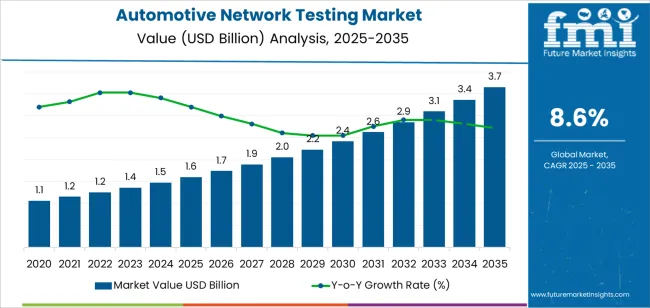

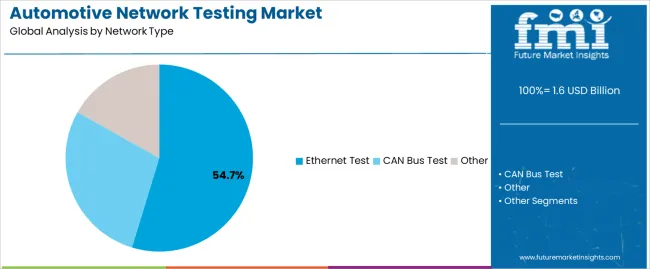

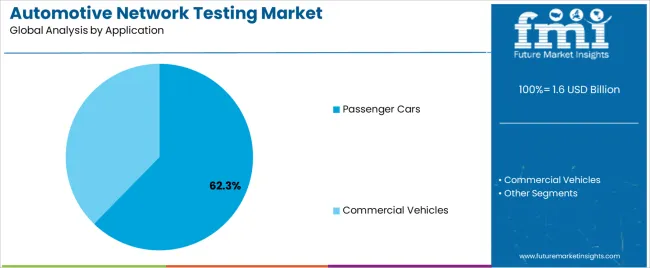

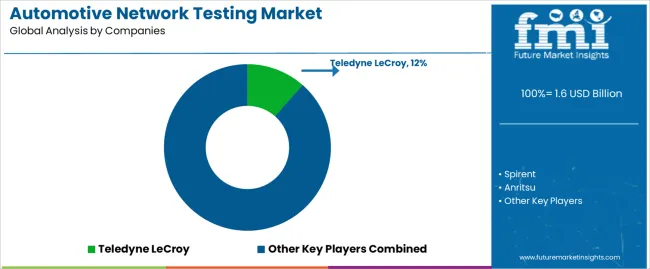

The automotive network testing space is set to rise from USD 1.6 billion in 2025 to USD 3.7 billion by 2035 at a CAGR of 8.6%, nearly 2.3x growth. Expansion is anchored in the shift to software-defined, zonal E/E architectures, rapid automotive Ethernet adoption, and compliance with UN R155, ISO/SAE 21434, and ISO 26262. Buyers prioritize platforms that unify hardware analyzers, protocol stacks, automation, and cybersecurity validation across development, production, and field phases. Passenger cars lead with 62.3% share as the launchpad for high-bandwidth features, while commercial vehicles add steady demand through fleet connectivity and EV charging comms. Ethernet test dominates with 54.7% share, widening as cameras, lidar, and centralized compute increase bandwidth and TSN timing needs. Competitive advantage accrues to vendors that bundle protocol breadth, test automation, and security tooling. Key names cited include Teledyne LeCroy, Spirent, Anritsu, Keysight, Rohde & Schwarz.

The continued shift toward centralized vehicle compute, zonal harnessing, and high-resolution sensor fusion is intensifying the need for deterministic, low-latency, fault-tolerant communication validation. As automakers migrate from distributed ECUs to domain/zonal controllers, the verification workload moves from discrete subsystem testing to system-level network assurance, where timing windows, message prioritization, and cybersecurity resilience are evaluated under dynamic driving conditions. Simultaneously, over-the-air software updating transforms network testing into a continuous process across the lifecycle, not just pre-SOP. Testing ecosystems are therefore expanding to include HIL benches, digital twins, automated replay environments, and cloud-based regression test scheduling, making software competence as critical as hardware instrumentation.

Regulatory requirements for functional safety, cybersecurity standards including UN R155 and ISO/SAE 21434, and quality assurance mandates from original equipment manufacturers are creating comprehensive validation requirements throughout development, production, and post-production phases. The market is characterized by convergence of automotive engineering, telecommunications testing expertise, and cybersecurity assessment capabilities, with solution providers developing integrated platforms combining hardware test equipment, protocol analysis software, and automated test frameworks that accelerate validation cycles while ensuring comprehensive coverage of network functionality, performance boundaries, and security vulnerabilities across the vehicle lifecycle.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.6 billion |

| Market Forecast Value (2035) | USD 3.7 billion |

| Forecast CAGR (2025-2035) | 8.6% |

| VEHICLE ARCHITECTURE EVOLUTION | CONNECTIVITY & AUTOMATION DRIVERS | REGULATORY & SAFETY REQUIREMENTS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

| By Network Type | CAN Bus Test, Ethernet Test, Other |

| By Application | Passenger Cars, Commercial Vehicles |

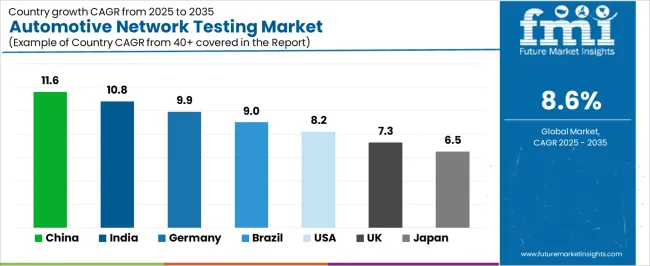

| By Region | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Ethernet Test |

|

| CAN Bus Test |

|

| Other |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Passenger Cars |

|

| Commercial Vehicles |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

| Region | Market Value 2025 (USD Million) | Market Value 2035 (USD Million) | CAGR (2025-2035) |

|---|---|---|---|

| China | 577.1 | 1,251.1 | 11.6% |

| India | 56.1 | 86.1 | 10.8% |

| Germany | 1,060.8 | 2,229.0 | 9.9% |

| Brazil | 1,152.1 | 2,420.7 | 9.0% |

| United States | 1,358.7 | 2,855.0 | 8.2% |

| United Kingdom | 1,475.6 | 3,100.5 | 7.3% |

| Japan | 1,740.3 | 3,367.2 | 6.5% |

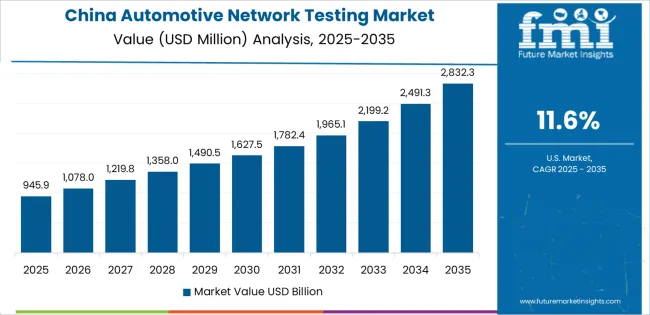

China is projected to reach USD 1,251.1 million by 2035, driven by the country's position as the world's largest automotive market and rapid electric vehicle adoption creating substantial demand for network validation solutions across domestic manufacturers and international suppliers. China's dominance in electric vehicle production and aggressive autonomous driving development programs generate extensive testing requirements for high-voltage networks, battery management communications, and sensor fusion systems. Government initiatives supporting intelligent connected vehicles and autonomous driving pilots create constant investment in testing infrastructure and validation capabilities. Domestic automakers including BYD, NIO, and Xpeng are implementing advanced electrical architectures requiring comprehensive network testing services and equipment. Growing software capabilities among Chinese automotive companies drive demand for continuous integration and testing automation platforms. Automotive Ethernet adoption accelerating in Chinese vehicles pursuing Level 3 and higher autonomous capabilities requiring sophisticated validation. International testing equipment suppliers and service providers maintain strong presence supporting global manufacturers operating Chinese facilities and technology development centers. Local testing solution providers emerging with competitive offerings tailored to Chinese market requirements and pricing expectations. Regulatory environment evolving with cybersecurity and data privacy requirements creating compliance-driven testing demand.

India is expanding to reach USD 86.1 million by 2035, supported by growing automotive electronics content and increasing domestic vehicle development capabilities creating emerging demand for network validation solutions. The country's expanding automotive industry and government initiatives promoting electric mobility and connected vehicle technologies support testing market development. Global automotive suppliers establishing engineering centers in India require testing capabilities supporting development activities for international programs. Growing focus on cost-effective engineering solutions positions India as attractive location for automotive testing services and validation activities. Domestic automakers including Tata Motors and Mahindra developing electric vehicles and advanced driver assistance systems require network testing expertise and equipment. Automotive electronics suppliers serving global customers implement quality assurance programs including comprehensive network testing. Limited local testing infrastructure creating opportunities for international testing solution providers and potential for domestic capability development. Technical education institutions and automotive engineering programs beginning to incorporate network testing training supporting long-term ecosystem development. Price sensitivity and capital constraints favoring testing services over in-house equipment investments initially.

Germany is projected to reach USD 2,229.0 million by 2035, supported by the country's position as global automotive innovation leader and concentration of premium manufacturers requiring sophisticated testing solutions for advanced vehicle technologies. German automotive manufacturers including Volkswagen Group, BMW, and Mercedes-Benz drive testing market through rigorous validation requirements for next-generation electrical architectures. The market is characterized by focus on comprehensive testing methodologies, early adoption of emerging standards, and integration of testing throughout development processes. Automotive supplier ecosystem including Bosch, Continental, and ZF maintains extensive testing capabilities supporting component development and system integration validation. Research institutions and technical universities collaborate with industry on testing methodology development and standardization activities. Strong focus on functional safety and cybersecurity compliance driving investment in specialized testing capabilities and automation. Electric vehicle development and autonomous driving programs require extensive network validation across sensor systems, computer platforms, and actuator networks. Germany's role as automotive technology exporter creates demand for testing solutions supporting global deployment and regional compliance requirements.

Brazil is growing to reach USD 2,420.7 million by 2035, driven by automotive electronics content increases and local development capabilities requiring network validation solutions supporting domestic production. The country's significant automotive manufacturing base and operations by international automakers including Volkswagen, General Motors, and Fiat create testing demand for production validation and quality assurance. Growing emission regulations and safety standards drive adoption of electronic control systems requiring network testing capabilities. Flex-fuel vehicle expertise and ethanol powertrain optimization create specialized testing requirements unique to Brazilian market. Automotive supplier operations support global product development requiring testing capabilities meeting international standards. Engineering centers established by global manufacturers conduct regional vehicle adaptations and validation requiring network testing infrastructure. Economic considerations favor outsourced testing services over major capital equipment investments particularly among smaller suppliers. Technical workforce development and engineering education programs supporting long-term testing capability growth. Challenges include infrastructure limitations, import costs for specialized testing equipment, and technical expertise availability constraining market development pace.

The United States is projected to reach USD 2,855.0 million by 2035, supported by leading autonomous vehicle development programs and comprehensive automotive supplier ecosystem creating steady demand for sophisticated network validation solutions. The country's technology leadership in autonomous driving, with companies including Waymo, Cruise, and Tesla, generates extensive testing requirements for sensor networks, compute platforms, and safety-critical communication systems. Automotive manufacturers including General Motors, Ford, and Stellantis maintain extensive testing capabilities supporting next-generation vehicle development. Silicon Valley technology companies entering automotive space bring software development methodologies requiring continuous integration and automated testing frameworks. Regulatory environment including NHTSA oversight and evolving autonomous vehicle standards creates compliance-driven testing demand. Cybersecurity focus given connected vehicle vulnerability concerns driving investment in security testing and penetration testing capabilities. Electric vehicle development by both established manufacturers and startups requires comprehensive validation of high-voltage networks and charging communication protocols. Strong testing equipment and service provider ecosystem including major test and measurement companies maintains comprehensive solution portfolios. University research programs and testing facilities support methodology development and validation framework advancement.

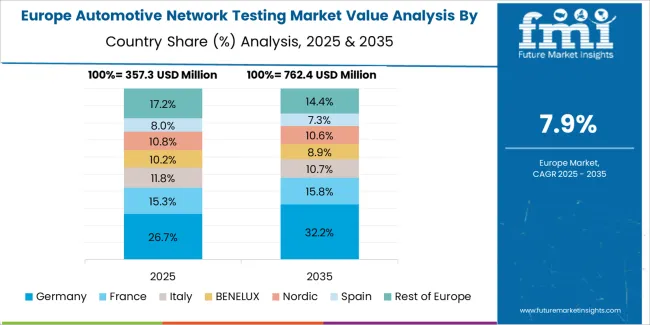

The automotive network testing market in Europe is projected to grow from USD 1,452.8 million in 2025 to USD 2,948.3 million by 2035, registering a CAGR of 7.4% over the forecast period. Germany is expected to maintain its leadership position with a 38.7% market share in 2025, projected to expand to 39.6% by 2035, supported by its concentration of premium automotive manufacturers and advanced supplier ecosystem. The United Kingdom follows with a 26.3% share in 2025, anticipated to reach 27.1% by 2035, driven by automotive engineering centers and motorsports industry testing capabilities. France holds a 18.4% share, while Sweden accounts for 12.2% in 2025, reflecting automotive manufacturing operations and technology development activities. The Rest of Europe region is projected to maintain approximately 4.4% collectively through 2035, with Italy, Spain, and Eastern European countries conducting network testing supporting automotive production and development activities.

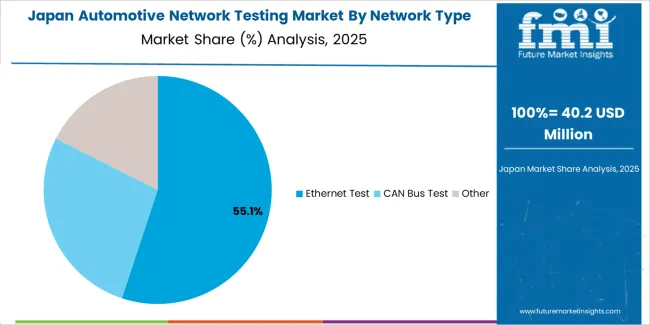

Japanese automotive network testing operations reflect the country's focus on quality assurance and comprehensive validation methodologies. Automotive manufacturers including Toyota, Honda, and Nissan maintain rigorous testing standards requiring extensive network validation throughout development and production processes. The market demonstrates unique requirements reflecting Japanese automotive engineering practices including thorough documentation, comprehensive coverage, and conservative approach to technology adoption until maturity proven. Domestic testing equipment manufacturers and service providers maintain strong capabilities supporting Japanese automotive industry requirements. Growing electric vehicle development and autonomous driving programs require enhanced network testing capabilities particularly for sensor fusion systems and centralized computing platforms. Technical preferences include preference for proven testing methodologies, comprehensive validation coverage, and integration with established development processes. Supplier quality assurance requirements drive testing demand throughout supply chain with tier suppliers implementing comprehensive validation programs. Export-oriented automotive production requires testing ensuring compliance with diverse global requirements and regional standards. Research collaborations between automakers, suppliers, and universities advance testing methodologies and automation capabilities.

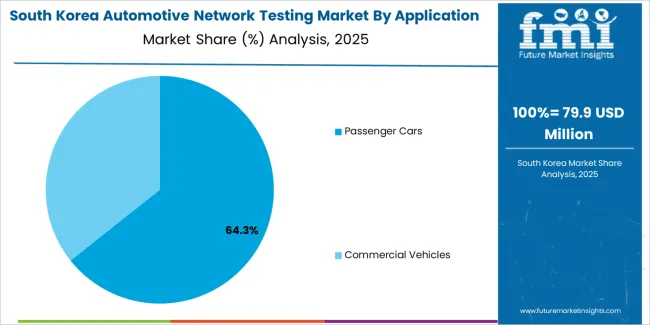

South Korean automotive network testing operations reflect the country's automotive industry sophistication and technology adoption. Major manufacturers including Hyundai and Kia drive testing market through advanced vehicle development programs incorporating latest electrical architectures and connectivity features. Growing electric vehicle production and autonomous driving capabilities require comprehensive network validation across battery management, sensor systems, and vehicle-to-everything communication. Domestic automotive electronics suppliers including LG, Samsung, and Hyundai Mobis maintain extensive testing capabilities supporting component development and system integration. Government initiatives promoting intelligent transportation systems and connected vehicle technologies create favorable environment for network testing market development. Technical requirements emphasize automation, efficiency, and integration with rapid development cycles characteristic of Korean automotive industry. Strong focus on cost-effectiveness and testing efficiency drives adoption of automated testing frameworks and simulation-based validation approaches. Cybersecurity testing gaining prominence given connectivity features and data privacy concerns. Growing collaboration between automotive and telecommunications industries in connected vehicle development creates demand for comprehensive protocol testing spanning automotive and cellular networks.

The market demonstrates consolidation among established test and measurement companies and specialized automotive testing solution providers. Profit concentration occurs in comprehensive testing platforms combining hardware equipment, protocol analysis software, and automation frameworks rather than point solutions. Value migration favors companies offering end-to-end validation capabilities spanning development, production, and field testing phases with expertise across multiple network protocols and automotive domains. Several competitive archetypes define market dynamics: established test and measurement companies leveraging telecommunications testing heritage and adapting solutions for automotive applications; specialized automotive testing providers focusing exclusively on vehicle network validation with deep domain expertise; semiconductor and component manufacturers offering testing solutions integrated with their connectivity products; and engineering services companies providing validation services and consulting alongside or instead of equipment sales.

Market differentiation centers on protocol coverage breadth spanning legacy and emerging standards, automotive domain expertise including functional safety and cybersecurity knowledge, automation capabilities reducing manual testing effort and accelerating validation cycles, and integration with automotive development toolchains including simulation platforms and continuous integration systems. Switching costs remain significant with primary barriers including capital equipment investments, engineer training and methodology development, test automation framework implementation, and integration with established development processes. Competition intensifies around cybersecurity testing capabilities recognizing growing regulatory requirements and customer concerns regarding vehicle cyber threats. Technical credibility established through automotive industry relationships, participation in standards development, proven validation methodologies, and track record supporting production vehicle programs.

Geographic presence proves valuable given importance of local technical support, application engineering assistance, and collaboration during development programs. Strategic partnerships between testing solution providers and automotive manufacturers, semiconductor companies, and software platform vendors create integrated ecosystems. Innovation focus includes developing automated testing frameworks reducing manual intervention, implementing AI-powered anomaly detection identifying network issues, creating cloud-based testing platforms enabling distributed validation, and advancing cybersecurity assessment methodologies addressing evolving threat landscape. Market dynamics favor companies successfully navigating transition from hardware-centric business models toward software and services emphasizing subscription-based offerings, managed testing services, and consulting engagements supporting automotive customers throughout development lifecycle.

| Items | Values |

|---|---|

| Quantitative Units | USD 1.6 million |

| Network Type | CAN Bus Test, Ethernet Test, Other |

| Application | Passenger Cars, Commercial Vehicles |

| Regions Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Key Companies Profiled | Teledyne LeCroy, Spirent, Anritsu, FEV Group, Molex, Avnet, NextGig Systems, Elektrobit, Xena Networks, Spirent Communications, Kyowa Electronic, UNH-IOL, Allion Labs, Excelforce, AESwave, Primatec, Rohde & Schwarz, Keysight |

| Additional Attributes | Dollar sales by network type and application, regional demand across key markets, competitive landscape, protocol testing adoption, automotive Ethernet transition, and validation methodology development driving vehicle safety, cybersecurity compliance, and software-defined architecture enablement |

The global automotive network testing market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the automotive network testing market is projected to reach USD 3.7 billion by 2035.

The automotive network testing market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in automotive network testing market are ethernet test, can bus test and other.

In terms of application, passenger cars segment to command 62.3% share in the automotive network testing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA