The ASEAN Food Emulsifier market is set to grow from an estimated USD 96.3 million in 2025 to USD 148.7 million by 2035, with a compound annual growth rate (CAGR) of 4.4% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025 E) | USD 96.3 million |

| Projected ASEAN Value (2035 F) | USD 148.7 million |

| Value-based CAGR (2025 to 2035) | 4.4% |

The ASEAN market of food emulsifiers is growing admirably due to the need for processed and convenience foods as a result of the increasing health consciousness among consumers, and the growing food and beverage industry.

Emulsifiers are of great importance in food formulation, and are the main ingredient in the enhancement of texture, stability, and shelf life, which are the main features of modern food items. In response to the changing customer preferences, which increasingly turn to natural and healthy products, the need for plant-based emulsifiers is rapidly increasing, which in turn, is a sign of the overall emphasis on clean labels.

The trend of ready-to-eat meals, bakery products, and dairy alternatives contributing to the demand for food emulsifiers is showing a positive rise in the region. The manufacturers are more and more focused on the process of innovation so as to adjust to the needs of the consumers who are changing all the time, as a result, they have created new emulsifier formulations that are directed towards customers who have special dietary needs such as gluten-free and vegan choices.

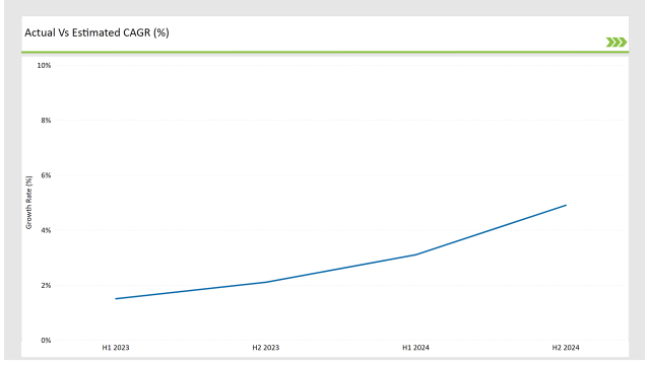

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEANFood Emulsifier market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEANFood Emulsifier market, the sector is predicted to grow at a CAGR of 1.5% during the first half of 2024, increasing to 2.1% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 3.1% in H1 but is expected to rise to 4.9% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Launch of a new line of organic pet supplements by XYZ Company, focusing on holistic health. |

| 2024 | Introduction of a subscription-based model for Food Emulsifier s by ABC Pet Care, enhancing customer loyalty. |

| 2025 | The partnership between DEF Supplements and a leading veterinary clinic to promote joint health products. |

| 2025 | Expansion of GHI Pet Products into the ASEAN market, introducing a range of probiotics for pets. |

Shift towards Plant-Derived Emulsifiers

A conspicuous trend that has been in the food emulsifier market is the movement toward plant-derived emulsifiers. Health awareness and environmental concerns of individuals now push the use of these natural and clean-label ingredients in food products on a rising curve.

Emulsifiers from plants, like lecithin, are the new market favorite for their advantages related to health and their longevity of use in an eco-friendly way. Manufacturers are adapting to this trend by reusing their products that include plant-based emulsifiers.

These not only match the consumer's needs but also are under the umbrella of the clean label regulations. This situation is so obvious in the bakery, dairy, and beverage sectors, for example, plant-derived emulsifiers are used to enhance texture, stability, and mouthfeel.

Growing Demand for Clean Label Products

Food emulsifiers that were usually seen as synthetic additives have recently become the target of criticism from consumers who prefer products with fewer artificial ingredients. As a consequence, the cause has gotten manufacturers to turn their focus to the creation of emulsifiers sourced from natural sources, such as seeds from flora and fruit, thus, supporting the clean label movement.

This is especially the case in the bakery, dairy, and sauce sectors, where emulsifiers serve as the main ingredients in the product. The trend of clean labels is also shaping marketing strategies, with brands giving prominence to the fact that they use natural emulsifiers in their products.

This method not only yay appeals to citizens who care a lot about their health but also, helps businesses build loyalty and trust. More and more manufacturers are drawing attention to the projects they are completing that involve the use of clean ingredients on their product packaging and in advertising campaigns.

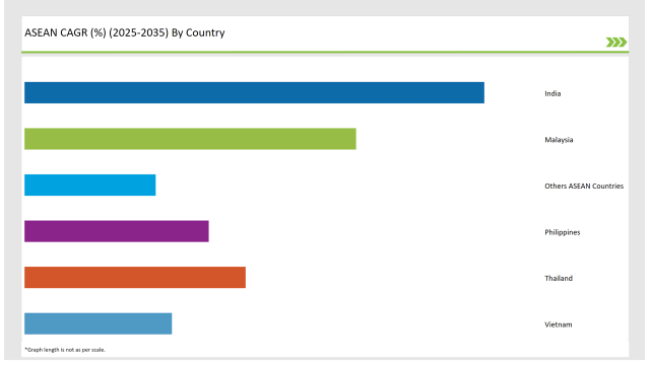

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

In the Indian food emulsifier market, we are witnessing a breakthrough increase due to the dietary and beverage industry's quick growth, urbanization, and changing consumer preferences. The food emulsifiers market, in India, is getting a push from urbanization and profitability in the food and beverage sector. Food emulsifiers are the ingredients that increase the texture, stability, and shelf life of various food products, and thus, they are the main components in food formulations.

The middle class, which is the most rapidly growing part of India's demographic structure, is helping the food emulsifier market to grow because people are beginning to spend more on processed foods that are easy to prepare and taste good.

The development of e-commerce and the practice of shopping for groceries online have made it easier to obtain a large selection of food emulsifiers, thereby offering manufacturers a wider audience to market to and customer preferences that are more diversified.

The Thailand emulsifier market is also on the rise due to the demand for processed and convenience foods.The massive fast pace of life of the urban dweller greatly affected the people of Bangkok to shift to a preference for ready-to-eat ketchup and emulsifier-based textured and stability-ensured packaged food products.

The mix of strong and diverse influences of spices and traditional ingredients is the main factor electronically of the food emulsion industry in the country. The food emulsion manufacturers are introducing emulsifiers that meet the needs of the people of Thailand complementing international styles to include the tastes of different cultures.Again this market growth is through the sharing of local and international food ideas.

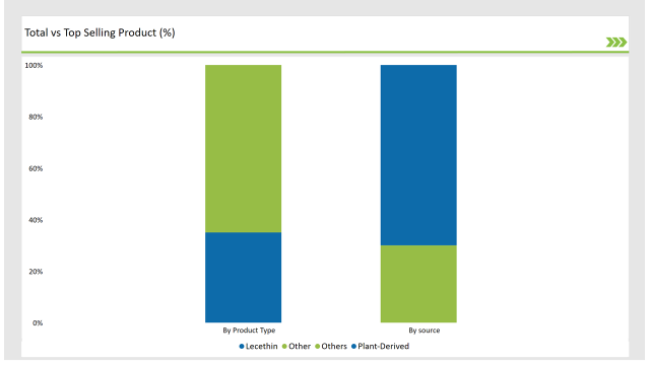

According to the market projections, plant-based food emulsifiers will dominate the food emulsifier market, with this source covering around 70% of the market in 2025. The growing consumer inclination towards naturally sourced and clean-label ingredients is the major factor that is fueling the demand for plant-derived emulsifiers, like lecithin, which are believed to be healthier than chemical emulsifiers.

To meet this tendency, vendors are reformulating their products by adding plant-based emulsifiers all the while staying in tune with consumer preferences and regulatory clean label requirements. This transition is particularly visible in the bread and pastry, milk, and soft drink industries, where plant emulsifiers are inserted to enhance jelling, stability, and mouthfeel.

From the standpoint of product types, lecithin is the leading player in the food emulsifier market, comprising around 60.4% of the total market share in 2025. Lecithin, which is manufactured from soybeans, sunflowers, and eggs, is widely used in food processes due to its excellent emulsifying properties. Because it can emulsify oil and water, it is a common ingredient in the production of bread, chocolate, margarine, and salad dressings.

The widespread use of lecithin may be the result of an attractive range of multifunctional aspects, including the improvement of texture, flavor release, and the extension of shelf life. In addition to these features, lecithin is also known for its health benefits, which include cardiovascular and brain function support; therefore, it is attractive to consumers who mind their health.

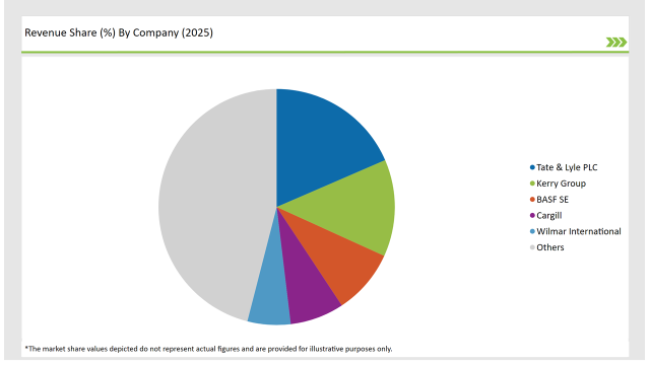

2025 Market Share of ASEAN Food Emulsifier Manufacturers

Note: The above chart is indicative

The food emulsifier market has been partitioned into a multiplicity of segments through frantic market players, aggressive firms, and intense rivalry. The main part of the business is filled mainly by Cargill, DuPont, BASF, Archer Daniels Midland (ADM), and the company in the third place is Ingredion. They have a strong presence in the market, push for products via well-known brands, and reach customers through an extensive distribution network.

By 2035, the market is expected to reach an estimated value of USD 148.7million.

India are key Country with high consumption rates in the ASEAN Food Emulsifier market.

Leading manufacturers include Tate & Lyle PLC, Kerry Group, and BASF SE the key players in the ASEAN market.

The ASEAN Food Emulsifier market is projected to grow at a CAGR of 4.4% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Pulses Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Probiotic Strains Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Compact Construction Equipment Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA