The ASEAN Shrimp market is set to grow from an estimated USD 1,754.7 million in 2025 to USD 6,062.7 million by 2035, with a compound annual growth rate (CAGR) of 13.2% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 1,754.7 million |

| Projected ASEAN Value (2035F) | USD 6,062.7 million |

| Value-based CAGR (2025 to 2035) | 13.2% |

As a significant player in the global seafood industry, the ASEAN shrimp market is benefited by the increasing consumer demand and the favorable aquaculture conditions of the region.

The ASEAN region consists of ten member countries and has access to a variety of shrimp species including both wild and farmed species. The main organism in the region is whiteleg shrimp, an exceptionally good taste and texture seafood product, which is worthy of being known for its excellent quality.

Recently, the rise of market has been prominent due to the easy supply of material and the low-cost of preferred diets as well as the tourists' observation of the health benefits that shrimp and other sea foods can provide.

Besides the tradational fishing methods which are used, the shrimp market in ASEAN is also characterized by modern aquaculture techniques for the purpose of sustainable production that meets the requirements of the international community.

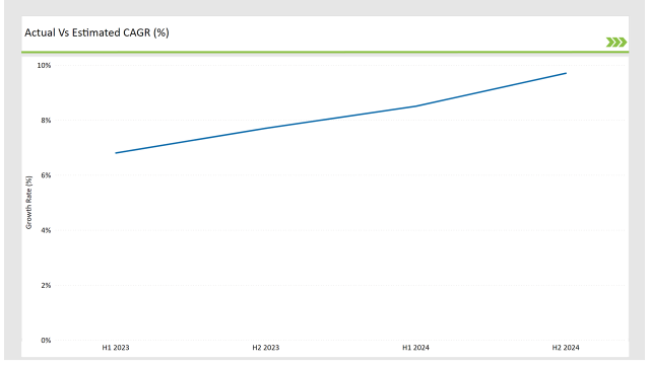

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Shrimp market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Shrimp market, the sector is predicted to grow at a CAGR of 6.8% during the first half of 2024, with an increase to 7.7% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 10.5% in H1 but is expected to rise to 13.2% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Introduction of the "Sustainable Shrimp Initiative" in Thailand to enhance sustainability in shrimp farming practices and improve local farmers' livelihoods. |

| 2023 | Malaysia's government announced a USD 10 million investment in shrimp aquaculture technology to boost production and export capabilities. |

| 2024 | India launched a new certification program for organic shrimp farming, aimed at increasing the country's competitiveness in the global market. |

| 2024 | Thailand's shrimp exports reached a record high, driven by increased demand from the USA and European markets. |

Technological Advancements in Farming and Processing

The shrimp industry benefits from advanced technology solutions which drive better farming performance alongside enhanced processing capabilities. Modern breeding methods combine selective breeding with genetic improvements to produce shrimp populations that show improved growth velocity and stronger disease tolerance.

Farmers achieve maximum efficiency and cost reduction with automated feeding systems and water quality monitoring solutions and data analytics methods for better production results. High-pressure processing (HPP) and cryogenic freezing technologies enable processors to extend product quality through enhanced shelf stability while producing convenient prepared shrimp products to meet market demands.

Advances in aquaculture and seafood processing represent essential elements for fighting market competition worldwide alongside following consumer preference trends.

Rising Demand for Value-Added Shrimp Products

Value-added shrimp products continue to gain popularity because changing consumer lifestyles and preferences for convenience drive demand. yoğun lifestyles push consumers toward pre-cooked marinated ready-to-eat shrimp products for their quick practical meal solutions which retain high quality standards.

Retailers provide multiple shrimp choices among frozen and breaded along with seasoned products to meet different needs of consumers. The upward trend is bolstered by online shopping platforms offering convenience-based shoppers broad shrimp product options through their digital formats.

Modern market developments compel manufacturers to broaden their shrimp offerings through product reforms which guard customer interest and stimulates market demand.

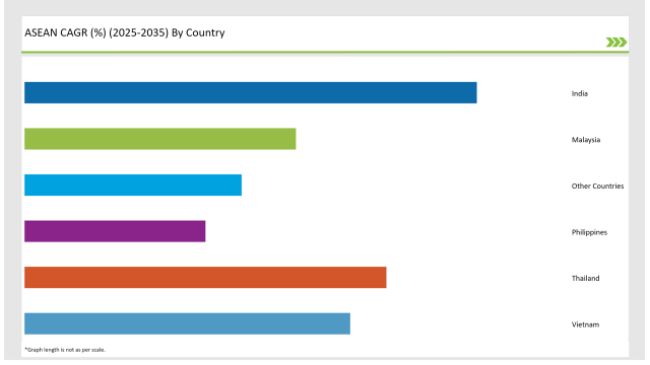

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

India stands as a leading shrimp producing nation among global markets because it holds a major distribution share worldwide. The country's advantageous climate along with its extended coastal areas combined with governmental support for aquaculture enables ongoing development.

The expanding market demand for shrimp both locally and internationally pushes production forward especially in the USA and Europe countries. State-of-the-art farming methods and sustainable practices have improved Indian shrimp competitiveness against international market competition.

The Indian shrimp industry now moves toward sustainable practices by having many farmers adopt environmentally friendly techniques to match global standards.

The global shrimp market positions Thailand as a leading player because of its premium shrimp products alongside its powerful export potential. The shrimp industry has operated in Thailand for many years building its status as a key international seafood provider especially to USA and European consumers and Japanese importers.

Thailand maintains its leadership position in shrimp product development thanks to its ideal climate environment while completely utilizing improved farming methods and strict quality standards.

The government shares its regulatory duties with industry stakeholders to conduct biosecurity measures and enhance farming practices which help reduce existing problems. Through the "Sustainable Shrimp Initiative" the country takes promising steps toward improving sustainable shrimp farming methods at a national level.

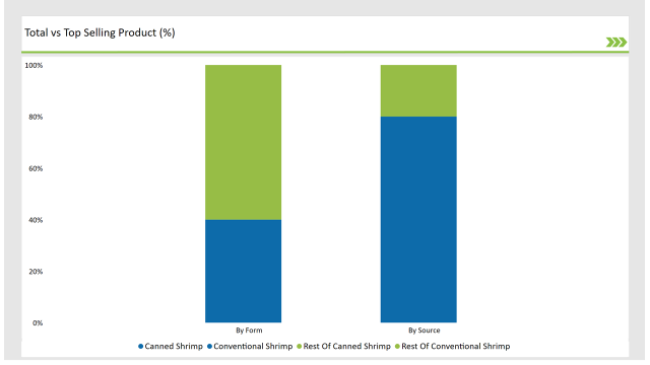

Market dynamics together with consumer preferences naturally follow the selling forms of shrimp products. The market segment for canned shrimp leads as its sales represent about 40% of total market activity. The long shelf life together with ease of accessibility make canned shrimp a preferred food choice primarily for markets that do not have easy access to freshly caught shrimp products.

Canned shrimp performs admirably in the culinary world because people prepare it for salads and pastas and soups so it enhances the versatility of their family kitchens. Canned shrimp maintains rising popularity because consumers with active lifestyles choose these products to obtain speedy convenient meals. Its ability to stay fresh without refrigeration alongside that fact creates packaging advantages which appeals strongly to buyers who need to stock non-expiring food supplies.

Conventional shrimp farming dominates the market, accounting for approximately 80% of the total share. This prevalence is largely due to the established practices and lower production costs associated with conventional farming methods.

Conventional shrimp farming typically involves intensive farming practices that maximize yield but may raise concerns regarding environmental sustainability and animal welfare. Farmer practices are becoming more sustainable because improved farming technologies and biosecurity regulations help overcome industry difficulties.

The commercial scalability of shrimp production through conventional farming since its inception continues to be the favored system for shrimp producers to keep up with demand for affordable seafood nationwide.

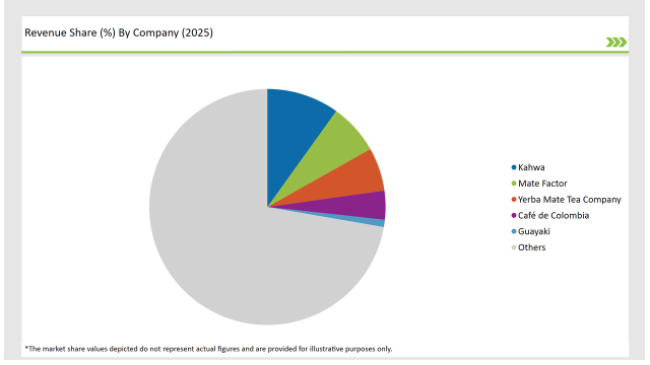

2025 Market Share of ASEAN Shrimp Manufacturers

Note: The above chart is indicative

The ASEAN Shrimp market is spectulating an intense mixed pool of reliable players and newly established companies that are fighting for part of the profit in a very soon matured sector.

Top companies are stressing on product development, emphasizing quality assurance, and forming strategic partnerships to sharpen their competitive blade. A handful of global players hold sway in the market but the prolific number of small firms in the industry, which offer cater to niche segments, cannot be overlooked.

As per Source, the industry has been categorized into Yeast and Fusarium Venenatum.

As per End Use Application, the industry has been categorized into Food and Beverage, Animal Nutrition, Pharmaceutical and Biotechnology

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Shrimp market is projected to grow at a CAGR of 13.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 6,062.7 million.

India are key Country with high consumption rates in the ASEAN Shrimp market.

Leading manufacturers include MycoTechnology, ADM (Archer Daniels Midland), BASF SE, DSM Nutritional Products, Ecoverse, Others are the key players in the ASEAN market.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA