The automotive camshaft market is experiencing consistent expansion driven by increasing vehicle production, advancements in engine efficiency, and the growing adoption of lightweight materials in engine components. Rising demand for performance optimization and improved fuel economy is influencing manufacturers to invest in precision-engineered camshafts. Market participants are focusing on advanced forging and casting technologies to enhance product durability and operational performance.

The shift toward hybrid and fuel-efficient vehicles is prompting design innovations that support variable valve timing and reduced emissions. Supply chain resilience, along with strategic collaborations among OEMs and component manufacturers, is strengthening industry competitiveness.

The future outlook is supported by the sustained demand for internal combustion engines in both emerging and developed markets, despite the rise of electrification trends Growth rationale is further reinforced by continuous research in materials engineering and machining precision, ensuring the automotive camshaft market remains integral to modern powertrain systems and continues its steady trajectory of technological and revenue advancement.

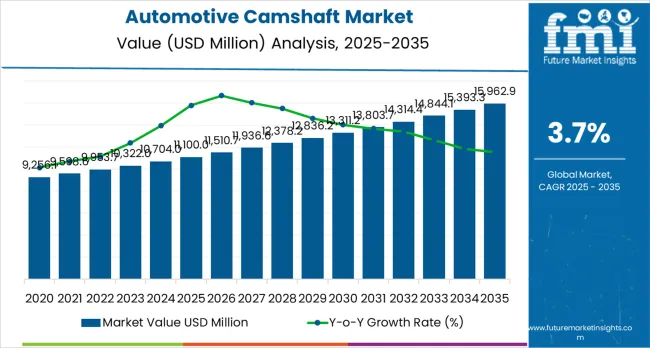

| Metric | Value |

|---|---|

| Automotive Camshaft Market Estimated Value in (2025 E) | USD 11.5 billion |

| Automotive Camshaft Market Forecast Value in (2035 F) | USD 16.6 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

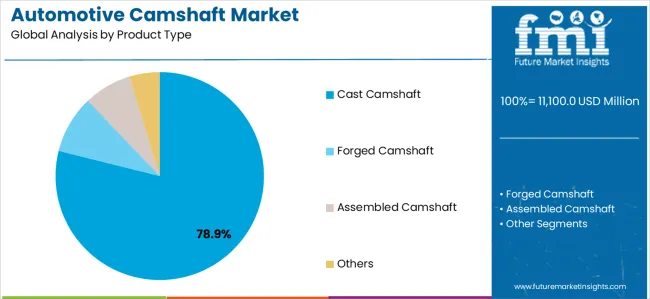

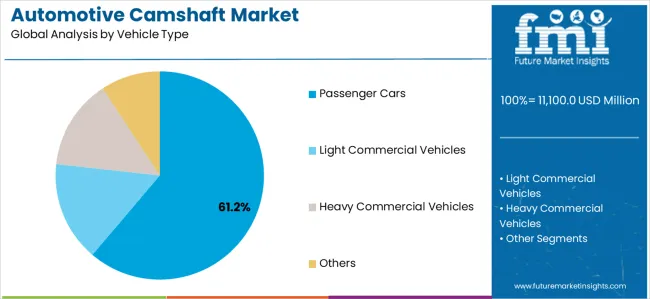

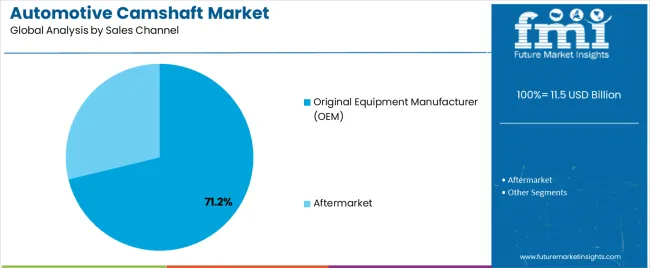

The market is segmented by Product Type, Vehicle Type, and Sales Channel and region. By Product Type, the market is divided into Forged Camshaft, Cast Camshaft, Assembled Camshaft, and Others. In terms of Vehicle Type, the market is classified into Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Others. Based on Sales Channel, the market is segmented into Original Equipment Manufacturer (OEM) and Aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The forged camshaft segment, holding 46.7% of the product type category, has been leading the market due to its superior mechanical strength, resistance to wear, and long operational lifespan. Its adoption has been favored by manufacturers seeking durability and reliability in high-performance and heavy-duty engines.

Advanced forging techniques have enhanced structural integrity and allowed precise control over dimensional accuracy. Continuous process improvements and metallurgical advancements have further optimized fatigue resistance and surface hardness.

The segment’s market leadership is also supported by its ability to meet stringent OEM specifications for quality and performance Growing demand for high-efficiency engines and the expansion of production capacities across Asia-Pacific are expected to sustain the dominance of forged camshafts over the forecast period.

The passenger cars segment, accounting for 58.4% of the vehicle type category, has maintained dominance due to the large-scale production of compact and mid-sized vehicles worldwide. Increased consumer demand for personal mobility, coupled with rising disposable incomes in emerging economies, has reinforced steady sales volumes.

The segment’s share is also driven by continuous technological integration in passenger vehicles, including variable valve actuation systems and improved fuel efficiency requirements. OEMs are prioritizing lightweight and durable camshaft designs to meet emission norms and performance standards.

With expanding vehicle ownership rates and the introduction of new hybrid and compact car models, the passenger cars category is expected to remain the key driver of camshaft demand in the global market.

The original equipment manufacturer (OEM) segment, representing 71.2% of the sales channel category, has emerged as the dominant channel owing to its integral role in supplying precision-engineered camshafts directly to automakers. The segment’s leadership is underpinned by strong partnerships between component suppliers and leading automotive manufacturers, ensuring adherence to strict quality, durability, and performance standards.

OEM supply contracts provide production stability and predictable revenue streams for manufacturers. Continuous improvement in machining and heat treatment technologies has strengthened OEMs’ preference for long-term supplier relationships.

As global vehicle assembly operations expand and OEMs increasingly integrate advanced engine technologies, this segment is expected to sustain its commanding position and continue driving overall market growth.

Increasing sales of vehicles is positively impacting the demand for automotive camshafts. Additionally, there is a growing market for the replacement of older and outdated engines, which is contributing to the rising adoption of automotive camshafts.

Growing popularity of double overhead camshafts (DOHC) is projected to be profitable for automotive camshaft manufacturers. This is because automakers are increasingly utilizing DOHC as it increases engine performance and boosts fuel efficiency.

Another notable trend that is lucrative for automotive camshaft manufacturers is engine downsizing. Manufacturers are further capitalizing on the growing aftermarket for vehicle camshafts.

Manufacturers are optimizing camshaft designs to increase engine control for cleaner emissions. This is in line with the implementation of stricter emission regulations imposed by governments. Additionally, key players are investing in research and development activities to propel advancement in automotive camshafts for greater performance and results.

| Leading Product Type | Cast Camshaft |

|---|---|

| Value Share (2025) | 78.90% |

Based on product type, the cast camshaft segment is projected to acquire a leading share of the global automotive camshaft market. As per the latest market estimates by FMI analysts, the cast camshaft segment is expected to acquire a 78.90% value share in 2025.

Increasing purchases of passenger, as well as commercial vehicles, have been directly impacting the demand for automotive camshafts. Additionally, rising infrastructural investments in emerging countries have been raising the sales of heavy trucks and trailers. This has created significant prospects for cast camshaft producers.

Cast camshafts provide a cost-effective solution for the casting process, which allows for their use in mass production and makes them appropriate for different vehicle applications. Moreover, manufacturers are consistently enhancing the properties of cast camshafts through lightweight designs and material advancements to promote fuel efficiency.

Increasing government norms for strict emission standards for vehicles is raising the use of cast camshafts as they help reduce emissions and optimize engine performance.

| Leading Vehicle Type | Passenger Cars |

|---|---|

| Value Share (2025) | 61.20% |

Passenger cars are the highly preferred vehicle types. This segment is anticipated to account for 61.20% in 2025. Increasing purchasing power of the population in developing countries is raising the sales of passenger cars. Car ownership is also rising as banks and financial institutions are providing different financing options and loans.

Growing demand for personal transportation is promoting the demand for passenger cars as they offer more convenience and flexibility as opposed to public transport. This is especially relevant in areas where public infrastructure is poorly maintained.

Manufacturers are providing a vast range of passenger cars to serve the different needs and budgets of customers. Various options of passenger cars to meet the requirement of buyers are enhancing buyer’s experience.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Canada | 3.20% |

| Germany | 3.30% |

| France | 4.40% |

| China | 4.40% |

| India | 5.10% |

Sales frequency of automotive camshafts is increasing at a relatively higher pace in Canada, than in the United States. This market dynamic in North America can be ascribed to the increasing population in Canada and the consequent growing demand for automobiles. According to recent estimates, Canada is expected to record a 3.2% CAGR over the next ten years.

Demand for passenger and commercial vehicles is raising the demand for more engines. Thus, pushing the sales of automotive camshafts. Several developments in the automotive landscape in Canada are painting an optimistic picture of the automotive camshaft industry.

In December 2025, for instance, Delphi Technologies officially disclosed that it will be adding 21 parts to its specialty Sparta fuel pump line and 142 parts to its main line. In the 142 new parts line, engine camshaft position sensors are also included.

In October 2025, production of CR-V hybrid began in Canada, soon followed by Ohio and Indiana plants as it is going to represent around 50% of CR-V sales.

Germany is an influential contender in the Europe automotive industry, showcasing leading car manufacturers like Mercedes-Benz and Volkswagen. As the car market in Germany experiences a surge, so is the demand for components like automotive camshafts. Through 2035, demand for automotive camshafts in Germany is projected to register a 3.3% CAGR.

Manufacturers in the camshaft industry are advancing their materials and designs to develop lighter and optimally functioning camshafts. The use of such next-generation camshafts enhances fuel economy and reduces emissions.

France is yet another important player in the Europe automotive camshaft market. As per the latest market statistics, the market is set to expand at a steady CAGR of 4.40% from 2025 to 2035. Rising sales of passenger cars in France are acting as a market driver.

Constant advancements by the key players in France are contributing to increasing market size. For instance, in May 2025, a prototype component was developed in collaboration between Belgian plastics manufacturer SBHPP/Vyncolit, French plastics company The Georges Pernoud Group, automotive parts manufacturer the MAHLE Group, the Daimler automotive company, and Germany's Fraunhofer Institute for Chemical Technology.

The finished camshaft module is lighter than the aluminum product and its usage in automotives reduces gas consumption.

In Asia Pacific, India is an important market for the business of automotive camshafts. With an estimated growth rate of 5.10% CAGR, which is relatively higher than the other markets, key players and investors are viewing India as their new investment pocket.

Several advancements in automotive camshafts are expected to increase their demand in the market. For instance, in June 2025, Precision Camshafts, a Solapur-based company developed a retrofitting technology for the LCV segment and announced that the first product rollout will be in the next three months.

The company had invested funds and time to create solutions and technology ready for India. The potential market for retrofitting in India alone is about 2 million vehicles. For the company, even if a small portion of these vehicles convert to electric, it is going to translate to significant volumes.

Sales of automotive camshafts are increasing at a CAGR of 4.40% in China. The country contributes significantly to the regional market in terms of vehicle production.

This suggests a growing demand for car parts like camshafts. Additionally, in China, a shift towards double overhead camshafts (DOHC), which are known for their power and efficiency, has been observed. These engines need more camshafts owing to a high number of valves.

Stringent emission standards in China are pushing manufacturers to develop fuel-efficient, lightweight engines, achieved via DOHC technology. This, in turn, is raising the demand for camshafts.

Key players are employing different strategies to gain a competitive advantage over their peers. Industry participants are consistently researching and developing new casting techniques and alloys to develop stronger, lighter, and more wear-resistant automotive camshafts. This is aimed at enhancing fuel efficiency, promoting longer engine life, and lowering emissions.

Manufacturers are developing and integrating variable valve timing (VVT) systems in camshafts to allow for optimized engine performance during different operating conditions. This effectively serves the growing demand for powerful and fuel-efficient vehicles.

Market players are building strong relationships with automakers to allow suppliers to secure long-term contracts. Additionally, players are acquiring small players or merging with competitors to increase their profits.

Key Developments Shaping the Automotive Camshaft Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 11.5 billion |

| Projected Market Size (2035) | USD 16.6 billion |

| CAGR (2025 to 2035) | 3.7% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2025 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Product Types Analyzed (Segment 1) | Cast Camshaft, Forged Camshaft, Assembled Camshaft |

| Vehicle Categories Covered (Segment 2) | Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle |

| Sales Channels Assessed (Segment 3) | Original Equipment Manufacturer (OEM), Aftermarket |

| End Uses Analyzed (Segment 4) | Automotive Engines, Engine Replacement, Performance Vehicles |

| Applications Analyzed (Segment 5) | Engine Timing, Valve Actuation, Emission Regulation |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, China, India, Japan, South Korea, Brazil, South Africa, GCC Countries, ANZ |

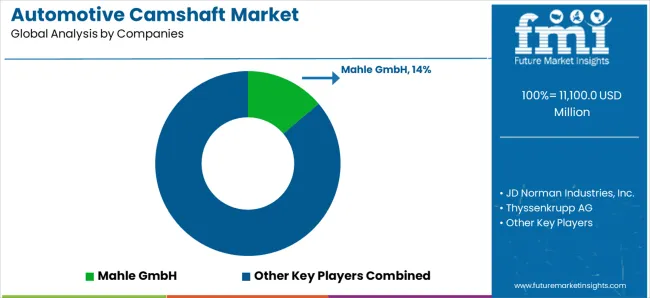

| Key Players influencing the Automotive Camshaft Market | Mahle GmbH, JD Norman Industries, Thyssenkrupp AG, Precision Camshafts Ltd., Linamar Corporation, Crance Cams Inc., Camshaft Machine Company, Comp Performance Group, ESTAS Camshaft, Hirschvogel Holding GmbH |

| Additional Attributes | Dollar sales comparison by cast vs. forged camshafts, Regional dollar trends in OEM vs. aftermarket, DOHC and VVT integration across performance engines, Emission compliance driving adoption in India and China |

| Customization and Pricing | Customization and Pricing Available on Request |

The global automotive camshaft market is estimated to be valued at USD 11.5 billion in 2025.

The market size for the automotive camshaft market is projected to reach USD 16.6 billion by 2035.

The automotive camshaft market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in automotive camshaft market are forged camshaft, cast camshaft, assembled camshaft and others.

In terms of vehicle type, passenger cars segment to command 58.4% share in the automotive camshaft market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA