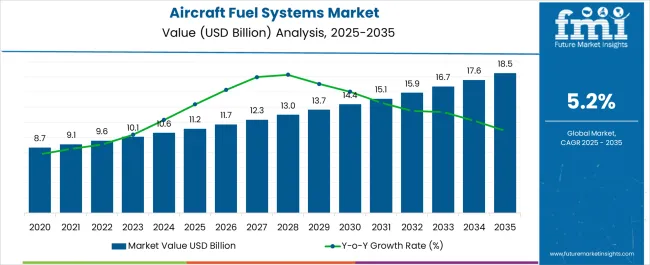

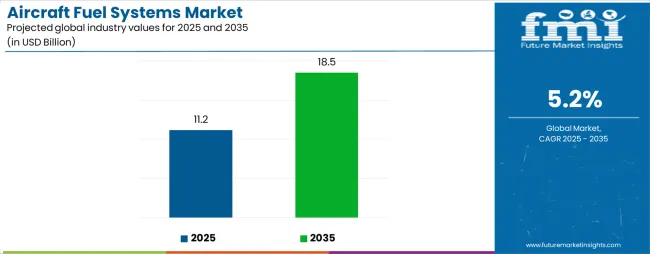

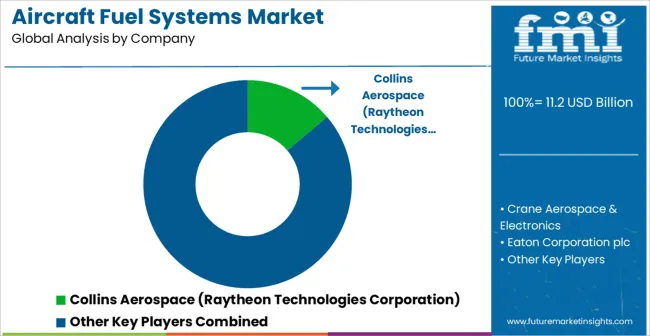

The Aircraft Fuel Systems Market is estimated to be valued at USD 11.2 billion in 2025 and is projected to reach USD 18.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Aircraft Fuel Systems Market Estimated Value in (2025 E) | USD 11.2 billion |

| Aircraft Fuel Systems Market Forecast Value in (2035 F) | USD 18.5 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Aircraft Fuel Systems market is experiencing steady growth, driven by the increasing demand for fuel-efficient and reliable aircraft across commercial and defense aviation sectors. Rising air travel, expanding cargo operations, and modernization of existing fleets are accelerating the adoption of advanced fuel system technologies. Fuel systems are critical for optimizing engine performance, reducing operational costs, and ensuring safety and compliance with environmental regulations.

Innovations in fuel metering, monitoring, and management systems, combined with integration of digital sensors and automated controls, are enhancing operational efficiency and reducing fuel consumption. The growing emphasis on sustainability and emission reduction is further boosting the adoption of advanced aircraft fuel systems.

Investments in research and development by aircraft manufacturers, coupled with regulatory mandates for optimized fuel usage, are shaping market trends As airlines and defense operators seek reliability, efficiency, and reduced lifecycle costs, the aircraft fuel systems market is expected to witness robust growth, supported by technological advancements and increasing fleet expansions globally.

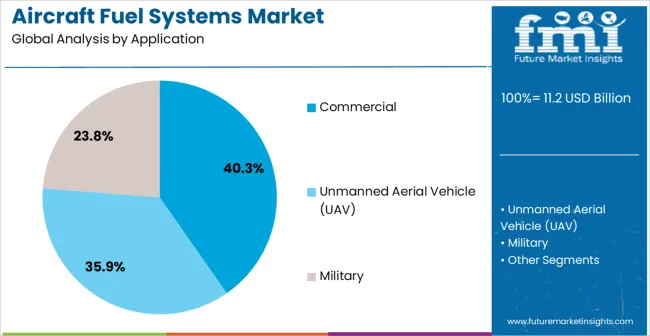

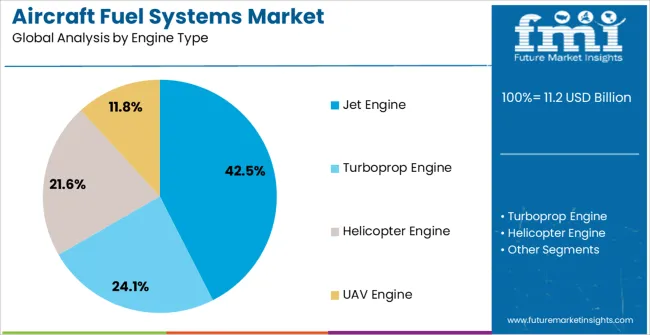

The aircraft fuel systems market is segmented by application, engine type, and geographic regions. By application, aircraft fuel systems market is divided into Commercial, Unmanned Aerial Vehicle (UAV), and Military. In terms of engine type, aircraft fuel systems market is classified into Jet Engine, Turboprop Engine, Helicopter Engine, and UAV Engine. Regionally, the aircraft fuel systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The commercial application segment is projected to hold 40.3% of the market revenue in 2025, establishing it as the leading application area. Its growth is driven by the expansion of passenger and cargo airline operations, which are placing increased demand on fuel system efficiency and reliability. Advanced fuel systems in commercial aircraft enable real-time monitoring of fuel levels, flow rates, and consumption patterns, improving operational planning and reducing wastage.

Integration with digital flight management and engine monitoring systems enhances overall efficiency and safety. Airlines are increasingly prioritizing fuel management solutions that can reduce operational costs while complying with environmental regulations and emission targets.

The adoption of automated and predictive fuel management technologies allows airlines to optimize routes, reduce fuel consumption, and enhance performance reliability As global air travel continues to grow and operational efficiency remains a priority, commercial aircraft are expected to remain the largest driver of market growth in the aircraft fuel systems sector, with solutions focused on efficiency, safety, and compliance continuing to lead adoption.

The jet engine type segment is anticipated to account for 42.5% of the market revenue in 2025, making it the leading engine category. Growth in this segment is being driven by the widespread use of jet engines in commercial airliners, business jets, and military aircraft, where efficiency, reliability, and performance optimization are critical. Aircraft fuel systems for jet engines are designed to ensure precise fuel delivery, prevent combustion instability, and maintain engine safety across varying flight conditions.

Integration of electronic fuel control systems, digital sensors, and automated monitoring enables improved fuel efficiency and real-time operational management. Increasing focus on reducing emissions, lowering operational costs, and enhancing engine performance further reinforces adoption.

The ability to integrate fuel systems with engine health monitoring and predictive maintenance platforms ensures reduced downtime and improved lifecycle performance As airlines and military operators continue to invest in jet engine fleets, the segment is expected to maintain its leading market share, supported by technological advancements in fuel management and control systems that optimize efficiency and reliability.

Aircraft fuel systems comprise components that ensure uniform flow of clean fuel under constant pressure to the engine under all operating conditions. Aircraft fuel systems differ greatly depending upon the size and type of aircraft in which they are installed. In a most basic arrangement a fuel system will generally consist of a fuel tank associated with fuel lines, which connect to the aircraft engine, however, in cargo aircrafts a fuel system may consist of multiple fuel tanks.

Moreover, the type of fuel systems vary for different applications such as commercial, military and UAV. A fuel tank consists of various components for performing desired operation such as pumps, piping, gauges, valves, filters and inserting systems. Furthermore, aircraft fuel systems are designed in such a way that it reduces the maintenance cost of the system.

Maintenance and servicing of aircraft fuel systems is done on regular basis for optimizing the performance of the components and system as a whole. Engines such as jet engines consist of emergency system to supply fuel in case of failure of main aircraft fuel system. Moreover, in some cases the emergency aircraft fuel system is duplicate of the main system.

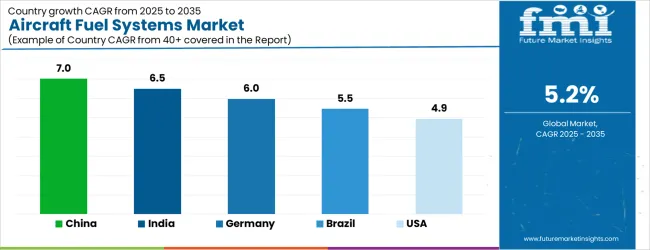

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| Brazil | 5.5% |

| USA | 4.9% |

| UK | 4.4% |

| Japan | 3.9% |

The Aircraft Fuel Systems Market is expected to register a CAGR of 5.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.0%, followed by India at 6.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.9%, yet still underscores a broadly positive trajectory for the global Aircraft Fuel Systems Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.0%. The USA Aircraft Fuel Systems Market is estimated to be valued at USD 4.0 billion in 2025 and is anticipated to reach a valuation of USD 4.0 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 517.9 million and USD 301.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.2 Billion |

| Application | Commercial, Unmanned Aerial Vehicle (UAV), and Military |

| Engine Type | Jet Engine, Turboprop Engine, Helicopter Engine, and UAV Engine |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Collins Aerospace (Raytheon Technologies Corporation), Crane Aerospace & Electronics, Eaton Corporation plc, GE Aviation, GKN Aerospace, Honeywell International Inc., Marshall Aerospace and Defence Group, Meggitt PLC, Parker Hannifin Corp., Robert Bosch GmbH, Safran SA, Secondo Mona S.p.A, Trelleborg AB, Triumph Group, Inc., and Woodward Inc. |

The global aircraft fuel systems market is estimated to be valued at USD 11.2 billion in 2025.

The market size for the aircraft fuel systems market is projected to reach USD 18.5 billion by 2035.

The aircraft fuel systems market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in aircraft fuel systems market are commercial, unmanned aerial vehicle (uav) and military.

In terms of engine type, jet engine segment to command 42.5% share in the aircraft fuel systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Fuel System Market

Aircraft Refueling Hose Market

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Washing Systems Market Analysis - Size, Share & Forecast 2025 to 2035

Fuel rail for CNG Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Communication Systems Market

Aircraft Seat Actuation Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Commercial Aircraft Video Surveillance Systems Market Growth - Trends & Forecast 2025 to 2035

Demand for Gas & Dual-Fuel Injection Systems in USA Size and Share Forecast Outlook 2025 to 2035

Digital Glass Military Aircraft Cockpit Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA