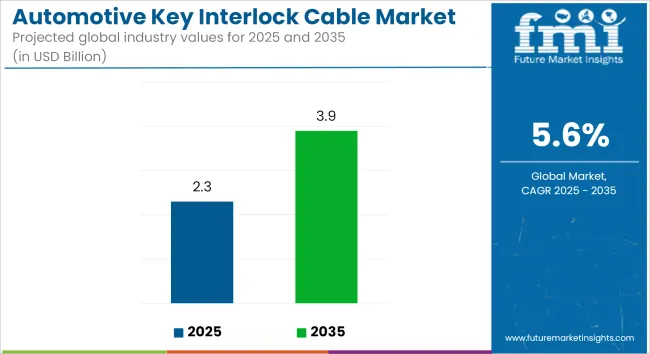

The global automotive key interlock cable market is estimated at USD 2.3 billion in 2025 and is projected to grow at a CAGR of 5.6%, reaching USD 3.9 billion by 2035. This growth is being driven by evolving vehicle safety regulations, technological enhancements in cable assemblies, and rising aftersales demand for reliable ignition and transmission interlocks.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 2.3 billion |

| Industry Value (2035F) | USD 3.9 billion |

| CAGR (2025 to 2035) | 5.6% |

Engineered configurations have been evolving to support both mechanical and electronic interlock functions in vehicles. Mechanically actuated cables continue to be standard in mass-produced passenger and commercial vehicles due to their proven reliability. Electrically actuated cables have begun to gain traction in premium and electric vehicle segments, where integration with electronic control units (ECUs) is favored for improved user experience and automation.

Materials innovation has been initiated to enhance durability and performance. High-strength polymers, stainless steel, and hybrid cable designs were reported in 2024 and 2025. These blends aimed to improve tensile strength and corrosion resistance, especially in high-temperature environments. Integration of embedded sensors and smart connectors in electronic cables was observed to support future shift-by-wire systems.

OEM and aftermarket channels have both recorded steady growth through 2025. OEM deployment was supported by regulatory mandates requiring key-interlock mechanisms in automatic transmission vehicles, aimed at preventing key removal when the vehicle is not in park. Aftermarket sales were also driven by replacement demand in aging vehicle fleets and retrofit solutions for older models.

Usage scenarios in passenger vehicles and fleet vehicles demonstrated differing needs. Fleet adoption of mechanical interlock cables remained strong due to cost-effectiveness and robustness. Premium vehicle segments began to adopt electronic and hybrid interlock systems as part of smart security packages.

Industry players have expanded their portfolios accordingly. Fortress Safety released its amGardpro interlock system in 2024, featuring configurable trapped key and pushbutton modules designed for heavy machinery and vehicle process safety applications. The system complied with PLe/Cat.4 safety standards and supported Ethernet-based control interfaces-an arrangement likely to influence automotive-grade interlock cable requirements.

Engineering discussions on owner forums, such as those for Nissan Frontier and Jeep Wrangler, highlighted the importance of preventing key removal when the transmission was not fully engaged in park. These anecdotal references pointed to the need for reliable interlock cables to enhance operational safety

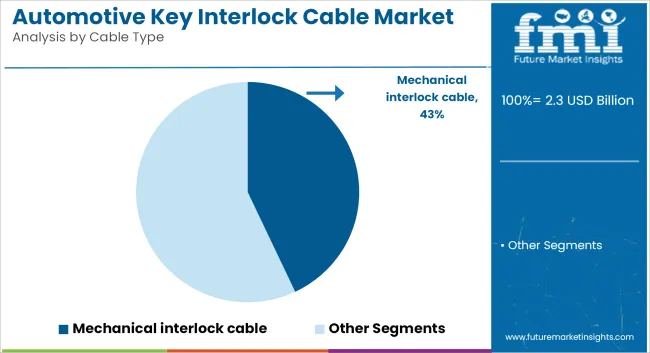

Mechanical interlock cables are estimated to account for approximately 43% of the global automotive interlock cable market share in 2025 and are projected to grow at a CAGR of 5.5% through 2035. These cables remain widely used in gear shift interlocks, parking brake systems, and door lock mechanisms, particularly in low-and mid-range vehicle platforms. Automakers favor mechanical cables for their cost efficiency, durability, and ease of integration within existing transmission architectures.

Manufacturers continue to enhance sheath flexibility, corrosion resistance, and tensile strength to support demanding applications across compact and light commercial vehicles. Despite rising electronic content in newer vehicle models, mechanical cables maintain strong market presence due to their robust performance under harsh operating conditions.

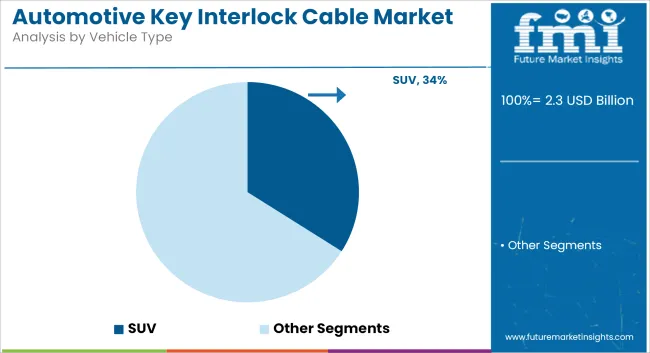

SUVs are projected to account for nearly 34% of the global interlock cable market share by vehicle type in 2025 and are expected to grow at a CAGR of 5.8% through 2035. Their increasing share is driven by elevated demand for versatile drivetrains, electronic shift mechanisms, and enhanced safety systems. Interlock cables in SUVs serve a range of functions, from transmission park-lock systems to tailgate actuation and column shifter engagement.

OEMs continue to deploy cable-based solutions across both internal combustion and hybrid SUV variants to ensure mechanical fail-safes and compliance with global regulatory standards. Growth is supported by SUV production expansions in North America, China, and India, where high consumer preference for feature-rich utility vehicles reinforces demand for dependable interlock cable assemblies.

Invest in Smart and Hybrid Interlock Cables Executives should prioritize R&D investments in smart and hybrid interlock cables to align with the industry's transition toward connected and autonomous vehicles. Developing next-generation solutions that integrate digital security, remote access, and enhanced durability will ensure competitive differentiation and long-term market positioning.

Align with Evolving Regulatory and Safety Standards Stakeholders must closely monitor and adapt to shifting global safety regulations, particularly in regions emphasizing vehicle security enhancements. Proactively working with policymakers and regulatory bodies will help manufacturers ensure compliance, avoid penalties, and gain a competitive advantage by positioning themselves as leaders in automotive safety solutions.

Strengthen OEM and Aftermarket Partnerships Building strong partnerships with OEMs for new vehicle integration and expanding aftermarket distribution networks will be critical for sustained growth. Manufacturers should enhance supply chain capabilities and explore M&A opportunities to secure advanced manufacturing technologies and optimize production efficiency to meet evolving demand.

| Risk | Probability - Impact |

|---|---|

| Supply Chain Disruptions | Medium - High |

| Rapid Technological Obsolescence | High - High |

| Competitive Pricing Pressures | High - Medium |

| Priority | Immediate Action |

|---|---|

| Material Innovation | Run feasibility studies on lightweight, high-durability cable materials |

| OEM Collaboration | Initiate OEM feedback loop to assess demand for smart cables |

| Market Expansion | Launch aftermarket channel partner incentive program |

The next decade will define winners and laggards in the automotive key interlock cable market, with technological innovation and regulatory alignment driving competitive success. To stay ahead, stakeholders must invest in smart cable solutions, optimize supply chains, and deepen OEM and aftermarket relationships.

With increasing vehicle security requirements and growing demand for electric and autonomous vehicles, aligning product portfolios with these market shifts will ensure sustainable growth and resilience. The roadmap should focus on scaling advanced manufacturing capabilities, leveraging digital integration in interlock solutions, and proactively addressing supply chain vulnerabilities to maintain leadership in this evolving landscape.

| Countries/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The National Highway Traffic Safety Administration (NHTSA) enforces stringent vehicle safety standards, pushing OEMs to integrate advanced interlock systems. Cybersecurity regulations under the Federal Motor Vehicle Safety Standards (FMVSS) are increasing demand for smart interlock cables. Companies must comply with FMVSS 114 (Theft Protection and Rollaway Prevention). |

| European Union | The EU’s General Safety Regulation (GSR) mandates stricter anti-theft and vehicle safety technologies, directly influencing interlock cable adoption. The EU’s Vision Zero policy is driving manufacturers toward high-security electronic interlock systems. Mandatory certifications include ECE R116 (Protection Against Unauthorized Use of Vehicles). |

| China | The China Compulsory Certification (CCC) scheme requires safety approvals for automotive components, including key interlock cables. The government is tightening regulations on vehicle safety under GB standards (e.g., GB 7258-2017 for vehicle safety technical requirements), increasing compliance costs for manufacturers. |

| India | The Automotive Industry Standards (AIS) regulations mandate enhanced vehicle security, aligning with global safety norms. AIS-140 requires tracking and security features in commercial vehicles, influencing interlock system upgrades. The Bureau of Indian Standards (BIS) certification is mandatory for automotive components. |

| Japan | The Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) enforces strict vehicle safety regulations under the Road Transport Vehicle Act. The Japan Automotive Standards Organization (JASO) guidelines influence interlock cable quality standards, with increasing focus on electronic and hybrid cables for advanced safety compliance. |

Key Developments in 2024

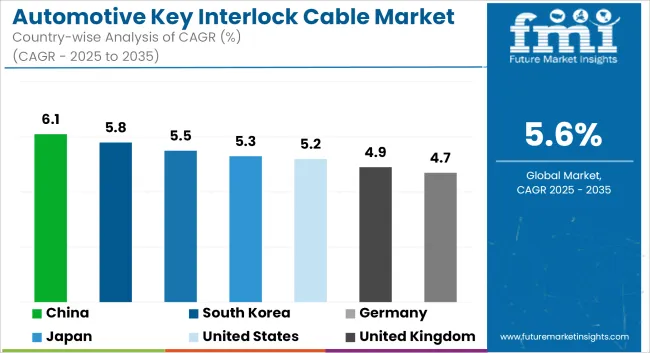

The automotive key interlock cable industry in the United States is expected to grow at a CAGR of approximately 5.2% from 2025 to 2035, driven by increasing regulatory requirements and rising consumer demand for vehicle security enhancements.

The National Highway Traffic Safety Administration (NHTSA) enforces stringent safety regulations, compelling automakers to integrate advanced interlock systems in new vehicles. With the rapid expansion of electric vehicles (EVs) and connected car technologies, there is a growing preference for smart and hybrid interlock cables that integrate with electronic security mechanisms.

The dominance of OEMs in the country further boosts demand as leading automakers focus on factory-fitted security solutions. Additionally, rising vehicle theft rates in urban centers push consumers to upgrade interlock systems, creating opportunities for the aftermarket segment. The presence of major industry players and a strong technological ecosystem fosters innovation, making the USA a key revenue contributor in this sector.

The automotive key interlock cable industry in the United Kingdom is set to expand at a CAGR of about 4.9% between 2025 and 2035, supported by evolving vehicle security standards and a transition toward intelligent mobility solutions. The UK government’s push for advanced automotive safety regulations, coupled with the increasing adoption of electric and autonomous vehicles, accelerates demand for modern interlock cable solutions.

British consumers exhibit a growing preference for luxury and high-end vehicles, driving the adoption of electronic and smart interlock cables. Additionally, the rise of shared mobility services and fleet management solutions encourages businesses to invest in reliable security features.

The presence of leading automakers and suppliers, along with partnerships in automotive cybersecurity, contributes to the steady expansion of this segment. Despite Brexit-related trade uncertainties, the UK remains a lucrative market due to its strong automotive innovation ecosystem and stringent safety mandates.

France’s automotive key interlock cable industry is forecast to grow at a CAGR of around 4.7% from 2025 to 2035, fueled by strong automotive manufacturing and a focus on vehicle security compliance.

The country’s stringent anti-theft regulations and the European Union’s General Safety Regulation (GSR) push manufacturers toward advanced security mechanisms. With France’s strong presence in the luxury automotive sector, there is a rising demand for smart interlock cables with electronic integration.

Additionally, the government’s aggressive electrification strategy encourages the use of hybrid and smart cables in EV models. OEMs in France are investing heavily in R&D to enhance security features, while the aftermarket segment gains traction as older vehicles seek security upgrades. The continued innovation in automotive technology and increasing consumer awareness of vehicle safety contribute to steady industry growth, making France a vital player in this segment.

Germany’s automotive key interlock cable industry is projected to grow at a CAGR of approximately 5.5% from 2025 to 2035, owing to its position as a global automotive hub and its focus on high-performance vehicle security. As home to some of the world’s most advanced automakers, Germany consistently pushes for cutting-edge automotive security standards. The adoption of smart and hybrid interlock cables is accelerating as luxury and premium car manufacturers integrate electronic locking mechanisms to enhance vehicle protection.

Additionally, Germany’s leadership in automotive electrification and autonomous driving technology further drives demand for sophisticated security solutions. The presence of major OEMs and Tier-1 suppliers enables rapid advancements in interlock cable innovation. With increasing regulations around cybersecurity and vehicle theft prevention, manufacturers are investing in next-generation technologies to strengthen their product offerings, positioning Germany as a dominant force in this segment.

Italy’s automotive key interlock cable industry is expected to expand at a CAGR of about 4.5% between 2025 and 2035, driven by the country’s strong luxury and performance vehicle segment. Italian automakers emphasize high-end security features, leading to increased demand for advanced interlock cables. Additionally, rising vehicle theft rates in urban regions encourage investment in sophisticated locking mechanisms.

The aftermarket sector is witnessing growth as consumers seek to retrofit existing vehicles with upgraded security systems. Italy’s government regulations on automotive safety are increasingly aligning with broader EU mandates, reinforcing the demand for compliant interlock cable solutions. While the country has a relatively smaller automotive manufacturing base compared to Germany and France, its specialized focus on premium and sports cars creates significant opportunities for high-end security cable integration.

The automotive key interlock cable industry in New Zealand is set to grow at a CAGR of approximately 4.2% from 2025 to 2035, primarily driven by rising vehicle security concerns and increasing regulations on imported cars. The country’s automotive industry heavily depends on used vehicle imports, leading to a growing demand for aftermarket security solutions.

New Zealand’s government has tightened vehicle safety regulations, encouraging the adoption of advanced interlock cable systems in both passenger and commercial vehicles. Additionally, the expansion of EV infrastructure is pushing automakers to equip vehicles with smart security features. While the country lacks a strong domestic automotive manufacturing base, the rise of connected vehicle technologies and fleet management services contributes to steady demand for key interlock cables.

South Korea’s automotive key interlock cable industry is anticipated to grow at a CAGR of about 5.8% from 2025 to 2035, driven by the country’s leading role in automotive electronics and smart mobility. South Korean automakers are at the forefront of integrating smart security solutions, leading to increased adoption of hybrid and smart interlock cables.

The government’s focus on vehicle cybersecurity regulations further accelerates innovation in this sector. Additionally, the country’s expanding EV and hydrogen vehicle market strengthens demand for advanced locking systems. With a strong presence of key automotive technology players, South Korea is rapidly becoming a center for next-generation vehicle security developments.

Japan’s automotive key interlock cable industry is projected to expand at a CAGR of approximately 5.3% from 2025 to 2035, supported by the country’s high safety standards and focus on technological innovation. Japanese automakers prioritize advanced security features, making smart and electronic interlock cables an essential component in modern vehicle designs.

The rise of autonomous and electric vehicles further boosts demand for integrated security solutions. Japan’s stringent vehicle theft prevention policies and emphasis on cybersecurity compliance contribute to the sector’s steady growth. Additionally, leading automotive suppliers in Japan continue to invest in R&D, strengthening the country’s position in the global industry.

China’s automotive key interlock cable industry is expected to grow at a CAGR of about 6.1% from 2025 to 2035, making it one of the fastest-growing regions in this sector. The rapid expansion of China’s automotive industry, coupled with government mandates for enhanced vehicle security, is driving demand for advanced interlock cable solutions.

The country’s strong push toward electric and connected vehicles is accelerating the adoption of smart and hybrid interlock cables. Additionally, domestic and international automakers are expanding production capacities to meet rising demand. With government-backed initiatives to strengthen cybersecurity in automotive applications, China is becoming a key market for high-tech security solutions.

Australia’s automotive key interlock cable industry is forecast to expand at a CAGR of approximately 4.3% from 2025 to 2035, driven by increasing vehicle security concerns and growing demand for aftermarket solutions. While Australia does not have a major automotive manufacturing industry, its strong aftermarket sector fuels demand for interlock cables.

The rising adoption of electric and connected vehicles is encouraging investments in advanced security mechanisms. Additionally, government safety regulations and anti-theft mandates are pushing automakers and fleet operators to enhance vehicle security. With a growing number of imported vehicles, there is a steady demand for upgraded interlock cable solutions across various vehicle segments.

Compact, Mid-size, Luxury, SUV, LCV, HCV

Mechanical Cables, Electrical Cables, Hybrid Cables, Smart Cables, Customized Cables

OEM, Aftermarket

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa

Increasing vehicle security regulations, advancements in smart locking systems, and the rising demand for electric and connected vehicles are driving adoption.

Luxury and SUV segments prefer advanced electronic and smart cables, while LCVs and HCVs rely on durable mechanical and hybrid solutions for enhanced security.

Integration of smart cables with IoT, cybersecurity enhancements, and the shift toward lightweight and eco-friendly materials are key trends shaping future developments.

OEMs dominate due to factory-fitted solutions, while the aftermarket is gaining traction with increasing replacements and upgrades for older vehicle models.

East Asia and Western Europe are leading due to stringent vehicle security regulations and growing investments in next-generation automotive technologies.

Table 01: Global Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Cable Type, 2018 to 2033

Table 02: Global Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Vehicle Type, 2018 to 2033

Table 03: Global Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Sales Channel, 2018 to 2033

Table 04: Global Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Region, 2018 to 2033

Table 05: North America Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Country, 2018 to 2033

Table 06: North America Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Cable Type, 2018 to 2033

Table 07: North America Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Vehicle Type, 2018 to 2033

Table 08: North America Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Sales Channel, 2018 to 2033

Table 09: Latin America Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Country, 2018 to 2033

Table 10: Latin America Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Cable Type, 2018 to 2033

Table 11: Latin America Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Vehicle Type, 2018 to 2033

Table 12: Latin America Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Sales Channel, 2018 to 2033

Table 13: Europe Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Country, 2018 to 2033

Table 14: Europe Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Cable Type, 2018 to 2033

Table 15: Europe Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Vehicle Type, 2018 to 2033

Table 16: Europe Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Sales Channel, 2018 to 2033

Table 17: East Asia Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Country, 2018 to 2033

Table 18: East Asia Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Cable Type, 2018 to 2033

Table 19: East Asia Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Vehicle Type, 2018 to 2033

Table 20: East Asia Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Sales Channel, 2018 to 2033

Table 21: South Asia & Pacific Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Country, 2018 to 2033

Table 22: South Asia & Pacific Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Cable Type, 2018 to 2033

Table 23: South Asia & Pacific Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Vehicle Type, 2018 to 2033

Table 24: South Asia & Pacific Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Sales Channel, 2018 to 2033

Table 25: Middle East & Africa Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Country, 2018 to 2033

Table 26: Middle East & Africa Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Cable Type, 2018 to 2033

Table 27: Middle East & Africa Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Vehicle Type, 2018 to 2033

Table 28: Middle East & Africa Market Size (US$ Million) and Volume (Units) Analysis and Forecast By Sales Channel, 2018 to 2033

Figure 01: Global Historical Volume (Units), 2018 - 2022

Figure 02: Global Current and Forecast Volume (Units), 2023 to 2033

Figure 03: Global Historical Market Size (USD Million) (2018-2022)

Figure 04: Global Absolute $ Opportunity Analysis (2018 to 2033)

Figure 05: Global Size (USD Million) & YOY Growth (%) (2023-2033)

Figure 06: Global Market Share and BPS Analysis By Cable Type, 2023 & 2033

Figure 07: Global Market Y-o-Y Growth Projections By Cable Type, 2023 to 2033

Figure 08: Global Market Attractiveness Analysis By Cable Type, 2023 to 2033

Figure 09: Global Market Absolute $ Opportunity by Mechanical Cables Segment, 2018 to 2033

Figure 10: Global Market Absolute $ Opportunity by Electrical Cables Segment, 2018 to 2033

Figure 11: Global Market Absolute $ Opportunity by Hybrid Cables Segment, 2018 to 2033

Figure 12: Global Market Absolute $ Opportunity by Smart Cables Segment, 2018 to 2033

Figure 13: Global Market Absolute $ Opportunity by Customized Cables Segment, 2018 to 2033

Figure 14: Global Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 15: Global Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 16: Global Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 17: Global Market Absolute $ Opportunity by Compact Segment, 2018 to 2033

Figure 18: Global Market Absolute $ Opportunity by Mid-size Segment, 2018 to 2033

Figure 19: Global Market Absolute $ Opportunity by Luxury Segment, 2018 to 2033

Figure 20: Global Market Absolute $ Opportunity by SUV Segment, 2018 to 2033

Figure 21: Global Market Absolute $ Opportunity by LCV Segment, 2018 to 2033

Figure 22: Global Market Absolute $ Opportunity by HCV Segment, 2018 to 2033

Figure 23: Global Market Share and BPS Analysis By Sales Channel, 2023 & 2033

Figure 24: Global Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 25: Global Market Attractiveness Analysis By Sales Channel, 2023 to 2033

Figure 26: Global Market Absolute $ Opportunity by OEM Segment, 2018 to 2033

Figure 27: Global Market Absolute $ Opportunity by Aftermarket Segment, 2018 to 2033

Figure 28: Global Market Share and BPS Analysis By Region, 2023 & 2033

Figure 29: Global Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 30: Global Market Attractiveness Analysis By Region, 2023 to 2033

Figure 31: Global Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 32: Global Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 33: Global Market Absolute $ Opportunity by Western Europe Segment, 2018 to 2033

Figure 34: Global Market Absolute $ Opportunity by Eastern Europe Segment, 2018 to 2033

Figure 35: Global Market Absolute $ Opportunity by East Asia Segment, 2018 to 2033

Figure 36: Global Market Absolute $ Opportunity by South Asia & Pacific Segment, 2018 to 2033

Figure 37: Global Market Absolute $ Opportunity by Middle East & Africa Segment, 2018 to 2033

Figure 38: North America Market Share and BPS Analysis By Country, 2023 & 2033

Figure 39: North America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 40: North America Market Attractiveness Analysis By Country, 2023 to 2033

Figure 41: North America Market Share and BPS Analysis By Cable Type, 2023 & 2033

Figure 42: North America Market Y-o-Y Growth Projections By Cable Type, 2023 to 2033

Figure 43: North America Market Attractiveness Analysis By Cable Type, 2023 to 2033

Figure 44: North America Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 45: North America Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 46: North America Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 47: North America Market Share and BPS Analysis By Sales Channel, 2023 & 2033

Figure 48: North America Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 49: North America Market Attractiveness Analysis By Sales Channel, 2023 to 2033

Figure 50: Latin America Market Share and BPS Analysis By Country, 2023 & 2033

Figure 51: Latin America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 52: Latin America Market Attractiveness Analysis By Country, 2023 to 2033

Figure 53: Latin America Market Share and BPS Analysis By Cable Type, 2023 & 2033

Figure 54: Latin America Market Y-o-Y Growth Projections By Cable Type, 2023 to 2033

Figure 55: Latin America Market Attractiveness Analysis By Cable Type, 2023 to 2033

Figure 56: Latin America Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 57: Latin America Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 59: Latin America Market Share and BPS Analysis By Sales Channel, 2023 & 2033

Figure 60: Latin America Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 61: Latin America Market Attractiveness Analysis By Sales Channel, 2023 to 2033

Figure 62: Western Europe Market Share and BPS Analysis By Country, 2023 & 2033

Figure 63: Western Europe Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 64: Western Europe Market Attractiveness Analysis By Country, 2023 to 2033

Figure 65: Western Europe Market Share and BPS Analysis By Cable Type, 2023 & 2033

Figure 65: Western Europe Market Y-o-Y Growth Projections By Cable Type, 2023 to 2033

Figure 66: Western Europe Market Attractiveness Analysis By Cable Type, 2023 to 2033

Figure 66: Western Europe Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 67: Western Europe Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 68: Western Europe Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 69: Western Europe Market Share and BPS Analysis By Sales Channel, 2023 & 2033

Figure 70: Western Europe Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 71: Western Europe Market Attractiveness Analysis By Sales Channel, 2023 – 2033

Figure 72: Eastern Europe Market Share and BPS Analysis By Country, 2023 & 2033

Figure 73: Eastern Europe Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness Analysis By Country, 2023 to 2033

Figure 75: Eastern Europe Market Share and BPS Analysis By Cable Type, 2023 & 2033

Figure 76: Eastern Europe Market Y-o-Y Growth Projections By Cable Type, 2023 to 2033

Figure 77: Eastern Europe Market Attractiveness Analysis By Cable Type, 2023 to 2033

Figure 78: Eastern Europe Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 79: Eastern Europe Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 80: Eastern Europe Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 81: Eastern Europe Market Share and BPS Analysis By Sales Channel, 2023 & 2033

Figure 82: Eastern Europe Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 83: Eastern Europe Market Attractiveness Analysis By Sales Channel, 2023 to 2033

Figure 84: East Asia Market Share and BPS Analysis By Country, 2023 & 2033

Figure 85: East Asia Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 86: East Asia Market Attractiveness Analysis By Country, 2023 to 2033

Figure 87: East Asia Market Share and BPS Analysis By Cable Type, 2023 & 2033

Figure 88: East Asia Market Y-o-Y Growth Projections By Cable Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness Analysis By Cable Type, 2023 to 2033

Figure 90: East Asia Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 91: East Asia Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 92: East Asia Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 93: East Asia Market Share and BPS Analysis By Sales Channel, 2023 & 2033

Figure 94: East Asia Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 95: East Asia Market Attractiveness Analysis By Sales Channel, 2023 to 2033

Figure 96: South Asia & Pacific Market Share and BPS Analysis By Country, 2023 & 2033

Figure 97: South Asia & Pacific Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 98: South Asia & Pacific Market Attractiveness Analysis By Country, 2023 to 2033

Figure 99: South Asia & Pacific Market Share and BPS Analysis By Cable Type, 2023 & 2033

Figure 100: South Asia & Pacific Market Y-o-Y Growth Projections By Cable Type, 2023 to 2033

Figure 101: South Asia & Pacific Market Attractiveness Analysis By Cable Type, 2023 to 2033

Figure 102: South Asia & Pacific Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 103: South Asia & Pacific Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 104: South Asia & Pacific Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 105: South Asia & Pacific Market Share and BPS Analysis By Sales Channel, 2023 & 2033

Figure 106: South Asia & Pacific Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 107: South Asia & Pacific Market Attractiveness Analysis By Sales Channel, 2023 to 2033

Figure 108: Middle East & Africa Market Share and BPS Analysis By Country, 2023 & 2033

Figure 109: Middle East & Africa Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 110: Middle East & Africa Market Attractiveness Analysis By Country, 2023 to 2033

Figure 111: Middle East & Africa Market Share and BPS Analysis By Cable Type, 2023 & 2033

Figure 112: Middle East & Africa Market Y-o-Y Growth Projections By Cable Type, 2023 to 2033

Figure 113: Middle East & Africa Market Attractiveness Analysis By Cable Type, 2023 to 2033

Figure 114: Middle East & Africa Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 115: Middle East & Africa Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 116: Middle East & Africa Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 117: Middle East & Africa Market Share and BPS Analysis By Sales Channel, 2023 & 2033

Figure 118: Middle East & Africa Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 119: Middle East & Africa Market Attractiveness Analysis By Sales Channel, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Control Cables Market Growth – Trends & Forecast 2025-2035

Interlocked Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Automotive Sparking Cable Market Size and Share Forecast Outlook 2025 to 2035

Automotive Speedometer Cable Market

Automotive Boot Release Cable Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Automotive Handbrake And Clutch Cables Market

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA