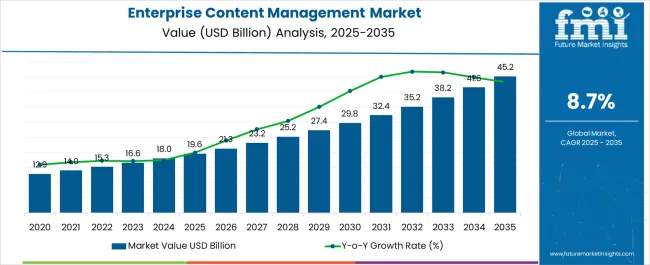

The Enterprise Content Management Market is estimated to be valued at USD 19.6 billion in 2025 and is projected to reach USD 45.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period.

| Metric | Value |

|---|---|

| Enterprise Content Management Market Estimated Value in (2025 E) | USD 19.6 billion |

| Enterprise Content Management Market Forecast Value in (2035 F) | USD 45.2 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The enterprise content management market is expanding rapidly due to the rising need for secure information handling, regulatory compliance, and digital transformation initiatives across industries. Organizations are increasingly adopting ECM solutions to streamline document workflows, reduce operational inefficiencies, and ensure governance of business critical data.

Cloud integration, AI based automation, and advanced analytics are further strengthening adoption by enabling scalability, real time collaboration, and improved decision making. Heightened focus on data privacy regulations and the growing volume of unstructured content are also driving enterprises toward robust ECM deployments.

The outlook remains strong as organizations continue to prioritize efficiency, compliance, and agility in managing digital content, making ECM a cornerstone of enterprise technology ecosystems.

The ECM software segment is projected to contribute 47.30% of total market revenue by 2025 within the component category, positioning it as the leading segment. This growth is supported by its ability to provide centralized content management, version control, and seamless integration with enterprise applications.

The software enables organizations to automate workflows, maintain regulatory compliance, and enhance collaboration across distributed teams. Increased reliance on cloud based ECM solutions and the incorporation of AI driven capabilities such as intelligent search and automated classification have further strengthened this segment’s dominance.

As businesses continue to digitize operations, ECM software adoption is expected to accelerate, solidifying its position as the key driver within the component segment.

The small and medium enterprises segment is expected to account for 55.80% of total revenue by 2025 within the enterprise size category, making it the most prominent segment. Adoption is being propelled by the rising need to manage increasing volumes of data efficiently while keeping costs under control.

SMEs are turning to ECM solutions to automate manual processes, reduce paperwork, and ensure compliance with regional data protection laws. Cloud based ECM platforms have made implementation affordable and accessible for SMEs, allowing them to achieve enterprise grade content management without heavy infrastructure investments.

As digital adoption deepens across smaller organizations, this segment is projected to remain the dominant revenue contributor.

The document management segment is projected to hold 49.60% of total market revenue by 2025 under the solution category, positioning it as the leading sub segment. Its dominance is attributed to the central role of document handling in business operations, where efficiency, accuracy, and security are critical.

Document management systems enable businesses to digitize, store, retrieve, and share documents seamlessly, reducing reliance on paper and minimizing errors. Enhanced compliance tracking, audit trails, and integration with workflow automation tools have reinforced its adoption across industries.

With growing demand for cloud based and mobile friendly document management systems, this segment continues to anchor growth within the ECM landscape.

The increased need for regulatory, compliance, and audit management amongst enterprises are fueling the sales of enterprise content management. The IT systems integrating with content management tools strengthen the corporate information governance.

The major factors driving the enterprise content management market are frequent audits, rising security risks, and regular compliance policies. Business enterprises demand maintenance of multiple documents and data required at the time of audits and protect the information from frauds and cyber-attacks.

Enterprise content management systems are used while integrating these solutions with cloud-based storage. Cloud-based solutions are easily available, while the on-premise type of content management is gaining popularity in enterprise content management.

The latest cutting-edge technological advancements have changed the way enterprise content management tools work, integrating with artificial intelligence, machine learning, and predictive learning.

Business platforms are using enterprise content management systems in order to provide solutions for record management, audit trail, content collaboration, and dashboard analytics. This enhances the operability of multiple sections of a corporate structure, increasing the productivity of the company.

COVID-19 has boosted content creation, especially social media content, due to high internet and 4G/5G networks. The transformation through the rising trend of AI – Integrated ECM systems are classifying, analyzing, and categorizing the data and information. AI-based technologies like image recognition, voice recognition, and machine learning.

Enterprise content management tools are used in 80% of unstructured data, and 70% of data is from written documents and comments. This pushes the sales of enterprise content management systems.

Data security and compliance while shifting and transferring data and information is the biggest concern in the enterprise content management market, restricting the sales of enterprise content management solutions. Company's content is largely confidential data that is very important such as accounts, recruitment data, and framework data.

Another factor that challenges the enterprise's content management is the lack of a skilled workforce and poor management. Employees need to go through skilled training programs that cost huge capital investment of the companies. Especially, covid-19 has decreased the per year revenue that can be invested.

The enterprise content management market is categorized by component, enterprise size, solution and industry vertical. These categories are further divided into small segments that expand their channels in multiple market spaces. These segments perform differently in multiple markets as they have a strong hold in multiple regions.

The deployment category is segmented into software and services while enterprise size is segmented into small & medium enterprises (SME’s), large enterprises. The solution category is divided into document management, content management, case management, workflow management, record management, digital asset management, eDiscovery and industry vertical category hold segments; BFSI, Education, Government & Public, Healthcare, Manufacturing, Media & Entertainment, Retail and Telecom & IT.

By component, the FMI study finds that the software type of deployment has the highest sales potential through 2035. The adoption of software systems is likely to grow at a CAGR of 8.8% during the forecast period.

Consumer demand for software systems is attributed to their characteristics like easy implementation, better availability, and low maintenance cost. In the future, sales of software-based enterprise content management systems are estimated to grow excessively in order to provide better end-user experience, security, and management tools. This pushes the sales of enterprise content management systems in the new regions.

By solutions, large enterprises are the biggest segment in the enterprise content management market and are expected to hold the largest portion in the forecast period. The segment is thriving at a strong CAGR of 8.2%.

The factors behind the growth of this segment are excessive use of enterprise content management and longer shelf life as these enterprises keep on upgrading the software. Small and medium sized enterprises also perform better than before as covid-19 has triggered the demand for enterprise content management solutions.

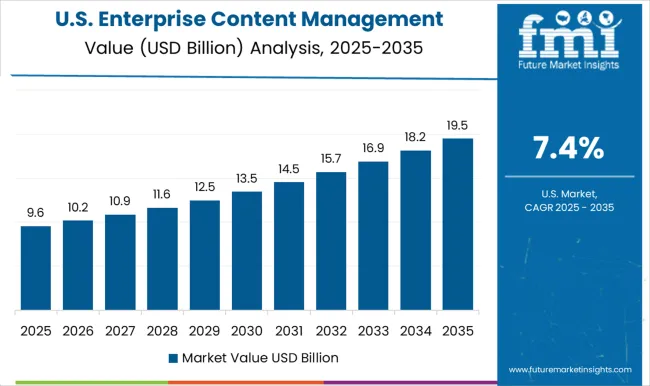

The enterprise content management market is divided into regions; North America, Latin America, Asia Pacific, Middle East and Africa (MEA) and Europe. The biggest market is United States, thriving at a CAGR of 8.4% between 2025 to 2035.

The region is expected to hold a market revenue of USD 45.2 Billion by the end of 2035. US holds the biggest forecasted revenue share as it has almost completed the digitization phase while India is the highest growing market for enterprise content management market due to excessively growing corporate spaces. India region will hold USD 2.5 Billion by the end of 2035 as it thrives on a promising CAGR of 10.4% between 2025 to 2035.

Japan also grows along with India the forecasted value of USD 2 Billion (2035) at a CAGR of 9.6% between 2025 to 2035 while China has the second biggest forecasted revenue of USD 3.2 Billion (2035) at a CAGR of 9.1%.

| Regions | CAGR (2025 to 2035) |

|---|---|

| United States | 8.4% |

| United Kingdom | 8.4% |

| China | 9.1% |

| Japan | 9.6% |

| India | 10.4% |

India is the highest growing market in the making the Asian region the highest growing region, adding Japan that is the second highest growing market for enterprise content management market with a CAGR of 9.6% between (2025 to 2035).

Growing management sector, rising IT & corporate and advent of new cutting-edge technologies like AI and ML in Asian countries like India, China and Japan are pushing the demand for enterprise content management system in the region.

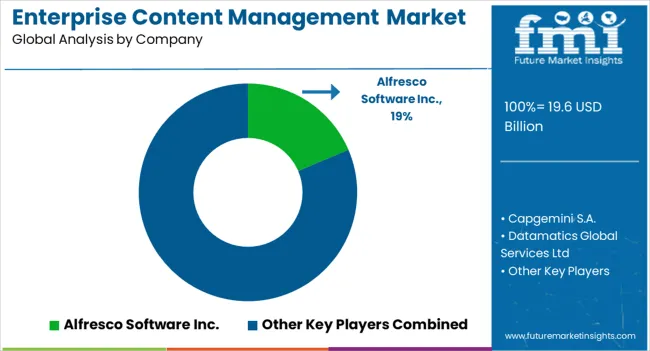

The competitive landscape of enterprise content management is diversified and makes the market more exclusive for new players. Companies also release their new updated enterprise content management systems that help in enlarging their customer base. The vendor companies focus on mergers and collaborations to expand their distribution channels in new regions.

Recent Developments in the Enterprise Content Management Market

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Germany, the United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Malaysia, Indonesia, Singapore, Australia & New Zealand, GCC Countries, Turkey, North Africa, and South Africa |

| Key Segments Covered | Component, Enterprise Size, Solution, Industry, and Region |

| Key Companies Profiled | Alfresco Software Inc.; Capgemini; Datamatics Global Services Ltd; EMC Corporation; Hyland Software Inc.; IBM Corporation; Laserfiche; M-files Inc.; Newgen Software; OpenText Corporation; Pennywise Solutions; SAP; Systemware Inc.; TCS |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global enterprise content management market is estimated to be valued at USD 19.6 billion in 2025.

The market size for the enterprise content management market is projected to reach USD 45.2 billion by 2035.

The enterprise content management market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in enterprise content management market are ecm software, _on-premise, _cloud based, services, _consulting, _system integration and _operation & maintenance.

In terms of enterprise size, small & medium enterprise (sme’s) segment to command 55.8% share in the enterprise content management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise Video Content Management Market

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sync And Share Platform Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Enterprise LLM Market Size and Share Forecast Outlook 2025 to 2035

Enterprise VSAT Systems Market Size and Share Forecast Outlook 2025 to 2035

Enterprise AI Governance and Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise IoT Market Size and Share Forecast Outlook 2025 to 2035

Enterprise WLAN Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Video Market Analysis - Size, Share, and Forecast 2025 to 2035

Enterprise-Grade DLT Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Information Archiving (EIA) Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Manufacturing Intelligence Market Analysis by Deployment Type, Offering, End-use Industry, and Region Through 2035

Enterprise Laboratory Informatics Market Analysis by Type of Solution, Component, Delivery, Industry, and Region Through 2035

Enterprise File Sharing And Synchronization Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA