The ASEAN Chitin market is set to grow from an estimated USD 41.7 million in 2025 to USD 264.9 million by 2035, with a compound annual growth rate (CAGR) of 20.3% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 41.7 million |

| Projected ASEAN Value (2035F) | USD 264.9 million |

| Value-based CAGR (2025 to 2035) | 20.3% |

The ASEAN Chitin market is rapidly expanding due to increasing utilizations in various sectors, including health, agro, and food processing. Chitin is a biopolymer made from the exoskeletons of crustaceans and its commercialization is based on the fact that it has the properties of biocompatibility, biodegradability, and non-toxic. A major driver of the market is the availability of raw materials provided by the region's seas and oceans which implies a rich biodiversity.

In the past few years, the trend of consumers shifting towards natural and organic products has been very prominent which resulted in the increased use of Chitin in dietary supplements and functional foods. Chitin, which can help alleviate joint pain, and its possible impact on weight management, has made it a favorite ingredient among those who care about their health. Moreover, the emphasis on environmental sustainability has been an impetus for companies to search for eco-friendly options, which has given Chitin the chance to position itself as a solution.

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEANChitin market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEANChitin market, the sector is predicted to grow at a CAGR of 6.9% during the first half of 2024, increasing to 7.7% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 8.9% in H1 but is expected to rise to 9.9% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Nestlé: Launched a new line of infant formulas enriched with Chitin to enhance gut health and immune support. |

| 2024 | Danone: Introduced a range of HMO-based functional foods aimed at toddlers, focusing on cognitive development and digestive health. |

| 2025 | Bifidobacterium : Announced the development of a new HMO extraction process that increases yield and reduces production costs for infant formula applications. |

| 2025 | FrieslandCampina : Expanded its product portfolio by incorporating HMOs into its premium infant formula line, targeting health-conscious parents. |

Growing Demand for Natural Health Supplements

The Chitin market is being heavily influenced by the worldwide movement towards health and wellness, particularly in the sector of natural health supplements. With the consumers evolving into more health-conscious individuals, the use of synthetic additives is on the decline and the preference for natural ingredients is on the rise. Chitin, especially in glucosamine form, is becoming a popular dietary supplement because it is considered to be beneficial for joint health and mobility.

The rise in cases of osteoarthritis and other joint-related disorders is the main reason for the increase in demand for glucosamine supplements, which are usually made from Chitin. The ongoing trend is highlighted by a rich research background that confirms the efficiency of glucosamine in reducing joint pain and consequently improving joint functionality. As a result, manufacturers are prioritizing the use of Chitin in their product formulations as a measure to satisfy this new demand.

Innovations in Chitin Extraction and Processing Technologies

Chitin extraction and processing technological changes are the market game changers. The rise of the green extraction of the system was the enzymatic and supercritical fluid extraction, which in turn is catching up with the productivity of Chitin.

These advancements not only shrink the ecological footprint that traditional extraction methods have but also enhance the quality and add function to the end product. The more efficient extraction process development, for example, enables manufacturers to source Chitin not only from shrimp and crabs but also from fungi, hence expanding the supply chain.

This adaptability is the key to satisfying the increasing need for Chitin in various sectors. Further, the advancements in nanotechnology have promoted the proliferation of Chitin nanoparticles that have particular physical characteristics that increase their use in drug delivery systems, wound healing, and food storage.

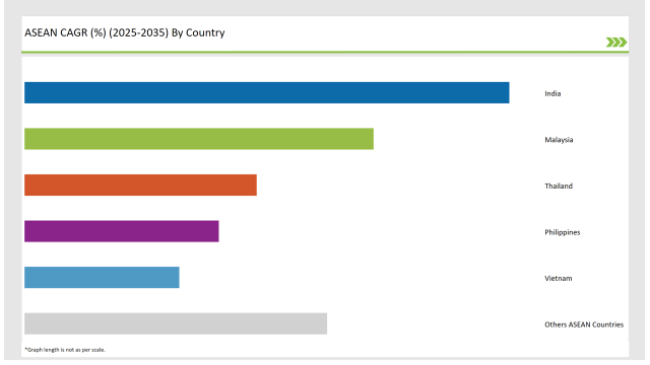

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

In India, the chitin market is enjoying a boisterous rise, with the main driver being growing health and wellness awareness among consumers. The climbing tide of lifestyle-related diseases has, in particular, resulted in a higher acceptance of supplementation with natural products, where chitin has a significant share due to its positive impact on joint health.

Alongside, the Indian government's promotion of organic farming and sustainable agriculture, schemes are a driving force behind the rise of demand for chitin-based products in agriculture.The pharmaceuticals section in India accounts for a big part of the chitin market too, as it is being used in drug formulation and wound healing applications. The increasing emphasis on R&D in the pharmaceutical sector is likely to lead to the emergence of new applications that utilize chitin.

With its rich marine resources and sophisticated processing technologies, Malaysia is quickly becoming a key player in the Chitin market. Being situated in the Southeast Asian region gives the country a geographical advantage for readily available raw materials, which are mainly obtained from shrimp and crab shells. The adequate availability of the thing, along with a discerning emphasis on the responsible use of resources, asserts Malaysia as the leading country in Chitin production.

Malaysia's government is at the forefront of helping to expand the biotechnology sector, this also includes the applications of Chitin in the fields of the pharmaceutical, agricultural, and food industries. The food industry has been the major force in the expansion of the Chitin market in the country, due to the increasing willingness of manufacturers to use natural preservatives and functional ingredients.

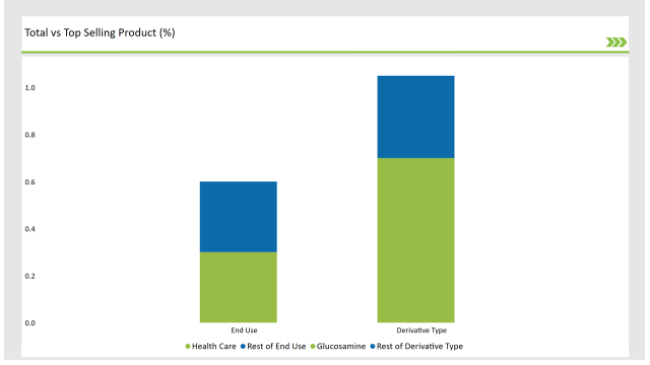

In the Chitin market, glucosamine is projected to dominate, accounting for approximately 70% of the market share by 2025. Glucosamine, a derivative of Chitin, is widely recognized for its potential benefits in joint health and mobility, making it a popular choice among consumers seeking natural health supplements.

The increasing prevalence of osteoarthritis and other joint-related disorders is driving the demand for glucosamine supplements, which are often derived from Chitin. This trend is further supported by a growing body of research highlighting the efficacy of glucosamine in alleviating joint pain and improving overall joint function. As a result, manufacturers are increasingly incorporating Chitin into their product formulations to cater to this rising demand.

The healthcare sector is anticipated to promote the major share of over 60.4% of the Chitin market by 2025, in terms of end application. The increased focus on health and wellness and the correlating rise in chronic diseases are leading to a higher demand for Chitin-based products in these areas.

Chitin and its modifications like glucosamine are predominantly used in dietary supplements, which are formulated for joint health and mobility. The discovery of glucosamine's effect on the symptoms of osteoarthritis and hence, it has become a popular choice among individuals who are interested in natural processes, contrary to the medical drugs that have side effects.

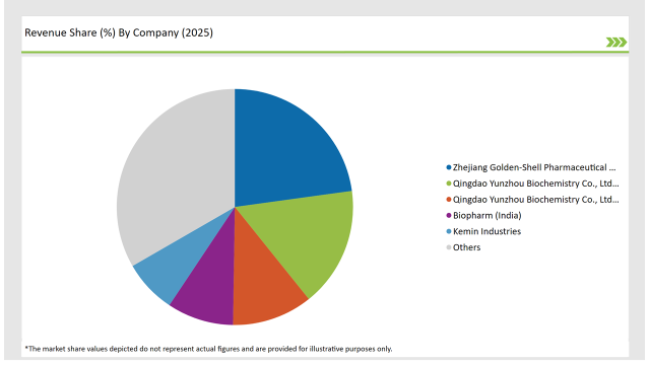

2025 Market Share of ASEAN Chitin Manufacturers

Note: The above chart is indicative

In the Chitin market, the situation is such that a significant part of the market is occupied by a large number of players competing fiercely in their quest for market share. To benefit from the unmet demand in the Chitin market, companies are primarily directing their efforts in the areas of innovation, product development, and the establishment of strategic partnerships. Market leaders include KitoZyme, Primex EHF, GTC Bio Corporation, Advanced Biopolymers, and BioCare Copenhagen.

The majority of these companies are channeling funds in the area of R&D to find out more uses of Chitin and make production better. For example, KitoZyme has been the one that pioneered the production of Chitin-based dietary supplements; however, Primex EHF is recognized for its green extraction techniques.

Derivative Type: Glucosamine, Chitosan, and Others

End-Use Industry: Food and Beverages, Agrochemicals, Healthcare, Cosmetics and Toiletries, Waste and Water Treatment, Others

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Chitin market is projected to grow at a CAGR of 20.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 264.9 million.

India are key Country with high consumption rates in the ASEAN Chitin market.

Leading manufacturers Zhejiang Golden-Shell Pharmaceutical Co., Ltd. (China), Qingdao Yunzhou Biochemistry Co., Ltd. (China), Qingdao Yunzhou Biochemistry Co., Ltd. (China), Biopharm (India)in the ASEAN market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA