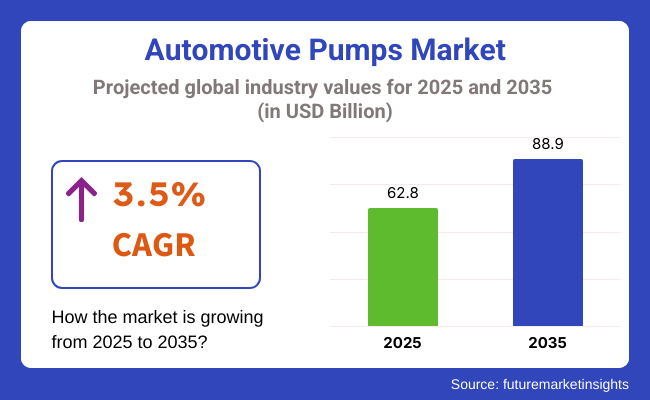

The automotive pumps market is projected to grow from USD 62.8 billion in 2025 to USD 88.9 billion by 2035, advancing at a compound annual growth rate (CAGR) of 3.5% over the forecast period. This growth is being supported by increased deployment of efficient fluid handling systems across ICE and hybrid vehicle platforms.

Continued market momentum has been enabled through the integration of electronically controlled pump technologies that improve precision across lubrication, cooling, and fuel injection circuits. OEM platforms are being equipped with variable-displacement and electric oil pumps, allowing for enhanced compliance with fuel economy and emissions regulations across North America, Europe, and Asia.

In January 2025, a commitment to precision fluid dynamics was reaffirmed by Continental AG. During an interview with Motoring Trends, Prashanth Doreswamy, President and CEO of Continental India, remarked that “energy efficiency is being deeply re-engineered in components like electric vacuum pumps, which reduce engine load while maintaining braking reliability.”

In its 2025 earnings report, Bosch Automotive Steering confirmed that production volumes for electric steering pumps had increased, attributed to robust demand from global EV platform launches. These developments were highlighted in the 2025 Bosch Mobility Solutions Report.

Fuel pump technologies are also being adapted to address evolving emission norms. In April 2024, Denso Corporation introduced a new high-pressure fuel pump unit, engineered for gasoline direct injection systems. The component was claimed to deliver a 15% improvement in flow rate alongside enhanced atomization.

Amidst rising electrification, thermal and fluid management systems are transforming. Pump systems are being increasingly integrated with vehicle Electronic Control Units (ECUs) and advanced thermal modules, particularly in battery electric and plug-in hybrid electric vehicle platforms. This trend is expected to drive product complexity, encourage modular pump architectures, and spur regionalized manufacturing strategies through 2035.

Regulatory support for low-emission technologies, coupled with advancements in electrohydraulic integration, is expected to shape competitive dynamics in this market. Component makers are being tasked with ensuring thermal efficiency, durability, and digital adaptability, key criteria identified in recent technical guidelines issued by the European Automobile Manufacturers’ Association (ACEA) and the International Council on Clean Transportation (ICCT).

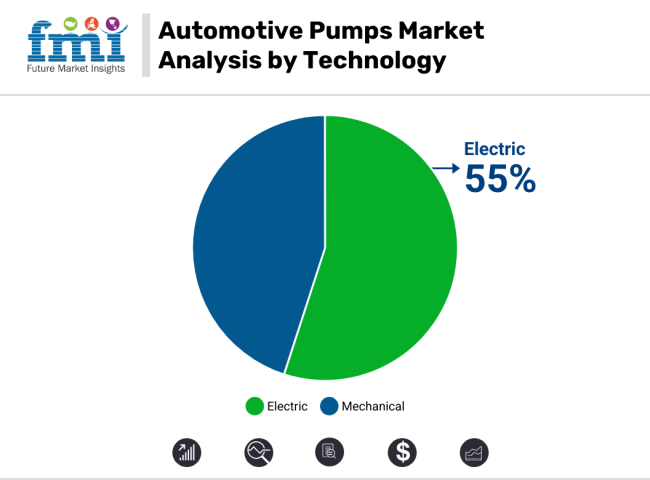

By 2025, electric automotive pumps are projected to account for approximately 55% of the total market value, reflecting a compound annual growth rate (CAGR) of 5.3% over the assessment period. This transition is being driven by the increasing electrification of vehicle systems and the emphasis placed on enhancing energy efficiency across internal combustion and electric vehicle platforms. Conventional mechanical and belt-driven pumps are being steadily replaced by electric alternatives, enabling more precise fluid control, reducing energy losses, and supporting compliance with stringent emission norms.

Greater adoption has been observed in applications such as engine cooling, fuel delivery, transmission lubrication, and vacuum generation for braking systems. The growing deployment of 48V mild hybrids and fully electric powertrains has further reinforced the demand for electrically actuated pumps. As vehicle architectures continue to shift toward modular, electrified systems, electric pumps are being prioritized for their operational flexibility and integration potential. This trend is expected to reshape supplier positioning and influence future component sourcing strategies across the industry.

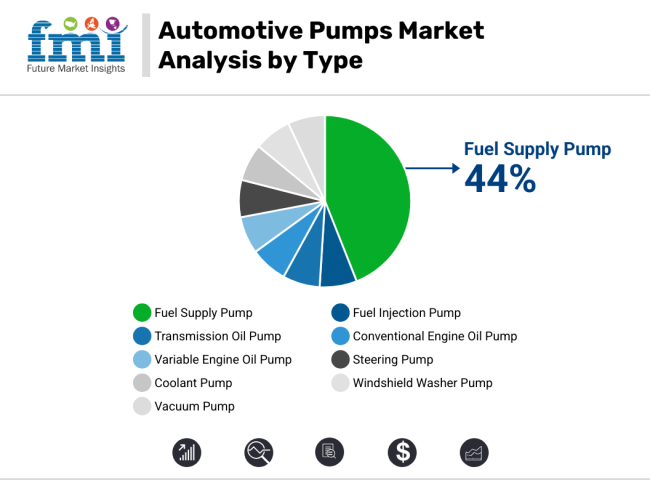

Fuel supply pumps are expected to account for approximately 44% of total automotive pump sales by 2025, reflecting their critical role in both internal combustion engine (ICE) and hybrid vehicle platforms. This category of automotive pumps is expected to exhibit a CAGR of 3.8% over the forecast period. This dominance is being sustained by the continued production of gasoline and diesel-powered vehicles, particularly in cost-sensitive and emission-regulated markets across Asia and Eastern Europe. Significant investments have been made to enhance pump durability, pressure handling, and compatibility with alternative fuels, including ethanol blends and biodiesel.

As stricter fuel economy and emission standards are enforced globally, automakers are prioritizing high-performance fuel delivery systems to optimize combustion and reduce particulate generation. Furthermore, the aftermarket demand for fuel supply pumps has remained resilient, supported by the aging vehicle parc and periodic replacement cycles. Technological upgrades, including the integration of brushless motors and modular pump assemblies, have also been widely adopted, reinforcing the segment’s strong market presence throughout the forecast period.

Electrification Effects on Traditional Pump Systems

The gradual shift towards battery electric vehicles (BEVs) over an upcoming year is a concern for the long-term development of mechanical and engine-driven components, such as fuel injection, oil circulation, and vacuum pumps, battery electric vehicles, on the distribution of the electric and software-driven pump systems, reducing the demand for traditional setups.

Although the transition will take time, particularly in emerging markets, manufacturers must prepare by reallocating R&D toward EV-compatible solutions, such as coolant pumps for battery thermal management and e-drive lubrication systems.

Entry Barriers and Design Complexity

Manufacturers face challenging times, requiring them to address specific issues related to the production of compact, multi-functional, and low-noise pump units. The integration of sensor-enabled, electronically controlled pumps requires precise engineering and material selection, which can increase production and development costs.

OEMs are not only requiring longer life cycles and less maintenance for critical safety and performance applications, but they are also creating technical challenges that need to be tackled concerning durability, fluid, compatibility, and heat resistance.

Growth in Hybrid and Electrified Powertrains

Hybrid vehicles, including HEVs, PHEVs, and mild hybrids with 48V systems, still utilize a combination of mechanical and electrical pumps for engine cooling, brake support, and transmission lubrication. The rise in this area also brings the need for adaptive, variable-speed, and low-voltage pumps that collectively increase system efficiency.

Electric pumps, such as e-water pumps and e-oil pumps, enable auxiliary systems to function independently of engine speed, thereby reducing emissions and optimizing start-stop performance. Companies that provide modules for hybrid, energy-efficient pump systems will greatly benefit from such schemes.

Utilization of Smart Pump Technologies in the Next-Generation Vehicles

The old cars, being smart, and the connected powertrains coming up with innovative ideas are the best examples of a pump-incorporating vehicle with vehicle electronics, control units, and diagnostic systems. Smart pumps can control the flow based on temperature, load, and road conditions, ensuring efficient vehicle operation and facilitating predictive maintenance.

As OEMs embrace mechatronics and sensor-driven systems, demand is increasing for pumps that provide feedback loops, adaptive control, and self-diagnostics, particularly in luxury, performance, and autonomous vehicles. Along with the long-term competitiveness, the businesses that are in tune with the patterns of intelligent mobility and system integration will have good prospects.

The United States automotive pump market is witnessing a moderate growth, supported by the presence of the internal combustion engine and hybrid vehicles, along with the increased use of electric coolant and fuel pumps in the latest vehicle generation. Additionally, the use of turbocharged engines and start-stop systems is further increasing the demand for vacuum and lubricant pumps.

Even with a strong aftermarket for maintenance and replacement of components, as well as the focus of OEMs on the improvement of fuel economy and emission control, the market for oil, fuel, and water pumps is not suffering. The USA is also seeing the implementation of EPW as part of thermal management in electric vehicles (EVs) and hybrids.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.6% |

The UK automotive pump market is experiencing gradual growth, driven by a steady shift toward mild hybrid and electric vehicles, which utilize electric coolant and vacuum pumps to enhance efficiency. Although full-electric vehicle (EV) adoption is increasing, internal combustion engine (ICE) and hybrid vehicles still dominate the current fleet, ensuring continued demand for fuel, transmissions, and oil pumps.

Moreover, government incentives for electrification and enhanced engine cooling and battery thermal management systems in EVs are driving the shift toward electric auxiliary pumps.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.3% |

The European Union automotive pump market is expanding steadily, primarily driven by the strong presence of automotive manufacturing in Germany, France, and Italy. The adoption of mild hybrid and plug-in hybrid vehicles (MHEVs and PHEVs) is instrumental to the development of electric coolant, fuel delivery, and oil circulation pumps.

EU emission regulations are encouraging manufacturers to incorporate energy-efficient pumps into their production processes to minimize friction losses, thereby enhancing fuel efficiency. High-efficiency pump systems are also crucial in the thermal management of EVs, as the control of the battery's temperature is a primary factor affecting performance.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.5% |

The Japanese automotive pump market is rising at a moderate rate, since the automobile industry places the hybrid electric cars (HEVs) on the top. Japanese manufacturers, such as Toyota, Honda, and Nissan, are utilizing high-efficiency electric fuel, coolant, and oil pumps to maximize the performance of both the engine and the battery.

The demand for mechanical pumps remains stable in conventional cars, but with the increasing use of hybrid power plants, the need for electronic control-based pump systems is also rising. Japan is also a pioneer in the development of small and low-noise pump technologies, which are especially suitable for urban and compact vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.2% |

The South Korean automotive pump market is experiencing robust growth, thanks to its strong presence in the compact sedan, SUV, and hybrid vehicle markets, which are driven by OEMs such as Hyundai, Kia, and Genesis. The increasing share of PHEVs and BEVs in the market is, in turn, encouraging the growth of electric water pumps, battery cooling pumps, and electric transmission oil pumps.

At the supplier side, South Korean manufacturers are also exploring the modular pump design for global market,s featuring lightweight, high-durability pumps for electric and gas vehicles. The move towards electric mobility is further supported by the increase in domestic electric vehicle (EV) sales.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

The automotive pump market plays a vital role in vehicle functionality by supporting the circulation of fluids through lubrication, cooling, fuel injection, transmission, and steering systems. These pumps are important for the ICE, hybrid, or electric vehicles (EVs). The automotive pump is being reformulated in both design and application due to the global shift toward emission reduction, thermal efficiency, and electrification.

The growing demand for fuel-efficient vehicles, rising adoption of electrically driven pumps, and increased integration of advanced thermal management systems in electric vehicles are driving innovation. In the market, it is moderately firm. Five leading companies collectively manage a turnover share of 48%-52 % for the global market, while many small local producers and some specialized companies cater to niche OEM and aftermarket requirements.

The global Automotive Pump Market is projected to reach USD 62.8 billion by the end of 2025.

The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 3.5% over the forecast period from 2025 to 2035.

By 2035, the Automotive Pump Market is expected to reach approximately USD 88.9 billion, driven by the automotive demand, especially in utility vehicles and commercial fleets.

Key players in the Automotive Pump Market include Bosch, Denso Corporation, Continental AG, and Aisin Seiki Co., Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Pump, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Pump, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 8: Global Market Volume (Units) Forecast by Technology, 2017 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 10: Global Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Pump, 2017 to 2033

Table 14: North America Market Volume (Units) Forecast by Pump, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 18: North America Market Volume (Units) Forecast by Technology, 2017 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 20: North America Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Pump, 2017 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Pump, 2017 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Technology, 2017 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Pump, 2017 to 2033

Table 34: Europe Market Volume (Units) Forecast by Pump, 2017 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 36: Europe Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 38: Europe Market Volume (Units) Forecast by Technology, 2017 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 40: Europe Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2017 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Pump, 2017 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Pump, 2017 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Technology, 2017 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2017 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Pump, 2017 to 2033

Table 54: MEA Market Volume (Units) Forecast by Pump, 2017 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 56: MEA Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 58: MEA Market Volume (Units) Forecast by Technology, 2017 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2017 to 2033

Table 60: MEA Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Pump, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Pump, 2017 to 2033

Figure 11: Global Market Volume (Units) Analysis by Pump, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Pump, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Pump, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 15: Global Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 19: Global Market Volume (Units) Analysis by Technology, 2017 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 23: Global Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Pump, 2023 to 2033

Figure 27: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 28: Global Market Attractiveness by Technology, 2023 to 2033

Figure 29: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Pump, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Pump, 2017 to 2033

Figure 41: North America Market Volume (Units) Analysis by Pump, 2017 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Pump, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Pump, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 45: North America Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 49: North America Market Volume (Units) Analysis by Technology, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 53: North America Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Pump, 2023 to 2033

Figure 57: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 58: North America Market Attractiveness by Technology, 2023 to 2033

Figure 59: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Pump, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Pump, 2017 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Pump, 2017 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Pump, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Pump, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Technology, 2017 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Pump, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Pump, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Pump, 2017 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Pump, 2017 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Pump, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Pump, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Technology, 2017 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 116: Europe Market Attractiveness by Pump, 2023 to 2033

Figure 117: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 118: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 119: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Pump, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Pump, 2017 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Pump, 2017 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Pump, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Pump, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Technology, 2017 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Pump, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Pump, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Pump, 2017 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Pump, 2017 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Pump, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Pump, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Technology, 2017 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2017 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 176: MEA Market Attractiveness by Pump, 2023 to 2033

Figure 177: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 178: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 179: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Fuel Transfer Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive Variable Displacement Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electro-hydraulic Power Steering Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA