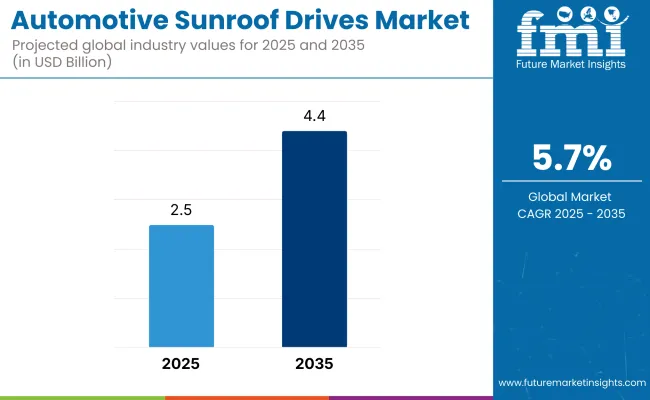

The global automotive sunroof drives market is projected to grow from USD 2.51 billion in 2025 to approximately USD 4.36 billion by 2035, recording an absolute increase of USD 1.85 billion over the decade. This translates into a total growth of 73.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.7% between 2025 and 2035. The overall market size is expected to grow by nearly 1.73X during the same period, supported by the rising integration of powered sunroof systems across mid-range and electric vehicle segments.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.51 billion |

| Industry Size (2035F) | USD 4.36 billion |

| CAGR (2025–2035) | 5.7% |

Between 2025 and 2030, the automotive sunroof drives market is projected to expand from USD 2.51 billion to USD 3.30 billion, resulting in a value increase of USD 0.79 billion, which represents 42.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer demand for premium features in mass-market vehicles, with sunroofs increasingly being offered in compact and mid-size segments across Asia-Pacific and Latin America.

OEMs are expected to standardize power sunroof drives in newer EV models to improve passenger experience, thermal regulation, and daylight access. Simultaneously, improvements in cost efficiency and miniaturization of drive components will support broader integration across price-sensitive vehicle classes. Tier-1 suppliers are also likely to benefit from modular drive units that enable flexibility across sedan, SUV, and crossover platforms.

From 2030 to 2035, the market is forecast to grow from USD 3.30 billion to USD 4.36 billion, adding another USD 1.06 billion, which constitutes 57.3% of the overall ten-year expansion. This period is expected to be characterized by next-generation sunroof technologies, such as smart glass integration, embedded solar panels, and AI-enabled ventilation automation, which will drive demand for more advanced and responsive drive mechanisms.

Automated closure systems, voice-activated modules, and cloud-linked diagnostics are likely to become standard in premium and high-volume EVs. Regulatory focus on noise reduction and energy efficiency will push innovation in silent-drive motors and self-lubricating components. Global production recovery, improved supply chain resilience, and platform consolidation across OEMs will further accelerate sunroof drive adoption across regional markets.

Between 2020 and 2025, the automotive sunroof drives market expanded from USD 1.97 billion to USD 2.51 billion, reflecting a cumulative value increase of USD 0.54 billion and a five-year CAGR of 5.0%. Growth during this period was supported by a steady rise in consumer preference for panoramic and tilt-and-slide sunroof configurations, especially in mid-range sedans and compact SUVs.

OEM strategies to differentiate vehicle trims through aesthetic and functional enhancements led to higher penetration of sunroof systems in both internal combustion engine (ICE) and electric vehicles. Asia-Pacific, particularly China and South Korea, witnessed significant integration of powered sunroofs driven by domestic production ramp-ups and local customization preferences. In parallel, European and North American markets sustained growth through increased adoption of dual-pane and multi-panel roof drives in luxury and crossover models.

While early years (2020–2021) experienced disruptions due to global semiconductor shortages and automotive production slowdowns, the market rebounded in 2022–2023 with the stabilization of supply chains, renewed product launches, and increased dealer-level customization options. Leading drive system suppliers also introduced quieter, more compact motor designs to align with evolving expectations in noise-sensitive EV cabins.

Market expansion is being supported by increasing consumer demand for premium features in passenger vehicles, along with the broader adoption of sunroof systems across mid-range models. Original Equipment Manufacturers (OEMs) are prioritizing powered sunroof integration as a differentiator in vehicle aesthetics and comfort, especially in response to shifting consumer preferences toward enhanced in-cabin experiences.

Advancements in roof architecture, such as panoramic and dual-panel formats, have elevated the need for more sophisticated sunroof drive mechanisms that deliver quiet, precise, and efficient operation. The transition to electric and hybrid vehicles has further amplified this trend, as automakers require compact, energy-efficient actuators compatible with battery-electric platforms.

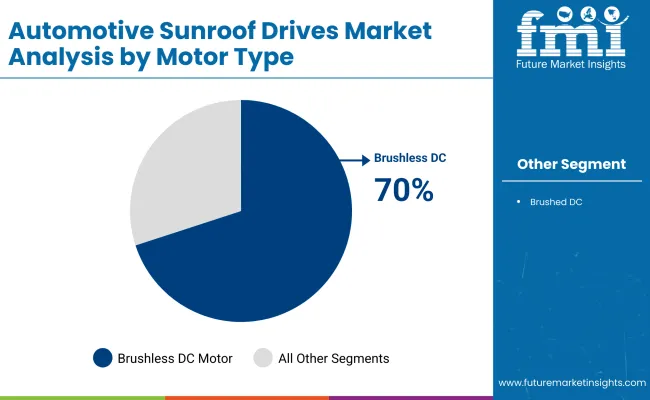

Additional growth is being contributed through rising retrofit activity in emerging markets, where powered sunroof kits are being increasingly installed in existing vehicles. Innovation in drive technology, including the adoption of brushless DC motors and integrated sensor systems for pinch protection and motion control, is reinforcing product value and broadening appeal across global vehicle segments.

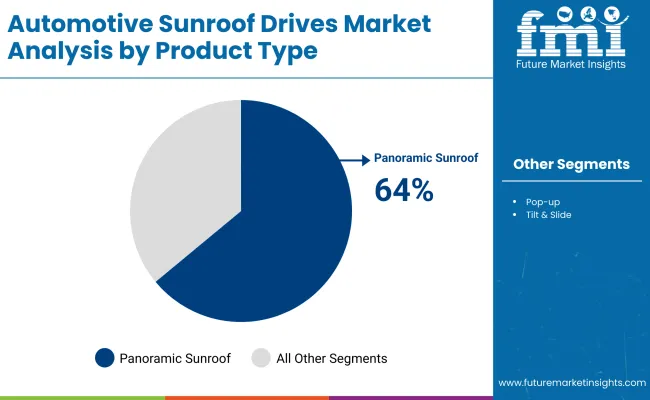

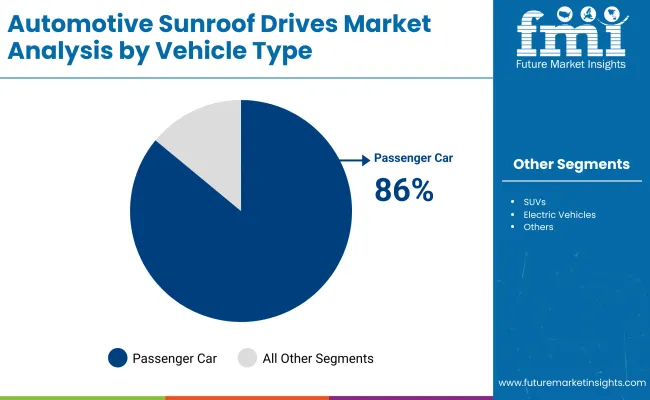

The market is segmented by sunroof type into tilt & slide, panoramic, and pop-up formats, each serving varied design and functional preferences across vehicles. Based on motor technology, it includes brushed DC and brushless DC systems, distinguished by performance efficiency and lifespan. Vehicle types are categorized into passenger cars, commercial vehicles, and heavy commercial vehicles, aligning with adoption trends across automotive segments. By sales channel, the market is split between OEM installations and aftermarket replacements, reflecting differing procurement and integration routes across global regions.

Panoramic sunroofs are projected to account for 64% of the automotive sunroof drive market in 2025. This leading share is supported by increasing consumer preference for larger glass panels that enhance visibility and natural lighting within vehicle cabins. Automakers are integrating panoramic sunroofs across mid-range and premium models to improve passenger experience and differentiate offerings. Growth is further supported by rising demand for comfort and luxury features, especially in compact SUVs and electric vehicles.

Brushless DC motors are estimated to hold 70% of the market share in 2025. Their dominance is attributed to higher energy efficiency, quieter operation, and lower maintenance needs compared to brushed counterparts. These characteristics align well with modern vehicle architectures, particularly in electric and premium vehicles where performance and durability are critical. OEMs are increasingly favoring brushless systems to ensure long-term reliability and seamless sunroof operation.

Passenger cars are expected to represent 86% of sunroof drive system installations in 2025. This strong share reflects high adoption across hatchbacks, sedans, and SUVs, where sunroof features are used to enhance cabin ambiance and resale value. The segment benefits from volume production and design standardization, which makes integration of drive systems more feasible and cost-effective across trims.

OEMs are projected to contribute 78% of the overall sales in 2025. The prevalence of factory-installed sunroofs is driven by increased availability of sunroof options as part of standard or optional equipment packages. Automakers are responding to consumer demand by expanding sunroof availability across vehicle classes, reducing the share of aftermarket installations. OEM integration also ensures better fitment, warranty support, and safety compliance.

The market for automotive sunroof drives is being supported by rising OEM demand for lightweight, low-noise, and compact drive units integrated into panoramic and tilt-and-slide roof systems. However, cost sensitivity in mass-market vehicle segments and the complexity of drive unit integration in EV architectures continue to constrain rapid scale-up. OEMs and Tier 1 suppliers are navigating challenges around component miniaturization, thermal stability, and integration with vehicle electronic systems.

Rising Integration of Sunroof Drives Across Mid-Size and Electric Platforms

The proliferation of powered sunroofs across mid-size sedans, compact SUVs, and battery-electric vehicles is accelerating demand for advanced drive units. These systems are being increasingly integrated into vehicle platforms as standard or optional comfort features. The transition from manually operated sunroofs to fully automated systems has prompted a higher uptake of electronic drive motors and precision actuator assemblies. Lightweighting mandates have further led to the selection of optimized materials in drive enclosures and motion assemblies.

Sensor-Integrated and Noise-Controlled Drive Units Gaining Preference

As consumer expectations around quiet cabin environments and smooth user interaction intensify, sunroof drive mechanisms equipped with noise-dampening technology and sensor-based obstruction detection are being preferred. Integration with anti-pinch controls, position memory, and rain detection systems has added functional value. These features are influencing procurement strategies among OEMs targeting premium vehicle comfort and safety. Suppliers are prioritizing modular drive configurations with enhanced programmability and diagnostic capabilities to support diverse sunroof formats.

| Country | 2025 Value Share |

|---|---|

| Germany | 35% |

| France | 15% |

| UK | 12% |

| Italy | 8% |

| Spain | 10% |

| BENELUX | 5% |

| Russia | 4% |

| Rest of Europe | 11% |

| Country | 2035 Value Share |

|---|---|

| Germany | 33% |

| France | 16% |

| UK | 12% |

| Italy | 9% |

| Spain | 11% |

| BENELUX | 6% |

| Russia | 3% |

| Rest of Europe | 10% |

Germany is expected to remain the dominant market for automotive sunroof drives in Europe, although its share is projected to decline slightly from 35% in 2025 to 33% by 2035. This marginal contraction reflects growing adoption in other countries, particularly in Southern and Western Europe. France is set to increase its share from 15% to 16%, supported by expanding production of electric vehicles and premium SUVs equipped with panoramic sunroofs. Spain also exhibits an upward trend, moving from 10% to 11%, driven by new manufacturing investments and export-oriented vehicle programs.

The UK is expected to maintain a stable share of 12%, as demand for luxury and crossover vehicles continues to support the installation of high-end roof drive units. Italy's share is projected to rise modestly from 8% to 9%, aided by Tier 1 supplier expansion and increased output of compact vehicles. BENELUX countries show growth from 5% to 6%, supported by high-end vehicle imports and EV assembly plants. Conversely, Russia’s share is likely to decrease from 4% to 3% due to ongoing supply chain disruptions and regulatory hurdles.

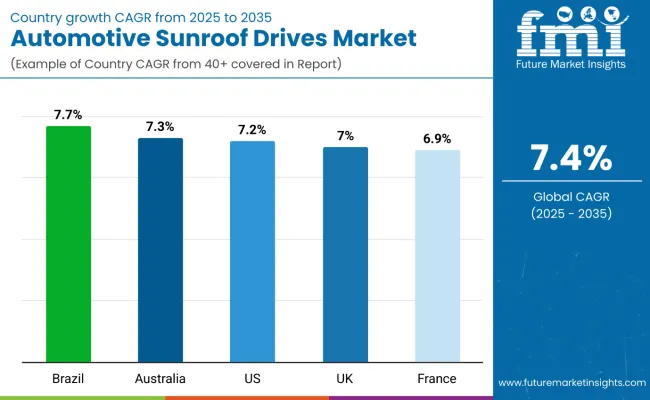

Brazil is projected to lead global growth in the automotive sunroof drives market, recording a CAGR of 7.7% from 2025 to 2035. Increasing local assembly of SUVs and premium hatchbacks is driving demand for powered roof systems. As mid-segment vehicles begin to adopt panoramic or tilt sunroof configurations, Tier 1 suppliers are expanding domestic supply capabilities.

Australia’s automotive market is forecast to grow at a CAGR of 7.3% during the same period, led by increased uptake of SUVs and utes with luxury-grade cabin features. Imports of sunroof-equipped models and a steady aftermarket for upgrades are supporting volume expansion.

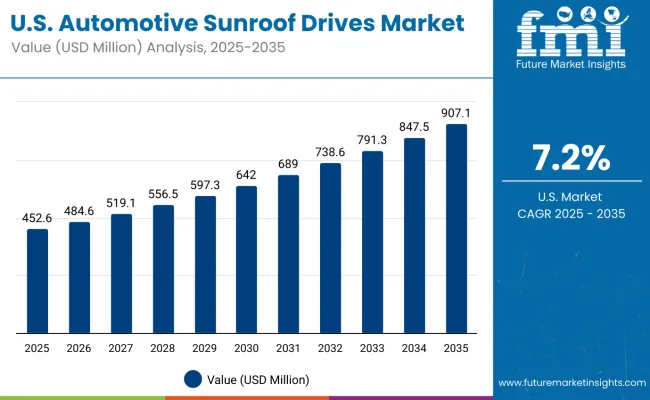

The USA market is set to grow at a CAGR of 7.2%, supported by increased adoption of panoramic sunroofs across EVs, crossovers, and high-end sedans. OEMs are focusing on enhanced cabin aesthetics and automated roof systems as standard offerings.

The UK is expected to witness a 7.0% CAGR, supported by adoption in B- and C-segment EVs and plug-in hybrids. Lightweight drives and silent electric actuators are gaining traction as OEMs standardize sunroof installations in export-bound vehicles.

France is projected to grow at a CAGR of 6.9%, reflecting increased factory output of EVs with panoramic or dual-pane roofs. The demand is particularly strong in premium electric sedans and city SUVs.

In Japan, panoramic sunroof systems represent 66% of the sunroof drive segment as OEMs focus on enhancing cabin aesthetics and visibility in premium compact vehicles and SUVs. Tilt & slide variants make up 28%, primarily in sedans and kei cars offering partial roof opening functionality. Pop-up sunroofs remain limited at 6%, used in select sports models or budget trims. The local market emphasizes advanced integration, with panoramic units often equipped with acoustic insulation and solar reflective coatings.

In South Korea, brushed DC motors account for 54% of sunroof drives due to their dominance in internal combustion engine models across Hyundai and Kia platforms. Brushless DC motors, with a 46% share, are rising in electric and premium vehicle lines where noise reduction and motor durability are prioritized. Tier-1 suppliers are scaling up brushless drive unit production in line with EV adoption and digital roof control technologies.

The automotive sunroof market is being shaped by innovations in electrochromic and smart glass technologies, enhancing passenger comfort, glare control, and energy efficiency. Production capacities are being expanded in key regions to meet rising demand, driven by growing integration of premium features in mid- and high-end vehicle models. Market players are investing in next-generation film and glazing solutions to differentiate offerings and support OEM requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion (2025) |

| Product Type | Tilt & Slide, Panoramic, Pop-up |

| Motor Type | Brushed DC, Brushless DC |

| Drive Mechanism | Cable Drive, Spiral Drive, Others |

| Vehicle Type | Passenger Cars, SUVs, Electric Vehicles, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, France, Brazil, Australia, Japan, South Korea |

| Key Companies Profiled | Brose Fahrzeugteile GmbH & Co., Continental AG, Mitsuba Corporation, Webasto Group, Inteva Products LLC, Aisin Corporation, CIE Automotive, Hi-Lex Corporation, BOS Group, Yachiyo Industry Co., Ltd. |

The global market is estimated to reach USD 2.5 billion in 2025, with strong growth expected through 2035.

The market is forecast to grow at a CAGR of 7.4% during the 2025–2035 period.

Panoramic sunroof systems hold a 66% share in Japan, favored for their enhanced cabin aesthetics.

Brazil, Australia, and the United States are projected to witness robust growth, each with a CAGR above 7%.

The increasing penetration of electric vehicles and preference for quiet, durable motor systems are boosting demand for brushless DC drives.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA