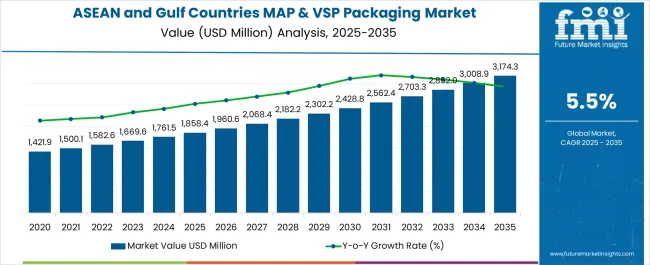

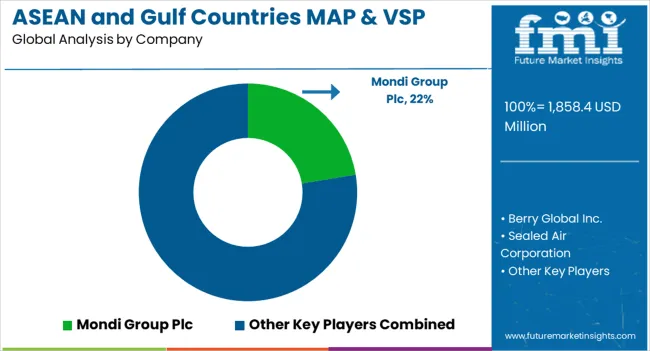

The ASEAN and Gulf Countries MAP & VSP Packaging Market is estimated to be valued at USD 1858.4 million in 2025 and is projected to reach USD 3174.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| ASEAN and Gulf Countries MAP & VSP Packaging Market Estimated Value in (2025 E) | USD 1858.4 million |

| ASEAN and Gulf Countries MAP & VSP Packaging Market Forecast Value in (2035 F) | USD 3174.3 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The ASEAN and Gulf countries MAP and VSP packaging market is expanding as demand for extended shelf life, food safety, and convenience continues to rise across fresh and processed food categories. Growing urbanization, rising disposable incomes, and changing dietary preferences are driving higher consumption of packaged food products, which in turn is accelerating the adoption of advanced packaging formats.

Modified atmosphere packaging and vacuum skin packaging technologies are being widely deployed to maintain product freshness, reduce food waste, and enhance visual appeal at the retail level. Investments in sustainable packaging films and equipment integration have further reinforced adoption across the region.

Additionally, stricter regulations on food safety and a stronger focus on export quality standards are creating opportunities for wider market penetration. The outlook remains positive as regional food producers and retailers increasingly shift toward high performance packaging solutions that meet both consumer expectations and compliance requirements.

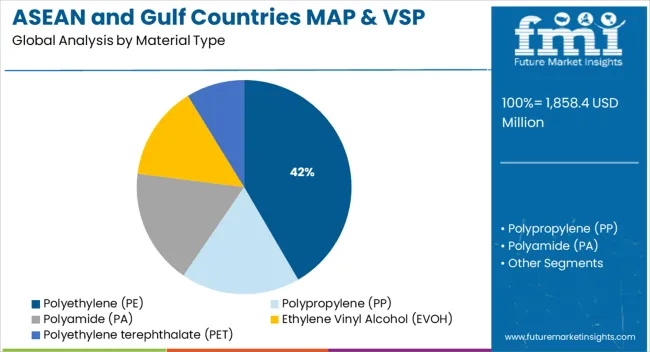

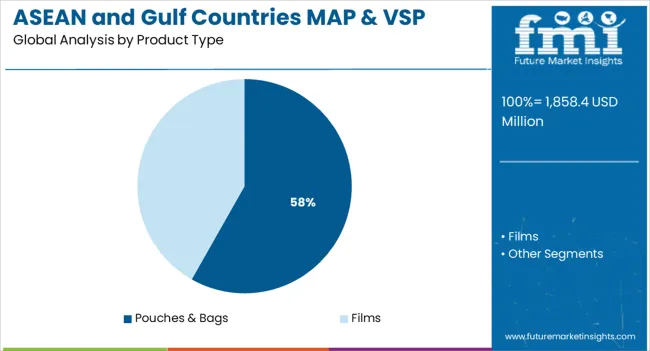

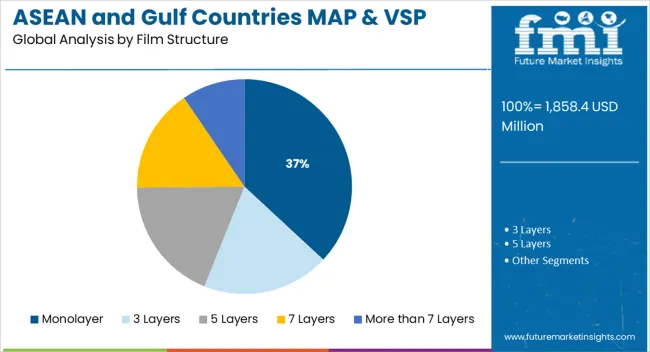

The market is segmented by Material Type, Product Type, Film Structure, Technology, and End Use and region. By Material Type, the market is divided into Polyethylene (PE), Polypropylene (PP), Polyamide (PA), Ethylene Vinyl Alcohol (EVOH), and Polyethylene terephthalate (PET). In terms of Product Type, the market is classified into Pouches & Bags and Films. Based on Film Structure, the market is segmented into Monolayer, 3 Layers, 5 Layers, 7 Layers, and More than 7 Layers. By Technology, the market is divided into Modified Atmosphere Packaging (MAP) and Vacuum Skin Packaging (VSP). By End Use, the market is segmented into Food and Non-Food. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene segment is projected to hold 41.60% of total market revenue by 2025, establishing it as the dominant material type. Its leadership is supported by its versatility, durability, and cost effectiveness, making it suitable for a wide range of MAP and VSP applications.

The material’s compatibility with high barrier technologies and recyclability has enhanced its attractiveness in regions where sustainability is becoming a stronger focus. Polyethylene also provides superior sealing properties and flexibility, ensuring extended freshness and protection during distribution.

The balance of performance, affordability, and environmental compatibility has reinforced the strong adoption of polyethylene in this market.

The pouches and bags segment is expected to account for 58.20% of total market revenue by 2025, positioning it as the leading product type. The segment’s growth is being driven by its lightweight nature, convenience in handling, and strong retail display benefits.

The adaptability of pouches and bags for multiple food categories including fresh produce, dairy, and meat products has further enhanced their utility. Additionally, ease of branding and the potential for resealable designs have increased consumer preference for this format.

Retailers and manufacturers are adopting this product type widely due to its operational efficiency and consumer friendly appeal, strengthening its market leadership.

The monolayer film structure is projected to represent 36.90% of total revenue by 2025 within the film structure category, making it the largest segment. Its dominance is supported by cost efficiency, straightforward manufacturing processes, and sufficient barrier properties for several food applications.

Monolayer structures are widely preferred in regions where affordability and accessibility remain key purchasing factors. In addition, their recyclability and compatibility with existing food safety regulations make them an attractive choice for producers.

The ability to balance performance with sustainability and cost control has ensured the strong position of monolayer film structures in the ASEAN and Gulf countries MAP and VSP packaging market.

From 2020 to 2024, a slow 3.7% CAGR was observed for the ASEAN MAP & VSP packaging market. Owing to the slow acceleration, the market’s value increased from USD 1,311.7 million in 2020 to USD 1,519.4 million in 2024. The sluggish expansion of the ASEAN market between 2020 and 2024 can be attributed to the COVID-19 pandemic, which heavily impacted several ASEAN countries.

Enforcement of extended lockdowns across affected nations resulted in temporary market closures. However, this created a lucrative opportunity for home delivery services, which expanded exponentially during the pandemic’s worst waves and kept the ASEAN market for MAP & VAP packaging ticking.

The Gulf Countries market for MAP & VSP packaging saw its value increase from USD 597.3 million in 2020 to USD 682.6 million in 2024. From 2020 to 2024, a sluggish 3.4% CAGR was estimated to drive acceleration for the Gulf Countries market.

Compared to the valuations and CAGRs that the ASEAN and Gulf Countries MAP & VSP packaging industries recorded from 2020 to 2024, the future for both regional markets looks brighter. Demand for perishable foods is set to increase across both regions, and this is likely to spur the expansion of the respective regional markets between 2025 and 2035.

According to Future Market Insights (FMI) analysts, multiple key factors are anticipated to contribute to the acceleration of the ASEAN and Gulf Countries markets for MAP & VSP packaging from 2025 to 2035. FMI’s analysts have assessed the trends along with potential opportunities, impediments, and threats for the respective markets.

The drivers, restraints, opportunities, and threats identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

Public and Private Initiatives to Reduce Food Waste and Limit the Perishability of Food Products to Drive Market Acceleration

Asia has come under fire in recent years for being one of the most prominent generators of food waste in the world. In ASEAN nations, which include the likes of developing economies such as India and Bangladesh, both public and private sectors are taking steps to reduce food waste. These initiatives are likely to result in positive expansion of the ASEAN market for MAP & VSP packaging.

Developed economies across ASEAN and Gulf Countries such as Australia, Qatar, Saudi Arabia, and United Arab Emirates are already adopting MAP & VSP packaging for their benefit. Adoption in these countries is greater compared to developing economies owing to the high costs associated with MAP & VSP packaging.

Companies that are aiming to offer food products without preservatives are also set to be backed by financial institutions. These companies are slated to gain access to attractive loan offers from 2025 to 2035, which should allow them to transition from traditional packaging to MAP & VSP packaging.

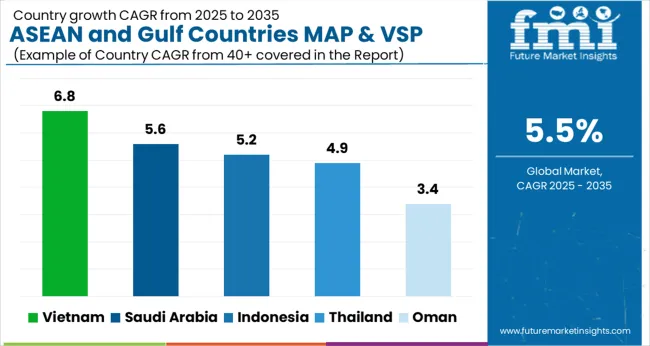

| Country | Vietnam |

|---|---|

| Market Share (2025) | 9.80% |

| Market Share (2035) | 11.10% |

| Anticipated CAGR (2025 to 2035) | 6.80% |

| Country | Indonesia |

|---|---|

| Market Share (2025) | 14.40% |

| Market Share (2035) | 14.00% |

| Anticipated CAGR (2025 to 2035) | 5.20% |

| Country | Thailand |

|---|---|

| Market Share (2025) | 12.60% |

| Market Share (2035) | 11.90% |

| Anticipated CAGR (2025 to 2035) | 4.90% |

| Country | Saudi Arabia |

|---|---|

| Market Share (2025) | 32.70% |

| Market Share (2035) | 34.80% |

| Anticipated CAGR (2025 to 2035) | 5.60% |

| Country | Oman |

|---|---|

| Market Share (2025) | 9.90% |

| Market Share (2035) | 8.60% |

| Anticipated CAGR (2025 to 2035) | 3.40% |

| Country | United Arab Emirates |

|---|---|

| Market Share (2025) | 23.70% |

| Market Share (2035) | 24.30% |

| Anticipated CAGR (2025 to 2035) | 5.10% |

Urgent Need for Reducing Food Waste in Vietnam to Drive Demand for MAP & VSP Packaging

According to statistics published by the World Bank in July, 2025, the garbage generated from takeaway beverages and foods accounts for around 44% of all the plastic waste found across Vietnam’s surveyed sites. Lao Cai, Hai Phong, Da Nang, Khanh Hoa, and Kien Giang were among the provinces and cities that were surveyed. The survey also revealed that plastic waste of around 0.28 to 0.73 million tons enters Vietnam’s seas each year. Several rivers flowing within the country are also being impacted adversely by garbage generated from takeaway beverages and foods.

Due to these factors, the Vietnam market for MAP & VSP packaging is slated for healthy expansion at a 6.8% CAGR from 2025 to 2035. This should take the country’s share in the ASEAN market from 9.8% in 2025 to 11.1% in 2035. However, the market for MAP & VSP packaging in Vietnam is also set to experience certain restraints as the country is a developing economy. Adoption of MAP & VSP packaging in the country’s food sector is challenging due to the high associated costs.

Powerful Economy and Strong Presence of Players to Fuel Surge of MAP & VSP Packaging Adoption in Saudi Arabia

For players in the Saudi Arabia market for MAP & VSP packaging, the future looks promising. This is due to the fact that Saudi Arabia is among the most economically prosperous nations among the Gulf Countries. The country’s economic status is allowing it to overcome the predominant challenge in MAP & VSP packaging adoption - their high costs. Saudi Arabia is also home to prominent food packagings companies such as Packaging Products Co., Printpack Saudi Modern Packaging Co. Ltd., and Noor Carton and Packaging Industry Co. Last but not least, Saudi Arabia is among the most prominent consumers of meat in the Gulf Countries. As demand for perishable meat products rises throughout the country, its MAP & VSP packaging industry is poised to benefit.

According to FMI research, Saudi Arabia dominated the Gulf Countries market for MAP & VSP packaging in 2025 with a whopping 32.7% share. Between 2025 and 2035, a steady 5.6% CAGR is likely to increase its regional market share to 34.8% in 2035.

Barrier Resistance against Multiple Gases to Escalate Adoption of EVOH in Gulf Countries Market for MAP & VSP Packaging

Ethylene Vinyl Alcohol or EVOH adoption in Gulf Countries market for MAP & VSP packaging is set for steady escalation. A crystal clear, flexible, and glossy thermoplastic copolymer, EVOH offers significant hydrocarbon resistance and flex-crack resistance. It is also popular for the barrier resistance it provides against gases like carbon dioxide, nitrogen, and oxygen. These properties of EVOH make it one of the most practical options for packaging perishable products across both food and non-food sub-segments.

Based on FMI research, sales of EVOH for MAP & VSP packaging in the Gulf Countries are likely to generate USD 3174.3 million in 2035. The segment is poised to expand in the coming years at a healthy 6.1% CAGR. Overall, the Gulf Countries market is set to be dominated by polyethylene (PE) between 2025 and 2035. However, the anticipated acceleration of EVOH adoption should be music for players’ ears, particularly those who are aiming to develop their MAP & VSP packaging solutions around EVOH.

VSP’s Cost and Quality Benefits over MAP to Make it More Popular across ASEAN and Gulf Countries

Adoption of both MAP & VSP packaging is set to soar in the years ahead across ASEAN and Gulf Countries. However, FMI expects VSP to generate more demand and sales compared to MAP from 2025 to 2035. This expectation is due to several advantages that VSP offers over MAP. For starters, VSP boasts a stronger barrier to several organic gases, especially oxygen. Perishable products packaged via the VSP technique are likely to have 20% longer shelf lives compared to MAP. Also, VSP prevents drips and leakage. Its weight is lighter as well, which translates to reduced product transportation costs.

In the Gulf Countries market for MAP & VSP packaging, VSP was estimated to have a 64.1% share in the regional market in 2025. A steady 4.5% CAGR is likely to take its regional market share to a marginally reduced 62.0% in 2035. In the ASEAN market, VSP’s market share in 2025 was observed to be around 64.2%. A consistent 5.1% CAGR is anticipated to drive its share in the ASEAN market to 60.1% in 2035.

The competitive landscape across the ASEAN and Gulf Countries markets for MAP & VSP packaging is likely to be fierce in the coming years. FMI anticipates prominent players across the ASEAN and Gulf Countries markets to invest heavily in research & development for creating more cost-effective and sustainable packaging products. Facility expansions, distribution channel strengthening, collaborations, and acquisitions are also likely as players look to cement their respective footholds across both regional markets.

Mondi Group Plc, Berry Global Inc., Sealed Air Corporation, Swiss Pack Europe, Klöckner Pentaplast Group, Amcor plc, Plastissimo Film Co., Ltd., Luban Pack, Al Borj Plastic Industries, VACUUM BAGS SARL, NARAI PACKAGING (THAILAND) LTD., IMPERIAL PACKAGING AND PLASTICS SDN BHD, FRAGSTAR CORPORATION SDN. BHD., SOLOS POLYMERS PVT. LTD., Vishakha Polyfab Pvt Ltd., and Napco National are among the leading players in the ASEAN and Gulf Countries markets for MAP & VSP packaging.

Recent Developments:

| Attribute | Details |

|---|---|

| ASEAN and Gulf Countries MAP & VSP Packaging Market Projected Value (2035P) | USD 3,841.0 million |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (USD million) and Units for Volume |

| Key Countries Covered | Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam, Bangladesh, Sri Lanka, Australia, Rest of ASEAN Countries, Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates |

| Key Segments Covered | Material Type, Product Type, Film Structure, Technology, End Use, and Country |

| Key Companies Profiled | Mondi Group Plc; Berry Global Inc.; Sealed Air Corporation; Swiss Pack Europe; Klöckner Pentaplast Group; Amcor plc; Plastissimo Film Co., Ltd.; Luban Pack; Al Borj Plastic Industries; VACUUM BAGS SARL; NARAI PACKAGING (THAILAND) LTD.; IMPERIAL PACKAGING AND PLASTICS SDN BHD; FRAGSTAR CORPORATION SDN. BHD.; SOLOS POLYMERS PVT. LTD.; Vishakha Polyfab Pvt Ltd.; Napco National |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global asean and gulf countries map & vsp packaging market is estimated to be valued at USD 1,858.4 million in 2025.

The market size for the asean and gulf countries map & vsp packaging market is projected to reach USD 3,174.3 million by 2035.

The asean and gulf countries map & vsp packaging market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in asean and gulf countries map & vsp packaging market are polyethylene (pe), _hdpe, _ldpe, _lldpe, polypropylene (pp), polyamide (pa), ethylene vinyl alcohol (evoh) and polyethylene terephthalate (pet).

In terms of product type, pouches & bags segment to command 58.2% share in the asean and gulf countries map & vsp packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Pulses Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Probiotic Strains Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA