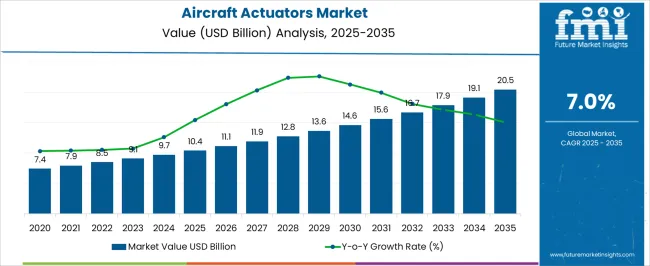

The aircraft actuators market is projected to grow from USD 10.4 billion in 2025 to USD 20.5 billion in 2035, reflecting a CAGR of 7.0%. This growth represents an absolute dollar opportunity of USD 10.1 billion over the decade. Annual growth shows steady expansion, starting from USD 10.4 billion in 2025, reaching USD 11.9 billion in 2028, USD 14.6 billion in 2031, and progressing to USD 19.1 billion by 2034. The consistent upward trend highlights strong market potential, providing manufacturers and suppliers with opportunities to expand production, enhance distribution, and capture a growing share of the commercial and defense aerospace sectors.

The absolute dollar opportunity highlights the growing value of the aircraft actuators market over the next decade. Incremental growth from USD 10.4 billion in 2025 to USD 20.5 billion in 2035 emphasizes a cumulative increase of USD 10.1 billion. Key years, such as USD 12.8 billion in 2029 and USD 16.7 billion in 2033, indicate periods of accelerated adoption. This growth trajectory allows stakeholders to scale operations strategically, optimize supply chains, and expand service offerings, ensuring they capture a meaningful portion of the expanding market value throughout the 2025–2035 period.

| Metric | Value |

|---|---|

| Aircraft Actuators Market Estimated Value in (2025 E) | USD 10.4 billion |

| Aircraft Actuators Market Forecast Value in (2035 F) | USD 20.5 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The aircraft actuators market is a segment of the broader aerospace components market, which includes flight control systems, landing gear systems, avionics, and other critical mechanical and electronic components. In 2025, aircraft actuators account for approximately 15% of the total aerospace components market, reflecting their critical role in flight control and operational efficiency. With the parent market projected to grow from around USD 69.3 billion in 2025 to USD 137.0 billion in 2035, the aircraft actuators segment’s growth from USD 10.4 billion in 2025 to USD 20.5 billion in 2035 at a CAGR of 7.0% represents roughly 20% of the total incremental growth in the parent market. Within the parent market, avionics systems hold about 25% of total value, landing gear systems contribute approximately 20%, and other mechanical components make up around 40%.

The aircraft actuators segment, with a CAGR of 7.0%, demonstrates steady and consistent growth, highlighting its increasing importance in both commercial and military aerospace applications. The incremental growth of USD 10.1 billion over the decade represents roughly 15% of total parent market expansion. This trend presents manufacturers and suppliers with opportunities to scale production, improve supply chains, and capture a larger share of the global aerospace components market.

The aircraft actuators market is experiencing substantial growth, supported by rising global aircraft production rates and increasing adoption of advanced flight control systems. Demand is being driven by the growing focus on fuel efficiency, lightweight materials, and improved aircraft performance. Technological advancements in actuator systems, including the integration of smart sensors and condition monitoring, are enhancing reliability and enabling predictive maintenance capabilities.

The market is also benefiting from rising passenger air traffic, leading to greater demand for new commercial aircraft as well as retrofit and maintenance services for existing fleets. Stringent safety and performance regulations are encouraging the use of advanced actuators capable of operating under extreme conditions while maintaining precision and durability.

The transition toward more electric aircraft architectures is further influencing market dynamics by increasing demand for electric and hybrid actuators With continuous investments in aerospace manufacturing capacity and R&D, the market is positioned for sustained growth, particularly in commercial aviation, defense, and specialized aircraft segments.

The aircraft actuators market is segmented by type, system, end user, and geographic regions. By type, aircraft actuators market is divided into Linear and Rotary. In terms of system, aircraft actuators market is classified into Hydraulic Actuators, Electrical Actuators, Pneumatic Actuators, and Mechanical Actuators. Based on end user, aircraft actuators market is segmented into Commercial Aircraft and Military Aircraft. Regionally, the aircraft actuators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

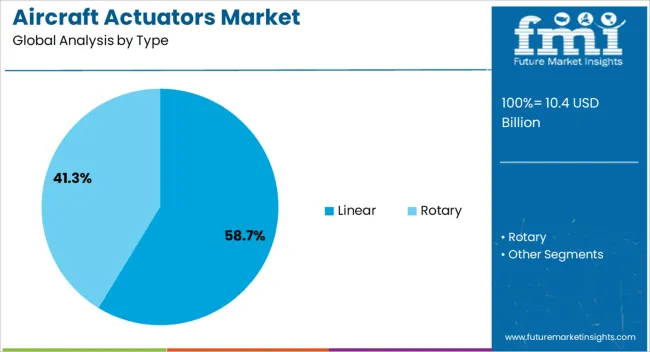

The linear actuators segment is projected to account for 58.7% of the aircraft actuators market revenue share in 2025, making it the leading type category. This leadership is supported by their widespread application in critical aircraft systems, including flight control surfaces, landing gear, and cargo doors. Linear actuators offer precise positioning, high load-handling capacity, and robust performance in challenging operational environments, which makes them highly reliable for aerospace use.

The segment’s dominance is also reinforced by advancements in materials and actuator design that improve efficiency and reduce overall system weight. Increased adoption of electric linear actuators in next-generation aircraft is being driven by the shift toward more electric aircraft designs, which aim to enhance fuel efficiency and reduce maintenance requirements.

Their ability to deliver consistent performance with minimal energy loss and compatibility with advanced avionics and control systems is ensuring their continued preference in the industry As aircraft manufacturers seek actuators that combine performance, efficiency, and durability, linear actuators are expected to maintain their strong market share.

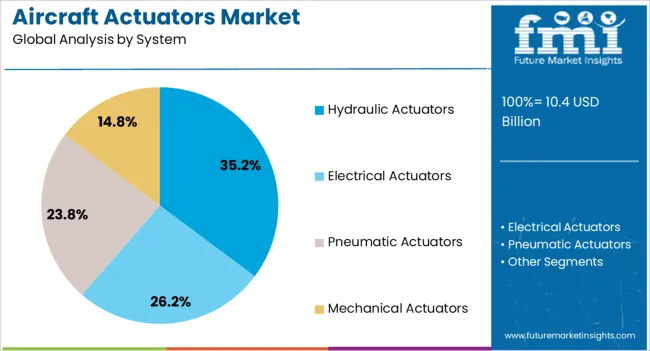

The hydraulic actuators segment is anticipated to hold 35.2% of the aircraft actuators market revenue share in 2025, establishing itself as the dominant system category. This position is driven by their proven ability to deliver high force output and withstand demanding operational conditions, making them essential for applications such as landing gear systems, thrust reversers, and primary flight controls.

Hydraulic actuators are valued for their reliability and performance in large aircraft, where significant force is required for actuation. Despite the gradual shift toward electric systems, hydraulic technology remains indispensable in many heavy-duty aerospace applications due to its efficiency in managing high loads.

The segment’s growth is also supported by ongoing improvements in sealing technologies, fluid management, and system integration, which enhance operational reliability and reduce maintenance needs As manufacturers develop hybrid actuator solutions that combine hydraulic power with electronic control, the system’s relevance is expected to remain strong, particularly in wide-body and long-haul aircraft programs.

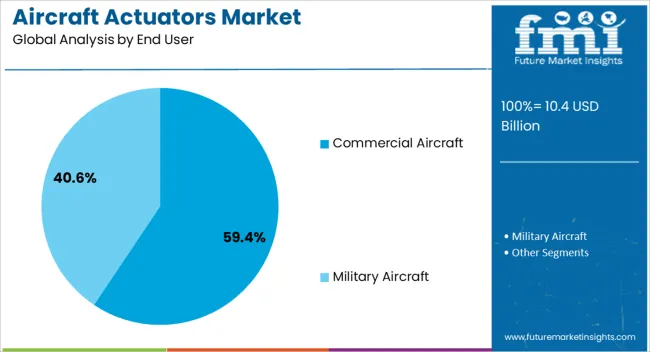

The commercial aircraft segment is expected to capture 59.4% of the aircraft actuators market revenue share in 2025, making it the leading end-user category. This dominance is being driven by rising global passenger traffic, prompting major airlines to expand their fleets and modernize existing aircraft with more efficient systems. The segment is benefiting from increasing demand for lightweight, high-performance actuators that can improve operational efficiency and reduce fuel consumption.

The expansion of low-cost carriers and growth in emerging aviation markets are further contributing to higher procurement rates for new commercial aircraft. Additionally, stringent safety and efficiency regulations are encouraging the adoption of advanced actuator technologies with enhanced reliability and reduced maintenance requirements.

As aircraft manufacturers focus on next-generation models with improved aerodynamics and system integration, commercial aircraft are expected to continue leading actuator demand The combination of new aircraft deliveries, retrofit programs, and ongoing maintenance activities ensures this segment’s sustained leadership in the global market.

The aircraft actuators market is expanding due to rising demand for advanced commercial, military, and UAV aircraft with automated flight controls and precision maneuvering capabilities. North America and Europe lead adoption with highly reliable, electrically and hydraulically driven actuators designed for aerospace safety and performance standards. Asia-Pacific shows rapid growth driven by expanding commercial fleets, defense modernization programs, and UAV applications. Manufacturers differentiate through actuation speed, precision, weight reduction, and reliability. Regional differences in certification standards, aircraft types, and operational environments influence adoption and competitiveness globally.

The growth of commercial and military aircraft fleets is a major driver of aircraft actuator demand. North America and Europe prioritize actuators with high precision, reliability, and long operational lifespans for passenger jets, cargo aircraft, and defense platforms. Asia-Pacific markets are experiencing rapid fleet expansion, including regional jets, defense aircraft, and UAVs, driving demand for cost-effective yet robust actuators. Differences in fleet composition, operational altitude, and mission requirements influence actuator specifications, including power type, control response, and redundancy. Leading suppliers provide lightweight, high-performance actuators with integrated diagnostics and high safety margins, while regional manufacturers focus on adaptable, locally certified alternatives. Fleet expansion contrasts directly affect adoption rates, system reliability, and market competitiveness globally.

Adoption of hydraulic, electric, and electro-mechanical actuators depends on aircraft design, efficiency targets, and control precision. North America and Europe emphasize electric and electro-mechanical actuators for fuel efficiency, weight reduction, and reduced maintenance in next-generation commercial and military aircraft. Asia-Pacific continues to rely on hydraulic actuators for heavy-lift and legacy aircraft while gradually integrating electric systems. Differences in power availability, redundancy requirements, and environmental conditions affect actuator selection, integration complexity, and performance outcomes. Leading suppliers invest in hybrid and electric systems with enhanced control accuracy and thermal management, while regional players provide cost-effective hydraulic options. Actuation technology contrasts shape adoption, operational efficiency, and competitiveness globally.

Compliance with aviation regulations and safety standards is critical for aircraft actuator adoption. North America and Europe enforce strict FAA, EASA, and DO-160/DO-178 certifications to ensure actuator reliability, failure tolerance, and environmental resilience. Asia-Pacific markets adopt international certifications for newer aircraft, while some regional manufacturers follow local standards for legacy or military platforms. Differences in certification timelines, testing rigor, and design validation influence development costs, procurement speed, and system integration. Leading suppliers provide certified, high-reliability actuators with extensive testing and documentation, while regional manufacturers focus on practical compliance solutions. Certification and safety contrasts drive adoption, market trust, and competitive positioning globally.

The rising adoption of UAVs, drones, and unmanned aerial vehicles significantly contributes to the aircraft actuator market growth. North America and Europe emphasize lightweight, precision actuators for UAV applications in surveillance, mapping, and defense missions.

Asia Pacific markets adopt cost-effective actuators for agricultural, logistics, and industrial drone applications. Differences in payload capacity, flight duration, and control complexity influence actuator design, material selection, and integration requirements. Leading suppliers provide compact, low-power, and high-precision actuators with feedback control systems, while regional players focus on affordable, modular designs. UAV adoption influences the shape of actuator demand, technological development, and competitive positioning in both commercial and military aviation sectors globally.

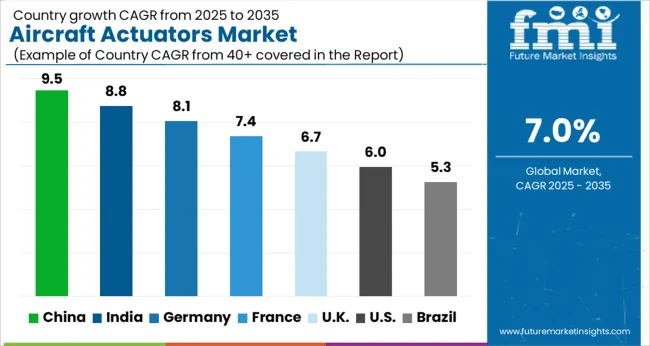

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

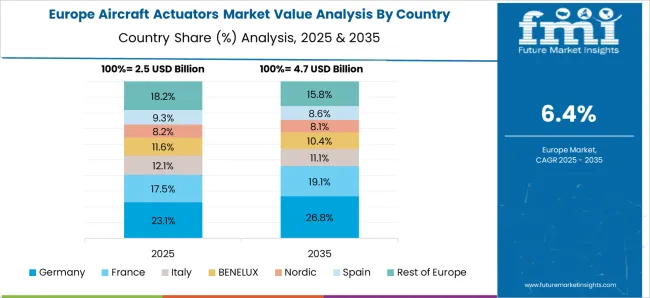

The global aircraft actuators market is projected to grow at a 7.0% CAGR through 2035, driven by demand in commercial aviation, defense aircraft, and unmanned aerial systems. Among BRICS nations, China led with 9.5% growth as large-scale manufacturing and deployment across aerospace and defense sectors were executed, while India at 8.8% expanded production and integration to meet rising regional aviation requirements. In the OECD region, Germany at 8.1% maintained steady adoption under stringent regulatory and quality standards, while the United Kingdom at 6.7% implemented aircraft actuators across commercial and military aviation operations. The USA contributed to market growth through consistent deployment in aerospace applications while adhering to federal and FAA-level regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The aircraft actuators market in China is projected to grow at a CAGR of 9.5%, driven by rising commercial and military aircraft production, modernization programs, and technological adoption in aviation. Adoption is being encouraged by actuators that provide high reliability, precise control, and durability under extreme conditions. Manufacturers are being urged to supply advanced, cost effective, and performance oriented solutions. Distribution through aircraft manufacturers, maintenance providers, and aerospace suppliers is being strengthened. Research in lightweight materials, enhanced actuation mechanisms, and reliability testing is being conducted. Increasing aircraft fleet expansion, government aerospace programs, and growing demand for automated flight control are considered key factors driving the aircraft actuators market in China.

In India, the aircraft actuators market is expected to grow at a CAGR of 8.8%, supported by domestic aircraft manufacturing, defense modernization, and increased civil aviation activity. Emphasis is being placed on actuators that ensure precision, durability, and operational efficiency. Local manufacturers are being encouraged to enhance production capabilities and offer high performance, cost effective solutions. Distribution through aerospace manufacturers, maintenance centers, and defense contractors is being expanded. Awareness programs highlighting performance benefits and maintenance efficiency are being conducted. Expansion of domestic aircraft programs, growth in commercial aviation, and modernization of military fleets are recognized as primary drivers of the aircraft actuators market in India.

Germany is witnessing steady growth in the aircraft actuators market at a CAGR of 8.1%, driven by demand from commercial aviation, defense aircraft, and aerospace maintenance services. Adoption is being encouraged by actuators that offer precision, reliability, and compliance with European aerospace standards. Manufacturers are being urged to supply advanced, lightweight, and high quality solutions. Distribution through aircraft manufacturers, maintenance providers, and aerospace suppliers is being optimized. Research in control accuracy, actuator durability, and automation integration is being pursued. Increasing commercial aircraft operations, defense upgrades, and maintenance service demand are considered key factors driving the aircraft actuators market in Germany.

The aircraft actuators market in the United Kingdom is projected to grow at a CAGR of 6.7%, supported by demand from civil aviation, defense aircraft, and aerospace maintenance services. Adoption is being emphasized for actuators that provide precision, reliability, and efficiency. Manufacturers are being encouraged to supply advanced, lightweight, and cost effective solutions. Distribution through aerospace manufacturers, defense contractors, and maintenance centers is being strengthened. Demonstrations and test programs are being conducted to highlight actuator performance and reliability. Expansion of commercial aircraft operations, defense modernization programs, and maintenance service requirements are recognized as major contributors to the aircraft actuators market in the United Kingdom.

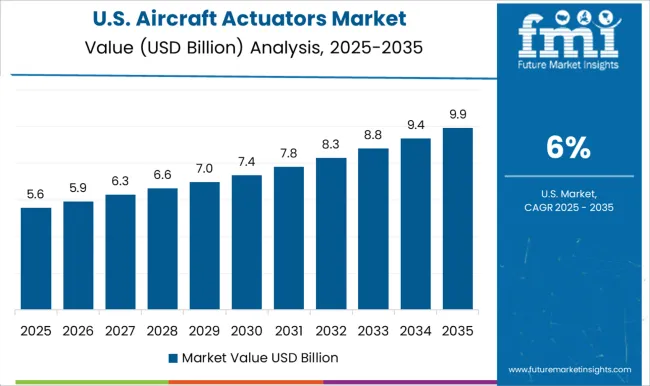

The aircraft actuators market in the United States is projected to grow at a CAGR of 6.0%, driven by rising demand from commercial aviation, defense aircraft, and aerospace maintenance programs. Adoption is being encouraged by actuators that provide high precision, reliability, and durability in extreme conditions. Manufacturers are being urged to develop advanced, lightweight, and cost effective solutions. Distribution through aircraft manufacturers, maintenance centers, and defense contractors is being maintained. Research in control accuracy, actuator automation, and enhanced durability is being pursued. Expansion of commercial airline fleets, defense modernization initiatives, and maintenance service requirements are considered key factors driving the aircraft actuators market in the United States.

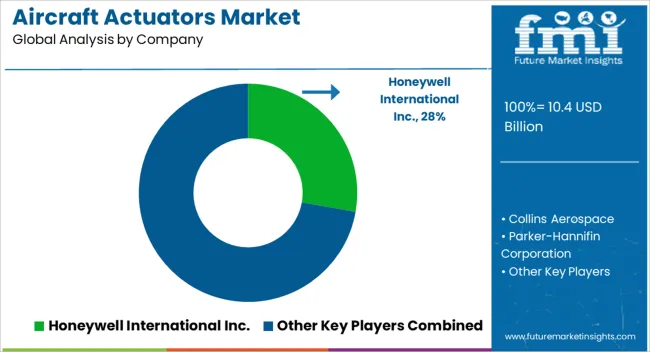

The aircraft actuators market is dominated by a group of leading suppliers that provide essential components for the control and operation of various aircraft systems. Key companies in this sector include Honeywell International Inc., Collins Aerospace, Parker-Hannifin Corporation, Moog Inc., and Eaton. These suppliers deliver a range of actuators, including electro-hydraulic, electric, and pneumatic systems, which are critical for controlling flight surfaces, landing gears, thrust reversers, and other vital aircraft mechanisms. Their technologies are designed to ensure precision, reliability, and safety under demanding aerospace conditions. Honeywell International Inc. and Collins Aerospace are recognized for their advanced, integrated actuator systems that enhance aircraft performance and fuel efficiency. These companies focus on innovation by developing actuators with higher power-to-weight ratios, improved energy efficiency, and enhanced durability to meet stringent aviation standards.

Parker-Hannifin Corporation and Moog Inc. contribute significantly by offering specialized solutions for military and commercial aircraft, emphasizing reliability, redundancy, and ease of maintenance. Their products are widely adopted for critical applications such as flight control, cargo doors, and landing gear actuation. Eaton complements the market with a focus on both civil and defense aviation, providing actuators that are robust, lightweight, and optimized for high reliability. These suppliers collectively drive the growth of the aircraft actuators market through continuous research and development, adherence to rigorous aerospace standards, and the adoption of smart technologies. By integrating advanced materials, digital control systems, and predictive maintenance features, the leading players ensure that modern aircraft operate safely, efficiently, and sustainably, meeting the evolving demands of the aviation industry worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.4 Billion |

| Type | Linear and Rotary |

| System | Hydraulic Actuators, Electrical Actuators, Pneumatic Actuators, and Mechanical Actuators |

| End User | Commercial Aircraft and Military Aircraft |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc., Collins Aerospace, Parker-Hannifin Corporation, Moog Inc., and Eaton |

| Additional Attributes | Dollar sales vary by actuator type, including hydraulic, electric, and electro-mechanical actuators; by application, such as flight control systems, landing gear, thrust reversers, and cargo doors; by end-use, spanning commercial aircraft, military aircraft, and business jets; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising aircraft production, retrofit demand, and advanced automation in aerospace systems. |

The global aircraft actuators market is estimated to be valued at USD 10.4 billion in 2025.

The market size for the aircraft actuators market is projected to reach USD 20.5 billion by 2035.

The aircraft actuators market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in aircraft actuators market are linear and rotary.

In terms of system, hydraulic actuators segment to command 35.2% share in the aircraft actuators market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA