The ASEAN Collagen Peptide market is set to grow from an estimated USD 69.7 million in 2025 to USD 121.4 million by 2035, with a compound annual growth rate (CAGR) of 6.2% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 69.7 million |

| Projected ASEAN Value (2035F) | USD 121.4 million |

| Value-based CAGR (2025 to 2035) | 6.2% |

ASEAN collagen peptide markets show robust expansion because consumers focus on health more intensely while beauty and personal care products increase in demand and numerous industries develop uses for collagen peptides.

The human body contains the important protein known as collagen which supports skin elasticity and joint health as well as overall wellness. Health-conscious customers are driving up the market demand for collagen supplements and functional foods because these products offer benefits for skin health and anti-aging purposes.

The ASEAN region has experienced growing popularity of collagen peptides mainly among its young adult population known as millennials and its aging demographic. Customers now seek youthful appearances through preventive healthcare measures which drives their increased consumption of collagen-based products such as powders, capsules and beverages. E-commerce services combined with social media presence enable customers to discover collagen products more easily so market expansion remains strong.

The beauty and wellness industries across Thailand and Malaysia together with Indonesia lead the way in collagen product adoption. Market expansion occurs because extraction and processing technologies continue to improve how collagen peptides become available and effective. The ASEAN collagen peptide market demonstrates strong expansion potential through innovations and growing consumer needs and health-oriented trends.

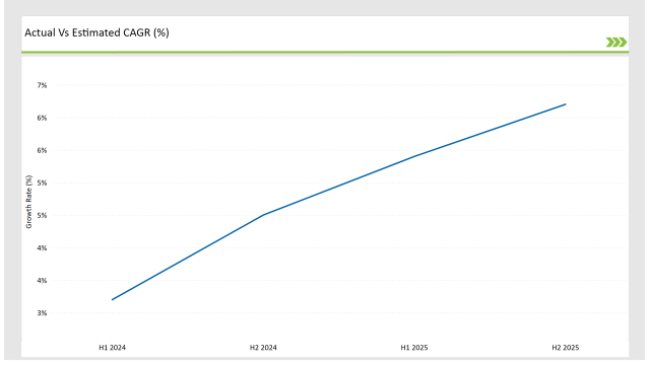

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Collagen Peptide market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Collagen Peptide market, the sector is predicted to grow at a CAGR of 3.2% during the first half of 2024, increasing to 4.5% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 5.4% in H1 but is expected to rise to 6.2% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Vital Proteins launched a new line of plant-based collagen alternatives in March 2024. |

| 2024 | Gelita AG introduced a new range of collagen peptides specifically designed for functional beverages in April 2024. |

| 2024 | Rousselot expanded its product portfolio by launching a new collagen peptide for sports nutrition in May 2024. |

| 2024 | Nitta Gelatin announced a partnership with a leading beverage company to develop collagen-infused drinks in June 2024 |

Growing Demand for Plant-Based Collagen Alternatives

Consumer awareness about health and environmental health drives them toward plant-based collagen products which substitute traditional animal collagen. The region known as ASEAN experiences an intense adoption rate of vegetarian and vegan lifestyles by a significant part of its population.

The collagen alternatives coming from plant-based origins which use algae and fruits and vegetables serve consumers who want collagen benefits with ethical sustainable products. Businesses dedicate funds to scientific advancement that develops innovative formulations identical to standard collagen thus expanding their consumer base.

The growing interest in plant-based eating patterns drives customers to select transparent foods with clear ingredients so manufacturers emphasize their production processes. Plant-based collagen alternatives will experience rising demand in the ASEAN market because consumers focus on health alongside sustainability and ethical factors during purchasing.

Increasing Integration of Collagen in Functional Foods and Beverages

The ASEAN market shows increasing interest in incorporating collagen peptides into different foods and drink products. A growing number of manufacturers are adding collagen content to protein bars alongside smoothies and ready-to-drink beverages because consumers want convenient nutritious choices.

The ASEAN market witnesses this trend because consumers actively seek health advantages from collagen intake that includes better skin elasticity and joint health and overall wellness. Ready-to-consumer products provide consumers with an easy way to include collagen as part of their regular activities resulting in heightened demand.

The wellness movement along with preventive health priorities drive consumers to select functional foods delivering extra value through the preventive health movement. Manufacturers are investing their efforts into developing appealing and effective collagen-infused products because the market demand for health and wellness solutions is continuously expanding.

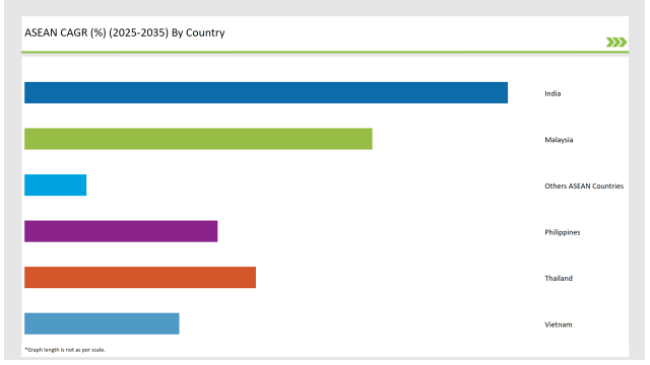

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The expansion of India's collagen peptide market originates from developing health and wellness knowledge among consumers especially the city residents. Market demand for both dietary supplements and functional foods promoting skin health has increased because Indian consumers now have more disposable income and different life styles.

The Indian beauty industry continues to adopt collagen peptides as vital components for skincare products because consumers desire anti-aging solutions and skin revitalization solutions. The market receives double support from ongoing trends in preventive healthcare along with rising customer interest in youthful aging. Collagen products have become more available to consumers through e-commerce platforms while such platforms also provide better visibility and greater convenience.

The ASEAN collagen peptide market sees Thailand as its leader because of its well-developed beauty and wellness sector combined with its export-focused business strategy. Thailand holds a deep cultural heritage of herbal and natural remedies that created conditions for collagen peptide products to find acceptance among its citizens.

Multiple collagen products exist throughout the Thai market spanning from supplements and functional foods through to skincare formulations. Consumers throughout Thailand and from international markets are increasingly seeking collagen while benefiting from its impact on skin elasticity and joint health because of the growing health benefits awareness.

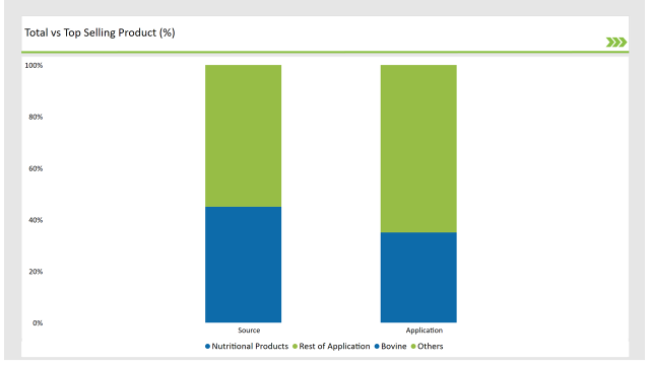

The ASEAN collagen peptide market gets its main market share from nutritional products. The market shows increasing interest in using collagen peptides within dietary supplements and protein powders as well as functional foods to satisfy consumers who seek health and wellness solutions.

Health-conscious consumers who include millennials and aging individuals actively drive the market for collagen-based nutritional products. Consumers now focus on finding easy yet effective protein-enhancing methods that benefit their health which has caused collagen supplements to gain significant market popularity.

The ASEAN market depends on bovine collagen as its principal collagen peptide raw material for manufacturing purposes. Bovine collagen originates from cattle hides and bones because it delivers exceptional bioavailability while enhancing skin well-being and joint function as well as total body health.

Bovine collagen peptides remain popular because manufacturers use them in different industries which provide both functional food production and dietary supplement preparation and cosmetic development. Bovine collagen meets high demand in the personal care segment because it appears in beauty products and anti-aging skincare formulas.

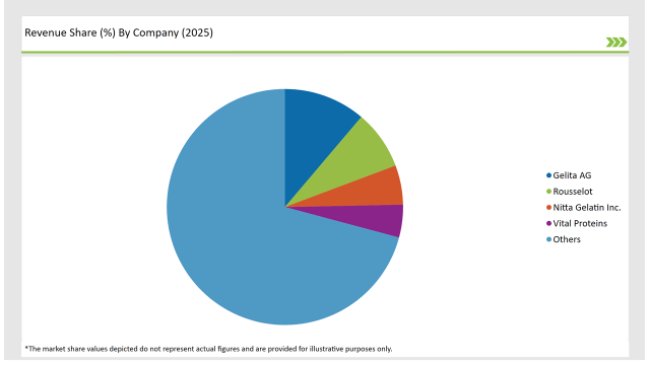

2025 Market Share of ASEAN Collagen Peptide Manufacturers

Note: The above chart is indicative

The ASEAN collagen peptide market experiences growing competition as many businesses strive to establish market positions. Major players within the ASEAN collagen peptide market consist of leading collagen manufacturers and innovative new entrants who prioritize sustainable operation methods. The market competition features several essential elements which include product quality alongside pricing structure distribution network alongside brand reputation.

This Segment further Categorise into Nutritional Products, Food & Beverages, Cosmetics & Personal Care Products, Pharmaceuticals

This Segment further Categorise into Bovine, Porcine, Marine & Poultry.

This Segment further Categorise Dry and Liquid

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Collagen Peptide market is projected to grow at a CAGR of 6.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 121.4 million.

India are key Country with high consumption rates in the ASEAN Collagen Peptide market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA