The automotive diagnostic scan tool market is advancing steadily, driven by rising vehicle complexity, electrification trends, and the demand for real-time fault detection technologies. Automotive OEMs and aftermarket service providers are investing in advanced diagnostic systems to meet evolving emission regulations, improve service efficiency, and reduce vehicle downtime.

Industry reports and automotive technology briefings have underlined the importance of integrating electronic control units (ECUs) across powertrain, safety, and infotainment systems, which has increased the need for specialized diagnostic interfaces. Additionally, increasing consumer demand for preventive maintenance and the shift toward predictive analytics in vehicle health management have supported broader tool adoption.

Connected diagnostics, remote access solutions, and mobile-integrated platforms are enabling mechanics and fleet operators to perform efficient fault resolution. As the aftermarket continues to digitize, demand for portable and wireless diagnostic tools is expected to grow further. Segmental expansion is being driven by Scanners in tool types, Handheld in mobility form factors, and Bluetooth among connectivity technologies, due to their accuracy, usability, and compatibility with modern automotive service ecosystems.

| Metric | Value |

|---|---|

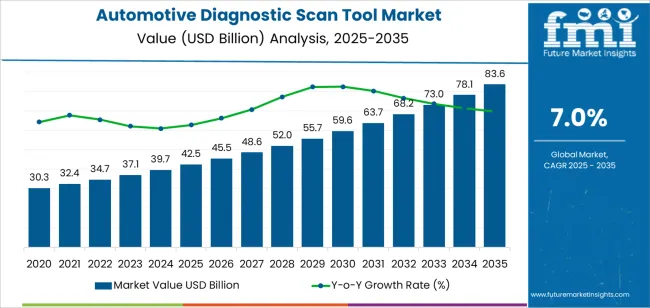

| Automotive Diagnostic Scan Tool Market Estimated Value in (2025 E) | USD 42.5 billion |

| Automotive Diagnostic Scan Tool Market Forecast Value in (2035 F) | USD 83.6 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The market is segmented by Tool Type, Mobility Type, Connectivity Type, and Vehicle Type and region. By Tool Type, the market is divided into Scanners, Code Readers, TPMS Tools, Digital Pressure Tester, Battery Analyzer, Exhaust Gas Analyzer, Wheel Alignment Equipment, Paint Scan Equipment, Dynamometer, Headlight Teaser, Fuel Injection Diagnostic, and Pressure Leak Detection. In terms of Mobility Type, the market is classified into Handheld and Fixed. Based on Connectivity Type, the market is segmented into Bluetooth, USB, and Wi-Fi. By Vehicle Type, the market is divided into Passenger Car and Commercial Vehicles. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

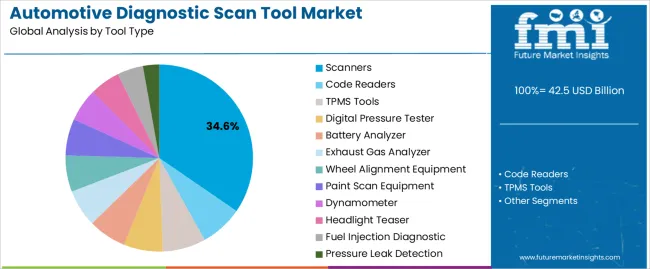

The Scanners segment is projected to hold 34.6% of the automotive diagnostic scan tool market revenue in 2025, maintaining its role as the leading tool type. Growth in this segment has been supported by the wide adoption of multi-functional scanners capable of reading and clearing diagnostic trouble codes across various vehicle systems.

Automotive service centers and repair shops have preferred scanners for their reliability in performing comprehensive diagnostics, including emissions, engine, ABS, and transmission systems. Manufacturers have developed advanced scanning tools compatible with both legacy and modern vehicle models, reinforcing their relevance across fleets.

User-friendly interfaces, support for multiple vehicle protocols, and real-time data streaming have also enhanced the segment’s popularity. As demand for faster and more accurate fault detection rises, the Scanners segment is expected to retain its stronghold due to its versatility and proven performance in both OEM and independent service environments.

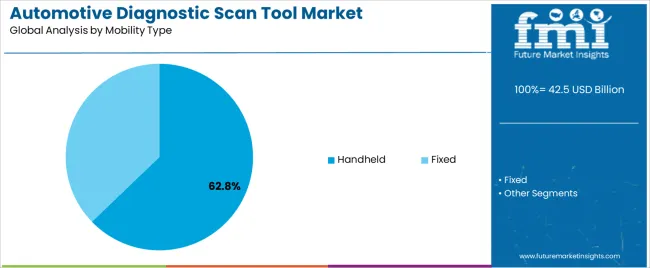

The Handheld segment is projected to contribute 62.8% of the automotive diagnostic scan tool market revenue in 2025, solidifying its dominance among mobility types. Growth has been driven by the portability, ease of use, and cost-effectiveness associated with handheld diagnostic tools, particularly in fast-paced workshop environments.

Automotive technicians have relied on these tools for quick plug-and-play diagnostics without the need for a connected workstation, enhancing workflow efficiency. Additionally, handheld tools have been equipped with rugged designs, wireless communication features, and intuitive user interfaces, making them suitable for both professional garages and field service operations.

Industry announcements have highlighted their growing usage in fleet maintenance and small-scale repair centers, where mobility and reliability are critical. With aftermarket demand shifting toward compact, easy-to-carry diagnostic equipment, the Handheld segment is expected to remain the preferred form factor for technicians and independent service providers globally.

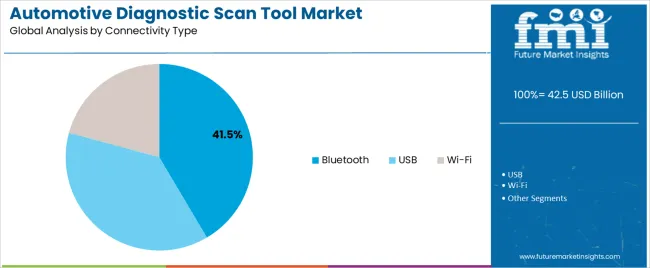

The Bluetooth segment is expected to account for 41.5% of the automotive diagnostic scan tool market revenue in 2025, establishing itself as the leading connectivity type. This segment’s growth has been fueled by the increasing demand for wireless diagnostics that can interface seamlessly with smartphones, tablets, and laptops.

Bluetooth-enabled tools have been preferred for their flexibility and compatibility with mobile applications, allowing technicians to perform diagnostics remotely and with minimal physical interface. Workshops and independent service providers have adopted these solutions to improve efficiency, reduce cable clutter, and enable digital record-keeping of diagnostic results.

Technology updates from automotive electronics companies have showcased innovations in low-latency Bluetooth communication, which enhances data accuracy and speed during fault detection. As connected vehicle ecosystems expand and the role of smart diagnostics grows, the Bluetooth segment is expected to sustain its leadership due to its scalability, user convenience, and integration with mobile diagnostic platforms.

Rising Complexity of Modern Vehicles to Boost Demand

Continuous advancements in automotive technology, including the integration of electronic systems, advanced car sensors, automotive scan tools, and connectivity features, are driving the demand for sophisticated diagnostic scan tools capable of diagnosing complex vehicle issues. Stringent emissions regulations and safety standards imposed by governments worldwide are compelling automotive manufacturers to invest in diagnostic scan tools to ensure compliance and meet regulatory requirements, driving growth.

The increasing complexity of modern vehicles, with intricate electronic systems, onboard computers, and advanced driver assistance systems (ADAS), is fueling the need for diagnostic solutions that can accurately diagnose and troubleshoot a wide range of vehicle issues.

Need for Special Training and High Cost to Hamper Demand

The high cost of diagnostic scan tools, especially those equipped with advanced features and capabilities, can be a barrier to adoption for smaller automotive repair shops and independent technicians, limiting industry penetration. The complexity of modern diagnostic tools and the need for specialized training to operate these effectively create a skills gap among automotive technicians, hindering the widespread adoption of advanced diagnostic solutions and limiting growth.

Compatibility issues between diagnostic scan tools and vehicle models can pose challenges for technicians, particularly in multi-brand repair shops or when working with older vehicles, impacting the usability and effectiveness of diagnostic solutions. The automotive diagnostic scanner market is highly fragmented, with numerous players offering a wide range of products and solutions, leading to sector saturation, price competition, and commoditization of basic diagnostic tools.

Rising Adoption of EVs to Bolster Expansion of Aftermarket Services

The growing adoption of electric vehicles (EVs) and hybrid vehicles presents opportunities for diagnostic scan tool manufacturers to develop specialized diagnostic solutions tailored to assess battery health, electric drivetrain performance, and charging system functionality. The integration of artificial intelligence (AI) and Internet of Things (IoT) technologies into diagnostic scan tools enables advanced features, creating new opportunities for innovation and differentiation in the sector.

The expansion of automotive industry in emerging economies presents opportunities for diagnostic scan tool manufacturers to tap into new customer segments and geographic regions where vehicle ownership is on the rise. The growing demand for aftermarket services creates opportunities for diagnostic scan tool manufacturers to offer integrated solutions that cater to the needs of automotive repair shops, dealerships, and fleet operators.

Integration of Telematics Systems to be a Key Trend

With the increasing adoption of electric vehicles (EVs), diagnostic scan tools are evolving to support the unique diagnostic needs of electric drivetrains, battery management systems, and charging infrastructure. Diagnostic scan tools are integrated with telematics systems and connected car platforms to access real-time vehicle data, monitor vehicle health remotely, and deliver predictive maintenance insights.

Diagnostic scan tools are becoming increasingly versatile, supporting multi-brand and multi-system compatibility to cater to the diverse needs of operators. Universal diagnostic platforms offer comprehensive vehicle coverage, enabling technicians to diagnose and repair vehicles from different manufacturers with a single diagnostic tool.

The automotive diagnostic scan tool market in India is experiencing robust growth, driven by the country's expanding automotive aftermarket industry, increasing vehicle ownership, and rising demand for diagnostic solutions. The sector is characterized by a large number of independent repair shops, service centers, and aftermarket retailers catering to a diverse customer base.

The country's automotive industry is embracing technological advancements, including the adoption of diagnostic scan tools with features such as wireless connectivity, cloud-based diagnostics, and predictive analytics. There is a growing demand for advanced diagnostic solutions capable of diagnosing a wide range of vehicle issues across different vehicle makes and models.

Spain's automotive diagnostic scan tool market is characterized by steady growth, driven by the country's automotive aftermarket sector, which comprises a mix of independent repair shops, dealership service centers, and aftermarket retailers. The sector is influenced by factors such as vehicle fleet composition, regulatory requirements, and technological advancements.

The automotive industry in Spain is witnessing increased adoption of advanced diagnostic scan tools equipped with features such as real-time data streaming, system diagnostics, and remote diagnostics capabilities. There is a growing demand for diagnostic solutions capable of addressing complex vehicle issues and supporting advanced automotive technologies.

Canada's automotive diagnostic scan tool market is characterized by steady growth, driven by factors such as vehicle ownership rates, aftermarket service demand, and technological advancements. The sector comprises a diverse ecosystem of automotive repair shops, dealership service centers, and aftermarket retailers.

The country’s automotive industry is embracing technological innovations in diagnostic scan tools, including wireless connectivity, cloud-based diagnostics, and predictive analytics. There is a growing demand for diagnostic solutions capable of diagnosing complex vehicle issues, supporting advanced automotive systems, and enhancing service efficiency.

Dynamometers play a crucial role, particularly in the automotive diagnostic scan tool market, in performance testing and calibration of vehicles. There are various types of dynamometers, each serving specific diagnostic and testing purposes.

Chassis dynamometers are set to be widely used to measure the performance and emissions of vehicles under simulated driving conditions. These allow technicians to assess vehicle performance parameters in a controlled laboratory or testing environment.

Engine dynamometers are projected to be used to measure the performance characteristics of internal combustion engines. Hydraulic dynamometers utilize hydraulic fluid to load and control the output of engines or drivetrain components during testing.

The demand for Wi-Fi automotive diagnostic scan tools is rising due to the increasing complexity and sophistication of modern vehicles. As cars become more advanced with numerous electronic systems and sensors, the need for efficient and accurate diagnostics has grown.

Wi-Fi diagnostic tools offer the convenience of wireless connectivity, allowing mechanics and car owners to easily connect their smartphones, tablets, or laptops to the vehicle's onboard diagnostics system. This wireless functionality enables more flexible and accessible diagnostics, facilitating real-time data monitoring, remote diagnostics, and software updates without the need for physical cables.

The competition outlook for the automotive diagnostic scan tool market is expected to remain intense, driven by several factors shaping the industry landscape. It is set to be fueled by technological innovations, with companies striving to develop advanced diagnostic solutions with enhanced features, capabilities, and performance.

The sector is likely to witness increased consolidation and merger and acquisition activity as companies seek to strengthen competitive positions, expand product portfolios, and gain access to new markets and customers.

Competition is projected to intensify as automotive diagnostic scan companies expand into emerging markets such as Asia Pacific, Latin America, and Africa, where rising vehicle ownership, urbanization, and disposable income levels present growth opportunities.

Companies are likely to invest in establishing a strong presence, distribution networks, and partnerships in these sectors to capitalize on the growing demand for diagnostic scan tools and aftermarket services.

Companies that can differentiate themselves through innovation, customer-centric strategies, global expansion, and strategic collaborations will be well-positioned to succeed in this competitive market landscape.

For instance

On the basis of tool type, the industry is divided into scanners, code readers, TPMS tools, digital pressure testers, battery analyzers, exhaust gas analyzers, wheel alignment equipment, paint scan equipment, dynamometers, headlight teaser, fuel injection diagnostics, pressure leak detection.

The sector is bifurcated into handheld and fixed.

The sector is divided into USB, Wi-Fi, and Bluetooth.

Two primary types of vehicles include passenger cars and commercial vehicles.

Based on region, the market is spread across North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan, Japan, and the Middle East and Africa.

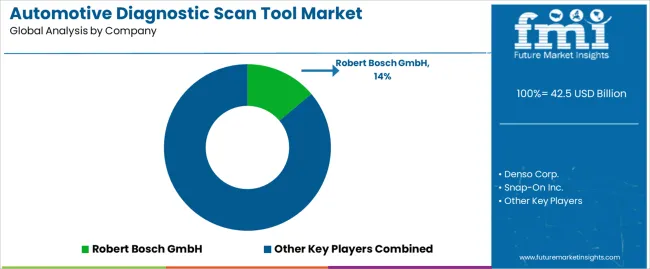

The global automotive diagnostic scan tool market is estimated to be valued at USD 42.5 billion in 2025.

The market size for the automotive diagnostic scan tool market is projected to reach USD 83.6 billion by 2035.

The automotive diagnostic scan tool market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in automotive diagnostic scan tool market are scanners, code readers, tpms tools, digital pressure tester, battery analyzer, exhaust gas analyzer, wheel alignment equipment, paint scan equipment, dynamometer, headlight teaser, fuel injection diagnostic and pressure leak detection.

In terms of mobility type, handheld segment to command 62.8% share in the automotive diagnostic scan tool market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA