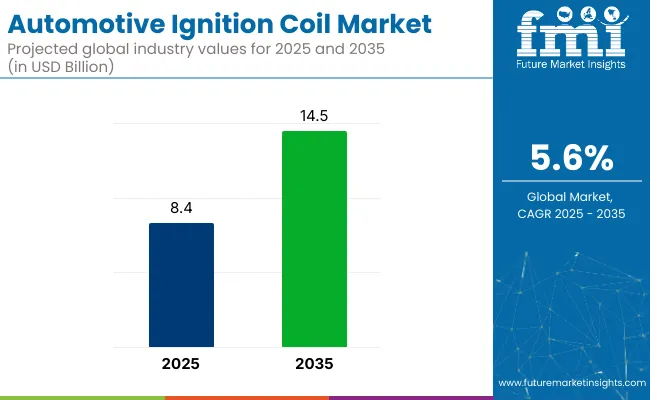

The global automotive ignition coil market is forecast to grow from USD 8.4 billion in 2025 to USD 14.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.6%. This expansion is being driven by rising vehicle production, stringent emissions standards, and growing demand for ignition system efficiency.

In Q1 2025, Standard Motor Products (SMP) released 170 new ignition coil part numbers, increasing coverage for late-model import and domestic vehicles. SMP’s ignition coil range now exceeds 800 SKUs, delivering near-complete coverage and extended service life. All of its coils are manufactured and validated in its IATF 16949-certified plant in Poland. Eric Sills, SMP’s CEO, confirmed that product expansion is aligned with rising demand for reliable ignition across powertrain types.

In 2023, Niterra (formerly NGK Spark Plug) introduced 29 new ignition coil references, increasing compatibility with key platforms such as Ford EcoBoost, Mazda, and Renault. The upgrade focused on emissions-compliant engines and covered over 2 million vehicles in the EMEA market. Michael Burchi, General Manager at Niterra North America, stated that the new “MOD Performance” coils were introduced to meet demand in the performance segment.

Growth in electric and hybrid vehicle output has prompted rising interest in ignition system maintenance and aftermarket readiness. Although EVs do not use traditional ignition coils, hybrids combine EFI systems with motors, increasing coil usage in certain segments. Regulatory tightening under Euro 7 and USA Tier 3 standards is also reinforcing market dynamics by mandating precise ignition timing and stable combustion profiles across vehicle lines.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 8.4 billion |

| Industry Value (2035F) | USD 14.5 billion |

| CAGR (2025 to 2035) | 5.6% |

Supply chain digitalisation is improving coil design and traceability. Both SMP and Niterra have deployed traceability codes and QC protocols across their production lines. These controls are being used to identify defective coils early and ensure compliance with OEM specifications during engine assembly.

Emerging markets in Southeast Asia and Latin America are contributing to volume growth. Local manufacturers are ramping up production to support increasing vehicle platforms, especially in regional hatchbacks, sedans, and compact SUVs.

Through the forecast decade, emphasis on combustion engine refinement, emissions reduction, and vehicle reliability is anticipated to sustain ignition coil demand. Technological advancements in coil durability, thermal resistance, and corrosion protection will be critical. Both OEM and aftermarket players are expected to pursue greater material enhancements and validation protocols to meet evolving requirements and support the market growth.

Electronic distributor coils are estimated to account for approximately 18.5% of the global automotive ignition coil market share in 2025 and are projected to grow at a CAGR of 5.4% through 2035. These coils are primarily used in distributor-based ignition systems and offer a cost-effective solution for multi-cylinder engine configurations.

While coil-on-plug (COP) and pencil coil systems dominate modern passenger vehicles, electronic distributor coils remain relevant in emerging markets where legacy vehicle architectures persist. Their integration into budget-oriented platforms, especially in regions with high two-wheeler and small car density, ensures sustained demand. Manufacturers continue to improve winding materials, housing durability, and thermal performance to extend lifecycle and reduce misfire rates under varying load conditions.

Two-wheelers are projected to account for nearly 22% of the global ignition coil market share in 2025 and are expected to grow at a CAGR of 5.7% through 2035. High ownership rates, expanding urban mobility, and frequent ignition cycling support steady demand for compact, reliable ignition coil systems in motorcycles, scooters, and mopeds.

In markets like India, Indonesia, and Vietnam-where two-wheeler production accounts for a significant share of total vehicle output-ignition coil replacement and OEM fitment remain critical for both performance and emissions compliance.

Suppliers are focused on delivering moisture-resistant, vibration-dampened ignition coils optimized for small displacement engines and variable ignition timing control, particularly in fuel-injected and BS-VI/Euro 5 compliant models. As electrification gradually influences the two-wheeler segment, ignition coil demand continues to remain robust in the ICE-dominated short-term landscape.

Electrification of Powertrains and the Decline of ICE in the Long Run

Pure electrification of battery vehicles (BEVs) and the easier decline of the ignition coil market is pure electric vehicles no longer need igniters. Governments across Europe, China, and North America are offering incentive packages and introducing regulations to push the EV market which could start the decay of the reach of ignition coil producers step by step.

The effect will be delayed but in the medium course, hybrids will play it back, for instance, the plug-in and mild ones which require ignition coils. They have to make innovations in application hybrids and to hedge their bets against this transition, they need to diversify into EV thermal and electronic systems.

Fakes and Low-Quality Parts in the Aftermarket

In some up-and-coming economies, the aftermarket is troubled with counterfeit ignition coils and substandard products. Many of these items fail too early or do not do their jobs well leading to damaged spark plugs, poor gas mileage, and pollution. For OEMs and branded suppliers, it also affects their brand reputation and consumer trust.

Manufacturers are combating this challenge through technology as they are investing in track-and-trace technology, tamper-proof packaging, and educational campaigns to differentiate genuine parts from counterfeit. Theƒ enlargement of authenticated service centers and e-commerce channels can also ensure that certified ignition systems are easily accessed.

Amp in Hybrid and Turbocharged Engine Applications

The increasing appropriation of hybrid powertrains and turbocharged machines is opening up a whole new area of implantation for high-performance ignition coils. Sterling gas engines must fully swallow ignition during the moment of fission, thus their advanced capacity overload and multi-spark systems are immensely helpful.

Original Equipment Manufacturers have now come up with technical strategies like integrating low-resistance windings, epoxy-filled housings, and high-dielectric-strength materials in ignition systems for the sake of fuel efficiency and emission standards.With this, they proof that they are environmentally friendly. The suppliers of the special coils available for hybrid engines can secure a leading position on the market.

Fast and Performance Upgrades in the Aftermarket

The existing car segment is getting transformed into a real forced beater in which many people demand increased car performance, especially in North America and Europe; this, in turn, is leading to the development of aftermarket performance kits such as high-voltage ignition coils for sports.

We offer a wide range of goods from premium coil packs to race-grade components and plug-and-play upgrade kits that are fitted into cars easily and quickly with the goal of making cars more performant.

On top of that, the burgeon of DIY vehicle maintenance cultures and online retail shops is making it easier and far cheaper to acquire branded ignition coils worldwide. Suppliers, in collaboration with aftermarket distributors, auto workshops, and e-retailers will benefit from the linking of supply to the fast-growing segment.

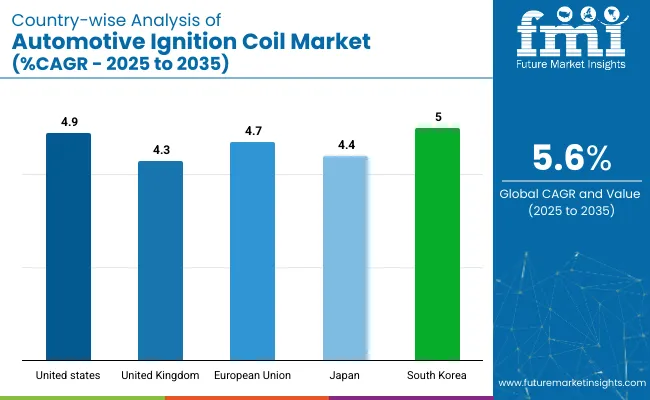

The territory of the automotive ignition coil imperium of the United States is flourishing unstoppably, owing to the large vehicle park, solid demand in the aftermarket, and continuation of gasoline car models, especially in the light truck and SUV segments. Absorbing the impact of increased adoption of electric vehicles, on the other hand, the internal combustion engine (ICE) vehicles maintain the upper hand, thus, inauguration of new ignition coils still remains a regular thing.

The combination of turbocharged/high-performance engines, along with people's demand for more dependable and fuel-efficient cars leads the manufacturers to devise high-energy and multi-spark coil systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

The automotive ignition coil market in the United Kingdom is experiencing fair growth spurred on by the increasing aftermarket sales, the sale of mild hybrid and ICE vehicles, and the need for periodic maintenance for cars that are aging. However even though electric vehicles are taking off, most cars on UK roads still run on traditional spark ignition systems.

The growing consciousness of engine misfire and emissions is resulting in prompt changing of the ignition components, thus the demand for coil is upheld especially in the fleets and shared vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

The ignition coil sector of the European Union which includes automotive is steadily increasing owing to the high amount of ICE and hybrid vehicles being produced, most of which are in Germany, France and Italy. Even though the growth of EVs is strong, the large share of gasoline vehicles that are still on the road supports the continuous need for OEMs and aftermarket ignition coils.

The OEMs belonging to the EU are prioritizing the introduction of low-emission and fuel-efficient combustion engines that will be compatible with multi-spark discharge ignition systems. New technologies have been introduced such as multi-spark discharge, and advanced heat-resistant materials which have been making a mark on the product market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

The market for automotive ignition coils in Japan is growing at a very slow rate due to the increasing share of EVs; however, the dominance of the hybrid electric vehicles (HEVs) utilizing ignition coils proves that the demand stays steady. Toyota Enterprises and others are utilizing their long-standing technologies for high-efficiency ignition systems which are not only cutting down carbons but also improving gasoline learning.

The focus on kei cars, hybrids, and a compact car line drives even higher demand for pon-space full-life ignition technology, especially in the OEM segment. The fiscal car emission targets in Japan represent international trade as most of the vehicles are exported while the emission output is cut down.

| CAGR (2025 to 2035) | |

|---|---|

| Japan | 4.4% |

The automotive ignition coil in South Korea is hitting a new high as a result of the strong production of gasoline and hybrid vehicles coupled with the technological advancements made by the leading OEMs, such as Hyundai and Kia. The thermal durability, extending the coil winding technology, and vehicle-specific coil pack designs, are the factors that the ignition coil segment benefits from.

Both domestic as well as export-driven manufacturing have contributed to the sustained demand for ignition modules, coil-on-plug as well as coil-near-plug systems, particularly in compact sedans, SUVs, and hybrid models.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The global automotive ignition coil market is on a roll with the support of the increasing passenger and commercial vehicle production, the growing aftermarket replacement needs, as well as the many fuel-efficient and low-emission engines manufactured. Ignition coils feed the battery voltage into the high-voltage sparks that are needed to mix with the air and fuel for gasoline internal combustion engines (ICEs) and some hybrid vehicles to function.

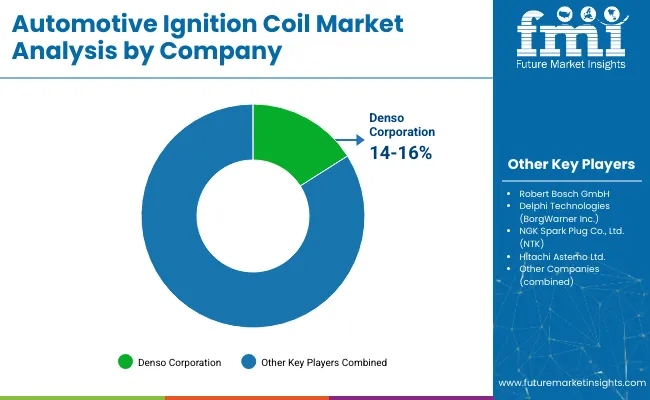

The trend of OEMs' gradual takeoff to multi-spark systems, coil-on-plug (COP) styles, and smart ignition technologies will speed up the search for compact ignition coils that operate at high-efficiency, and are thermally resistant. In terms of market structure, the industry is somewhat consolidated, with the top five firms covering about 48%-52% of the total global market. These companies are based on their capabilities such as long-lasting OE partnerships, technology licensing, and global manufacturing networks.

The global Automotive Ignition Coil market is projected to reach USD 8.4 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 5.6% over the forecast period.

By 2035, the Automotive Ignition Coil market is expected to reach USD 14.5 billion.

The Can-Type Ignition Coil segment is expected to dominate the market, owing to its robust design, high energy output, cost-effectiveness, and widespread adoption in both passenger and commercial vehicles.

Key players in the Automotive Ignition Coil market include Mitsubishi Electric Corporation, Yura Corporation, Diamond Electric Mfg. Co., Ltd., Federal-Mogul (DRiV, Tenneco).

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Ignition Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Coil Spring Market

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA