The ASEAN Chickpea Protein market is set to grow from an estimated USD 3.3 million in 2025 to USD 7.4 million by 2035, with a compound annual growth rate (CAGR) of 8.6% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 3.3 million |

| Projected ASEAN Value (2035F) | USD 7.4 million |

| Value-based CAGR (2025 to 2035) | 8.6% |

The ASEAN (Association of Southeast Asian Nations) Chickpea Protein Market maintains rapid expansion because consumers demonstrate better understanding about nutrition while following plant-based diets and demanding sustainable protein alternatives.

The high protein content and nutritional value of chickpeas make them an established choice for health-conscious individuals and athletic consumers throughout the world. The market growth is accelerated by food and beverage processing alongside sports nutrition and infant nutrition segments which use a wide range of applications.

Plant-based proteins have become increasingly popular during recent times and the market leadership is now split between chickpea protein because it offers both practical applications and useful characteristics. Advances in vegetarian and vegan lifestyles as well as lactose intolerance and gluten sensitivity have compelled consumers to adopt new protein options thus driving up chickpea protein demand.

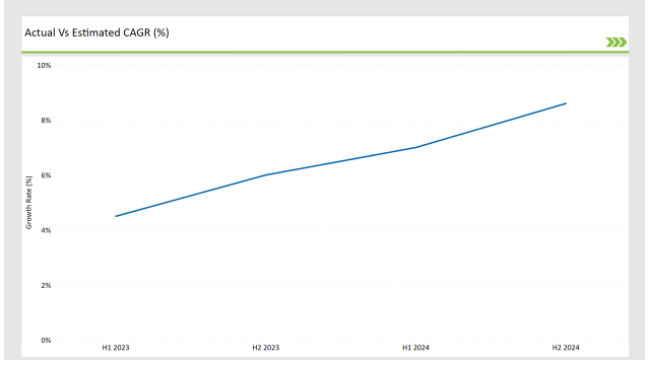

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEANChickpea Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEANChickpea Protein market, the sector is predicted to grow at a CAGR of 4.5% during the first half of 2024, with an increase to 6.0% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 8.0% in H1 but is expected to rise to 8.6% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Launch of a new line of chickpea protein snacks by a leading manufacturer, targeting health-conscious consumers. |

| 2023 | Partnership between a chickpea protein producer and a major food brand to develop plant-based meat alternatives. |

| 2024 | Introduction of chickpea protein-based infant formula by a prominent nutrition company, catering to the growing demand for plant-based options. |

| 2024 | Expansion of a chickpea protein processing facility in Malaysia to increase production capacity and meet rising demand. |

Rise of Plant-Based Diets Adoption

Plant-based diets worldwide represent an important market trend that dramatically affects chickpea protein production. The consumer trend towards both health and environmental concerns drives people to select plant-based protein alternatives from animal protein options.

The behavior of sustainability-conscious consumption along with ethical buying preferences is strongest among millennials and members of Gen Z. The nutrient composition of chickpeas including protein along with fiber and essential vitamins makes them an important ingredient for vegetarian and vegan nutritional approaches. The ability of chickpea protein to function in different food products enhances its market demand through products ranging from snacks to meat substitute products.

The market expansion for chickpea protein stems from growing flexitarian diets which encourage eating less meat but do not prevent its total consumption. The chickpea-based product sector shows strong market growth potential which experts predict will dramatically increase over the next several years.

Increased Focus on Health and Nutrition

The growing understanding of diet-related protein importance creates a rising market for high-protein product demand among consumers. The addition of chickpea protein to diets delivers substantial protein content while providing numerous health advantages that support digestive health and maintain weight control Moreover the protein protects heart functions. Growth of health-oriented consumer segments involving fitness enthusiasts and professional athletes boosts the marketplace for chickpea protein in sports nutrition applications.

The COVID-19 pandemic has increased consumer focus on health and wellness so people actively choose nutritious food choices. The rising market need for nutritious protein-loaded foods and beverages leads food and beverage manufacturers to strategically add chickpea protein in their product formulations.

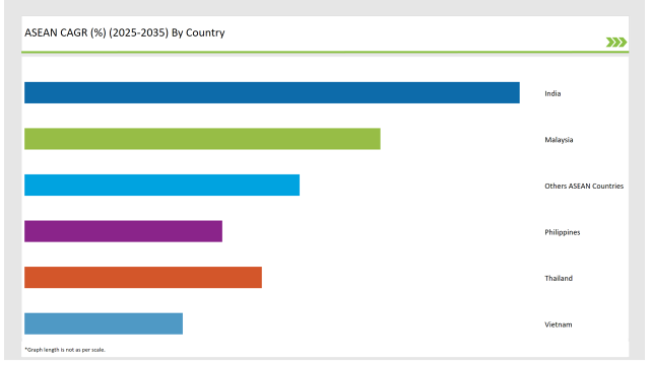

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The Indian market for chickpea proteins shows substantial growth because health-conscious consumers seek plant-based protein alternatives. The country's wealthy culinary historic background featuring many chickpea-based meals led to broad endorsement of chickpeas as fundamental food products. Vegetarianism together with veganism has gained popularity across India thanks to cultural and religious influences which spurred the demand for chickpea protein.

The government of India supports the growth of pulse farming as part of their plans to secure food supplies while increasing dietary nutrition. The government initiative has created greater chickpea production levels resulting in expanded availability which yields more affordable chickpea protein products for consumers. The market continues to grow because consumers are becoming more aware of the health advantages of eating chickpeas for better digestion and weight control.

The Malaysian market for chickpea protein demonstrates substantial growth because of rising consumer knowledge about health and nutrition. People who want nutritious eating alternatives because of lifestyle disease increases are driving the market for plant proteins such as chickpea protein to grow. Through vigorous guidelines the Malaysian government encourages legume consumption as part of a healthful diet which builds future market potential.

Chickpeas and chickpea protein successfully entered traditional cuisine in Malaysia because the nation's broad food traditions include many different kinds of legumes. acements in vegetarian diets and flexitarian choices by Malaysian consumers are fueling the rising need for chickpea protein-based products. Manufacturers have launched new chickpea-based products including snack items and protein powders alongside ready-eating meals to meet the needs of health-minded consumers who are evolving in their culinary preferences.

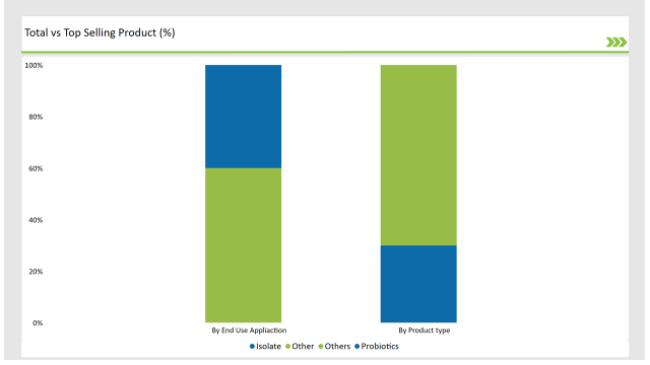

The market favors Chickpea protein isolate because it combines superior protein density together with valuable functional attributes. Manufacturers use chickpea protein isolate routinely for protein bar manufacturing and beverage making alongside meat substitute development.

Chickpea protein isolate maintains rising market demand from two main factors: modern health-conscious consumers seek nutritious foods and the expanded consumer base for plant-based foods. Food manufacturers actively develop premium chickpea protein isolates which have better processing characteristics and thickening abilities to respond to changing health-conscious customer needs. Chickpea protein isolate demonstrates flexibility that enables application within a broad spectrum of food products which drives market interest.

The food and beverage processing industry leads all end-use applications of chickpea protein with its substantial market dominance. The expanding market for protein-enriched foods together with consumer interest in nutritional wellness fuels this application segment's development.

The processing industry increasingly utilizes chickpea protein to create snacks alongside protein bars in addition to creating ready-to-eat meals which meet the dietary needs of modern health-conscious consumers. Chickpea protein displays versatility because it functions as a nutritional ingredient in multiple food items while preserving taste and preserving product texture.

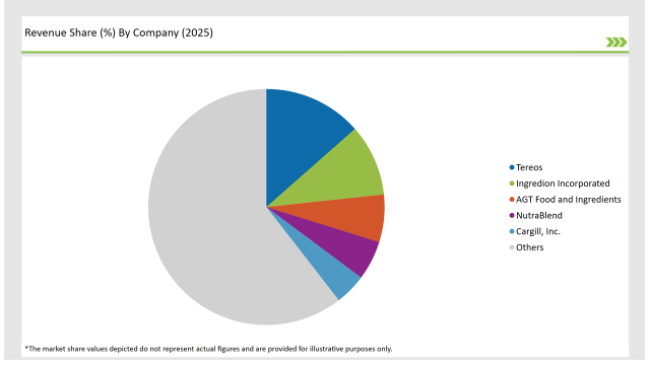

2025 Market Share of ASEAN Chickpea Protein Manufacturers

Note: The above chart is indicative

Customers are driving rising demand for plant-based protein sources which has attracted numerous market participants to compete in the chickpea protein sector. Manufacturers in the market emphasize product development alongside quality upgrades and alliance creation to build their market leadership through understanding transforming customer needs.

Leading companies operating in the chickpea protein market spend research funds to develop premium products made from quality chickpea proteins that perform better at mixture solution and have enhanced flexible properties. End-users in food processing and beverage industry sports and infant nutrition demand diverse needs requiring product innovations to deliver solutions successfully.

As per Product Type, the industry has been categorized into Isolate, Concentrate, Textured, and Hydrolyzed

As per End Use, the industry has been categorized intoFood & Beverage Processing, Sports Nutrition, Infant Nutrition, Pharmaceutical Products, Personal Care Products, and Animal Nutrition

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Chickpea Protein market is projected to grow at a CAGR of 8.6% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 7.4 million.

India are key Country with high consumption rates in the ASEAN Chickpea Protein market.

Leading manufacturers include MycoTechnology, ADM (Archer Daniels Midland), BASF SE, DSM Nutritional Products, Ecoverse, Others are the key players in the ASEAN market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Pulses Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA