The ASEAN Food Additives market is set to grow from an estimated USD 94.3 Billion in 2025 to USD 193.4 Billion by 2035, with a compound annual growth rate (CAGR) of 7.4% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 94.3 Billion |

| Projected ASEAN Value (2035F) | USD 193.4 Billion |

| Value-based CAGR (2025 to 2035) | 7.4% |

The ASEAN food additives market is on the verge of a major revolution, thanks to the growing consumer base that is shifting to the consumption of processed and convenience foods along with the concern about the food safety and quality. The increase of urbanization and the overall population in the region have, in turn, led to the burgeoning consumption of packaged foods that largely require extra additives for flavor improvement, and keeping desired properties and long-term storage.

For instance, the change is acutely discussed amid the two nations the people of which are usually working hard, Indonesia, Malaysia, and Thailand where, as a result of different circumstances, fast food has become a solution of a busy lifestyle.

People are looking for more ways to keep themselves healthy and the availability of natural and organic food additives is the most required category. More and more, customers are considered to be the driving force of this change as firms are starting to produce new items which do not contain artificial additives. This movement is recognized as the result of the manufacturers being obliged to come up with transparent and health-oriented products that are in line with customers' choices.

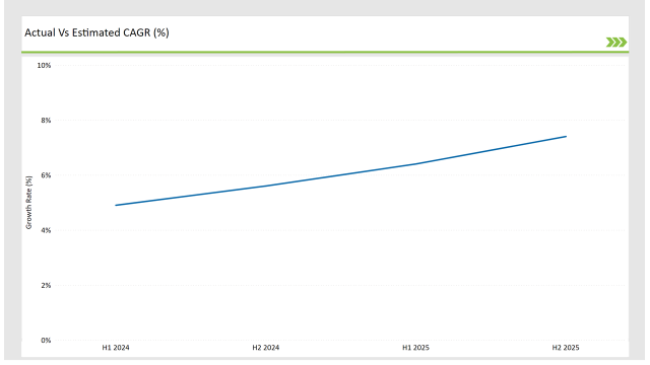

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEANFood Additives market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEANFood Additives market, the sector is predicted to grow at a CAGR of 4.9% during the first half of 2024, increasing to 5.6% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 6.4% in H1 but is expected to rise to 7.4% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Naturex launched a new line of natural preservatives derived from plant sources. |

| 2024 | DuPont introduced a range of functional additives for gut health in dairy products. |

| 2024 | Givaudan expanded product offerings to include organic food colorings and flavors . |

Consumers increasingly seek products that are perceived as healthier and more transparent.

The movement towards naturally-based and clean label additives is dramatically changing the food additives business since shoppers, in particular, are looking for more trustful and healthiery options nowadays. The course of this process is mainly formed by the increasing knowledge of people about the negative health consequences that come with the use of synthetic additives such as artificial colors, flavors, and preservatives.

The consumers are more and more concerned about the chemicals in their food products that lead to the wish for items with natural or organic additives.

For instance, plant-derived natural preservatives like rosemary extract and vinegar are changing to the position of being the most preferred over synthetic preservatives. Also, natural sweeteners such as stevia and monk fruit are implemented in the place of traditional sugars and artificial sweeteners.

Increasing Demand for Functional Additives

Amidst the health consciousness shift to functional products, there is a rising demand for functional additives. Beyond the basic nutrition, consumers now want products that offer additional health benefits. Probiotic-jaching functional additives, prebiotics, and the addition of vitamins and minerals have made them a green trend in the food industry.

It is the food production industry that benefits from the additional nutrients that probiotic additives, prebiotics, and fortified vitamins and minerals give to the products.

For instance, people now want foods that not only full their stomach but also help them with their health goals. The response from food manufacturers is to disparate their assistance for the business by coming out with the advanced and functional additives in an extensive portfolio of products that includes dairy, soft drinks, snacks, and baking products.

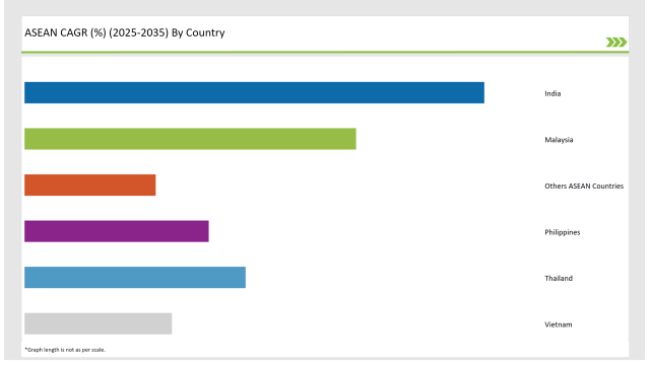

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

India's food additives market is experiencing exponential growth, primarily because of the soaring demand for processed and packaged foods. The fact that urbanization is still in the ongoing process of increasing means that the number of consumers searching for a quick and easy meal is on the rise, thus affecting the increase in consumption of ready-to-eat and frozen foods. This phenomenon is especially apt in the case of the big cities, which, due to the very busy lifestyles of their inhabitants, have made convenience a top priority for them.

The increase in the people's awareness of food safety and quality is changing the demands of the consumers from the products just being convenient to also being safe and nutritious. The Indian government has carried out the enforcement of more stringent food safety laws, which has in turn, persuaded manufacturers to put up money in quality ingredients that are above the standards set.

The food additives market in Thailand has experienced a remarkable potential due to the combination of health trends and the rising consciousness of quality food products among the population.The Thai people are now more focused on their health and thus are looking for food items that include added nutrition.

Consequently, this leads to a greater number of food items that contain additional functional additives like probiotics, vitamins, and minerals.The growth of artisanal and specialty food products in Thailand is also one of the factors influencing the increase of the food additives market. Buyers are more concerned about traditional, quality foods, and therefore, producers are forced to work with their imaginations and come up with new formulations that reflect these interests.

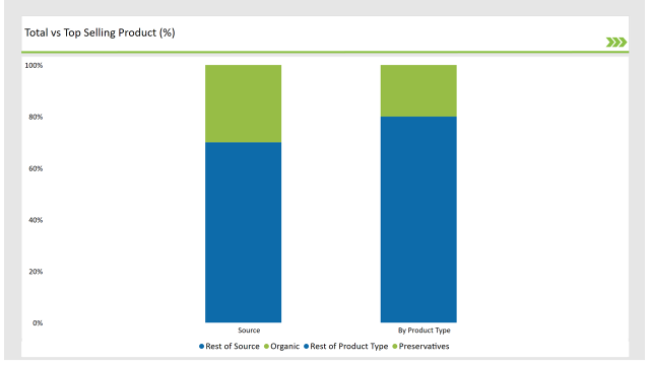

Preservatives are the leading category in the food additives market and represent a sizable part of the whole market. They owe their prevailing position to the fact that areare preservatives are crucial for the shelf life of food and they prevent spoilage. The increase in the consumption of processed and packaged foods makes the effective preservatives necessary.

Growing concern among consumers about food safety and quality leading them to look for the preservatives that are both effective and safe. This condition was the reason for the appearances of the new preservative solutions through the efforts of the manufacturers to be in line with what consumers expect from health and safety. Among natural preservatives are vinegar, salt, rosemary extract which are getting more and more customers as the clean label products are the trend of our days.

The most traded form in the food additives market is that of powdered standardized supplements. This can be related mainly to the flexibility and the easiness of powdered additives usage which are capable of being used in many types of food products. Look at them they are the additives found in most everything from baking to sauces, snacks, and drinks, thus making them the first choice for manufacturers.

The practical aspect of using and storing powdered additives is also a major reason for their fame. They usually stay fit for many more months than liquid additives do and it is not at all difficult to measure and add them in the formulations.

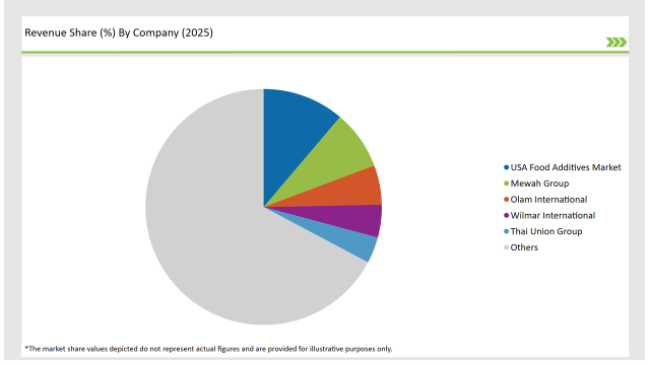

2025 Market Share of ASEAN Food Additives Manufacturers

Note: The above chart is indicative

The situation in the food additives market is quite tense as it is mainly characterized by a competitive landscape, with many established players, as well as, emerging companies in fierce contention for market share. The inflow of high-quality, safe, and cutting-edge food products, which is a result of increased consumer demand, is the main factor that pushes the manufacturers to strive to develop new and improved food additives that require substantial investments in research and development.

A major portion in the food additives market is represented with the manufacturers who are the main interest in product innovation; they are expanding their product portfolios to involve natural and clean label additives as consumer preferences are shifting in that direction.

By Product Type: Preservatives, Flavour Enhancers, Colouring Agents, Emulsifiers, Others

By Application: Beverages, Bakery Products, Snacks and Confectionery, Dairy Products, Others

By Source: Natural and Synthetic

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Food Additives market is projected to grow at a CAGR of 7.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 193.4 Billion.

India are key Country with high consumption rates in the ASEAN Food Additives market.

Leading manufacturers Gardenia Bakeries, Bread Talk, The Baker's Cottage, Food Additives & Co. in the ASEAN market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Pulses Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Probiotic Strains Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Compact Construction Equipment Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA