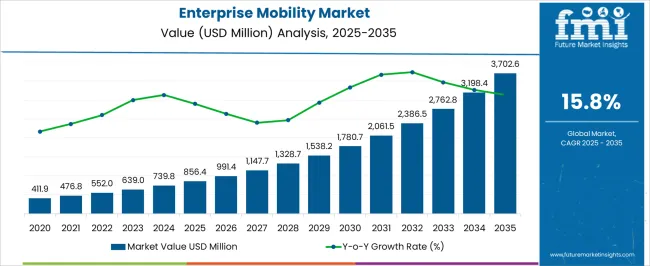

The Enterprise Mobility Market is estimated to be valued at USD 856.4 million in 2025 and is projected to reach USD 3702.6 million by 2035, registering a compound annual growth rate (CAGR) of 15.8% over the forecast period.

| Metric | Value |

|---|---|

| Enterprise Mobility Market Estimated Value in (2025 E) | USD 856.4 million |

| Enterprise Mobility Market Forecast Value in (2035 F) | USD 3702.6 million |

| Forecast CAGR (2025 to 2035) | 15.8% |

The enterprise mobility market is expanding rapidly as organizations prioritize digital transformation, remote workforce enablement, and secure data accessibility. Rising adoption of bring your own device policies and the need for unified management of mobile applications, content, and endpoints are fueling demand.

Companies are increasingly focused on enhancing productivity while maintaining compliance with strict security frameworks. Investments in advanced mobility platforms that integrate with cloud, AI, and analytics are providing enterprises with scalable and flexible solutions.

Regulatory requirements for data protection and growing emphasis on seamless collaboration tools are further driving adoption. The market outlook remains favorable as enterprises continue to strengthen mobility strategies that align with hybrid work models, security compliance, and digital-first operational frameworks.

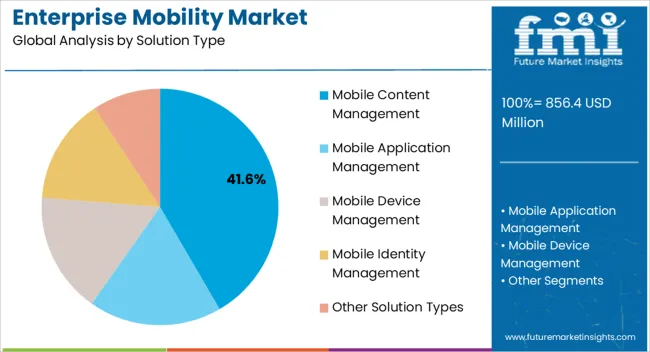

The mobile content management segment is expected to account for 41.60% of the overall revenue by 2025, making it the dominant solution type. Growth is being driven by the increasing need to secure sensitive business content, provide controlled document access, and enable real time collaboration across devices.

Enterprises have adopted mobile content management to protect corporate intellectual property while supporting remote and mobile workforce requirements. Its ability to streamline workflows, reduce data loss risks, and integrate with productivity applications has reinforced its widespread deployment.

As businesses seek scalable and secure solutions to enhance mobility, this segment continues to lead the solution type category.

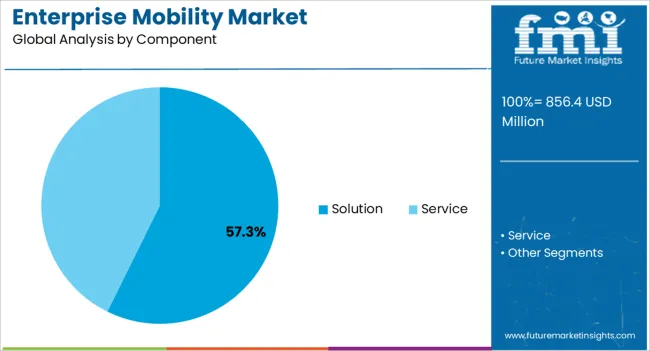

The solution segment is projected to hold 57.30% of total market revenue by 2025 within the component category, positioning it as the largest contributor. The dominance of solutions is attributed to their ability to deliver end-to-end management of devices, content, and applications within enterprise mobility ecosystems.

Enterprises favor integrated platforms that address compliance, security, and productivity simultaneously. The ability to tailor solutions to industry-specific needs while reducing operational complexity has increased adoption.

As organizations shift toward holistic platforms instead of standalone tools, the solution component segment has solidified its leadership position.

The net valuation of the market was merely USD 221,060 million by the end of the year 2020. Though the market progressed moderately in the following years, the sudden pandemic outbreak proved to be bliss for at least this market. With a steep growth in adopting enterprise mobility services, the average market recorded a CAGR of 23.2% until 2025.

As per the market study, employers are obligated to provide remote access alternatives to their employees in response to the widespread transmission of COVID-19, allowing them to work outside of the company infrastructure. Providing employees with the option of working from home is an intelligent way to avoid the spread of viruses in the office.

To maintain company continuity during this pandemic, many firms adopted a BYOD policy allowing employees to use their devices for work. Organizations that utilize a remote workforce ensure that employees have access to company resources while working from home and that they have the tools they need to stay productive. As a result of these factors, large corporations are using enterprise mobility solutions.

Enterprise mobility is becoming more popular because it allows businesses to operate remotely, update, and delete data from devices. As per the critical enterprise mobility adoption trends, remote workforces and MDM are more vital than ever. Unmanaged remote endpoints are among the most severe threats to a company's cyber-security today.

Enterprises have invested significant sums of money in recent months to roll out more robust VPN solutions and mobile devices (laptops and tablets) to allow employees to work remotely, but security appears to have taken a backseat to these more extensive efforts to keep workers employed and productive.

Another element of market solutions is remote wiping, which may permanently delete any files on a gadget via a trigger if it is damaged or destroyed, preventing the loss of critical data. Enterprise mobility and the capacity to detect and mitigate vulnerabilities on distant endpoints are no longer a luxury but a necessity.

Enterprise Mobility Systems can Meet any Business Demand for a Consistent End-user Experience

Providers of enterprise mobility solutions need help to customize the solution to fit unique company requirements. Enterprises commonly express unhappiness with the enterprise mobility solution's inability to meet multi-user connections' speed and adaptability.

Vendors face various challenges when implementing enterprise mobility into an organization's existing vulnerability management compliance. For mobile devices that connect to the internal network, each firm has its own set of security needs. By allowing an IT administrator to administer and monitor systems from a single place, the right enterprise mobility solution may increase quality and reliability.

Every organization has business requirements, and gaining a good grasp of what a corporation requires is quite challenging. Enterprise mobility systems should be implemented uniquely for each company's needs to guarantee a consistent end-user interface.

On-premise enterprise mobility solutions ensure that company data is secure and in compliance with all industry laws while allowing for safe employee mobility.

The cloud enterprise mobility segment is predicted to grow at a faster rate than the deployment segment. The Software-as-a-Service (SaaS) concept is used in cloud-based solutions, and customers can access enterprise mobility solutions digitally via the Internet.

Cloud-based EMM solutions, on the other hand, have several drawbacks, including a lack of control over apps, tight government laws, and private content. Because of the linked functionality and critical features, the general adoption of cloud enterprise mobility solutions is expected to rise and be high during the forecast period.

| Category | By Component |

|---|---|

| Top Segment | Solution |

| Market Share in Percentage | 62.3% |

| Category | By Deployment |

|---|---|

| Top Segment | On-premise |

| Market Share in Percentage | 62.2% |

The usage of enterprise mobility systems has risen in response to the growing BYOD trend in the BFSI industry. Several BFSI firms are increasingly emphasizing workplace mobility as a means of promoting employee productivity and satisfaction.

Enterprise mobility solutions are offered via the cloud in this deployment style. Flexibility, scalability, affordability, operational efficiency, and minimal expenses are all advantages of using cloud-based enterprise mobility solutions. ABANCA, for example, one of the central banks in Galicia (Spain), needed a versatile, extendable platform that allows its IT department to handle COPE devices.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| North America | 28.4% |

| Europe | 21.3% |

The existence of top enterprise mobility solution vendors in the region can be credited for this increase. Increased usage of enterprise mobility solutions in leading industries like retail, BFSI, and others to support remote working and real-time data analysis and management are driving market expansion.

As per the market study, the on-premise segment in Brazil is expected to grow at a CAGR of roughly 15% through 2029, owing to increasing concerns about enterprise data security and tight compliance rules.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| United States | 15.4% |

| Germany | 9.2% |

| Japan | 5.3% |

| Australia | 4.1% |

Rising investments in the development of enterprise mobility technologies are likely to have a beneficial impact on market growth over the next few years. Employee productivity is increased by allowing them to work in more pleasant locations outside of the organization's walls.

Failure to connect mobile devices with complicated systems may result in information silos, which occur when essential data is only available on one device and is not shared with the company's network. An information silo can be created by an employee who works from home on occasion and fails to transmit vital files after switching to another organization. This creates an essential need for enterprise mobility systems to be in place in an organization.

| Regions | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 12.1% |

| China | 14.3% |

| India | 18.5% |

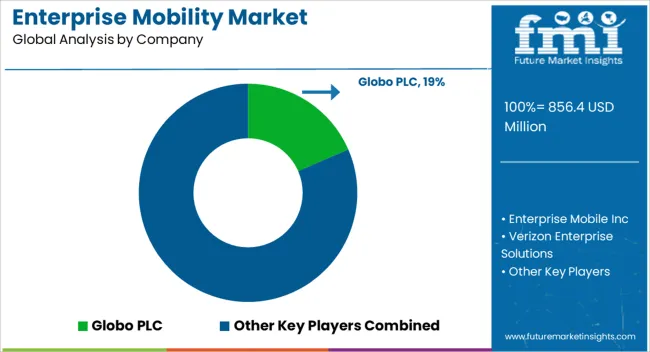

There are several prominent companies in the enterprise mobility management industry, which is moderately competitive. Few big firms currently dominate the market in terms of market share. Companies in this field invest a lot of money in research and development.

Collaboration, joint ventures, and mergers and acquisitions are among the business tactics that have allowed enterprise mobility management enterprises to remain competitive in the market.

The key enterprise mobility management market trends indicate that many businesses feel that by updating their current portfolio, they are likely to attract more clients. Firms are looking at the solutions given by corporate mobility companies to gain a much sought-after competitive advantage.

Some Recent Developments in the Enterprise Mobility Market

IBM introduced Watson Works in June 2024 to address the barriers to returning to work. Watson Works is a selected group of products that incorporate Watson AI models and applications to assist businesses in navigating many parts of the return-to-work problem following COVID-19 lockdowns.

During the COVID-19 epidemic, Citrix and Microsoft teamed up in July 2024 to create future flexible workspaces. Citrix Workspace can be chosen as a preferred digital workspace solution by Microsoft. Microsoft Azure is likely to be selected from Citrix as a preferred cloud platform, allowing Citrix's existing on-premises clients to work anywhere, on any device.

Cisco announced an agreement to buy IMImobile in December 2024. Both businesses have agreed to the parameters of a proposed cash offer in which Cisco may pay 595 pence per share for each share of IMImobile, for a total purchase price of roughly USD 730 million (assuming fully diluted shares, net of cash and debt).

The global enterprise mobility market is estimated to be valued at USD 856.4 million in 2025.

The market size for the enterprise mobility market is projected to reach USD 3,702.6 million by 2035.

The enterprise mobility market is expected to grow at a 15.8% CAGR between 2025 and 2035.

The key product types in enterprise mobility market are mobile content management, mobile application management, mobile device management, mobile identity management and other solution types.

In terms of component, solution segment to command 57.3% share in the enterprise mobility market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

BYOD and Enterprise Mobility Market Analysis and Forecast 2025 to 2035, By Security, Software, Deployment Type, End-Use, Organization Size, and Region

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sync And Share Platform Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Metadata Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Rights Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Enterprise LLM Market Size and Share Forecast Outlook 2025 to 2035

Enterprise VSAT Systems Market Size and Share Forecast Outlook 2025 to 2035

Enterprise AI Governance and Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Content Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise IoT Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise WLAN Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA