The demand for better transportation integration in growing urban population will drive the growth of MaaS market significantly from 2025 to 2035. Mobility as a Service Market integrates multiple transportation services -,including ride-hailing, public transit, bike-sharing, and some car rental and car-sharing- into a single accessible digital interface, enhancing user convenience and reducing reliance on personal vehicles.

Continued penetration of smartphones, advancements in artificial intelligence and increasing environmental challenges are some of the factors fueling the adoption of MaaS solutions. Governing bodies' efforts to promote sustainable urban mobility, investment in smart transportation infrastructure, and leverage of public and private transport operator partnerships further intensify market growth.

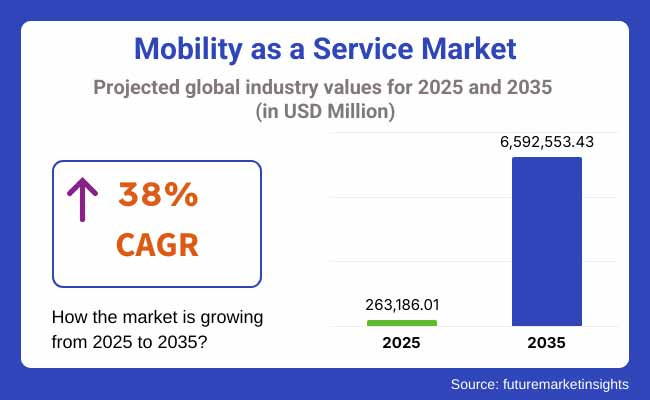

In 2025, the Mobility as a service market was valued at approximately USD 263,186.01 million. By 2035, it is projected to reach USD 6,592,553.43 million, reflecting a robust compound annual growth rate (CAGR) of 38%. The market’s exponential growth is attributed to the widespread adoption of subscription-based transport models, increasing investments in electric and autonomous vehicles, and rising consumer preference for cost-effective and flexible mobility solutions.

Furthermore, advancements in real-time data analytics, artificial intelligence-driven route optimization, and blockchain-based secure payment systems are revolutionizing the MaaS landscape. The rapid proliferation of 5G networks and the integration of cloud computing technologies are also playing a pivotal role in the market’s expansion, offering seamless connectivity and improved service efficiency.

North America remains among the leading Mobility as a Service markets, complemented by high investments in smart city projects, extensive consumer awareness, and existing major MaaS providers. The United States and Canada is projected to offer high growth opportunities for the integrated mobility solution, owing to the presence of dense metropolitan cities with high levels of congestion.

Such sustainable transport policies in cities, and increasing interest in ride-hailing services, electric scooters and on-demand public transit. These trends are spurred by national policies promoting the expansion of electric vehicle (EV) charging networks and AI-powered traffic management systems that support the growth of the MaaS ecosystem; In addition, collaboration between municipal transportation agencies and private mobility service providers further fuels adoption as well as transport integration, allowing consumers to enjoy seamless travel experience.

The EV market for Mobility as a service in Europe is experiencing fast growth, propelled by stricter emission regulations, robust public transportation networks, and a growing number of consumers demanding sustainable travel solutions. Germany, France and the UK are leading the way in the adoption of MaaS, with several cities implementing multimodal transport systems and digital ticketing platforms.

The European Union is emphasizing measures such as enhanced public transit efficiency and shared mobility services as part of an effort to reduce carbon footprints, and the latter is affecting the MaaS landscape in the region. Moreover, the rise of real-time mobility data sharing, AI-powered predictive analytics, and heightened government support for green transportation policies are working as drivers propelling the mass-market deployment of MaaS solutions.

The Mobility as a service market is being driven by rapid urbanization in the Asia-Pacific region along with smartphone penetration and funding in smart transport solutions. China, Japan, and India account for a significant portion of this growth due in large part to the ever-increasing adoption of electric, and shared mobility platforms in densely populated cities.

The rise of ride-sharing services, micro-mobility solutions, and transport and payment integrations all experienced growth fueled by the growing need for affordable and flexible travel solutions. Government plans that support smart city development, congestion reduction initiatives, and large-scale infrastructure projects are also fueling the market. Additionally, AI-based navigation systems and IoT-enabled mobility solutions are improving user experience and operational efficiency in the region.

Technological evolution, consumer transportation preference changes, and growing regulatory support for the mobility as a service market will drive tremendous growth over the next decade. Optimize routes using AI, integrate seamlessly across modes, and build digital platforms that are user-friendly all to make service as efficient as possible.

The mobility landscape is evolving with the advent of progressive solutions such as EVs, IoT-based vehicle tracking, and data-backed transport analytics. Smart transport solutions are already on the rise in cities around the world, and if trends continue, MaaS providers will shape how the world of urban citizens travel more efficiently, sustainably, and accessibly.

Challenge

Infrastructure Limitations and Integration Issues

The Mobility as a Service (MaaS) Market is Segmented by region, occupancy type, application perspective. Frustration in implementation due to legacy transportation systems, regulatory hurdles, and issues of interoperability between private and public mobility providers. To achieve this, governments and private stakeholders need to invest in smart infrastructure, develop standardized application programming interfaces (APIs), and promote public-private partnerships (PPPs) to improve service integrations and scalability.

Data Security and Privacy Concerns

Data Security and Privacy With its emphasis on data mobility, real-time data collection, and user tracking, the MaaS platform raises concerns about data security and privacy, as well as the risk of violating strict regulations like GDPR. Concerns about data breaches, cyber-attacks, and improper use of personal information could restrict consumer adoption. Strong encryption, blockchain for transactional security, and transparent data governance policies are key to ensuring compliance and building trust with customers.

Opportunity

Increasing Adoption of Sustainable and Smart Mobility Solutions

Increased focus on lowering carbon emissions and improving urban mobility efficiency is contributing to the uptake of Mobility as a Service (MaaS) solutions. Governments around the globe are encouraging the use of wide-ranging, sustainable transport modes thumbing less at gridlock and pollution by bolstering vehicles like electric cars, bike-share, and on-demand mass transit. Implementing AI-based route optimization, multimodal transport integration, and carbon-neutral initiatives will enable companies to stay a few steps ahead in the developing market.

Advancements in 5G, AI, and IoT for Enhanced User Experience

Emerging technologies including 5G connectivity, artificial intelligence (AI), and the Internet of Things (IoT) are revolutionizing MaaS through optimizing real-time traffic management, predictive analysis, and seamless user experiences. Advanced technologies like AI-driven smart routing, IoT-based vehicle tracking, and dynamic pricing models improve service efficiency and customer satisfaction. MaaS solutions will go global as companies who utilize these innovations will lead with increased adoption.

Evolution in MaaS market from 2020 to 2024 and future trends (2025 to 2035) As cities expand due to growing population, the need for efficient modes of transport is also on the rise in urban areas. The boom of ride-sharing, micro-mobility services, and digitizing public transportation paved the way for adopting MaaS.

Yet pandemic-related lethargy, regulatory roadblocks and integration complexities dented market development. Companies adhered to the trends by improving platform-to-interoperability, developing solutions for autonomous transport, and rolling out contactless payment systems.

Accelerating to 2025 to 2035: Widespread autonomous vehicle adoption, Artificial Intelligence (AI)-driven demand forecasting, and blockchain-based mobility ecosystems will take MaaS to the next level. New urban planning initiatives focusing on sustainability, expansion of electric vehicle fleets, and shared mobility business models are going change the transportation space. The next generation of MaaS evolution will be led by companies focusing on AI-enhanced predictive analytics, real-time multimodal transport optimization, and eco-friendly mobility solutions.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with data privacy and transportation policies |

| Technological Advancements | Growth in app-based ride-hailing and shared mobility platforms |

| Industry Adoption | Increased reliance on micro-mobility and public transit integrations |

| Supply Chain and Sourcing | Development of electric vehicle-sharing programs |

| Market Competition | Dominance of established ride-hailing firms |

| Market Growth Drivers | Demand for cost-effective urban mobility |

| Sustainability and Energy Efficiency | Initial adoption of electric and hybrid vehicle-sharing services |

| Integration of Smart Monitoring | Limited AI-powered traffic optimization |

| Advancements in Product Innovation | Development of contactless ticketing and multimodal transport apps |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance automation and blockchain-secured mobility data management |

| Technological Advancements | Expansion of AI-driven autonomous MaaS solutions and connected smart infrastructure |

| Industry Adoption | Widespread adoption of AI-enhanced multimodal transport ecosystems and personalized MaaS offerings |

| Supply Chain and Sourcing | Shift to sustainable supply chain models for EV production and renewable energy-based charging infrastructure |

| Market Competition | Rise of decentralized MaaS networks, autonomous fleet providers, and AI-powered urban mobility startups |

| Market Growth Drivers | Expansion of carbon-neutral and autonomous MaaS solutions driven by smart city initiatives |

| Sustainability and Energy Efficiency | Full-scale implementation of renewable energy-powered mobility networks and zero-emission transport policies |

| Integration of Smart Monitoring | AI-driven real-time congestion management and predictive route planning for enhanced transport efficiency |

| Advancements in Product Innovation | AI-driven MaaS assistants, on-demand autonomous shuttles, and hyperloop-enabled ultra-fast transport services |

The United States is one of the largest contributors to the market for MaaS owing to their fast-paced urbanization, acceptance of ride-sharing solutions, and various government policies around smart transportation. This market is growing due to the presence of significant technology firms, especially the app-based transportation sector.

Increased fuel prices and global warming also incentivize consumers to adopt shared mobility solutions. Also, 5G connectivity development and improvements in autonomous vehicle technologies are set to contribute to service efficiency. An important player in the MaaS development is the public-private partnership;

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 39.2% |

The UK MaaS market is expected to grow rapidly due to increasing investment for sustainable transportation solution and governmental support. Integrating alternative transport, such as bike-sharing, e-scooters and on-demand ride-hailing services, into existing commuter networks is increasingly in demand.

The evolution of a smart city is also going some way to easing the uptake of MaaS too, with digital payments and real-time traffic management systems easing use. Transport authorities have also been collaborating with the private sector players to develop seamless multimodal transport solutions to enhance ease of commute and mitigate traffic woes in urban areas.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 37.5% |

MaaS adoption in the European Union, which is at the leading edge of this trend, is already supported by government agencies interested in sustainable mobility solutions. Nations like Germany, France, and Netherlands are channeling massive funding into their public transport ecosystems, combined with the integration of their digital mobility platforms.

Policies to reduce carbon emissions and build smart cities are key drivers. This is increasing the popularity of subscription-based MaaS models, which give users flexible transportation options at discounts. It helps implement mobility as a service and enhance operational efficiency and user experience.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 38.5% |

Japan's advancements in autonomous mobility, artificial intelligence, and smart transport have seen its MaaS market experience rapid growth. The wide-spread public transport system in the country, along with high penetration of smartphones, facilitates the adoption of MaaS platforms.

Ride-hailing, car-sharing and AI-powered traffic management are making urban mobility more efficient. This, combined with the government promoting connected vehicle technologies and developing hydrogen-powered transport solutions, is likely to further propel the market. Moreover, Japan is working towards developing integrated mobility applications that bring together multiple modes of transport under one umbrella to ease commuter convenience.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 38.8% |

Gill said MaaS adoption in South Korea is also being driven by the nation's strong technological infrastructure and the government push towards smart mobility solutions. Mobile applications for transportation service booking and payment are gaining popularity among customers, which is also contributing to market growth.

Collaborations between private operators and public authorities are crucial in building integrated mobility platforms. Through even smarter city initiatives, the government is actively promoting sustainable urban transport by increasing carpool taxi users in new areas, thereby increasing the number of users of shared mobility services. It is further complemented by the growing popularity of electric and autonomous vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 39.0% |

The recent growth in the Mobility as a Service (MaaS) sector is testament to the increasing need for seamless, integrated and economical transport services. The evolution of smart mobility ecosystems, integration of digital payments, on-demand ride services, and mobility subscription models has brought a substantial transformation in urban commuting.

Journey planning & management solutions, payment solutions, and booking & ticketing platforms are transforming the way individual’s access transportation, allowing for real-time route optimization, multimodal connectivity, and seamless ticketing. Moreover, developing application technology, AI-powered route recommendations, and blockchain-powered transactions improve the smart and secure efficiency of materials transportation services as well.

When segmented based on the service provided, the MaaS market is facing domination from the ride-hailing, ride-sharing, micromobility, and public transport services. As cities worldwide adapt to an upheaval in urban transit with the advent of ride-hailing apps, e-scooter rentals and bike-sharing programs they are facing a host of new challenges including congestion, an environmental toll and greater dependency on personal cars.

Guide on the Expansion of Shared Transportation Models With Authorities and Stakeholder Investments in Sustainable Electric Drive Transport Solutions In addition, increasing consumer demand for affordable, flexible and sustainable means of transport is fuelling the adoption of subscription and on-demand models in mobility as a service.

The key drivers are changing, as reflected through propulsion type segmentation spotlighting the shift to EVs, CNG/LPG, and ICE for MaaS offerings. Adoption of EVs in ride-hailing and shared mobility services is gaining momentum, driven by government emission regulations, electric vehicle (EV) adoption incentives, and battery technology improvements.

Moreover, organizations are incorporating fleet electrification plans, sustainable charging frameworks, and AI-driven vehicle dispatch optimization to make it more efficient. In fact, the need for CNG/LPG-based public transport solutions is also growing, especially in areas aiming to decrease their dependency on fossil fuels and upgrade clean mobility projects.

The segmentation of the payment model indicates a major shift towards subscription-based MaaS models as they enable users to utilize multiple transport services that can be accessed via a single platform at an agreed fixed cost. This trend is transforming consumer behaviors with mobility services offered as a bundle, multi-modal connections, and lowering travel costs.

For occasional passengers, on-demand payment methods are still common, but many find subscription-based models more economically efficient as it allows for customized travel plans and rewards systems based on usage, which makes them appealing for higher frequency commuters and corporate consumers. AI-enabled fare optimization, digital wallets, and dynamic ride pricing are being integrated into systems for a better user experience and widespread adoption of utilities among companies.

MaaS is being widely adopted for Business to Business (B2B), Business to Consumer (B2C) and Peer to Peer (P2P) applications. Increased demand for corporate mobility programmers, employee transport type solution and fleet management service is seen in B2B segment as organizations prefer renting vehicles over purchasing them for cost-effective, efficient and environmentally sustainable commuting option.

The largest segment of the transport-as-a-service market is B2C, driven by the rise of app-based ride applications, micromobility, and multimodal transport integration. You are moving towards the P2P sector with the emergence of P2P platforms, which allow people to share their rides with others, thereby reducing costs and promoting better vehicle utilization, and sustainable transport habits.

Increased urbanization and demand for seamless transportation, along with advancements in digital platforms are resulting in rapid growth of the Mobility as a Service (MaaS) market. The combining ride-sharing, car rental, bike-sharing & public transport as one digital service and, the companies are eyeing to improve user experience and efficiency with AI powered route optimization, real-time traffic data analytics and multi-modal transport solutions. Major trends include subscription-based mobility models, sustainability initiatives, integration with autonomous vehicles, and smart city collaborations to provide more transportation access and reduce road congestion.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Uber Technologies Inc. | 18-22% |

| Lyft, Inc. | 14-18% |

| Didi Chuxing | 11-15% |

| Moovit (Intel Corporation) | 8-12% |

| MaaS Global Ltd. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Uber Technologies Inc. | Leading provider of ride-hailing, shared mobility solutions, and integrated public transit options with AI-based route planning and cost optimization tools. |

| Lyft, Inc. | Specializes in peer-to-peer ridesharing, bike and scooter rentals, and subscription-based MaaS services with a strong focus on sustainability and user convenience. |

| Didi Chuxing | Develops intelligent transportation solutions, offering a mix of ride-sharing, autonomous vehicle pilot programs, and AI-powered traffic optimization platforms. |

| Moovit (Intel Corporation) | Provides multimodal mobility services, including public transit planning, real-time navigation, and smart city mobility integration for improved commuter efficiency. |

| MaaS Global Ltd. | Creator of the Whim app, a pioneering MaaS platform combining ride-hailing, car rentals, and public transit for seamless urban transportation experiences. |

Key Company Insights

Uber Technologies Inc. (18-22%)

Best known as the most popular ride-hailing service, Uber is among the biggest players in the MaaS space, using AI route planning, fleet electrification efforts, and collaboration with public transit agencies. It connects users to ride-hailing, micro-mobility options, and public transport through integrated digital platforms, enhancing urban mobility. Uber is at the forefront of revolutionizing the way people move; the company makes substantial investments in autonomous vehicles and integrates itself into smart cities around the globe.

Lyft, Inc. (14-18%)

The transport has been disrupting the transport with the sustainable solutions in urban transport with its MaaS built from electric-vehicles, bike-sharing, and scooter rentals which makes up the MaaS built on Lyft. They get to work on establishing user-friendly subscription-based models that are affordable and flexible. Additionally, Lyft helps alleviate traffic by partnering with public transit agencies and city planners to improve city infrastructure and facilitate environmentally-friendly transportation options.

Didi Chuxing (11-15%)

China-based d-hailing giant, which has strong global position in MaaS domain. These investments include AI-powered traffic management systems, fleets of electric vehicles and technologies to support autonomous driving. By tapping on multi-modal transportation, real-time navigation and predictive analytics, Didi carves a niche for itself as the pioneer in the smart mobility ecosystem.

Moovit (Intel Corporation) (8-12%)

One of the leading innovators in the MaaS market is Moovit, which offers integrated public transit solutions that include bus, train, and rideshare services. For instance, AMS Mobility Analytics Solutions provides smart routing solutions and traffic flow analysis to make smart cities transportation more efficient. Intel, which acquired Moovit, has enhanced its AI and automated driving competence, making it a forerunner in smart transport solutions.

MaaS Global Ltd. (6-10%)

One of the most recognized companies in the MaaS sector is MaaS Global Ltd. The Whim app: a single mobility solution, an app that combines ride-hailing with car rentals and public transit. Users benefit from seamless access to vehicles, a concept the company has embraced via a subscription-based model. By establishing strategic partnerships with city governments and transit agencies, MaaS Global reinforces its position as a key player in the transformation of urban mobility.

Other Key Players (30-40% Combined)

Major regional and international players in the MaaS industry are concentrated on innovative, user-centric solutions and sustainable transportation. Key companies include:

The overall market size for mobility as a service market was USD 263,186.01 million in 2025.

The Mobility as a service market expected to reach USD 6,592,553.43 million in 2035.

The demand for the mobility as a Service (MaaS) market will be driven by increasing urbanization, rising adoption of shared and on-demand mobility solutions, growing integration of digital payment and smart transportation systems, government initiatives for sustainable transport, and advancements in AI-driven route optimization and autonomous vehicles.

The top 5 countries which drives the development of mobility as a service market are USA, UK, Europe Union, Japan and South Korea.

Adoption of mobility as a service (MaaS) solutions market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Transportation Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Propulsion Type, 2019 to 2034

Table 6: Global Market Value (US$ Million) Forecast by Payment Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 8: Global Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 12: North America Market Value (US$ Million) Forecast by Transportation Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Propulsion Type, 2019 to 2034

Table 14: North America Market Value (US$ Million) Forecast by Payment Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 16: North America Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 20: Latin America Market Value (US$ Million) Forecast by Transportation Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Propulsion Type, 2019 to 2034

Table 22: Latin America Market Value (US$ Million) Forecast by Payment Type, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Latin America Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 28: Western Europe Market Value (US$ Million) Forecast by Transportation Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Propulsion Type, 2019 to 2034

Table 30: Western Europe Market Value (US$ Million) Forecast by Payment Type, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 32: Western Europe Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 36: Eastern Europe Market Value (US$ Million) Forecast by Transportation Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Propulsion Type, 2019 to 2034

Table 38: Eastern Europe Market Value (US$ Million) Forecast by Payment Type, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 40: Eastern Europe Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 44: South Asia and Pacific Market Value (US$ Million) Forecast by Transportation Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Propulsion Type, 2019 to 2034

Table 46: South Asia and Pacific Market Value (US$ Million) Forecast by Payment Type, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 48: South Asia and Pacific Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 52: East Asia Market Value (US$ Million) Forecast by Transportation Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Propulsion Type, 2019 to 2034

Table 54: East Asia Market Value (US$ Million) Forecast by Payment Type, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 56: East Asia Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 60: Middle East and Africa Market Value (US$ Million) Forecast by Transportation Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Propulsion Type, 2019 to 2034

Table 62: Middle East and Africa Market Value (US$ Million) Forecast by Payment Type, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 64: Middle East and Africa Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Solution, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Service, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Transportation Type, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Propulsion Type, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Payment Type, 2024 to 2034

Figure 6: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 7: Global Market Value (US$ Million) by End-user, 2024 to 2034

Figure 8: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Transportation Type, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Transportation Type, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Transportation Type, 2024 to 2034

Figure 21: Global Market Value (US$ Million) Analysis by Propulsion Type, 2019 to 2034

Figure 22: Global Market Value Share (%) and BPS Analysis by Propulsion Type, 2024 to 2034

Figure 23: Global Market Y-o-Y Growth (%) Projections by Propulsion Type, 2024 to 2034

Figure 24: Global Market Value (US$ Million) Analysis by Payment Type, 2019 to 2034

Figure 25: Global Market Value Share (%) and BPS Analysis by Payment Type, 2024 to 2034

Figure 26: Global Market Y-o-Y Growth (%) Projections by Payment Type, 2024 to 2034

Figure 27: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 28: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 29: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 30: Global Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 31: Global Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 32: Global Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 33: Global Market Attractiveness by Solution, 2024 to 2034

Figure 34: Global Market Attractiveness by Service, 2024 to 2034

Figure 35: Global Market Attractiveness by Transportation Type, 2024 to 2034

Figure 36: Global Market Attractiveness by Propulsion Type, 2024 to 2034

Figure 37: Global Market Attractiveness by Payment Type, 2024 to 2034

Figure 38: Global Market Attractiveness by Application, 2024 to 2034

Figure 39: Global Market Attractiveness by End-user, 2024 to 2034

Figure 40: Global Market Attractiveness by Region, 2024 to 2034

Figure 41: North America Market Value (US$ Million) by Solution, 2024 to 2034

Figure 42: North America Market Value (US$ Million) by Service, 2024 to 2034

Figure 43: North America Market Value (US$ Million) by Transportation Type, 2024 to 2034

Figure 44: North America Market Value (US$ Million) by Propulsion Type, 2024 to 2034

Figure 45: North America Market Value (US$ Million) by Payment Type, 2024 to 2034

Figure 46: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 47: North America Market Value (US$ Million) by End-user, 2024 to 2034

Figure 48: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 49: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 52: North America Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 53: North America Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 54: North America Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 55: North America Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 56: North America Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 57: North America Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 58: North America Market Value (US$ Million) Analysis by Transportation Type, 2019 to 2034

Figure 59: North America Market Value Share (%) and BPS Analysis by Transportation Type, 2024 to 2034

Figure 60: North America Market Y-o-Y Growth (%) Projections by Transportation Type, 2024 to 2034

Figure 61: North America Market Value (US$ Million) Analysis by Propulsion Type, 2019 to 2034

Figure 62: North America Market Value Share (%) and BPS Analysis by Propulsion Type, 2024 to 2034

Figure 63: North America Market Y-o-Y Growth (%) Projections by Propulsion Type, 2024 to 2034

Figure 64: North America Market Value (US$ Million) Analysis by Payment Type, 2019 to 2034

Figure 65: North America Market Value Share (%) and BPS Analysis by Payment Type, 2024 to 2034

Figure 66: North America Market Y-o-Y Growth (%) Projections by Payment Type, 2024 to 2034

Figure 67: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 68: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: North America Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 71: North America Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 72: North America Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 73: North America Market Attractiveness by Solution, 2024 to 2034

Figure 74: North America Market Attractiveness by Service, 2024 to 2034

Figure 75: North America Market Attractiveness by Transportation Type, 2024 to 2034

Figure 76: North America Market Attractiveness by Propulsion Type, 2024 to 2034

Figure 77: North America Market Attractiveness by Payment Type, 2024 to 2034

Figure 78: North America Market Attractiveness by Application, 2024 to 2034

Figure 79: North America Market Attractiveness by End-user, 2024 to 2034

Figure 80: North America Market Attractiveness by Country, 2024 to 2034

Figure 81: Latin America Market Value (US$ Million) by Solution, 2024 to 2034

Figure 82: Latin America Market Value (US$ Million) by Service, 2024 to 2034

Figure 83: Latin America Market Value (US$ Million) by Transportation Type, 2024 to 2034

Figure 84: Latin America Market Value (US$ Million) by Propulsion Type, 2024 to 2034

Figure 85: Latin America Market Value (US$ Million) by Payment Type, 2024 to 2034

Figure 86: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 87: Latin America Market Value (US$ Million) by End-user, 2024 to 2034

Figure 88: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 89: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 90: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 91: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 92: Latin America Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 95: Latin America Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 96: Latin America Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 97: Latin America Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 98: Latin America Market Value (US$ Million) Analysis by Transportation Type, 2019 to 2034

Figure 99: Latin America Market Value Share (%) and BPS Analysis by Transportation Type, 2024 to 2034

Figure 100: Latin America Market Y-o-Y Growth (%) Projections by Transportation Type, 2024 to 2034

Figure 101: Latin America Market Value (US$ Million) Analysis by Propulsion Type, 2019 to 2034

Figure 102: Latin America Market Value Share (%) and BPS Analysis by Propulsion Type, 2024 to 2034

Figure 103: Latin America Market Y-o-Y Growth (%) Projections by Propulsion Type, 2024 to 2034

Figure 104: Latin America Market Value (US$ Million) Analysis by Payment Type, 2019 to 2034

Figure 105: Latin America Market Value Share (%) and BPS Analysis by Payment Type, 2024 to 2034

Figure 106: Latin America Market Y-o-Y Growth (%) Projections by Payment Type, 2024 to 2034

Figure 107: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 108: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 109: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 110: Latin America Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 111: Latin America Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 112: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 113: Latin America Market Attractiveness by Solution, 2024 to 2034

Figure 114: Latin America Market Attractiveness by Service, 2024 to 2034

Figure 115: Latin America Market Attractiveness by Transportation Type, 2024 to 2034

Figure 116: Latin America Market Attractiveness by Propulsion Type, 2024 to 2034

Figure 117: Latin America Market Attractiveness by Payment Type, 2024 to 2034

Figure 118: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 119: Latin America Market Attractiveness by End-user, 2024 to 2034

Figure 120: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 121: Western Europe Market Value (US$ Million) by Solution, 2024 to 2034

Figure 122: Western Europe Market Value (US$ Million) by Service, 2024 to 2034

Figure 123: Western Europe Market Value (US$ Million) by Transportation Type, 2024 to 2034

Figure 124: Western Europe Market Value (US$ Million) by Propulsion Type, 2024 to 2034

Figure 125: Western Europe Market Value (US$ Million) by Payment Type, 2024 to 2034

Figure 126: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 127: Western Europe Market Value (US$ Million) by End-user, 2024 to 2034

Figure 128: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 129: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 130: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 131: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 132: Western Europe Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 135: Western Europe Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 136: Western Europe Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 137: Western Europe Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 138: Western Europe Market Value (US$ Million) Analysis by Transportation Type, 2019 to 2034

Figure 139: Western Europe Market Value Share (%) and BPS Analysis by Transportation Type, 2024 to 2034

Figure 140: Western Europe Market Y-o-Y Growth (%) Projections by Transportation Type, 2024 to 2034

Figure 141: Western Europe Market Value (US$ Million) Analysis by Propulsion Type, 2019 to 2034

Figure 142: Western Europe Market Value Share (%) and BPS Analysis by Propulsion Type, 2024 to 2034

Figure 143: Western Europe Market Y-o-Y Growth (%) Projections by Propulsion Type, 2024 to 2034

Figure 144: Western Europe Market Value (US$ Million) Analysis by Payment Type, 2019 to 2034

Figure 145: Western Europe Market Value Share (%) and BPS Analysis by Payment Type, 2024 to 2034

Figure 146: Western Europe Market Y-o-Y Growth (%) Projections by Payment Type, 2024 to 2034

Figure 147: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 148: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 149: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 150: Western Europe Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 151: Western Europe Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 152: Western Europe Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 153: Western Europe Market Attractiveness by Solution, 2024 to 2034

Figure 154: Western Europe Market Attractiveness by Service, 2024 to 2034

Figure 155: Western Europe Market Attractiveness by Transportation Type, 2024 to 2034

Figure 156: Western Europe Market Attractiveness by Propulsion Type, 2024 to 2034

Figure 157: Western Europe Market Attractiveness by Payment Type, 2024 to 2034

Figure 158: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 159: Western Europe Market Attractiveness by End-user, 2024 to 2034

Figure 160: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 161: Eastern Europe Market Value (US$ Million) by Solution, 2024 to 2034

Figure 162: Eastern Europe Market Value (US$ Million) by Service, 2024 to 2034

Figure 163: Eastern Europe Market Value (US$ Million) by Transportation Type, 2024 to 2034

Figure 164: Eastern Europe Market Value (US$ Million) by Propulsion Type, 2024 to 2034

Figure 165: Eastern Europe Market Value (US$ Million) by Payment Type, 2024 to 2034

Figure 166: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 167: Eastern Europe Market Value (US$ Million) by End-user, 2024 to 2034

Figure 168: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 169: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 170: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 171: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 172: Eastern Europe Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 175: Eastern Europe Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 176: Eastern Europe Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 177: Eastern Europe Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 178: Eastern Europe Market Value (US$ Million) Analysis by Transportation Type, 2019 to 2034

Figure 179: Eastern Europe Market Value Share (%) and BPS Analysis by Transportation Type, 2024 to 2034

Figure 180: Eastern Europe Market Y-o-Y Growth (%) Projections by Transportation Type, 2024 to 2034

Figure 181: Eastern Europe Market Value (US$ Million) Analysis by Propulsion Type, 2019 to 2034

Figure 182: Eastern Europe Market Value Share (%) and BPS Analysis by Propulsion Type, 2024 to 2034

Figure 183: Eastern Europe Market Y-o-Y Growth (%) Projections by Propulsion Type, 2024 to 2034

Figure 184: Eastern Europe Market Value (US$ Million) Analysis by Payment Type, 2019 to 2034

Figure 185: Eastern Europe Market Value Share (%) and BPS Analysis by Payment Type, 2024 to 2034

Figure 186: Eastern Europe Market Y-o-Y Growth (%) Projections by Payment Type, 2024 to 2034

Figure 187: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 188: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 189: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 190: Eastern Europe Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 191: Eastern Europe Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 192: Eastern Europe Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 193: Eastern Europe Market Attractiveness by Solution, 2024 to 2034

Figure 194: Eastern Europe Market Attractiveness by Service, 2024 to 2034

Figure 195: Eastern Europe Market Attractiveness by Transportation Type, 2024 to 2034

Figure 196: Eastern Europe Market Attractiveness by Propulsion Type, 2024 to 2034

Figure 197: Eastern Europe Market Attractiveness by Payment Type, 2024 to 2034

Figure 198: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 199: Eastern Europe Market Attractiveness by End-user, 2024 to 2034

Figure 200: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 201: South Asia and Pacific Market Value (US$ Million) by Solution, 2024 to 2034

Figure 202: South Asia and Pacific Market Value (US$ Million) by Service, 2024 to 2034

Figure 203: South Asia and Pacific Market Value (US$ Million) by Transportation Type, 2024 to 2034

Figure 204: South Asia and Pacific Market Value (US$ Million) by Propulsion Type, 2024 to 2034

Figure 205: South Asia and Pacific Market Value (US$ Million) by Payment Type, 2024 to 2034

Figure 206: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 207: South Asia and Pacific Market Value (US$ Million) by End-user, 2024 to 2034

Figure 208: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 209: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 210: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 211: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 212: South Asia and Pacific Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 213: South Asia and Pacific Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 214: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 215: South Asia and Pacific Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 216: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 217: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 218: South Asia and Pacific Market Value (US$ Million) Analysis by Transportation Type, 2019 to 2034

Figure 219: South Asia and Pacific Market Value Share (%) and BPS Analysis by Transportation Type, 2024 to 2034

Figure 220: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Transportation Type, 2024 to 2034

Figure 221: South Asia and Pacific Market Value (US$ Million) Analysis by Propulsion Type, 2019 to 2034

Figure 222: South Asia and Pacific Market Value Share (%) and BPS Analysis by Propulsion Type, 2024 to 2034

Figure 223: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Propulsion Type, 2024 to 2034

Figure 224: South Asia and Pacific Market Value (US$ Million) Analysis by Payment Type, 2019 to 2034

Figure 225: South Asia and Pacific Market Value Share (%) and BPS Analysis by Payment Type, 2024 to 2034

Figure 226: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Payment Type, 2024 to 2034

Figure 227: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 228: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 229: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 230: South Asia and Pacific Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 231: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 232: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 233: South Asia and Pacific Market Attractiveness by Solution, 2024 to 2034

Figure 234: South Asia and Pacific Market Attractiveness by Service, 2024 to 2034

Figure 235: South Asia and Pacific Market Attractiveness by Transportation Type, 2024 to 2034

Figure 236: South Asia and Pacific Market Attractiveness by Propulsion Type, 2024 to 2034

Figure 237: South Asia and Pacific Market Attractiveness by Payment Type, 2024 to 2034

Figure 238: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 239: South Asia and Pacific Market Attractiveness by End-user, 2024 to 2034

Figure 240: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 241: East Asia Market Value (US$ Million) by Solution, 2024 to 2034

Figure 242: East Asia Market Value (US$ Million) by Service, 2024 to 2034

Figure 243: East Asia Market Value (US$ Million) by Transportation Type, 2024 to 2034

Figure 244: East Asia Market Value (US$ Million) by Propulsion Type, 2024 to 2034

Figure 245: East Asia Market Value (US$ Million) by Payment Type, 2024 to 2034

Figure 246: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 247: East Asia Market Value (US$ Million) by End-user, 2024 to 2034

Figure 248: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 249: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 250: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 251: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 252: East Asia Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 253: East Asia Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 254: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 255: East Asia Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 256: East Asia Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 257: East Asia Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 258: East Asia Market Value (US$ Million) Analysis by Transportation Type, 2019 to 2034

Figure 259: East Asia Market Value Share (%) and BPS Analysis by Transportation Type, 2024 to 2034

Figure 260: East Asia Market Y-o-Y Growth (%) Projections by Transportation Type, 2024 to 2034

Figure 261: East Asia Market Value (US$ Million) Analysis by Propulsion Type, 2019 to 2034

Figure 262: East Asia Market Value Share (%) and BPS Analysis by Propulsion Type, 2024 to 2034

Figure 263: East Asia Market Y-o-Y Growth (%) Projections by Propulsion Type, 2024 to 2034

Figure 264: East Asia Market Value (US$ Million) Analysis by Payment Type, 2019 to 2034

Figure 265: East Asia Market Value Share (%) and BPS Analysis by Payment Type, 2024 to 2034

Figure 266: East Asia Market Y-o-Y Growth (%) Projections by Payment Type, 2024 to 2034

Figure 267: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 268: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 269: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 270: East Asia Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 271: East Asia Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 272: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 273: East Asia Market Attractiveness by Solution, 2024 to 2034

Figure 274: East Asia Market Attractiveness by Service, 2024 to 2034

Figure 275: East Asia Market Attractiveness by Transportation Type, 2024 to 2034

Figure 276: East Asia Market Attractiveness by Propulsion Type, 2024 to 2034

Figure 277: East Asia Market Attractiveness by Payment Type, 2024 to 2034

Figure 278: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 279: East Asia Market Attractiveness by End-user, 2024 to 2034

Figure 280: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 281: Middle East and Africa Market Value (US$ Million) by Solution, 2024 to 2034

Figure 282: Middle East and Africa Market Value (US$ Million) by Service, 2024 to 2034

Figure 283: Middle East and Africa Market Value (US$ Million) by Transportation Type, 2024 to 2034

Figure 284: Middle East and Africa Market Value (US$ Million) by Propulsion Type, 2024 to 2034

Figure 285: Middle East and Africa Market Value (US$ Million) by Payment Type, 2024 to 2034

Figure 286: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 287: Middle East and Africa Market Value (US$ Million) by End-user, 2024 to 2034

Figure 288: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 289: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 290: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 291: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 292: Middle East and Africa Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 293: Middle East and Africa Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 294: Middle East and Africa Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 295: Middle East and Africa Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 296: Middle East and Africa Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 297: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 298: Middle East and Africa Market Value (US$ Million) Analysis by Transportation Type, 2019 to 2034

Figure 299: Middle East and Africa Market Value Share (%) and BPS Analysis by Transportation Type, 2024 to 2034

Figure 300: Middle East and Africa Market Y-o-Y Growth (%) Projections by Transportation Type, 2024 to 2034

Figure 301: Middle East and Africa Market Value (US$ Million) Analysis by Propulsion Type, 2019 to 2034

Figure 302: Middle East and Africa Market Value Share (%) and BPS Analysis by Propulsion Type, 2024 to 2034

Figure 303: Middle East and Africa Market Y-o-Y Growth (%) Projections by Propulsion Type, 2024 to 2034

Figure 304: Middle East and Africa Market Value (US$ Million) Analysis by Payment Type, 2019 to 2034

Figure 305: Middle East and Africa Market Value Share (%) and BPS Analysis by Payment Type, 2024 to 2034

Figure 306: Middle East and Africa Market Y-o-Y Growth (%) Projections by Payment Type, 2024 to 2034

Figure 307: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 308: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 309: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 310: Middle East and Africa Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 311: Middle East and Africa Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 312: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 313: Middle East and Africa Market Attractiveness by Solution, 2024 to 2034

Figure 314: Middle East and Africa Market Attractiveness by Service, 2024 to 2034

Figure 315: Middle East and Africa Market Attractiveness by Transportation Type, 2024 to 2034

Figure 316: Middle East and Africa Market Attractiveness by Propulsion Type, 2024 to 2034

Figure 317: Middle East and Africa Market Attractiveness by Payment Type, 2024 to 2034

Figure 318: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 319: Middle East and Africa Market Attractiveness by End-user, 2024 to 2034

Figure 320: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobility Aids and Transportation Equipment Market is segmented by Product and Distribution Channel from 2025 to 2035

Mobility On Demand (MOD) Market Size and Share Forecast Outlook 2025 to 2035

Ion Mobility Spectrometry Market

Micromobility Platform Market by Vehicle Type, Platform Type, End User, and Region through 2035

Micro Mobility Market Size and Share Forecast Outlook 2025 to 2035

Micro-mobility Charging Infrastructure Market – Trends & Forecast 2025 to 2035

Managed Mobility Services Market Size and Share Forecast Outlook 2025 to 2035

4-Wheel Mobility Scooters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clinical Mobility Market Size and Share Forecast Outlook 2025 to 2035

Personal Mobility Devices Market Analysis - Trends, Growth & Forecast 2025 to 2035

Eldercare Mobility Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Crop Mobility Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

BYOD and Enterprise Mobility Market Analysis and Forecast 2025 to 2035, By Security, Software, Deployment Type, End-Use, Organization Size, and Region

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Asphalt Mixing Plants Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Aspirating System Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Formulation Processing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA