The ASEAN Probiotic Strains market is set to grow from an estimated USD 1,065.5 million in 2025 to USD 2,431.4 million by 2035, with a compound annual growth rate (CAGR) of 8.6% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 1,065.5 million |

| Projected ASEAN Value (2035F) | USD 2,431.4 million |

| Value-based CAGR (2025 to 2035) | 8.6% |

The ASEAN probiotic strains market shows rapid expansion because consumers understand better health and wellness along with increasing digestive disorders and stronger preventive healthcare trends.

Consumers are adopting probiotics as live microorganisms because they provide health advantages when taken adequately to enhance gut health, immune function and general wellness. Probiotics find their application across dietary supplements alongside functional foods and beverages through different probiotic strains which serve diverse health needs of consumers.

The ASEAN region has experienced increased availability of probiotic products because e-commerce platforms expanded while health-focused brands became more prevalent during recent years.

People use probiotics more frequently as part of their health practices which drives higher market demand for new products and delivery approaches. The COVID-19 pandemic has raised consumer understanding about gut health and immunity hence accelerating the marketplace expansion for probiotic strains.

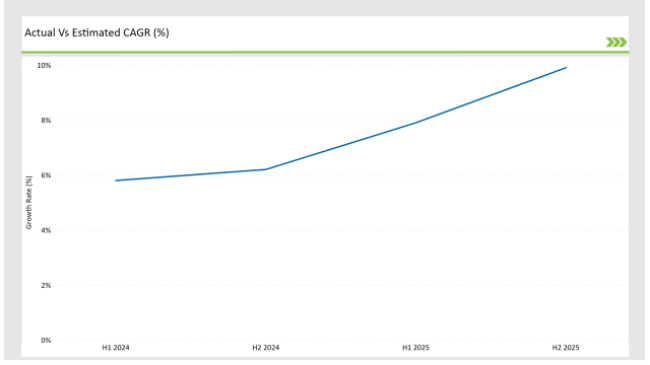

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEANProbiotic Strains market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEANProbiotic Strains market, the sector is predicted to grow at a CAGR of 4.2% during the first half of 2024, increasing to 5.5% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 6.3% in H1 but is expected to rise to 8.6% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | ProBioTech launched a new line of probiotic supplements targeting digestive health. |

| 2024 | NutraBlend expanded its product range to include probiotic-infused functional beverages. |

| 2024 | HealthFirst introduced personalized probiotic solutions based on individual microbiome analysis. |

| 2024 | BioBalance partnered with local farmers to source organic ingredients for probiotic products. |

Increasing focus on health and wellness

The marketplace shows growing interest in functional foods and beverages because people have switched their attention to health and wellness needs. Users seek convenient ways to improve their diets so manufacturers add probiotics to food items including yogurt and smoothies and snack bars.

The ASEAN area demonstrates an intense interest in traditional fermented foods given its long culinary history with such products. The market trend toward probiotic adoption drives manufacturers to create new probiotic solutions which match local taste expectations.

The rising consumer knowledge about probiotic advantages including better digestion and immunity and mental well-being drives the market demand forward. Changes in consumer health behaviors drive individuals to purchase products which deliver supplementary health advantages beyond fundamental nutrition.

Personalized Probiotics and Tailored Health Solutions

Microbiome research developments enabled scientists to make progress in understanding how diverse probiotic strains work on health systems thus enabling individualized probiotic development. Businesses present custom-made products which match user-specific health characteristics alongside dietary choices and life-style patterns.

The ASEAN region shows great significance for this dietary pattern because it contains various eating preferences along with healthcare needs. The consumer market demands probiotics that resolve particular health problems including digestive health needs together with immune system enhancement and mental wellness needs. Manufacturers currently focus financial resources on studying which strains produce optimal outcomes for specific health problems while establishing products that target these distinct requirements.

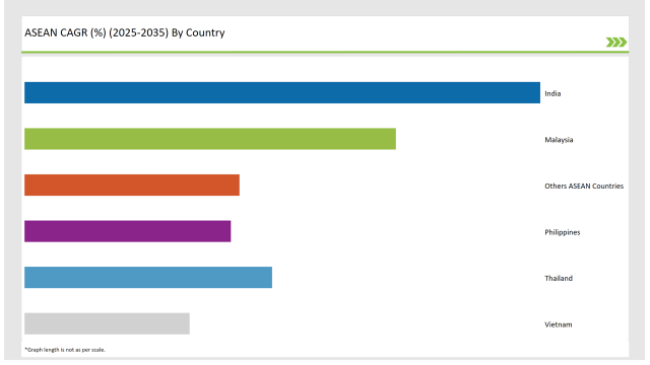

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The probiotic strains market in India demonstrates substantial growth because more people understand health matters and diseases from modern lifestyles have increased. Indian consumers accept probiotics because yogurt (dahi) and buttermilk (chaas) are traditional fermented foods that Indian culture has consumed for many years.

The increase in preventive healthcare together with people demanding probiotic supplements and functional foods happens to be a major market driver.

E-commerce platforms have increased consumer access to probiotic products which enables them to shop from different options. Indian consumers have rapidly taken to probiotic products due to growing interest in gut health and immunity during the COVID-19 pandemic period.

Indian consumers grow better informed about pro-biotic benefits which generates changes in their buying preferences to pick products benefiting their digestive system together with their general wellness.

Strong cultural food practices in Thailand support the growth of its probiotic strains market because it includes traditional food products like Thai yogurt and fermented vegetables. Upgraded consumer understanding about health advantages of probiotics fuels increasing demand for probiotic supplements and functional foods.

Acute governmental health and wellness promulgations support the increasing growth of the probiotic market in Thailand. People recognize that caring about their health means looking for products which target digestive wellness and immune health and general welfare. People now want probiotic-added drinks and snacks and dietary supplements making the market demand increase.

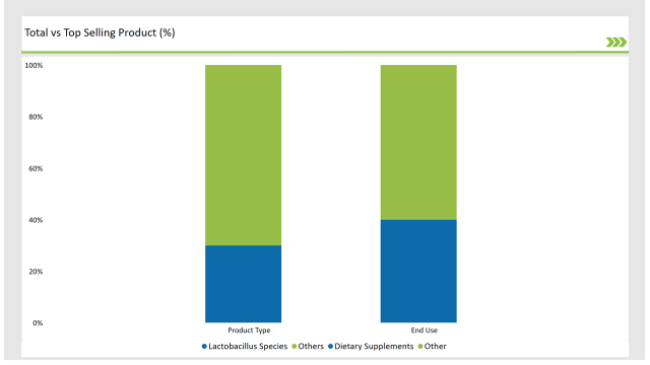

The probiotic strains market will mainly consist of Lactobacillus species because they possess both well-known health advantages and flexible features. These strains appear in fermented foods where they demonstrate three essential functions: improved gut health and enhanced digestion and stimulated immunity.

Because Lactobacillus appears frequently in yogurt and dairy items it has become commonly accepted by the consumer market. The growing interest in health-related knowledge drives consumers to choose products with Lactobacillus strains because of their proven health effects.

Manufacturing companies work to produce creative product formulations involving these strains across food and drink products to satisfy the rising interest in health-based food ingredients. Manufacturers adopt Lactobacillus strains because customers want products containing recognizable natural ingredients that deliver health advantages.

Dietary supplements lead the probiotic strains market segment because consumers focus on wellness and preventive healthcare and wellness. The market popularity of probiotic supplements exists because consumers see them as effective for enhancing both gut well-being and immune defines along with total body wellness.

People who want simple ways to take probiotics in their everyday life find dietary supplements with their different formats like first making capsules and second manufacturing powders and third creating gummies convenient. The growth of the dietary supplement market received additional support from e-commerce growth which enabled customers to buy multiple probiotic options through online platforms.

Publishers of dietary supplements reply to market requests by developing new formulations that focus on particular health problems such as gastrointestinal health and immune function and psychological wellness.

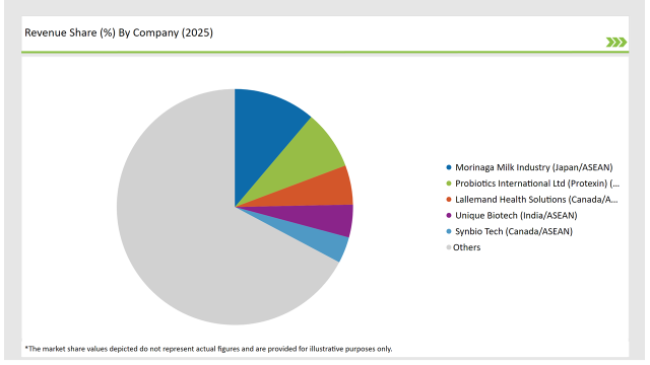

2025 Market Share of ASEAN Probiotic Strains Manufacturers

Note: The above chart is indicative

The probiotic strains market contains several active participants who vie in the competitive field. Companies within the market sector place their emphasis on creative products combined with improved quality standards and strategic business alliances to establish a stronger competitive position. The rising competition in the market stems from both established brand and emerging industry participants who introduce varied product selections.

Lactobacillus Species, Bifidobacterium Species, Bacullis Species, Others

Food & Beverage Processing, Dietary Supplements, Personal Care & Cosmetics, Others

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Probiotic Strains market is projected to grow at a CAGR of 8.6% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 2,431.4 million.

India are key Country with high consumption rates in the ASEAN Probiotic Strains market.

Leading manufacturers Morinaga Milk Industry (Japan/ASEAN), Probiotics International Ltd (Protexin) (UK/ASEAN), Lallemand Health Solutions (Canada/ASEAN), Unique Biotech (India/ASEAN) in the ASEAN market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA