The ASEAN Bakery Mixes market is set to grow from an estimated USD 1,650.7 million in 2025 to USD 3,190.2 million by 2035, with a compound annual growth rate (CAGR) of 6.8% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 1,650.7 million |

| Projected ASEAN Value (2035F) | USD 3,190.2 million |

| Value-based CAGR (2025 to 2035) | 6.8% |

The ASEAN bakery mixes market is on the rise mainly due to the changing consumer preferences, urbanization, and the increasing popularity of home baking. As people become increasingly busy, people are looking for convenience and time-saving solutions for baking, which is leading to the increase in bakery mixes.

These mixes are the best way to bake delicious items, such as bread, cakes, and pastries, with just little preparation and without the need for special techniques.This new tendency of home baking has brought the demand for high-quality bakery mixes, which are different available tastes and dietary preferences, to increase. Manufacturers are meeting this problem with the help of new products based on natural ingredients, gluten-free options, and untraditional tastes, which help them satisfy the turning customer's need.

The foodservice sector growth in ASEAN countries also contributes to the success of bakery mixes; this includes cafes, restaurants, and bakeries. Foodservice operators are now more often using these mixes for the sake of efficiency and consequently, for the improvement of the quality of their products. This development can particularly be seen in the urban areas where the interest in convenience and immediately ready-to-eat baked goods is rising.

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEANBakery Mixes market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEANBakery Mixes market, the sector is predicted to grow at a CAGR of 3.4% during the first half of 2024, increasing to 4.5% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 5.4% in H1 but is expected to rise to 6.8% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Kerry Group introduced a new range of flavor -enhanced bakery mixes designed for the foodservice sector in May 2024 |

| 2024 | Cargill expanded its portfolio by introducing a range of natural sweeteners for bakery applications in April 2024. |

| 2024 | Archer Daniels Midland (ADM) announced a partnership with local farmers to source high-quality grains for its Bakery Mixes in May 2024. |

| 2024 | Baker Hughes introduced a new line of emulsifiers designed to improve the texture and shelf life of baked goods in June 2024. |

Growing demand for natural sweeteners

The Bakery Mixes market is undergoing a substantial transformation due to the health and wellness trend that is reshaping while consumers are now highly leaning towards healthier products in their diets. ASEAN region is the most conspicuous area of observation to this transformation where increasing health consciousness is the main driver of demand for healthier diet constituents.

Consumers are looking for bakery products that are not only tasty but also pack health benefits which is why whole grain flours, natural sweeteners, and functional ingredients have become a mainstay in this field.

For example, there is a particular interest in natural sweeteners like stevia and monk fruit, which can provide sweetness without the calories that are related to the regular sugars. What is more, the choice of whole grain and high-darktype flours alongside this trend is increasing, as consumers learn more about the vital role that dietary fiber has in gut health.

Rise of home baking has emerged as a significant trend in the Bakery Mixes market

Home baking has appeared as a remarkable trend in the Bakery Mixes market. With the majority of people being at home, many found their way to home baking as a method of expression and also a tool to bond with the family. The increased level of home banking activities that we are seeing nowadays has resulted in the need for more superior materials that are used in making bakery products through self-consumption.

The trend has been absorbed by producers by adding their line of products aimed at home bakers. The number of items on the market, including such niche products as specialty flours, baking mixes, and cake decorations, has increased remarkably. Businesses are also putting their money into marketing activities that are aimed at the consumer segment of home bakers by providing them with recipes, tips, and general inspiration that they can use to bake at home.

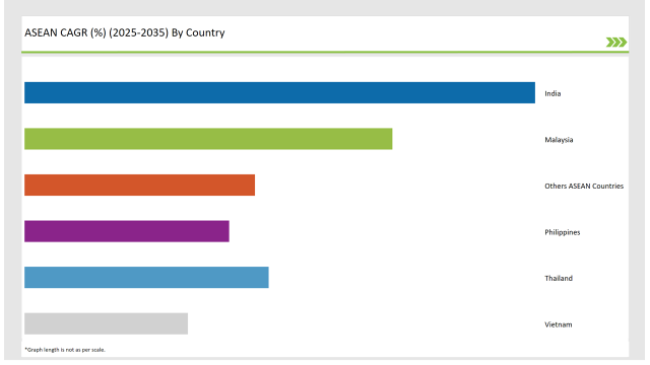

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The India market for Bakery Mixes is ballooning at a fast pace, benefitting from a myriad of factors. The rising urban population and per capita income push the consumers to switch from traditional foods to the ready-made conglomerates that also include packed baked foods.

Thus, more people want to buy only those products that are fully prepared for use. Consequently, those consumers who demand high-quality Bakery Mixes are increasing in numbers. On top of this factor is the fast-growing tendency of eating healthily among the Indians, which indeed affects the choice of their purchases.

There is a noticeable increase in the consumption of bakery products which are made healthier, and the manufacturers are therefore taking the lead by providing more and more of the ingredients that are organic, whole grain, and low in sugar. The change is clear, for instance, the increasing use of whole wheat flour and natural sweeteners, as the people are now more conscious of the health advantages of these foods.

As the lifestyle changes and preferences of consumers are directed the growth of the Bakery Mixes market in Malaysia, this sector is primarily on the way of achieving huge success. The rising middle class, which demands more convenience foods, is the main reason for the increase in the consumption of baked goods.

People want to prepare meals easier and faster, so they look for quality Bakery Mixes thus their demand goes up.The food market has seen new brands of bakery raw materials that align with the eating habits of locals, thus, further driving the market.

The health and wellness movement is also one factor contributing to the changes in the tastes of consumers in Malaysia. A larger number of people are becoming more aware of their health so the demand for bakery items produced with no additives and organic ingredients has risen. Consequently, this has driven the manufacturers to create and offer products that have low gluten, less added sugars, and extra health benefits.

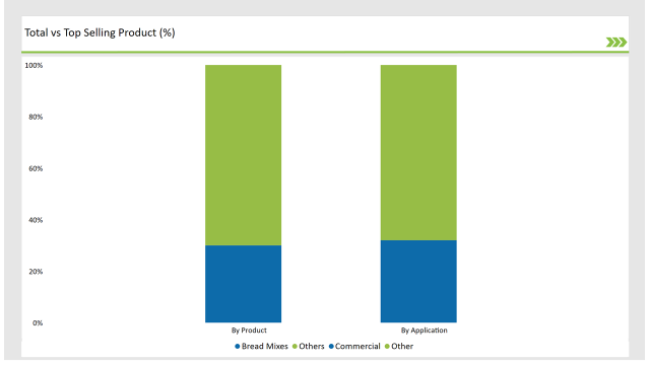

Bread mixes are a big part of the bakery mixes market, they dominate the market because they are multipurpose and find almost universal applications. These mixes make the bread-making process much easier, as they are the pre-measured ingredients which allow the home bakers as well as the commercial outlets to make high-quality bread with a minimum of effort.

The factor of convenience is a major force behind the growth of this section as the busy consumers and foodservice operators are looking for quick and easy alternatives for their baking needs.

The bread mixes segment is also growing, thanks to the increased demand for artisanal and specialty breads. As consumers become more creative with their baking, they try different types of bread such as sourdough, whole grain, and gluten-free.

Manufacturers are keeping pace with the trend and offer a wide variety of choices for bread mixes that will please different palates and also cater to specific dietary needs. For example, there is a rising interest in organic and whole grain bread mixes which consumers that are concerned about their health are looking for.

The presence of ready-to-drink (RTD) Bakery Mixes has seen an upsurge due to their convenience and The bakery mixes market is riding high due to the commercial usage of bakery mixes which has been adopted by most of the foodservice operators like restaurants, cafes, and bakeries, to facility their operations and to augment the quality of the products they serve.

The utility of these bakery mixes is to produce a consistent and trustworthy substitute for baking a wide range of products, including breads, pastries, cakes, and cookies.

The most notable benefit of foodservice establishments using these bakery mixes is the time and labor savings. Because of the use of pre-measured mixes, the operators of foodservice facilities can lessen the prep time and also minimize the mistakes made in ingredient measurements. The increased productivity thus allows them to concentrate on other areas of their operation, such as customer service and menu handling.

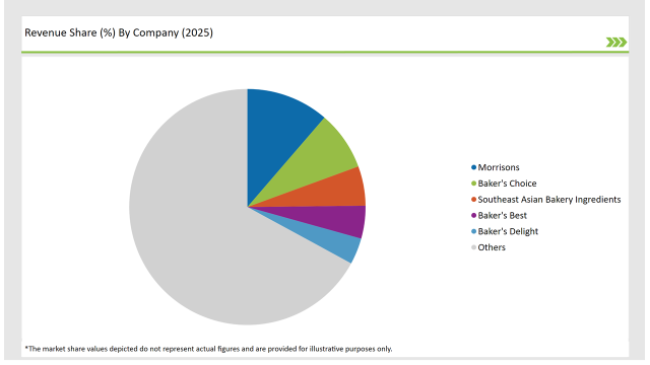

2025 Market Share of ASEAN Bakery Mixes Manufacturers

Note: The above chart is indicative

The bakery mixes market is a field of contention as it has an environment marked by a dense competition and cutthroat rivalry between different key players to grab a larger share of the markets. The powerful corporations, which constitute the bakery mixes market, are the likes of General Mills, Cargill, Archer Daniels Midland (ADM), and Kerry Group that handle it with aplomb, thanks to their broad product ranges and proven distribution facilities.

The companies that are involved in this process utilize their brand equity and facilities to come up with new models and even more offers to meet the changing choices of people.

By Product Type: Cake Mixes, Bread Mixes, Pastry Mixes, Cookie Mixes, Others

By End User: Household, Commercial, Food Service Providers, Retail Chains, Others

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Bakery Mixes market is projected to grow at a CAGR of 6.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 3,190.2 million.

India are key Country with high consumption rates in the ASEAN Bakery Mixes market.

Leading manufacturers Morrison, Baker's Choice, Southeast Asian Bakery Mixes in the ASEAN market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA