The ASEAN Animal Feed Alternative Protein market is set to grow from an estimated USD 1,052.7 million in 2025 to USD 3,510.8 million by 2035, with a compound annual growth rate (CAGR) of 13.8% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) (USD million) | USD 1,052.7 million |

| Projected ASEAN Value (2035F) (USD million) | USD 3,510.8 million |

| Value-based CAGR (2025 to 2035) | 13.8% |

The ASEAN (Association of Southeast Asian Nations) area is now experiencing a quick and wide transformation in the animal feed realm, which is mainly the result of the demand for alternative proteins. Alongside the continuous increase of the global population, the necessity for animal protein production through the sustainable and effective way has turned into the prominent object.

The use of alternative protein, especially plant proteins, is now enunciated to be one of the few possible alternatives to the issues concerning traditional animal feed sources like fishmeal and soybean meal.

The ASEAN animal feed alternative protein market is not only featured by plant-based proteins derived from legumes, grains and oilseeds but also includes insect-based proteins and fermentation-derived proteins. The trend of people caring more about the environment and the risen consumer demand for the sustainably overall animal products are driving the application of alternative proteins in the animal feed formulations.

Thailand, Malaysia, and Indonesia are among the leaders of this market transition, using their agricultural resources to make alternative protein components. The biodiversity of the region and the favorable climate help the production of diverse protein-rich crops, and this creates a great opportunity for alternative protein businesses.

ASEAN Economic Community (AEC) is promoting cooperation and trade in the region, making the transfer of technologies and solutions for feed production more efficient. At the time of the market undergoes the changes, the stakeholders, such as farmers, feed manufacturers, and researchers, are more and more concentrating on inventing economical and environmentally friendly alternatives to meet the need for animal feed.

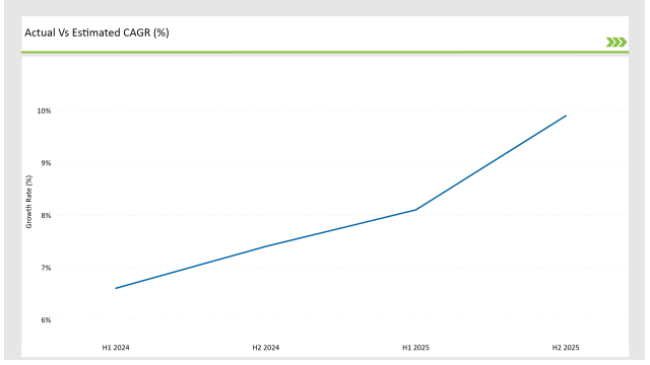

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEANAnimal Feed Alternative Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEANAnimal Feed Alternative Protein market, the sector is predicted to grow at a CAGR of 6.6% during the first half of 2024, increasing to 7.4% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 8.1% in H1 but is expected to rise to 9.9% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Cargill launched a new line of plant-based protein products specifically designed for poultry feed, enhancing nutritional value and sustainability. |

| 2024 | ADM (Archer Daniels Midland) invested in a state-of-the-art facility in Malaysia for the production of insect-based protein, aiming to meet the growing demand for sustainable feed solutions. |

| 2024 | Nutreco introduced a novel fermentation-derived protein ingredient for aquaculture feed, improving growth rates and feed efficiency in fish farming. |

| 2024 | BASF partnered with local farmers in Thailand to develop sustainable protein crops, focusing on enhancing the nutritional profile of animal feed. |

Increasingly turning to alternative protein sources

Sustainability is the main concern in feeding livestock thus driving the interest for the development of insect protein in the animal feed alternative protein market. With the rise in the number of people who are aware of the importance of taking care of the environment, there is increased attention on lowering the animal agriculture carbon footprint.

Most of the high-protein ingredients such as fishmeal and soybean meal come from the environment which is suffering from overfishing and deforestation respectively.

To counter this problem, cattle owners and feed companies are more and more looking for plant proteins that allow them to have a smaller ecological footprint. The main reason legumes, such as lentils, peas, or chickpeas, are becoming more and more prominent is their potential for sustainability. They are the source of protein that is not only valuable for the animal's health but also needs less energy, water, and land to grow compared to the traditional sources.

Using insects has been a radical solution, since they can be fed on agricultural organic waste and can convert the food into body mass with a high rate of efficiency. It is a creative adjective method to both protein deficiency and the ecological problem of waste in the agricultural sector.

Technological Advancements in Protein Production

Animal Feed Alternative Protein market is undergoing a shift due to technological developments such new technologies have a dominant part in expanding and the market introduction of alternative proteins in animal feed. Biotechnology, fermentation and precision agriculture have a great influence on the production of high-quality proteins, which can be given to livestock to meet their nutritional needs.

For example, the evolution of fermentation technology allows us to produce microbial proteins which can be made from renewable resources, are very high in protein and thus very cheap. These proteins could act as sustainable alternatives to foods made from animals, which contain essential nutrients for growth and health.

The Council also recommends the use of precision agriculture to further increase the production efficiency of protein crops. With the availability of data analytics, farmers can achieve optimal results in the planting, irrigation, and harvesting of crops, thus leading to more yields and better protein content. This not only raises the financial status of farmers but also leads to the sustainability of the agricultural system in total.

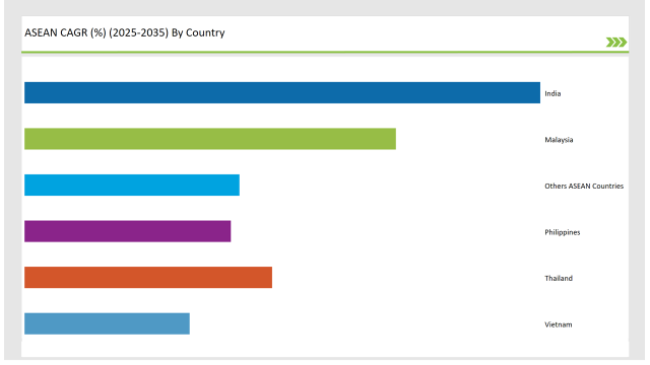

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The market of India animal feed alternative protein is on a rollercoaster growth ride as a result of many forces. The large livestock population, in tandem with the increase in meat and dairy consumption, is the main factor for the demand of high-quality animal feed. With the continued expansion of the Indian economy, a number of consumers are turning to protein-rich diets that in turn leads to the increase in the demand for poultry, dairy, and aquacultural products.

The Indian government is also introducing schemes for the improvement of the livestock sector's productivity and sustainability. Initiatives that aim to improve the skills of those involved in animal husbandry and promote the use of alternative protein sources are now fashionable. The first one is the promotion of plant-based proteins, such as soybean and pulses, which are not just fantastic sources of protein but also have a positive effect on local agriculture.

The ASEAN animal feed alternative protein market has Thailand as its main actor due to its advanced agricultural sector that can provide alternative protein sources. The increasing demand for quality animal feed in connection with livestock that is in a boom, especially poultry and aquaculture, is the main reason to turn to alternative proteins.

Thai government is eagerly implementing congratulated programs to build sustainability and the productivity chain of the livestock section. Initiatives that are focused on the more efficient utilization of feed and the less harmful effect of animal agriculture are in the course of action. In this context, the recommended use of alternative proteins, like plant-based and insect-based proteins, has been given especial consideration because of their ecological balance.

Modified starches represent a main segment of the Animal Feed Alternative Protein market and are a good amount of their versatile applications to different sectors. These starches are modified by chemical or physical treatments to enhance their functional properties, which makes them suitable for a broad variety of uses, such as in food, pharmaceuticals, and cosmetics.

In the sector of food, modified starches act as thickening agents, stabilizers, and emulsifiers, which in turn have better texture and consistency to products such as sauces, dressings, and yogurt. The rise in their popularity of ready-to-eat meals and convenience foods creates a pressure to the industry for modified starches as the producers look for the possibilities of the increase of product shelf life and quality.

Insect-based proteins are coming up as a very new and sustainable alternative to replace other proteins in the animal feed market, which means they are becoming popular due to their high nutritional value and their low environmental impact. Insects such as black soldier flies, mealworms, and crickets are high in protein, essential amino acids, and healthy fats, and therefore, they are an excellent feed ingredient for livestock, poultry, and aquaculture.

The insect-based protein production is extremely effective as it takes way less land, water, and feed than the regular livestock farming process. Insects can be cultivated on organic waste, such as food scraps, and agricultural by-products, which not only helps bring down waste generation numbers but also leads to the establishment of a circular economy.

The sustainability aspect, in this case, seems to be particularly attractive to both consumers and producers, as the need for environmentally friendly feed alternatives is still on the rise.

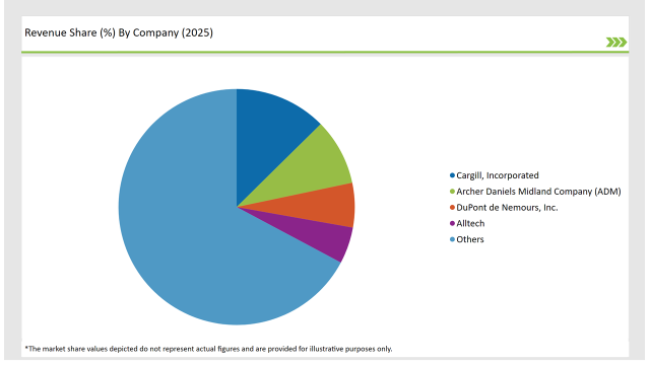

2025 Market Share of ASEAN Animal Feed Alternative Protein Manufacturers

Note: The above chart is indicative

The animal feed alternative protein market is a thriving sector characterized by the competition among many key players, who are trying their best to capture the market share. The leading companies in this field are Cargill, ADM (Archer Daniels Midland), Nutreco, Alltech, and BASF, to name a few. These organizations are following different routes to increase their visibility in the market, such as the introduction of new products, collaboration with strategic partners, and research of unexplored markets.

This Segment further Categorise into Insect Based Protein, Plant based Protein, Fish Meal Alternative, Single-cell proteins, Others

This Segment further Categorise into Poultry, Swine, Cattle, Equine, Aquaculture

This Segment further Categorise into Food & Beverages, Paper & Paperboard, Feed Industry, Pharmaceuticals, Textiles

By Form Type: Meal, Pellets, and Liquid, Freeze-dried

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Animal Feed Alternative Protein market is projected to grow at a CAGR of 13.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 3,510.8 million.

India are key Country with high consumption rates in the ASEAN Animal Feed Alternative Protein market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Pulses Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA