The ASEAN Non-Alcoholic Malt Beverages market is set to grow from an estimated USD 694.1 million in 2025 to USD 1,980.7 million by 2035, with a compound annual growth rate (CAGR) of 11.1% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 694.1 million |

| Projected ASEAN Value (2035F) | USD 1,980.7 million |

| Value-based CAGR (2025 to 2035) | 11.1% |

The non-alcoholic malt beverages sector of the ASEAN region is witnessing substantial advances, which can be attributed to the shifts in consumer interest toward healthier and non-alcoholic substitutes.

Malt beverages, which usually contain malted grains as their primary ingredient and come with various flavors, have emerged as a popular drink among individuals who want to avoid alcohol while enjoying refreshing and savory options.

This is more pronounced especially in the regions where the cultures are more family-oriented towards the drinks and more concerned about health issues.

The market has been under the influence of the growing recognition of the good health properties that malt drinks contain, including their rich nutrient profile and improved gut health. Secondly, the new trend of wellness has also encouraged the change in consumer consumption, which boosts the tender of nonalcoholic malt drinks.

The company's offer of various flavors and products has also been a factor to the growth of the market, meeting the different needs of consumers.

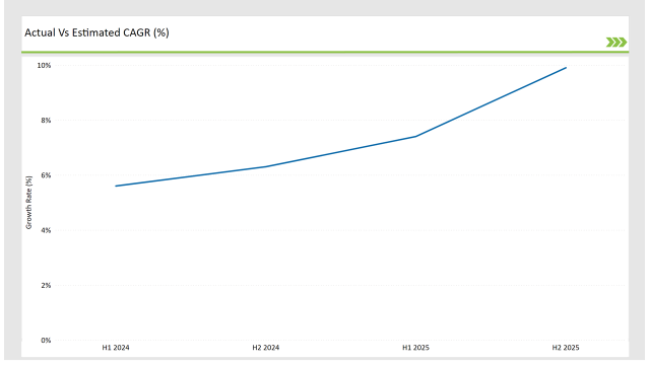

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Non-Alcoholic Malt Beverages market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Non-Alcoholic Malt Beverages market, the sector is predicted to grow at a CAGR of 4.7% during the first half of 2024, increasing to 5.4% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 6.5% in H1 but is expected to rise to 11.1% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Heineken launched a new line of non-alcoholic malt beverages under its "Heineken 0.0" brand, focusing on natural ingredients and unique flavors. |

| 2024 | AB InBev expanded its portfolio by introducing a new range of non-alcoholic malt beverages aimed at health-conscious consumers in Southeast Asia. |

| 2024 | Carlsberg announced a partnership with local distributors to enhance the availability of its non-alcoholic malt beverages across ASEAN countries. |

| 2024 | MaltCraft introduced a new line of craft non-alcoholic malt beverages, featuring innovative flavors inspired by local ingredients. |

Rising Health Consciousness among Consumers

A significant impact on non-alcoholic malt beverages market is played by the consumer's health-docaisexhodization. People are becoming more and more inclined to health-promoting drinks with the rise in the public's awareness about maintaining a healthy lifestyle. Alcohol-free malts are no longer viewed merely as drinks without alcohol; rather, they are now considered as the best alternative to soft drinks that have high sugar content and alcoholic beverages, thus, they are the magnet of choice for nutrient-l/ben-tangPELL.Sc.

The ones that abuse it. The manufacturers are reacting to this by cutting down on sugar and redecorating their products. Lots of brands are considering the addition of things that are natural instead of artificial flavors by including fruit extracts and herbal infusions, which are the start of this initiative.

Furthermore, arising with the trend of clean labeling is the companies that opt for transparency to declare their ingredients and the production processes, which promises to the consumer’s technetium the quality and the authenticity that they prioritize.

Innovation in Flavors and Product Offerings

Productline and flavors innovation is a very important trend in the prosection of the non-alcoholic malt beverages sector. While the tastes of the consumer undergo the evolution, the producers welcome and familiarize themselves with the new and interesting tastes so as to catchy the eye of the wider audience. The delivery of unexpected palate choices, like those from tropical fruits, spices, and herbal blends, would help to set products apart in a saturated market.

This movement is of special importance in the ASEAN area where the presence of different culinary cultures and palate perceptions can be felt. Producers are making the most of locally sourced materials and taste in the production process and thus they bring products that are more close to the people and locales in the region. One clear illustration of this is the infusion of indigenous plant species and spices into malt beverages, which not only improves the taste but also creates a strong brand identity.

On top of that, the premium and handmade non-alcoholic malt beverages market is slowly becoming the trend and people are willing to spend extra money on high-quality and artisanal products.

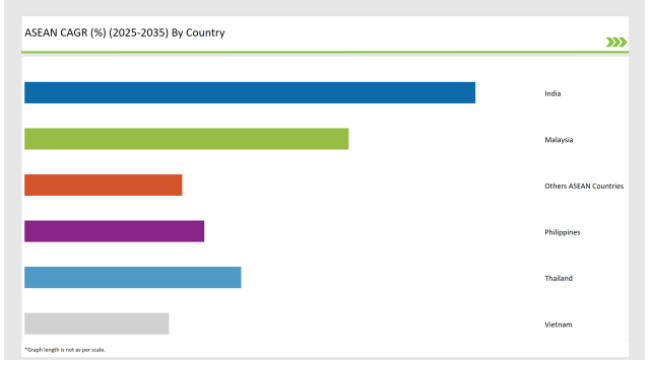

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The Indian market for non-alcoholic malt beverages is climbing to higher stages with the impact of profound driving forces. To begin with, there is a significant rise in the health awareness of Indian consumers that is resulting in a switch from sugary soft drinks and alcoholic beverages. As more and more people become familiar with the health issues related to high sugar and alcohol consumption, malt beverages without alcohol are being seen as a better alternative and as a matter of fact are prevailing more and more.

The middle class's rise and the continuous increase of the economic surplus are the two major factors that are boosting the demand for not only premium but also modern beverage options. The drinkers are more than willing to pay a higher price for items that come with standalone tastes and some added health advantages.

The one trend is that socializing without the alcohol has become very popular among the younger age demographic, who are looking for non-alcoholic choices in parties and celebrations, especially for the gatherings without any alcoholic drinks.

The market of non-alcoholic malt beverages in Thailand is experiencing rapid growth backed by the health trend and the shift in consumer behavior. The Thai consumers' increasing attitude towards health and wellness is yielding to a greater acceptance of non-alcohol alternatives. With people shifting towards being more health-friendly, they are demanding drinks that are not only free of sugar but also have no adverse effects on health.

The trend of drinking socially without alcohol is positively affecting the non-alcoholic malt beverages market in Thailand. A significant number of clients are in search of refreshing and tasty non-alcoholic alternatives to the regular drinks, in particular for use at parties and during commemorations. The trend is particularly obvious among the younger generation who tend to be more interested in non-alcoholic choices.

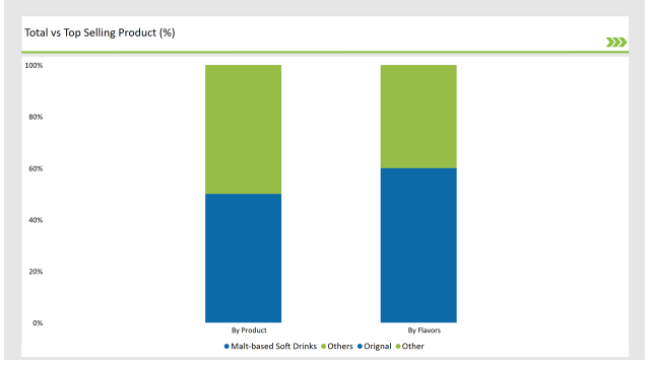

Non-alcoholic malt beverages dominate the market with malt-based soft drinks being the biggest share of it. These drinks are generally loved because of their distinctive flavors that are created by mixing malt with other components. The main reason people like these kinds of drinks is because of their multi-use; they can be consumed alone or used to make up non-alcoholic cocktails.

The rise of the health-conscious trend among consumers has been reflected in the growth of malt-based soft drinks that are lower in sugar and are made of natural ingredients. Companies are growing one step ahead of them by making changes in their products which include the use of healthier sweeteners and the aimed addition of vitamins and minerals.

This movement can be especially seen in countries like India and Malaysia where consumers eagerly look for drinks that are both tasty and provide health advantages.

The presence of ready-to-drink (RTD) non-alcoholic malt beverages has seen an upsurge due to their convenience and availability in the market. With the increasing number of people leading busy lifestyles, the consumers are now more on the lookout for beverages that do not require any preparations and which they can have on the go.

RTD malt beverages are the most suitable answer for that, as they provide a straightforward and rapid option for people wanting to enjoy the refreshing drinks without the need for mixing or preparation.

Nothing can beat the popularity of RTD malt beverages in cities where people are always on the run and look for the easiest of solutions. Manufacturers who recently noticed this trend are introducing new flavors and marketing of RTD malt beverages in cans and bottles. Thus consumers can have it their way by the selection of products they desire.

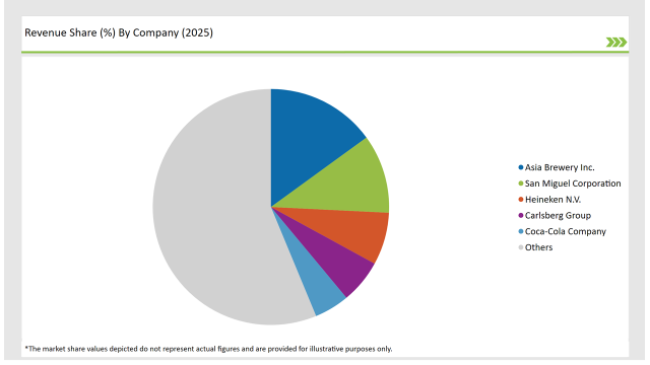

2025 Market Share of ASEAN Non-Alcoholic Malt Beverages Manufacturers

The competitive market landscape of the non-alcoholic malt beverage industry entails that numerous key contenders are competing for the market. Including Heineken, AB InBev, and Coca-Cola, the leading beverage companies that are extending their product lines with non-alcoholic drinks.

This step is taken in response to the irretrievable trend towards healthier alternatives. These corporations gain an advantage through their well-established supply chains and other brands to bring forth the product and establish a leading market share.

Malt Beers, Malt-based Soft Drinks, Malt Extracts, others

Original/Plain, Flavored (e.g., Fruit, Spices), Herbal

Cans, Bottles, Pouches, Others

B2B (HoReCa), B2C, Hypermarkets/Supermarkets, Convenience Stores, Online Retail, Others

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Non-Alcoholic Malt Beverages market is projected to grow at a CAGR of 11.1% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,980.7 million.

India are key Country with high consumption rates in the ASEAN Non-Alcoholic Malt Beverages market.

Leading manufacturers Asia Brewery Inc., San Miguel Corporation, Heineken N.V., Carlsberg Group in the ASEAN market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA