The ASEAN Food Testing Services market is set to grow from an estimated USD 737.3 million in 2025 to USD 2,333.3 million by 2035, with a compound annual growth rate (CAGR) of 12.2% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 737.3 million |

| Projected ASEAN Value (2035F) | USD 2,333.3 million |

| Value-based CAGR (2025 to 2035) | 12.2% |

Rising consumer awareness about food safety and the growing demand for food quality and regulatory compliance testing services, the ASEAN food testing services sector has attained prominent growth. The acceleration of the consumable sector, tethered to the food and beverage industry in the region, is root cause for the meteoric rise in the demand for credible testing services.

The end result of this is that food and beverage producers, retailers, and foodservice providers are giving more importance to measures to assure food safety. The market includes a variety of tests including microbiological, chemical, and nutritional analyses that help food products meet the safety standards, and consumer expectations.

ASEAN region has had its fair share of foodborne diseases and pollution, which has made food safety top priority is on the list. The local government and regulative organizations tend to be tougher towards food safety by introducing new laws and rules so that consumers know that the food they eat is not dangerous which causes the increase in testing services.

Furthermore, the boom in people becoming more health-conscious has prompted food industry manufacturers to undergo testing for quality assurance which means they need to pin more of their crafts into third-party testing.

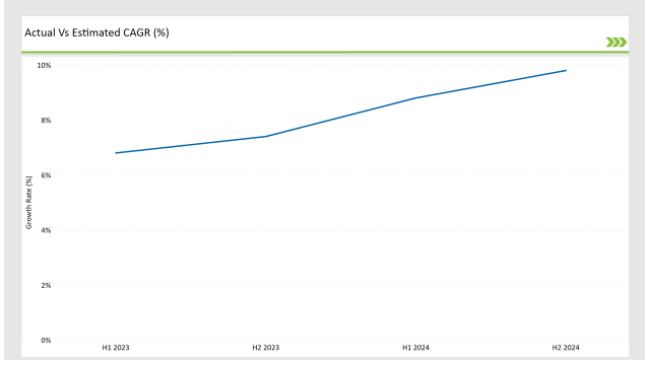

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the ASEAN Food Testing Services market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Food Testing Services market, the sector is predicted to grow at a CAGR of 9.8% during the first half of 2023, with an increase to 10.4% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 11.8% in H1 but is expected to rise to 12.2% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Eurofins Scientific acquired a leading food testing laboratory in Malaysia, enhancing its capabilities in the ASEAN region. |

| March 2024 | SGS launched a new line of rapid testing services for food safety in Thailand, focusing on microbiological analysis. |

| July 2024 | Intertek expanded its food testing services in Vietnam, introducing advanced analytical techniques for nutritional testing. |

| September 2024 | Bureau Veritas partnered with local food manufacturers in Indonesia to provide comprehensive testing and certification services. |

| November 2024 | ALS Limited opened a new food testing laboratory in Singapore, aimed at supporting the growing demand for food safety testing. |

Increasing Demand for Third-Party Testing Services

The food testing services are evolving towards the involvement of third-party test service providers, as food producers and retailers are looking for the independent evaluation of product's safety and quality. This movement is caused by the rising consumer demand for food supply chain transparency and accountability. Third-party testing is an impartial evaluation method for food products; thus it entails regulatory standards compliance and consumer trust building.

Consumers that become more aware about health and informed of food safety concerns are questioning food products more. This resulted in more suppliers associated with the third-party testing that can validate the claims of safety, quality and nutritional assessments of their products. Besides that, regulatory agencies are tightening the screws on the guidelines that are pushing the food industry to hire independent testing labs to get compliance.

Growing Focus on Sustainability and Organic Testing

With the increasing consumer knowledge of environmental issues and sustainable development, the food testing services easily notice the received enthusiasm for sustainability and organic testing. Consumers are more and more wanting not only the products that are secure and healthy but also the ones that are eco-friendly and ethically made. The very fact that this is happening is driving the food manufacturers to the use of and then seek the standard of the organic product.

The nascent food testing service curl is sitting in the proof's superior to the fresh products and they need certification and testing for organic and sustainable products. With these services the food products are ensured to follow the organic labeling rules that are rigorous, so manufacturers can trust the consumers and access the market. Hence, food testing laboratories are extending their capabilities by adding organic certification, pesticide residues, and sustainable sourcing to their testing.

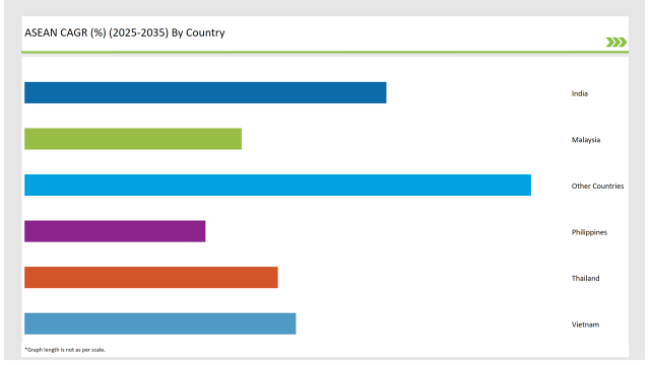

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

India is witnessing a huge transformation in the food testing services industry, which is growing strong like anything. The consumer realization has been the major factor in driving this growth. The increasing number of cases related to foodborne illnesses and food contamination have caused consumers and food regulators to given food safety top priority.

Thus, more food industries are taking tests for the food to the degree that they eat in diners invest in quality control to assert their right to compliance with safety standards and get consumer trust.

The Union government of India has come down heavily on food safety regulations that are consequently leading to the greater need for testing services. On the flip side, the health-conscious population is the one that has got foodgrowing companies to start quality control strides but this action even drives the need for trustworthy testing facilities.

The emergence of e-commerce and the rising popularity of food delivery have also opened new avenues in the food safety aspect and the necessitation of robust testing protocols to be followed in the entire supply chain for product integrity storage.

The food testing services market in Thailand has been rapidly growing, due to the greater awareness exhibited by the consumers towards food safety and quality. The government authorities in Thailand have put into effect some strict rules to improve food safety which has indirectly caused a rise in the need for trustworthy testing services. A good number of food manufacturers are now focusing on testing services as a way of getting safety standards compliance and enhancing customer trust.

The increasing tendency of individuals to be more health-conscious is the other reason the market is flourishing. More and more customers are choosing products that are safe, healthy, and not contaminated. The fact that many food producers are now shifting to the adoption of these quality control processes is blamed for the increase in demand for food testing solutions.

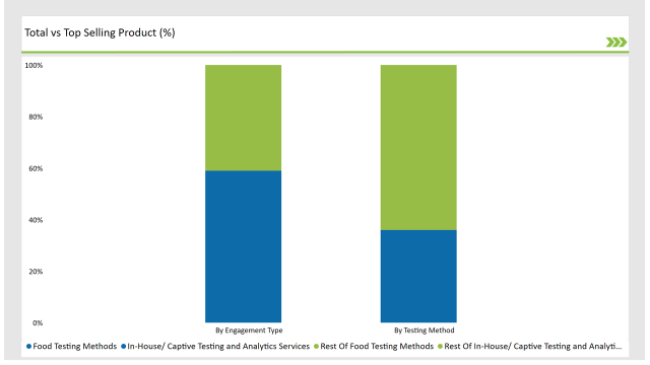

The ASEAN food testing services market is largely captured by the food testing methods, with this segment taking a share of 35.3% of the total market as per the estimates. This section consists of a multitude of testing services that are dedicated to the assurance of food products being free from pathogens and high quality. The raising occasions of foodborne illnesses as well as incidents of contamination have further prompted promoting food safety, which in turn subsequently increased the demand for all-round testing solutions.

The spectrum of food testing methods such as microbiological analysis, chemical testing, nutritional analysis, and allergen testing, etc. is present. These methods act as a basis for demonstrating that the food products have been prepared according to the safety and regulatory requirements. The trend of consumers who pay more and more attention to their health as well as acquire the knowledge about the food safety issues can lead to a steady growth of the supply of trustworthy food testing services.

The ASEAN food testing services market is dominated by in-house or captive testing and analytics services with a share of 58.6%. Typically, this segment consists of food manufacturers and processors to set up their own laboratories for the testing of raw materials and final products according to the quality control and quality assurance processes that they define. The increased focus on food safety and quality has made many companies allocate their resources to in-house testing which is the way to achieve the regulatory standards and meet customer expectations.

The benefits of in-house testing are numerous, such as quicker times for testing results, more autonomy for the testing procedures, and the possibility to develop the tests according to the specifications of the products. This is particularly valuable for food producers which are making a diverse product range and want to have the same high quality of all products.

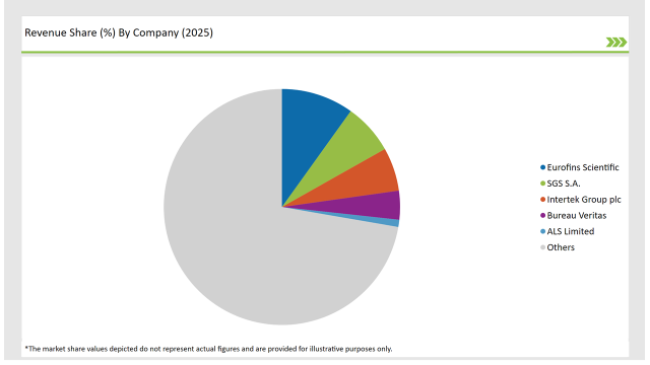

2025 Market Share of ASEAN Food Testing Services Manufacturers

The food testing services industry is being driven by major players who are the ones making the most significant investments in new technologies and the use of methods that have already been proven to improve the efficiency and accuracy of their testing processes.

This is the case with the inclusion of rapidly testing schemas, automation, and digitalization, which are the things that allow laboratories to turn around faster yet more reliable data. With foodborne infectious diseases and pollution cases still generating immense risks, the capacitation to quickly and precisely articulate testing results is becoming an unprecedentedly desirable factor.

Testing Methods, the industry has been categorized into Dairy Products Testing Methods, Dietary Supplements Testing Methods, Food Testing Methods, Meat Testing Analysis, Plant-Based, and Novel Food Testing Methods, and Animal Feed Testing Methods.

As per Engagement, the industry has been categorized into House/ Captive Testing and Analytics Services, and 3rd Party/ Independent Testing and Analytics Service Providers

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Food Testing Services market is projected to grow at a CAGR of 12.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 2,333.3 million.

India are key Country with high consumption rates in the ASEAN Food Testing Services market.

Leading manufacturers include Kahwa, Mate Factor, Food Testing Services Tea Company, Café de Colombia are the key players in the ASEAN market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Examining Food Testing Services Market Share & Industry Outlook

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

USA Food Testing Services Market Outlook – Share, Growth & Forecast 2025–2035

Food Safety Testing Services Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Europe Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

Food Authenticity Testing Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Latin America Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Food Stabilizers Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Superfood Powder Market Report - Growth, Demand & Forecast 2025 to 2035

ASEAN Frozen Food Market Growth – Trends, Demand & Innovations 2025–2035

Food Allergen Testing Market - Size, Share, and Forecast Outlook 2025-2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

Food Pathogen Testing Market Analysis by Contaminant Type, Technology, Application, and Region through 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA