed to simplify hybrid integration. Regional assembly, licensed production, and supplier partnerships are widening access to qualified parts and faster service. Vendors that deliver traceability, fast prototyping, and reliable field diagnostics are being favored in procurement decisions.

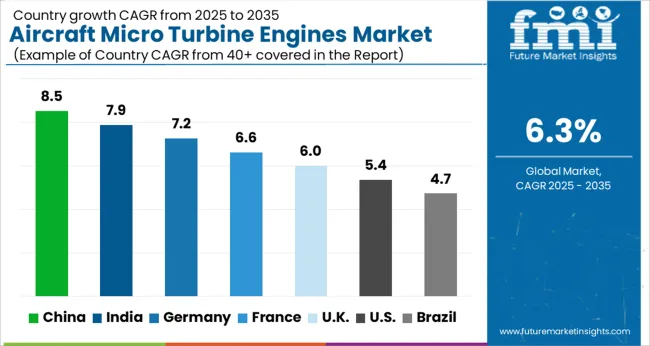

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The aircraft micro turbine engines market is forecast to grow globally at a CAGR of 6.3% between 2025 and 2035. China leads with 8.5%, followed by India at 7.9% and Germany at 7.2%, while the UK records 6.0% and the USA posts 5.4%. China and India deliver the strongest growth premiums of +2.2% and +1.6% above the baseline, driven by UAV expansion and defense modernization. Germany sustains high growth through aerospace R&D and EU collaborations. The UK maintains steady momentum with defense and light aircraft programs, while the USA, despite slower CAGR, dominates in absolute value with strong defense budgets and advanced propulsion technologies. The analysis covers over 40 countries, with the leading markets shown below.

The aircraft micro turbine engines market in China is projected to grow at a CAGR of 8.5% from 2025 to 2035, the highest among all profiled regions. China’s rapid expansion in unmanned aerial vehicles (UAVs), personal air mobility, and defense aviation is creating strong demand. Micro turbines are valued for their compact size, high thrust-to-weight ratio, and versatility in both military and civil applications. Domestic aerospace companies are increasingly investing in localized production, supported by partnerships with international engine makers. The government’s emphasis on strengthening aviation autonomy and innovation in propulsion technologies is further boosting adoption.

The aircraft micro turbine engines market in India is forecasted to grow at a CAGR of 7.9% between 2025 and 2035. India’s increasing focus on UAV development, defense modernization, and general aviation is propelling market expansion. Micro turbine engines are being widely integrated into drones for surveillance, logistics, and border patrol operations. Domestic aerospace startups are collaborating with global engine technology providers to advance localized production. The government’s “Make in India” initiative is encouraging domestic capability building, particularly for defense and UAV propulsion. Civil aviation is also adopting micro turbines for training aircraft and experimental designs.

The aircraft micro turbine engines market in Germany is expected to expand at a CAGR of 7.2% from 2025 to 2035. Germany’s established aerospace sector and innovation in propulsion systems are major growth enablers. Micro turbine engines are being adopted in UAVs, experimental aircraft, and auxiliary systems due to their efficiency and reliability. German aerospace firms are investing in advanced turbine materials, digital monitoring systems, and hybrid-electric propulsion integration. The country’s role in European defense collaborations and civilian UAV development strengthens demand. Research institutions and industry leaders are actively working on enhancing micro turbine performance for both military and commercial use.

The aircraft micro turbine engines market in the United Kingdom is forecasted to grow at a CAGR of 6.0% during 2025–2035. The strong aerospace manufacturing ecosystem, combined with defense and UAV programs, supports steady adoption. Micro turbine engines are being used in UAVs for intelligence and logistics operations, while civil applications include light aircraft and research prototypes. The country’s emphasis on defense modernization and UAV integration into military operations adds consistent demand. Local aerospace companies are collaborating with universities and global engine makers to develop efficient and compact turbine systems. Although growth is moderate compared to Asia, the UK remains a key contributor within Europe, especially in specialized defense and research-driven applications.

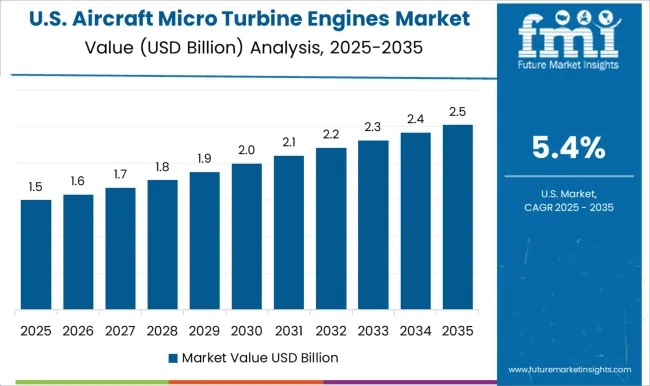

The aircraft micro turbine engines market in the United States is projected to grow at a CAGR of 5.4%, slower than Asia and Europe but significant in absolute value. The USA market benefits from a large defense budget, advanced aerospace R&D, and growing UAV deployment. Micro turbine engines are widely adopted in unmanned systems, personal air mobility projects, and auxiliary applications in business jets and military aircraft. USA-based engine manufacturers are at the forefront of innovation, developing high-efficiency, lightweight turbines with digital control integration. Defense programs, particularly UAV surveillance and reconnaissance projects, remain the backbone of demand. Civil aviation and experimental aircraft sectors are also contributing to adoption.

Competition in aircraft microturbine engines is decided by thrust-to-weight, start reliability, specific fuel consumption, and power generation for onboard systems. Rolls-Royce, Pratt & Whitney, GE Aerospace, Safran, and Honeywell are anchored by certified APU and small turbine portfolios, so supply chains, test assets, and field support are leveraged across fixed-wing and rotorcraft programs. Kratos Defense is positioned toward tactical UAV and missile class propulsion, where cost per unit, rapid ramp, and mission availability dominate. PBS Group brings export ready turbojet, turboprop, and turboshaft units for UAVs and gliders, valued for compact form factors and straightforward installation. Elliott Company participates through small turbine assemblies and engineered components used in auxiliary power and specialty aerospace projects. Awards are often decided by qualification pedigree, thermal signature management, and readiness of documentation. Lead time and spares coverage matter. Strategy has been framed around modular cores, digital control, and maintainability. Multi mission variants are derived from a common hot section to spread certification cost. FADEC is standardised to enable consistent transient response and better fuel scheduling. Starter generators are integrated to deliver regulated 28 VDC or higher voltage channels for payloads and avionics.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Installation | Aftermarket and Original equipment manufacturers |

| Platform | General aviation, Commercial aviation, and Advanced air mobility |

| Engine Type | Turboshaft micro turbine engines market, Turbojet micro turbine engines market, and Turboprop micro turbine engines market |

| Horsepower | 50 to 100 HP, Below 50 HP, 100 to 200 HP, and Greater than 200 HP |

| Fuel Type | Jet fuel and Multi fuel |

| End Use | Propulsion and Auxiliary power |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rolls-Royce Holdings plc, Honeywell International Inc., General Electric (GE Aerospace), Pratt & Whitney (RTX), Safran S.A., Kratos Defense & Security, PBS Group, and Elliott Company |

| Additional Attributes | Dollar sales by product type cover propulsion micro turbines for UAVs, auxiliary power units, hybrid-electric compatible micro turbines, and small aircraft jet engines. Dollar sales by end use include defense UAV fleets, commercial light aircraft, business aviation, auxiliary energy systems, and experimental aviation. Demand dynamics are shaped by the rapid adoption of UAVs in defense and surveillance, interest in lightweight hybrid propulsion, and the need for efficient APUs in regional and business jets. Regional trends highlight North America as the lead market due to defense procurement, Europe as a hub for UAV and light aircraft programs, and Asia Pacific expanding rapidly with government-backed UAV deployments and indigenous aircraft development. |

The global aircraft micro turbine engines market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the aircraft micro turbine engines market is projected to reach USD 6.3 billion by 2035.

The aircraft micro turbine engines market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in aircraft micro turbine engines market are aftermarket and original equipment manufacturers.

In terms of platform, general aviation segment to command 45.0% share in the aircraft micro turbine engines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft De-icing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA