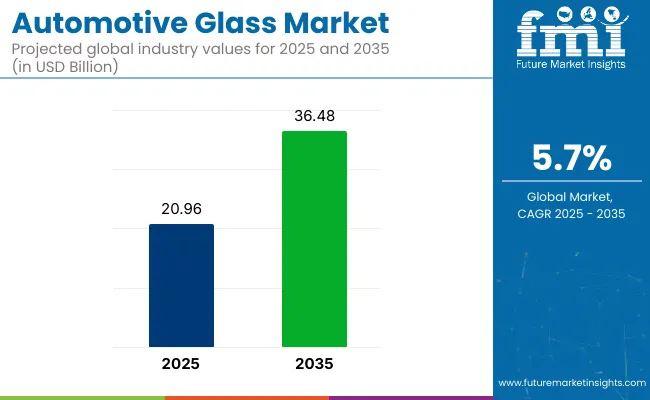

The global automotive glass market is valued at USD 20.96 billion in 2025 and is poised to garner USD 36.48 billion by 2035, reflecting a compound annual growth rate CAGR of 5.7% during the forecast period. The increasing production of passenger and commercial vehicles, particularly in emerging economies like China, India, and Brazil, is driving demand for advanced automotive glass solutions.

| Attributes | Description |

|---|---|

| Estimated Global Automotive Glass Industry Size (2025) | USD 20.96 billion |

| Projected Global Automotive Glass Industry Value (2035) | USD 36.48 billion |

| Value-based CAGR (2025 to 2035) | 5.7% |

Moreover, the rise in adoption of electric and autonomous vehicles is encouraging manufacturers to integrate specialized glass such as solar control, acoustic, and HUD-compatible glass. These factors, coupled with growing consumer preference for enhanced safety, comfort, and aesthetics, are expected to fuel market growth consistently during the forecast period.

Technological advancements are further influencing the market, with the development of smart glass, self-healing glass, and switchable glass becoming more prominent and commercially viable. The rising popularity of panoramic sunroofs, larger windshields, and display-integrated glass in premium and mid-range vehicles is boosting the demand for high-performance and lightweight glass solutions.

Additionally, increasing environmental awareness is compelling automakers to use recyclable, durable, and energy-efficient glass materials to improve vehicle fuel economy and reduce carbon emissions. The focus on lightweight glass also aligns with the broader industry trend toward reducing vehicle weight for enhanced energy efficiency, driving performance, and overall vehicle sustainability.

Government regulations globally are reinforcing this market momentum by mandating strict safety and performance standards for automotive glazing. Regulatory bodies like the National Highway Traffic Safety Administration (NHTSA) in the USA and Euro NCAP in Europe have set guidelines for the use of laminated and tempered glass to improve occupant protection during accidents and collisions.

Moreover, standards requiring optical clarity, UV protection, and shatter resistance are prompting manufacturers to invest in advanced glass technologies. Incentives promoting the use of recyclable, energy-saving, and sustainable materials are also shaping product development, ensuring that automotive glass solutions meet both environmental and safety expectations worldwide.

The industry was projected to be at a CAGR of 5.3% in the first half (H1) of 2024. However, in the second half (H2), there is a noticeable increase in the growth rate of 5.6%.

| Particulars | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.3% |

| H2 (2024 to 2034) | 5.6% |

| H1 (2025 to 2035) | 5.5% |

| H2 (2025 to 2035) | 5.8% |

From H1 2025 to H2 2035, the CAGR is projected to slightly decrease to 5.5% in the first half and then increase to 5.8% in the second half.

The market is segmented based on glass type, application, vehicle type, sales channel, and region. By glass type, the market is divided into laminated glass and tempered glass. Based on application, the market is categorized into windshield, back glass, door glass, quarter glass, vent glass, and moon/sun roof. In terms of vehicle type, the market is segmented into passenger vehicles, light commercial vehicles, heavy commercial vehicles, and electric vehicles. Passenger vehicles are further classified into compact, mid-size, luxury, and SUV.

Electric vehicles are segmented into BEV (Battery Electric Vehicles), HEV (Hybrid Electric Vehicles), and PHEV (Plug-In Hybrid Electric Vehicles). Based on sales channel, the market is divided into OEM and aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and Middle East & Africa.

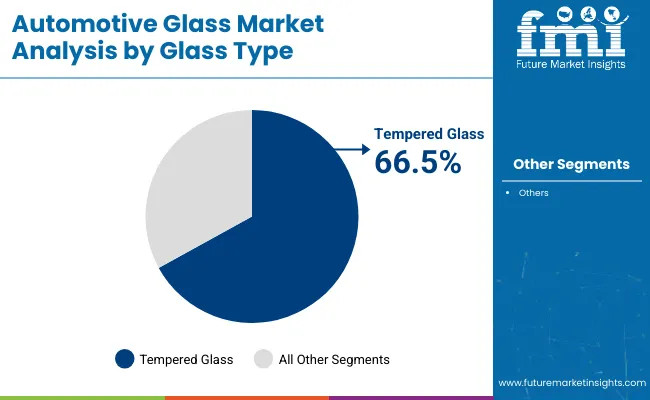

Tempered glass is projected to be the leading glass type in the automotive glass market, accounting for a commanding 66.5% market share in 2025. This dominance is driven by several favorable attributes that make tempered glass the preferred choice among automakers and aftermarket suppliers. Its key advantage lies in its inherent safety feature, when broken, tempered glass shatters into small, blunt pieces that are less likely to cause serious injury, unlike regular glass that breaks into sharp shards. This property is crucial for side and rear windows where passenger safety is paramount.

| Glass Type Segment | Market Share (2025) |

|---|---|

| Tempered Glass | 66.5% |

Additionally, tempered glass is cost-effective compared to laminated glass, making it an economically viable option for mass vehicle production without compromising on quality and safety. Its resistance to thermal stress and impact also enhances its longevity in various climatic conditions.

The demand for tempered glass is further supported by the rising need for replacements in the automotive aftermarket, driven by accidental damage and wear over time. Moreover, as global automakers emphasize lightweight and durable materials to improve vehicle fuel efficiency and safety performance, tempered glass is likely to sustain its leading position in the industry, fulfilling both functional and economic requirements of the automotive sector.

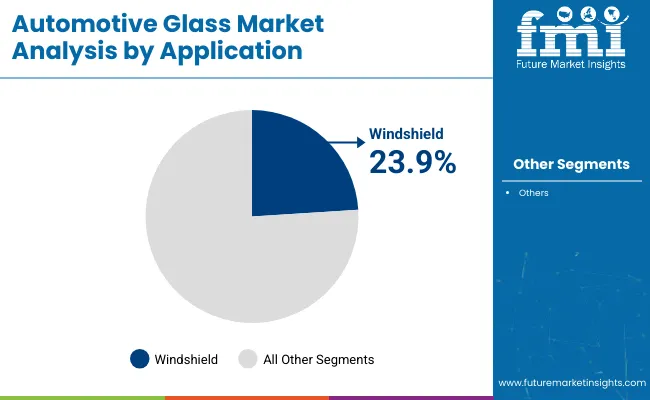

The windshield segment is expected to continue its leadership in the automotive glass market by application, securing a 23.9% market share in 2025. Windshields are critical components of a vehicle’s structure, providing essential protection against wind, road debris, rain, and harmful ultraviolet radiation.

| Application Segment | Market Share (2025) |

|---|---|

| Windshield | 23.9% |

Modern windshields are primarily constructed from laminated glass, a material that prevents shattering upon impact, ensuring passenger safety while preserving the vehicle’s structural rigidity during collisions. High replacement frequency is another factor sustaining windshield demand, as this component is particularly vulnerable to cracking and chipping from stones, debris, and accidents. In the automotive aftermarket, windshields represent the most frequently replaced glass part due to their exposure and large surface area.

Moreover, the increasing adoption of advanced driver assistance systems (ADAS), which often require precision-fitted windshields embedded with sensors and cameras, has further spurred the demand for technologically advanced windshield products.

As global vehicle sales and usage continue to grow and as stringent road safety regulations become widespread, the need for high-quality, durable windshields will persist. The segment's robust performance is thus assured throughout the forecast period, supported by both original equipment and aftermarket replacement needs.

The electric vehicles (EV) segment is projected to record the highest CAGR of 7.1% from 2025 to 2035 in the automotive glass market. This robust growth is fueled by the global transition toward sustainable mobility solutions, driven by supportive government regulations, stricter emission norms, and the rising adoption of clean energy alternatives.

Automakers in regions such as North America, Europe, and Asia Pacific are increasingly focusing on battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs), all of which require specialized glass solutions to meet evolving design and performance demands.

The need for lightweight, durable, and multi-functional glass in EVs is growing rapidly, as reducing vehicle weight directly impacts battery efficiency and overall driving range. Features such as panoramic sunroofs, insulated side glass, acoustic glazing, and solar control coatings are becoming standard to enhance passenger comfort and energy efficiency.

Additionally, innovations like electrochromic or smart glass are being incorporated into EV models by industry leaders such as Tesla, BYD, and Volkswagen. These factors are expected to drive significant demand for advanced automotive glass solutions in the EV segment throughout the forecast period.

| Vehicle Type Segment | CAGR (2025 to 2035) |

|---|---|

| Electric Vehicles | 7.1% |

The OEM (Original Equipment Manufacturer) segment is expected to dominate the automotive glass market with a consistent CAGR of 4.0% during the forecast period from 2025 to 2035. The expansion of global vehicle production, especially in automotive hubs such as China, India, Germany, and the United States, is contributing to the sustained demand for OEM-fitted glass products.

OEMs are prioritizing the adoption of high-performance glass materials like laminated, tempered, and solar control glass to comply with enhanced safety standards, regulatory norms, and consumer expectations for noise reduction and thermal comfort.

Additionally, technological advancements, such as the integration of heads-up displays (HUD) and advanced driver assistance systems (ADAS), require precision manufacturing and coating of windshields and other glass components, driving demand in the OEM channel.

Automakers are also focusing on incorporating panoramic sunroofs, smart glazing, and lightweight glass materials into new vehicle models to improve aerodynamics and energy efficiency. This continuous innovation in design and technology is sustaining the relevance of the OEM sales channel, ensuring that it remains the preferred route for high-quality, technologically advanced automotive glass products during the forecast period.

| Sales Channel Segment | CAGR (2025 to 2035) |

|---|---|

| OEM | 4% |

Increased Demand for Electric Vehicles

Expansion of the electric vehicle sector has led to a heightened demand for automotive glass. It is indicative of a situation where demand for glass used for making electric vehicles is forecasted to continue soaring as emission-friendly vehicles gain acceptance in the global market and further countries set ambitious targets to embrace such vehicles.

The worldwide electric-powered motor industry is ready to strengthen its hold globally at a promising CAGR of 21% from 2025 to 2035. This will increase demand for automotive glass significantly.

Governments internationally are increasingly prioritizing sustainability and emissions reduction. Due to this, EV adoption rates are skyrocketing. Countries are enforcing stringent guidelines and providing incentives for EV adoption. The goal is to accelerate the shift far from inner combustion engines toward electric-powered propulsion.

This regulatory environment and advancements in battery generation and charging infrastructure, is driving consumer self-assurance and boosting EV sales. This boom immediately translates into a heightened call for automotive glass, as every electric vehicle requires automotive glass.

The automotive glass market experienced a CAGR of 2% from 2020 to 2024. The market size of USD 18.76 billion in 2023 was projected.

The pandemic impacted consumer purchasing power. This led to a decline in demand for goods and a subsequent drop in industrial production. This directly affected automotive glass production. As a result, lower purchasing power contributed to decreased sales of vehicles. The pandemic caused global supply chain disruptions. This resulted in a temporary downturn in the market.

The growth reflects a recovery in consumer confidence and an ongoing demand for vehicle upgrades and replacements. This is positioning the automotive glass industry for a promising future. The customization of vehicles by incorporating advanced functions such a panoramic glass roofs, and tinted glasses among others will create demand for automotive glasses.

Also, the aftermarket segment will increase the total demand as it is evident that there will be the need to replace these glasses as a result of wear and tear and even accidents. Increasing adoption of electric vehicles will create the need for more advanced glass technologies for example lighter glasses compared to traditional ones.

The automotive glass industry is moderately consolidated among leading manufacturers. The leading players account for more than 45%-50% of the automotive glass market share. Tier-I players hold around of total share. They leverage their extensive expertise in manufacturing and a broad geographical reach. Fuyao Glass Industry Group Co. Ltd., Magna International Inc. and Guardian Industries.

Tier-II Players hold 20%-25% of total value share. They may specialize in specific types of glass or serve niche end uses within the industry Nippon Sheet Glass Co., Ltd, AGC Inc., XINYI GLASS HOLDINGS LIMITED, Saint-Gobain S.A., Central Glass Co. Ltd., Gentex Corporation, Vitro, S.A.B. de C.V, Dura Automotive System LLC and a few others are the prominent players in the Tier-II players.

In the automotive glass industr, Tier-III Players hold 40%-45% of the total share. Tier 3 companies are smaller and more specialized compared to Tier 1 and Tier 2 manufacturers. They often focus on local or regional trade, niche applications, or specific types of glass. These companies are mostly domestic players with smaller production capacities and are heavily reliant on intra-region trade and domestic demand.

The section analyzes the automotive glass market by country, including China, India, Japan, Italy, and Canada. The table presents the projected CAGRs for each country, indicating their expected future contribution to the sector growth from 2025 to 2035. China is estimated to hold a prominent industry volume share in global trade. Also, Japan holds a prominent share in global trade and shows a promising growth of 6.7% over the forecast period.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 8.5% |

| Japan | 6.7% |

| Italy | 6.4% |

| India | 6.2% |

| Canada | 5.6% |

China tops the automotive glass market in Asia. Chinese automotive glass market is forecasted to experience a CAGR of 8.5% from 2025 to 2035. The country is a major player in automobile production with its highly skilled production units. It has a large manufacturing sector, which helps the country boost its production volume. The rising middle-class population in China creates the need for vehicles. In China, there is a huge consumer base of vehicles that drives the demand for automotive glass in the aftermarket.

The Indian automotive glass industry is projected to register a CAGR of 6.2% from 2025 to 2035. India is an attractive destination for manufacturers in this sector. The country has inexpensive labor and lower production costs. Global and domestic automotive glass manufacturers are ramping up their production capacities in India. They are upscaling to cater to the growing demand for electric vehicles.

Populace in India prefers the inclusion of sunroofs into their vehicles to keep up with the changing automobile landscape. This provides a great opportunity for glass manufacturers to tap into the newly emerging sunroof segment in medium to highly expensive cars segment.

The automotive glass market in Japan is poised to grow at a CAGR of 6.7% from 2025 to 2035. Japan is second largest automotive industry in East Asia. Major automotive manufacturers here are Toyota, Honda, Nissan, Mazda, Suzuki, Subaru, Daihatsu, and Mitsubishi.

The advanced automotive sector holds credit for its development worldwide. Nippon Sheet Glass Co., Ltd. and other companies are increasing their investments to expand their production facilities. The rising electric vehicle adoption culture in Japan will drive the automotive glass market.

This section helps business owners to understand sector trends, fostering competitive advantage and sustainable business growth. It insights into competitive dynamics.

The market participants are strategically focusing on the introduction of high durability and lightweight glass along with investments in expanding production capacities. For example, Saint-Gobain’s acquisition of Adfil NV and its pioneering hydrogen-based glass production shows the company’s commitment to innovation. Fuyao Glass's substantial investments in new factories in North America and Asia demonstrate its strategy to enhance production capabilities.

Industry Updates

Glass types included in the study are laminated and tempered glass.

The report includes six types of categories under by application segment windshield, back glass, door glass, quarter glass, vent glass, and moon/sun roof.

Vehicle types included in the study are passenger vehicles (Compact, Mid-Size, Luxury, and SUV), light commercial vehicles, heavy commercial vehicles, and electric vehicles BEV (battery electric vehicles), HEV (hybrid electric vehicles) and PHEV (plug-in hybrid electric vehicles).

The report includes two types of categories under by sales channels segment OME and aftermarket.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

The global market is anticipated to reach USD 36.48 billion by 2035, expanding from USD 20.96 billion in 2025, at a CAGR of 5.7% during the forecast period.

Tempered glass is projected to lead the market with a 66.5% share in 2025, owing to its superior safety features, cost-effectiveness, and durability in both OEM and aftermarket applications.

The windshield segment is expected to dominate with a 23.9% share in 2025, driven by frequent replacements and growing integration of ADAS and HUD technologies requiring precision-fitted glass.

Major growth drivers include rising vehicle production, growing electric vehicle adoption, advancements in smart and lightweight glass technologies, and stringent safety regulations worldwide.

Prominent players include AGC Inc., Saint-Gobain Sekurit, Fuyao Glass Industry Group Co., Ltd., Nippon Sheet Glass Co., Ltd., Guardian Industries, and Xinyi Glass Holdings Limited.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA