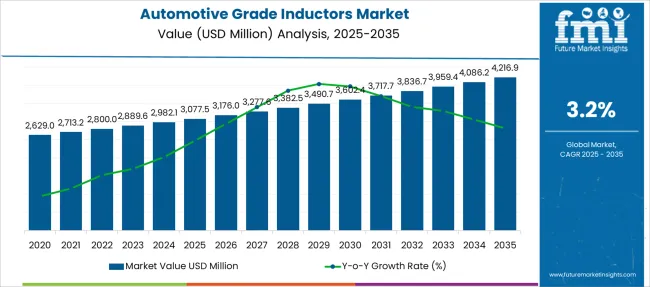

The Automotive Grade Inductors Market is estimated to be valued at USD 3077.5 million in 2025 and is projected to reach USD 4216.9 million by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Grade Inductors Market Estimated Value in (2025 E) | USD 3077.5 million |

| Automotive Grade Inductors Market Forecast Value in (2035 F) | USD 4216.9 million |

| Forecast CAGR (2025 to 2035) | 3.2% |

The automotive grade inductors market is gaining momentum due to the rapid electrification of vehicles, integration of advanced driver assistance systems, and rising adoption of in-vehicle infotainment platforms. As modern vehicles transition toward more sophisticated electronic architectures, the demand for reliable and thermally stable inductive components has significantly increased.

These components are critical for voltage regulation, electromagnetic interference suppression, and power management within electric and hybrid vehicles. Technological advancements in ferrite materials, compact designs, and high-temperature tolerance have improved inductor performance across automotive systems.

OEM focus on improving fuel efficiency, vehicle safety, and emission compliance further supports market growth. The outlook remains strong as automakers pursue innovations in electric mobility and digitalization, fueling the need for high-performance inductive components across various vehicular systems.

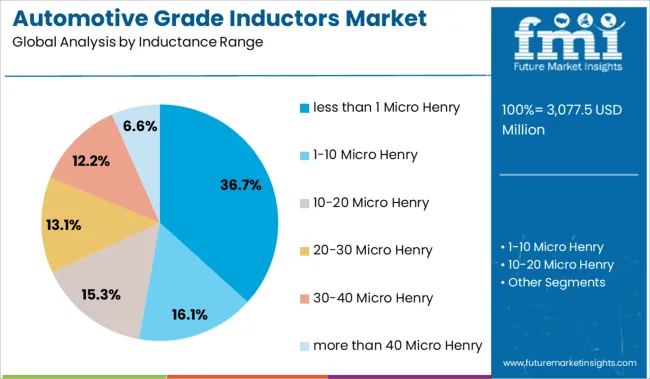

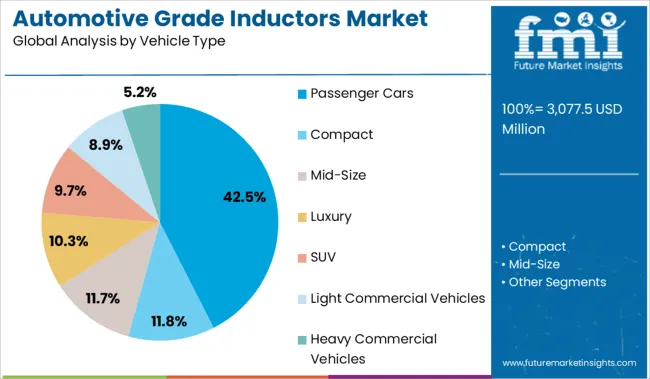

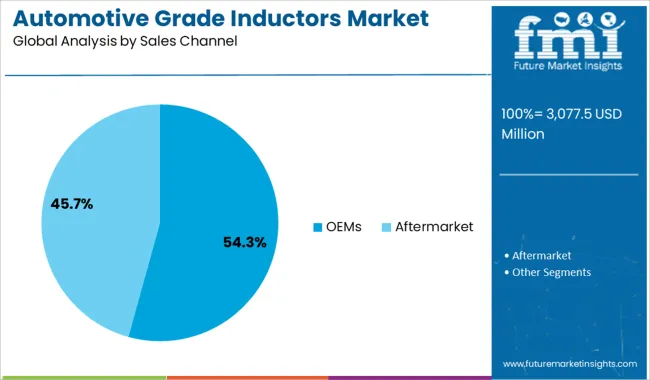

The market is segmented by Inductance Range, Vehicle Type, and Sales Channel and region. By Inductance Range, the market is divided into less than 1 Micro Henry, 1-10 Micro Henry, 10-20 Micro Henry, 20-30 Micro Henry, 30-40 Micro Henry, and more than 40 Micro Henry. In terms of Vehicle Type, the market is classified into Passenger Cars, Compact, Mid-Size, Luxury, SUV, Light Commercial Vehicles, and Heavy Commercial Vehicles. Based on Sales Channel, the market is segmented into OEMs and Aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 1 micro henry segment is projected to account for 36.70% of the overall market revenue by 2025 within the inductance range category, making it the most dominant segment. This growth is driven by the increasing deployment of high-frequency circuits and miniaturized electronics in automotive control units and infotainment systems.

Inductors in this range are preferred for their fast response, compact footprint, and suitability for high-speed switching applications. They are widely adopted in energy-efficient DC-DC converters and power regulation modules that require low inductance but high current handling capacity.

The combination of size efficiency and functional stability positions this segment as the preferred choice across evolving electronic vehicle platforms.

The passenger cars segment is expected to contribute 42.50% of total market revenue by 2025 under the vehicle type category, establishing its leadership in the segment. This dominance is attributed to the increasing electrification of consumer vehicles, growing demand for in-vehicle connectivity, and enhanced infotainment and safety systems.

Inductors play a key role in the performance of electronic control units, advanced safety sensors, and battery management systems, all of which are rapidly being integrated into passenger car platforms. The widespread production volume of passenger vehicles and emphasis on compact high-efficiency electronics further reinforce segment growth.

As consumers prioritize technologically advanced and energy-efficient vehicles, the demand for robust inductive components within this category continues to rise.

The OEMs segment is projected to hold 54.30% of total revenue by 2025 within the sales channel category, positioning it as the market leader. This dominance is driven by the increasing integration of electronic components at the manufacturing stage, where inductors are embedded into vehicle powertrains, control units, and entertainment systems.

OEMs are prioritizing component standardization, quality assurance, and supply chain efficiency by sourcing directly from trusted inductor manufacturers. Furthermore, long-term contracts and collaborative product development between automakers and component suppliers are ensuring consistent inductor demand through the OEM channel.

The focus on building technologically advanced and compliant vehicles from the factory level is expected to maintain the OEMs segment as the primary contributor to market revenues.

The adoption of part accessories to augment the efficiency of operations is witnessing the growth of the automotive grade inductors market over the forecast period. The epitome of a global standard for stress resistance- AEC-200 which underlines efficiency in the vehicles to withstand extreme temperatures and resistance to physical stress drives growth for the automotive grade inductors market. The clutter-free and noiseless operations of the intricate parts in automobiles augment the prolific design and manufacture of the passive automotive grade inductors, driving the automotive grade inductors market.

Miniaturization of parts in the passive component industry leads to the growth of the automotive grade inductors market with the development of miniature inductors. Furthermore, Wi-Fi, Bluetooth, GPRS, and GPS-enabled digitalization in technology will directly impact the automotive grade inductors market. With the integration of technology, the automotive grade inductors market finds a strong foothold in the market.

A consistent drive to spur the technological frontiers of the automobile industry by introducing new technology has taken its toll on the automotive grade inductors industry. Also, the raw materials in the manufacture of electronic inductors are traversing a low trajectory.

This is due to the supply of copper which makes up the inductive coil in the automotive grade inductors and ferrite rods which are imported from China, Japan, and India are fluctuating owing to variations in prices. Thus the prices of raw materials will impact the automotive-grade inductor industry adversely.

Asia Pacific is anticipated to grow at a considerable growth rate in the global automotive grade inductors market owing to the prolific number of passenger cars under manufacture coupled with an increasing market penetration of electrically monitored accessories. China is tagged with the moniker- the automotive capital of the world with the largest automotive market in the world, with registrations climbing to 2982.1 million units in 2024.

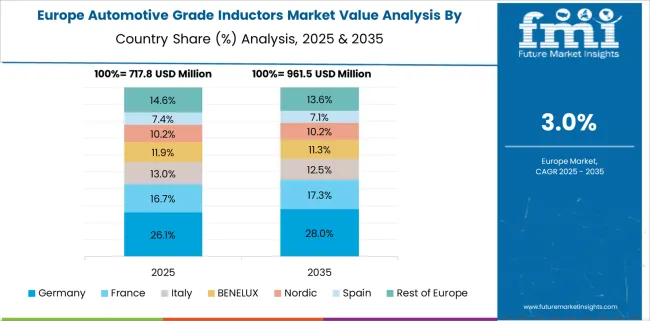

Europe is projected to witness noteworthy growth in the global automotive grade inductors market during the slated timeframe owing to rising vehicle production as well as growing demand for passenger vehicles. Germany has new car brands rolling out with iconic automotive designs such as Mercedes, BMW, and Audi belonging to the nation and adding value to the automotive grade inductors market.

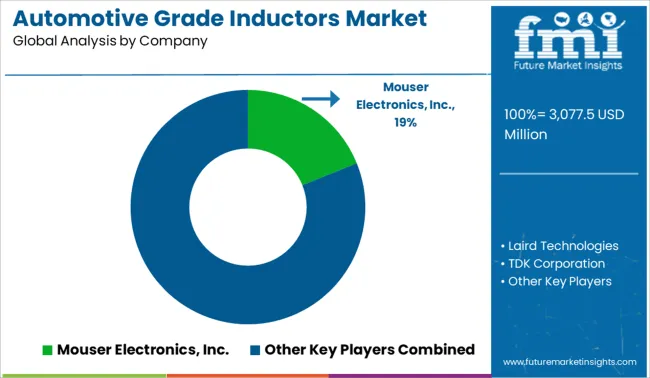

Some of the key participants present in the global automotive grade inductors market include Mouser Electronics, Inc., Laird Technologies, TDK Corporation, Abracon, TTI, Inc., Avnet, Inc., Vishay Intertechnology, Bourns, Inc., Murata Manufacturing Co., Ltd., and Viking Tech Corporation.

With the presence of such a high number of participants, the market is highly competitive. While global players such as TDK Corporation and Abracon account for a considerable market size, several regional-level players are also operating across key growth regions, particularly in the Asia Pacific.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.2% from 2025 to 2035 |

| Market Value in 2025 | USD 3077.5 million |

| Market Value in 2035 | USD 4216.9 million |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Inductance Rate, Vehicle Type, Sales Channel, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Argentina, Chile, Peru, Germany, United Kingdom, France, Spain, Italy, Russia, BENELUX, China, Japan, South Korea, GCC Countries, South Africa, Turkey |

| Key Companies Profiled |

Mouser Electronics, Inc.; Laird Technologies; TDK Corporation; Abracon; TTI Inc.; Avnet Inc.; Vishay Intertechnology; Bourns Inc.; Murata Manufacturing Co. Ltd.; Viking Tech Corporation |

| Customization | Available Upon Request |

The global automotive grade inductors market is estimated to be valued at USD 3,077.5 million in 2025.

The market size for the automotive grade inductors market is projected to reach USD 4,216.9 million by 2035.

The automotive grade inductors market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in automotive grade inductors market are less than 1 micro henry, 1-10 micro henry, 10-20 micro henry, 20-30 micro henry, 30-40 micro henry and more than 40 micro henry.

In terms of vehicle type, passenger cars segment to command 42.5% share in the automotive grade inductors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA