The ASEAN Pulses market is set to grow from an estimated USD 37,447.1 million in 2025 to USD 77,179.6 million by 2035, with a compound annual growth rate (CAGR) of 7.5% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 37,447.1 million |

| Projected ASEAN Value (2035F) | USD 77,179.6 million |

| Value-based CAGR (2025 to 2035) | 7.5% |

The ASEAN Pulses Market is currently undergoing tremendous progress, primarily due to the increasing consumer perception of healthy diets and nutrition, together with a climbing demand for plant protein sources.

Beans, including chickpeas, lentils, yellow peas, and pigeon peas, are being given preference for their high protein content, fiber, and essential nutrients, thus, they are a viable put on the roster for them. The marketplace's growth will continue as the people who eat vegetarian and flexitarian diets will be the ones who are searching for a more sustainable food option that is both nutritious and health-friendly.

Pulses in the ASEAN region are not solely a major component of traditional diets but they are also being embedded into modern cooking. The fast-developing food trend of plant-based products is coupled with an increasingly serious public health crisis caused by lifestyle-related diseases that have sparked people to seek out healthier food. The government campaigns that adopt pulses as part of a balanced diet offering farmers the support they require, further back this change.

The market is strengthening the hold of health foods also through innovation in product development. The companies have come out with a variety of food products such as snacks, flour, and ready-to-eat meals that are made mostly of beans.

ASEAN Pulses Market is on the right path as the consumer searches for easy, healthful options it is a growing area where both the local and worldwide companies can make their mark by entering the market.

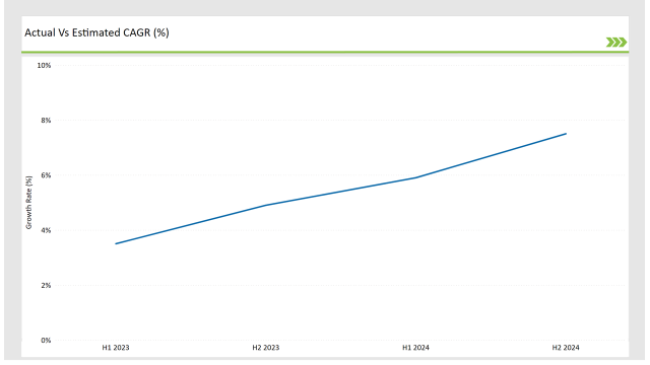

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Pulses market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Pulses market, the sector is predicted to grow at a CAGR of 3.5% during the first half of 2024, with an increase to 4.9% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 5.9% in H1 but is expected to rise to 7.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Launch of a new line of chickpea-based snacks by a leading food manufacturer, targeting health-conscious consumers. |

| 2024 | The partnership between a pulse supplier and a major food brand to develop lentil-based ready-to-eat meals. |

| 2024 | Introduction of a new range of organic yellow pea flour by a prominent food company, catering to the growing demand for gluten-free alternatives |

| 2024 | Expansion of a pulse processing facility in Malaysia to increase production capacity and meet rising demand for pulse-based products. |

Rising Demand for Plant-Based Proteins

The increasing number of people who are more concerned about their health and the environment has led to the occurrence of alternative plant proteins instead of the usual animal proteins on the list of favorite foods. Pulses such as chickpeas and lentils that are rich in proteins and important nutrients have found a place on the menu of those who want to eat less meat.

This pattern is widespread, especially among the younger generations now such as the millennials and Z generation who have learned to respect the environment and ethical issues by including them in their food choices.

The majority of newly diagnosed lifestyle-related diseases, for example, obesity and diabetes, have also been a big reason for people looking for healthy food options like pulses. The more people go vegetarian or flexitarian, the more demand for pulse-based products is first predicted by this trend, resulting in further growth in the ASEAN Pulses market.

Innovations in Product Development

The ASEAN Pulses Market has been making strides due to the introduction of innovative product development by manufacturers who are adamant about fulfilling the challenges offered by the changing demands of health-conscious consumers.

The push for the production of high-quality, functional pulse products has made manufacturers employ newer processing techniques and formulations. With this ever-increasing variety, manufacturers are dedicating a lot of their resources to developing all sorts of products; from flour and snacks to ready-to-eat meals, all made with pulses, to suit consumers' broad choices.

The pulses market has also witnessed the influence of the trend of clean-label products, which promote the concept of processing foods with fewer ingredients and more natural ones, on product development.

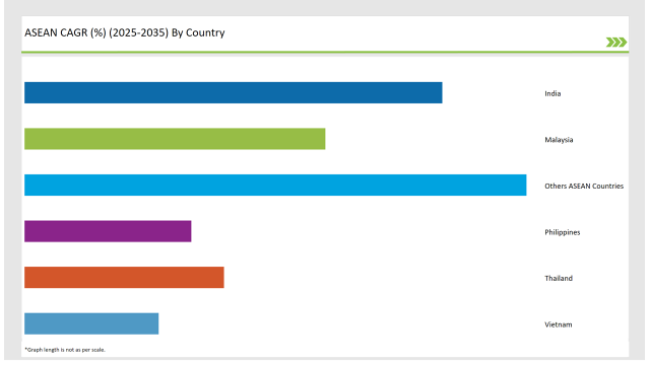

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The Indian government has taken several steps forward in the promotion of pulse crops, for example, subsidies for farmers as well as funding for research to improve yield results. Through these activities, the production has been raised, thus making pulses more within reach and affordable for consumers.

Furthermore, the increasing number of people who choose greens instead of meat has been the cause of fast-growing pulses demand. The upsurge in health-related illnesses such as diabetes and heart disease has caused people to become more conscious of what they eat.

Besides that, pulses are known to be a good source of protein, fiber, and other nutrients, people are now acknowledging all these aspects more and more. For this reason, the Indian pulses market is predicted to thrive in the future as a result of both local consumption and international trading.

The government of Malaysia has introduced several programs to promote the instinctive consumption of pulses as part of a balanced diet. These projects consist of educational campaigns targeting the increase in awareness of the nutritional benefits of pulses and their influence on the prevention of chronic diseases.

Besides, Malaysian people have become more inclined to accept pulses in their diets due to the incorporation of pulses into the popular foods of Malaysia. On top of this, the flexitarian trend which leans toward the reduction of meat intake instead of eliminating it, is the other reason for the assembling of the pulse products.

Osculation to this trend by the manufacturers is the launching of novel pulse-based snacks and ready-to-eat meals that appeal to health-conscious consumers. The emphasis on health and nutrition will determine the course of the pulses market in Malaysia as long as it is continually developing.

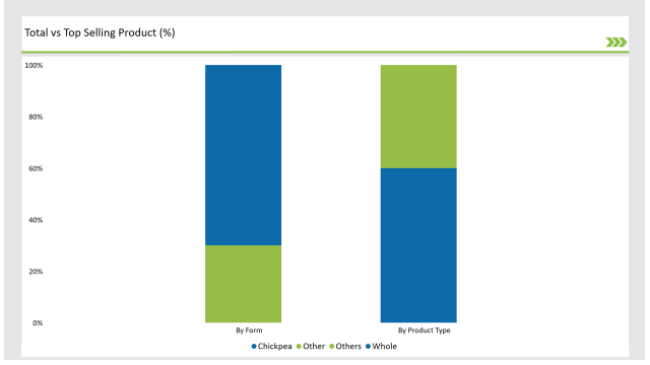

Chickpeas, a major player in the ASEAN Pulses Market, contribute about 60% of the total market. The fact that chickpeas are versatile, high-protein foods and have been around for a long time in different food applications explains their popularity. Chickpeas are found in many snacks, hummus, and other products given value, which are sold due to the consumers' preference for them as a protein source in food manufacturing.

Chickpeas are a good source of essential amino acids, fiber, and vitamins, which is why they are often included in a healthy diet. Furthermore, the recent trend in consumers eating less has increased the consumption of chickpeas owing to their advantages such as better digestion and weight control.

Whole pulses, in terms of appearance, are the widely recognized category in the ASEAN Pulses Market, mainly comprising about one-fourth of the total market. Their being the most popular choice of pulses can be easily explained by the fact that they are the most nutritious and can be used in many cooking processes.

Whole pulses are frequently preferred for their characteristic features of being able to keep their natural taste and textures, which makes them a choice for a variety of ASEAN regional traditional food recipes. Whole pulses are a regular component of soups, stews, and salads, and they are often used as an ingredient in many local dishes.

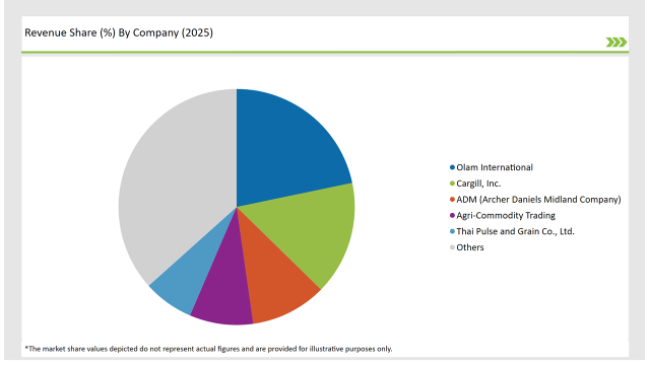

2025 Market Share of ASEAN Pulses Manufacturers

Note: The above chart is indicative

The ASEAN Region of Pulses Market is marked by the strong level of competition among the numerous businesses trying to obtain a certain market share. The rise in demand for plant protein has led the market to invite both existing food manufacturers and new arrivals that dynamically form and change the market.

As per Product Type, the industry has been categorized into Chickpeas, Lentils, Yellow Peas, and Pigeon Peas

As per Form, the industry has been categorized into Whole, Split, Flour, Grits and Flakes

As an End-use Application, the industry has been categorized into Business to Business, Household Retail, Food Service, and Institutional

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Pulses market is projected to grow at a CAGR of 7.5% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 77,179.6 million.

India are key Country with high consumption rates in the ASEAN Pulses market.

Leading manufacturers include Olam International, Cargill, Inc., ADM (Archer Daniels Midland Company), Agri-Commodity Trading, and Thai Pulse and Grain Co., Ltd. are the key players in the ASEAN market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA